Bitcoin is already the second largest commodity ETF asset (from Bitcoin Archive via X)…

JUST IN: #Bitcoin overtakes silver to become the second biggest commodity ETF. 1. Gold – $96b 2. BITCOIN – $27.5b 3. Silver – $11.5b It’s just week 1…

JUST IN: #Bitcoin overtakes silver to become the second biggest commodity ETF. 1. Gold – $96b 2. BITCOIN – $27.5b 3. Silver – $11.5b It’s just week 1…

Twice as much #bitcoin is LOST as is currently controlled by institutions and governments. Only a tiny fraction of the world owns bitcoin, and after the halving in April, only 1.3125 / 21M @btc will be left to be mined. It might make sense to get some, just in case it catches on.

For distressed-debt investors, knowing about bankruptcy is critical. In this month’s update, we will tell you how bankruptcy works, and explain why it’s important for bondholders to know the ins and outs of the process – and to realize huge gains when bonds emerge from a troubled state.

This innovative business is the fastest-growing company in the HR-software industry, with a 1,200% increase in revenues over the last decade. With only 5% market share today, the company has a long growth runway to continue delivering market-crushing returns.

Dear Porter & Co. Biotech Frontiers Subscribers: On January 22, Sagimet Biosciences (Nasdaq: SGMT) – a member of our inaugural 10-stock basket kicking off our portfolio – announced top-line results from the Phase 2b clinical trial of its lead drug candidate, Denifanstat. Denifanstat is a promising treatment for liver fibrosis and NASH, serious metabolic illnesses that afflict

An investment fad is a short-term financial trend that quickly gains popularity and interest among investors – but typically lacks long-term viability or strong underlying fundamentals. Let’s look at several prominent fads of the last decade and see what they reveal about today’s investment fads.

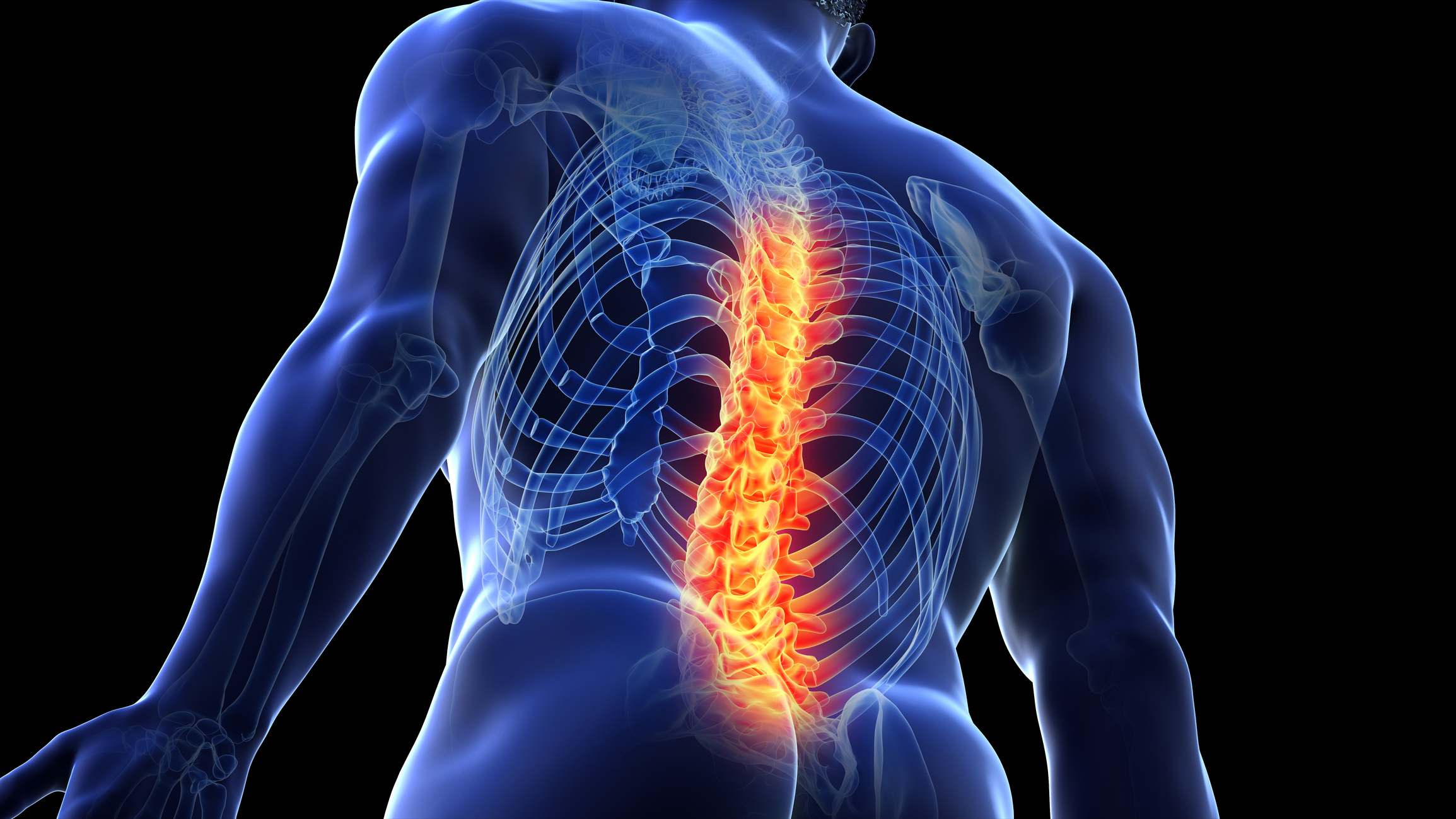

In this issue, we focus on a medical-device company that specializes in both orthopedic and spinal products used by doctors and surgeons across the globe. A mismanaged merger and other changes in strategy have sent the stock to record lows. Now, with an activist investor involved, we see good things happening for this company.

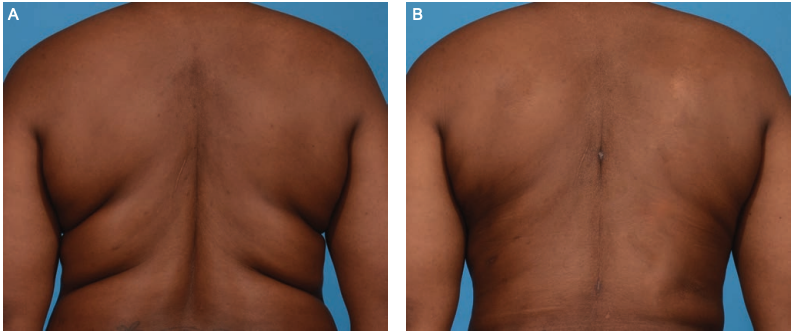

This capital efficient global leader in cosmetic devices has grown revenues at more than 50% annually the past five years. But due to a series of short-term macroeconomic challenges, the business trades at a record low valuation, creating a rare buy opportunity

This issue features of one of the largest and best-known online education companies in the world. The bonds declined 75% from their highs as the business stagnated in 2023 but now offer good value. As we detail in the analysis, these are speculative bonds with a meaningful chance of gain, a possibility of bankruptcy, and a real chance of loss.