Whenever Warren Buffett sees bad times approaching, he raises a pile of cash and then deploys it on exceptional companies. It’s an approach that has much to teach investors when we carefully examine his historical sells and major buys.

Why We Expect A Recession Next Year

Right now, Warren Buffett is sitting on $157.2 billion in cash.

His company, Berkshire Hathaway (BRKA), reached a record cash hoard this week after selling its entire stakes in General Motors (GM), Johnson & Johnson (JNJ), and Procter & Gamble (PG).

One of these stocks deserves special mention – General Motors. Buffett doesn’t make many investment mistakes, but buying GM was a terrible decision.

We made one of the most important (and most obvious) calls of our careers back in 2007 when we began to write our “Letter From the Chairman of General Motors” about the growing inevitability of a GM bankruptcy. At the heart of our analysis: GM wasn’t earning any money selling cars. Instead, GM had become an enormous (and very risky) bank via its GMAC subsidiary. And, even these financial earnings weren’t enough to cover its interest expenses and pension obligations.

Buffett purchased GM in 2012 shortly after it emerged from a government-engineered pseudo-bankruptcy. The unions were paid out about $0.90 of what they were owed, received a slew of preferred shares, and got board seats. The company’s creditors got robbed. They received about $0.10 on the dollar in newly issued equity that sat below the union’s preferred stock in the capital structure.

Thus, today’s GM is a company born out of a crime. It’s since become a real-time litmus test of modern management theory – the idea that “diversity” is an attribute in corporate boards.

Today a majority of GM’s board members are women. I’d be willing to bet $100,000 that none of them can change the oil in their cars. Meanwhile, every member of GM’s board (according to the proxy statement) has expertise in ESG issues – the popular acronym for environmental, social, and governance. But only one board member (out of 13) has any automotive-industry experience – and that’s Jonathan McNeill.

Interestingly, he doesn’t own a single share of the stock. Likewise, neither do five other directors. And none of them, not even one of the 12 outside directors of the company – who are supposedly representing the interest of GM’s long-suffering shareholders – owns any significant amount of stock. Instead of a board made up of industry veterans and major shareholders, GM’s board looks like a modern Disney movie. And it’s about as profitable too.

As outsiders, it’s difficult to know exactly how much Buffett made. But we do know in his 2021 letter he reported holding 52.9 million GM shares with a cost basis of $1.6 billion, or about $30.50 per share. And we know he sold 10 million shares at $37.75 in Q1 2023, then 18 million shares at $34.61 in Q2 2023; then 22 million shares at $35.58 in Q3 2023.

Adding it up, we estimate he made something like 10% to 12% on these investments. But… that’s over a 10-to-11-year holding period. If you would have bought the S&P 500 instead of GM at the same times that Buffett bought and sold GM, we estimate you would have made about $2.8 billion – 173%.

Moral of the story: it’s usually a bad idea to buy enormous, low-return-on-asset businesses that require huge capital investments, and that make products that are largely commoditized. Especially when they’ve been led by a cast of clowns.

We admit that bashing GM has long been a hobby horse of ours, but we do think Buffett exiting the position entirely and building a record-level of cash is significant.

Historically when Buffett has built up such a large cash position, it’s preceded or coincided with an economic slowdown or shock.

Looking at Past Hoards of Cash

The last time Berkshire had so much cash was in November 2021. At the time, unprecedented fiscal and monetary stimulus, low interest rates, and strong consumer spending helped inflate stock valuations following a sharp market decline tied to the 2020 COVID-19 lockdown.

What happened next?

The S&P 500 Index peaked in December 2021 and would eventually collapse by 25% over the next several months.

Between the end of 2013 and the end of 2015, Buffet grew Berkshire’s cash hoard from $45 billion to $64 billion – an increase of 42%. Most investors won’t remember, but there was a mini-bear market in late 2015 and early 2016. The S&P 500 declined 19% and tech stocks fell more. Shares of Apple (AAPL) fell from the low $30s to the low $20s by May 2016.

And you know what happened next.

