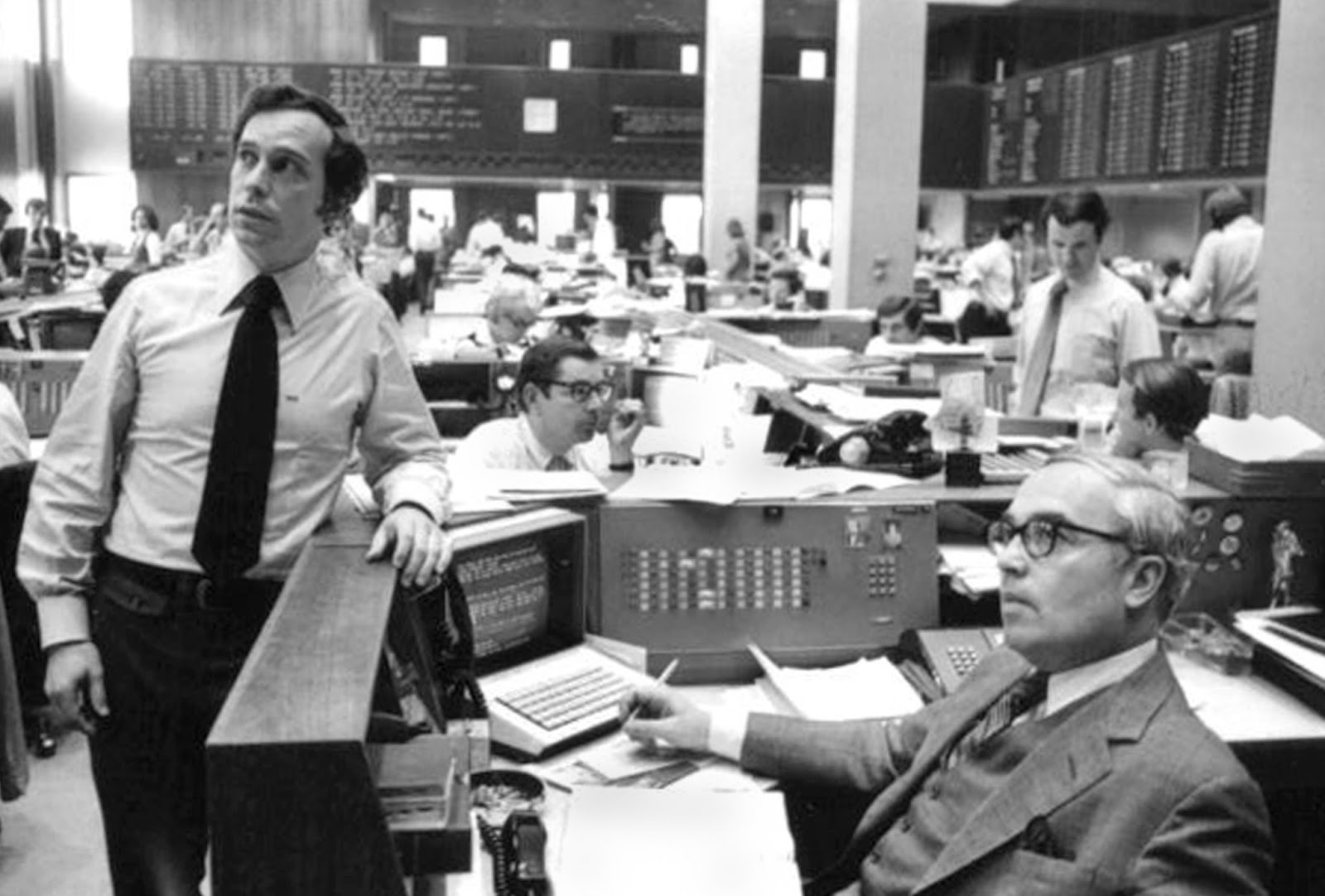

The Wild West Of Bonds

The collapse of Drexel Burnham Lambert in 1990 triggered a collapse of the high-yield bond market: not a single new high-yield issue came to market for the whole remainder of the year. Marty Fridson recounts how the Great Debacle came to be.