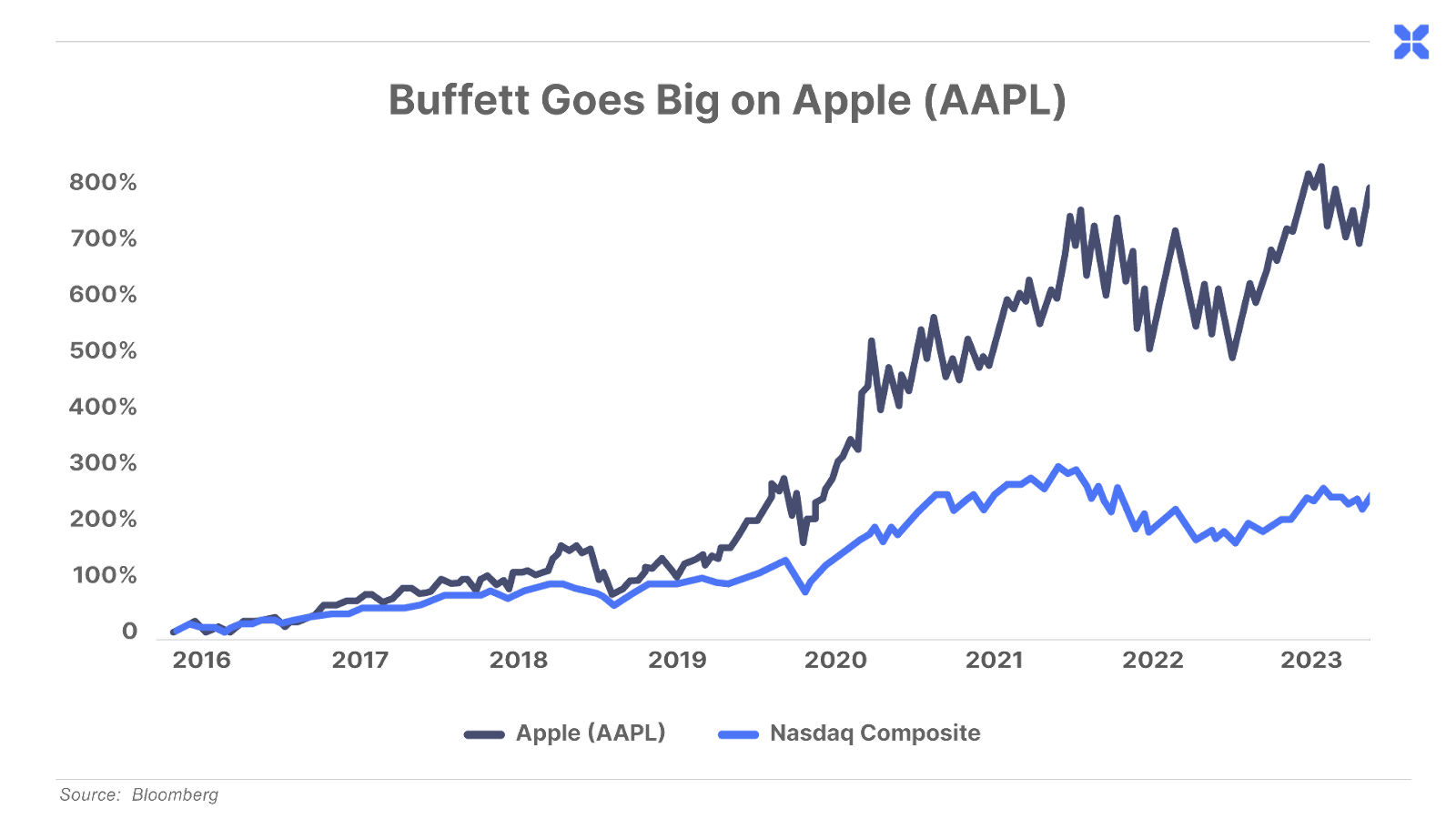

Buffett purchased almost 40 million shares of Apple in the first quarter of 2016 and 21 million more shares in the second quarter that year. He followed those purchases up with constantly buying every quarter between the fourth quarter of 2016 and the third quarter of 2018. He’s bought more Apple shares in early 2022 and early 2023. In total Buffett owns almost a billion shares worth $175 billion – roughly half his entire portfolio.

Since Buffett started buying AAPL in the first quarter of 2016, shares have increased by more than 760%, blowing away the Nasdaq Composite Index’s increase of 250% since then.

Now, Buffett seems ready to move again.

Berkshire Hathaway now has a record $157 billion to deploy.

Which means, if previous periods when Buffett increased his cash position are any indication, there could be storms on the market’s horizon.

Two Red Flags Buffett Sees

Buffett has good reason to be wary – he looks at the same indicators that we do. Two especially bright-red recession warning flags are the tech-stock bubble and the shrinking total money supply in the economy.

We know that the bull market that’s kicked off since last October is little more than a mirage. It’s been fueled by a small number of overvalued stocks… Here’s the Magnificent Seven you’re always hearing about and their P/E ratios: Nvidia (NVDA) at 119x, Tesla (TSLA) at 79x, Amazon (AMZN) at 76x, Apple at 31x, Microsoft (MSFT) at 36x, Meta Platforms (META) at 30x, and Alphabet (GOOG) at 26x.

These stocks have created an even more concentrated and even larger financial bubble than the epic tech bubble of 2000.

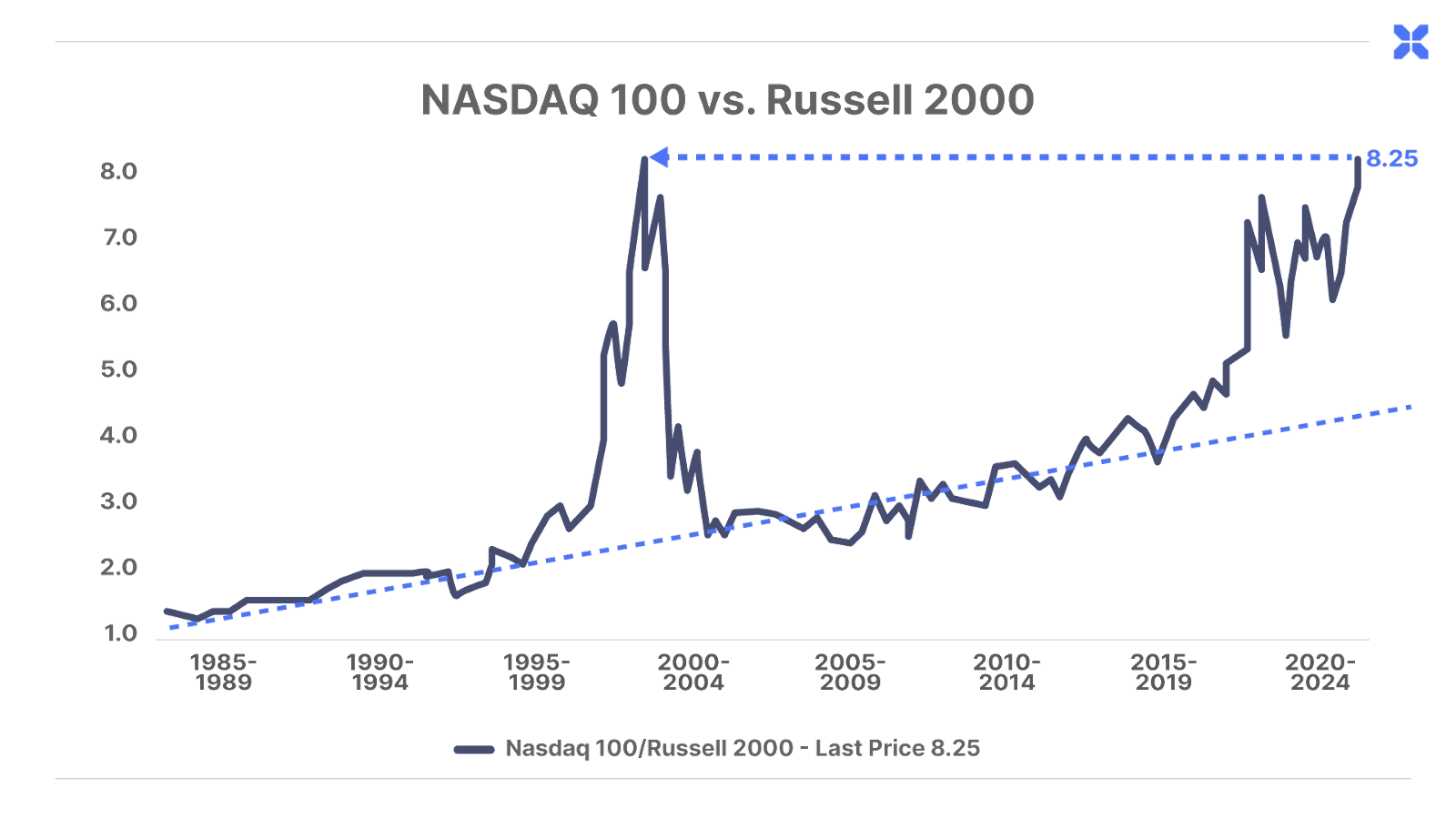

Here’s a chart I presented at our recent Porter & Co. conference at my farm. When I did, everyone got very quiet.

Just compare the Nasdaq 100 (the biggest tech stocks) to the Russell 2000 (the smallest U.S. listed stocks) over the last 25 years.

During the dot-com bubble’s peak, the Nasdaq 100/Russell 2000 ratio hit 8.1. That means tech stocks were 8.1 times more expensive than small-cap stocks.

Today… tech stocks are 8.2 times more expensive than the Russell 2000.

Unfortunately, too many people (especially pundits and talking heads) forget that mean reversion works like a magnet, pulling it back to historical averages over time.

And when the recession eventually hits, we’ll see those Magnificent Seven stocks – with market capitalizations well above $1 trillion – take the air out of this massive bubble. These stocks all have downside potential of 50% or more in the next 12 months as a recession tears through the U.S. economy.

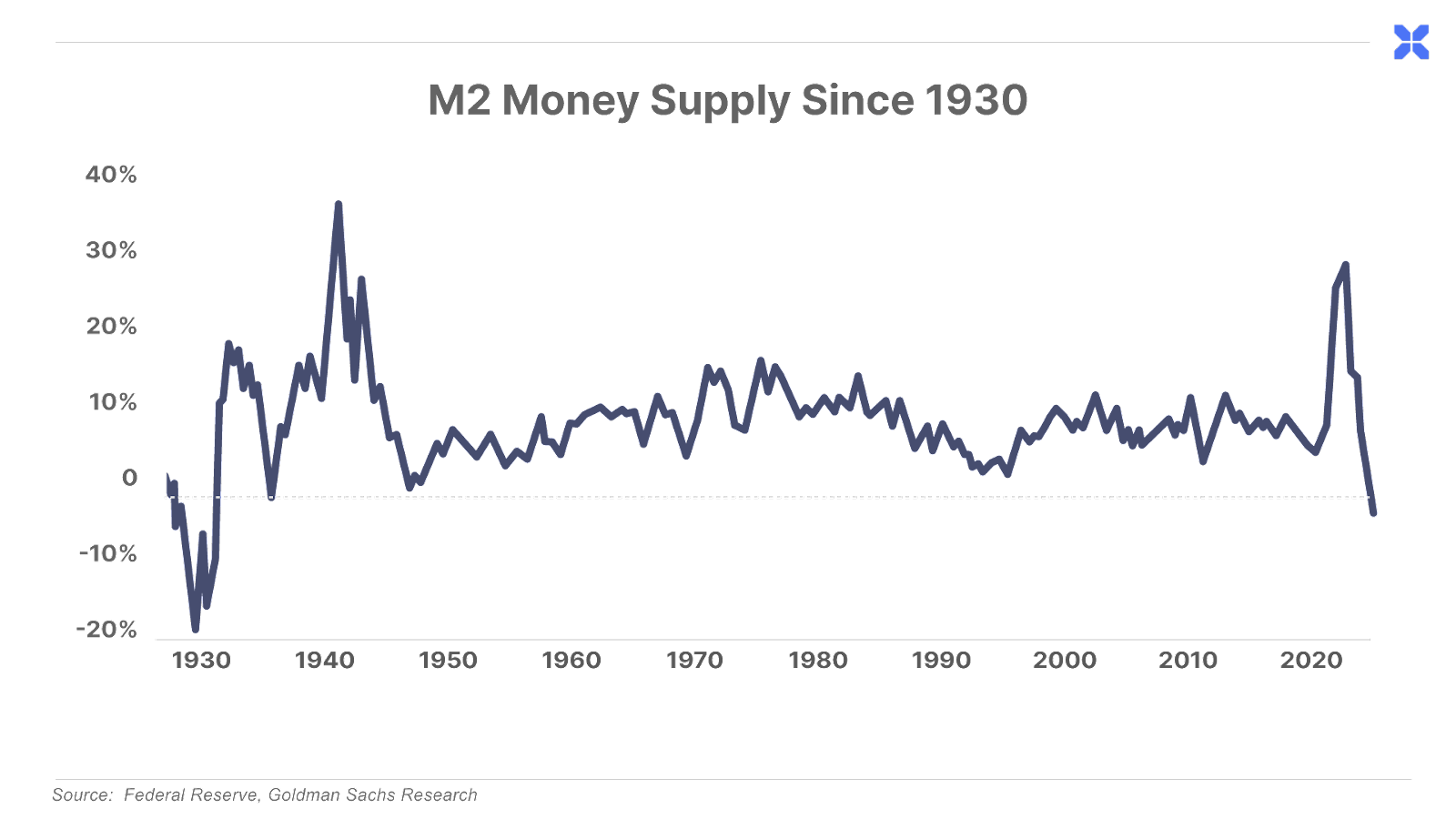

In addition, M2 or total money supply (cash and checking accounts) is contracting for the first time in 74 years. Each time this has happened, dating back to the Civil War, double-digit unemployment and a Depression have followed.

Sure, the central bank and Congress may continue pumping stimulus to try to save their jobs. But this indicator has only experienced this type of contraction four times in the last 150 years.

But what’s different this time from the previous ones?

Inflation…

The silent killer was at a 40-year high just over a year ago. If the Fed tries to pump more stimulus into the coming disaster, inflation will only shoot right back up to those levels or worse.

Inflation is already killing the consumer. So too is crippling debt.

Credit conditions remain highly worrisome for the horizon. In September, S&P Global Ratings warned “credit conditions for borrowers in North America will likely deteriorate” due to higher rates and a likely recession.

The company projects that the U.S. trailing-12-month, junk-corporate-bond default rate will hit 4.5% by June 2024.

And the surge in consumer-credit delinquencies rivals the 2007 period, one year before the epic financial meltdown that sank the global economy. Mortgage rates have swelled above 7%, credit card debt has hit all-time highs above $1 trillion, and car-loan defaults have risen above 2%, according to the FDIC.

These negative economic factors – and plenty more – lead us to believe that a recession remains imminent for 2024 despite the ample amounts of infrastructure stimulus and massive government deficits.

Waiting for the Storm to Hit

While the mainstream media continues to toe the line on economic reports, it’s evident that consumers and businesses are hurting, and contraction is inevitable.

We believe that Buffett sees the same storm coming and wants to be ready to deploy capital at points next year when the market moves lower. Buffett will continue to request discretion from the Securities and Exchange Commission on one or more of the companies he is buying or in which he is building stakes.

This will allow him ample time to allocate capital over a period of time to dollar-cost average into these positions. By the time his positions are eventually disclosed, he will have exploited the value created in the market by this pending downturn.

Any upcoming period of volatility will fuel panic among most retail investors, but we argue that it presents an uncommon opportunity.

It’s also important to note that cash is a position and an essential tool for a patient investor. Investors don’t need to allocate every dollar available to equities, bonds, or other assets. Buffett’s business partner and Vice Chair of Berkshire Charlie Munger once said, “The big money is not in the buying or selling, but in the waiting.”

Here at The Big Secret on Wall Street, we follow a similar blueprint. We believe the surest way for investors to protect – and even build – wealth in the years ahead is to own the world’s most dominant, capital efficient businesses, as well as hard assets (particularly gold and Bitcoin).

That’s why we have built a portfolio dedicated to these businesses that would be attractive to Buffett and other investors who style their portfolios around long-term forever companies – or “Inevitables,” as Buffett describes them.

We’ve also compiled a list of 15 of our favorite capital efficient businesses that we recommend buying when they reach attractive prices – you can view that list here. We will alert active subscribers of The Big Secret when these stocks reach the right price to buy.

As Buffett once said, “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.” While we can’t predict the weather or the timing of the market, it feels like that time is fast approaching. Build up your own cash hoard – and be ready to buy when the storm arrives.

Mailbag

In The Big Secret on Wall Street mailbag, Porter answers letters from readers. He cannot offer individual investment advice, but can respond to general questions.

Please email us at [email protected] to have your questions answered. We’d love to hear from you!

Today’s first letter comes from L.S. who writes:

I’ve been with Stansberry Research for several years before watching your video and coming aboard.

I don’t have complaints. Most of your top soldiers were more than helpful – including the phone staff.

What concerns me is not the unstoppable emails I receive from so-called stock market gurus, but from the same catastrophic nightmare they all claim is coming.

I’m referring to the more than 100 largest banks joining with “Fed Now” and an insidious plan to end the dollar immediately – replacing it with a digital dollar or some form of crypto. Then, deciding what our “actual” dollars are worth.

12 cents? Of course, I sound manic, foolish, crazy. But Biden is our president. Millions of people think men can have babies. Biden’s supposed to speak of this sweeping change the second week of December. Maybe I’m overthinking this but what if I’m not.

Thanks so much for your time, Mr. Stansberry.

Should I move to Venezuela?

You and Hershey are my last hope.

Porter’s comment: I appreciate your note.

A couple of points in reply:

1. We (at Porter & Co. and also at Stansberry Research) do not spam. If you don’t want our emails, you can unsubscribe. That said, our emails are often sent to you by companies we contract with for that purpose. Our contracts require them to follow all applicable laws and regulations relating to such marketing, which includes not engaging in spam. So… if you’re getting emails and they’re not from us and they won’t let you cancel… Please take the time to contact us. We want to know about it so we can do everything in our power to make sure it stops.

2. I am 50 years old. My grandmother was born in 1920. Her grandmother lived through the Civil War, where their house was burnt to the ground by Sherman’s forces. Think about the number of horrendous catastrophes that we have brought onto ourselves in this period: We started a global war of conquest (against the Spanish). We decided to participate in a global war of cousins in WWI. We decided to abandon gold. We decided to go to war alongside Stalin. We decided to be involved in a land war in Asia. Twice. We invaded Afghanistan – the graveyard of empires. We invented and detonated nuclear weapons – twice. Despite not having any worthy seaborne adversaries, we’ve maintained a nuclear Navy at massive expense for almost 80 years… a fact that’s led us into one catastrophe after another.

Despite all of these enormous mistakes, we still have, by far, the wealthiest and best country in the world. And our best corporations are, generally speaking, wonderful institutions.

I don’t know what the banks have planned for us next. But with a Fed debt well in excess of 100% of GDP, it’s not hard to imagine what they’re going to do: print it away.

Whether they do that with paper or CBDC (central bank digital currency) doesn’t make much difference, in my view.

How should one handle that?

Well, it’s been going on since 1913. What’s done well in that period?

- Good businesses.

- The war machine.

- Gold.

- Bonds – when their yields are safely above inflation.

- And probably best of all, at least on an annualized basis, Bitcoin.

- Real estate – when the leverage can be obtained at a cost below inflation.

My bet is that these trends continue.

The next letter comes from K.S. who writes:

Being only an amateur “economist” but quantitatively oriented, I am perplexed as to why “recession” is identified only if and when some government agency gives that identification its blessing. It also seems obvious that “recession” would mean different things to the poor, working poor, middle class (small entrepreneurs), wealthy, and ultra wealthy. One “size” or indicator does not fit everyone.

This being said, has anyone researched the quantitative characteristics of recession and charted these various characteristics over time and thereby tried to build a better quantitative indicator and severity indicator of “recession” across the “wealth” levels and age groups?

Thank you.

Porter’s comment: You make a great point, and it’s one of the many failures of our modern day approach to the “dismal science” of economics.

From an investment perspective, the key is that, if you wait until the recession becomes obvious and officially declared, it’s too late.

During the Great Financial Crisis, for example, it took the National Bureau of Economic Research until December of 2008 to officially declare that the U.S. entered a recession one year earlier, in December 2007. Of course, by that point, investors had already suffered through the worst of the bear market declines… and you would have been much better off buying stocks rather than selling at that point.

How to avoid this fate? I suggest taking a lesson from one of the world’s greatest traders, billionaire Stanley Druckenmiller, who once said:

“The best economist I know is the guts of the stock market”

What he meant by this was to pay attention to the average stock in the market. This can often provide clues to where the economy is headed before the broad market averages, like the Nasdaq Composite or S&P 500, which can mask weakness thanks to the outperformance of a few large stocks.

One way to measure the inside of the market is through the equal-weighted Russell 2000 Index. This is a basket of the smallest 2,000 publicly traded stocks, with each stock contributing equally to the overall index – as opposed to the market-cap weighted S&P 500 index, where a handful of large stocks dominate the price action.

Prior to the Great Financial Crisis, the equal-weight Russell 2000 peaked in July 2007 and began to roll over. Even as the S&P 500 rallied to new record highs in October 2007, the equal-weighted Russell 2000 made a lower low before continuing its descent. That provided a clear warning signal that all was not well below the surface of the market.

We’re seeing the same dynamic at work today. The equal-weight Russell 2000 peaked in November 2021, and has continued making a series of new lower lows – and is down 32% – even as the S&P 500 and Nasdaq recover toward new highs. In other words, the average stock in the market is the deepest bear market since the dot-com bust and the Great Financial Crisis.

Stepping away from the price charts, let’s listen to what CEOs are saying about the state of the U.S. economy. Yesterday, the CFO of WalMart, America’s largest retailer, warned of a sharp slowdown in consumer spending:

“In the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer… We are more cautious on the consumer than we were 90 days ago at this time.”

Meanwhile, the management of Target – America’s sixth largest retailer – issued the following note of caution in an earnings call earlier this week:

“Higher interest rates, resumption of student-loan repayments, increased credit card debt, and reduced savings rates have left them [Target consumers] with less discretionary income, forcing them to make trade-offs in their family budgets.”

Even as Wall Street cheered the supposedly good news on a “better than expected” inflation reading earlier this week, Target noted that its consumers remain under intense pressure from the cumulative effect of soaring prices over the last few years.

Whether you look at the guts of the stock market, or listen to the conference calls of America’s top retail giants, one thing is clear: all is not well in this economy. I continue to recommend investors approach today’s market with extreme caution.

The final letter today comes from L.L. who writes:

Porter and team: It only makes sense that Xi will want to go in and take full control of Taiwan while the U.S. is weak and distracted. So with the war in Ukraine, the war in Israel, the hardware we left behind in Afghanistan, the draw down of the SPR and our current administration, it seems like Xi will make his move sooner rather than later. I’ve seen people go on record predicting it will be before the end of 2023! But let’s assume it will be at least before our next election – so within one year. Have you and your team been researching this and can you estimate the timing better than that? And also there are usually industries that will get hurt badly that maybe we should be backing out of ahead of time and maybe an industry or two that will benefit from said attack/crisis. Can you lend any details to the likely impact by major industry?

Porter’s comment: I agree that the world is entering a very dangerous time. Historically, when a global debt bursts – like the one I see unfolding in the coming months – politicians seem to find their way into starting wars.

The China-Taiwan situation has been simmering for many years, and is one of many global hot spots that could boil over any moment. In today’s issue of the Porter & Co. Activist Investor, Tom Carroll goes into great detail about these risks. He’s also identified one stock that could provide a safe haven for investors in today’s age of rising geopolitical risks. Click here to read the latest issue, just published today.

Porter & Co.

Stevenson, MD

P.S. If you’d like to learn more about the Porter & Co. team, you can get acquainted with us here. You can follow me (Porter) here: @porterstansb.