Innovations Have Slowed and Sales Are Falling Fast

“Maybe that was a little too hard…”

In 2019, Elon Musk challenged a co-worker to throw a metal ball at the “armor glass” window of the brand-new Cybertruck. Musk’s company, Tesla (Nasdaq: TSLA), had just unveiled the long-awaited – and quite unusual looking – electric vehicle (“EV”) to the public during a special event at its Los Angeles, California, design studio.

The vehicle’s cold-rolled stainless-steel doors were undented by an earlier sledgehammer blow. But the window didn’t fare as well. The metal ball unexpectedly – and embarrassingly – shattered the supposedly bulletproof glass. Oh, well, Tesla’s CEO seemed to say. “Maybe that was a little too hard.”

The Cybertruck was promised as a rugged all-terrain vehicle with a 500-mile battery range and a relatively affordable sticker price of less than $40,000. Today – after years of production delays – it’s been downgraded to a $61,000-plus vehicle with a 250-mile range and questionable off-road performance… if you can get one at all (it still hasn’t gone into mass production). And no, it (still) isn’t bulletproof… or even hardball proof.

It’s been five years since that on-stage debacle – but it remains an apt metaphor for the company itself.

At Tesla, reality has long lagged the hype… but that gap is growing into a Grand Canyon-like chasm. Musk likes to frame Tesla as a world-changing technology company. But now it’s looking more and more like an ordinary (and overpriced) automaker.

Meanwhile, legacy automakers in Europe, the U.S., and Japan – like BMW, Ford, and Toyota – have invested more than $500 billion into EV innovations since the Cybertruck debut. Models such as Rivian’s R1S, Ford’s Mustang Mach-E, and the lower-priced Hyundai Ioniq 5 are finding an audience .

Companies that didn’t even exist in 2019 are already manufacturing EVs that look fresher and better-built than any current Tesla. And the more mature Chinese car maker BYD has launched eight new EV models – subcompact and compact hatchbacks, compact and midsize SUVs, and compact and midsize sedans.

While the pace of growth of the EV industry has slowed to the speed of a sloth, Tesla is stuck in the quicksand. Most companies that make EVs are selling more EVs than they did the year before. And EVs have grown market share in the overall auto sector, from 5.9% to 7.6% over the last year. But while Tesla remains the best-seller in the category, its sales are now declining for the first time in four years and its share of the EV market has dropped from 61% in Q1 2023 to 51% now.

This is not breaking news, but the worsening continuation of a downward trend…

Last May, we warned Big Secret readers that Tesla was in deep trouble.

In short, the EV maker was beginning to face serious competition for the first time in its history. CEO Elon Musk had responded by significantly slashing prices. And though this did boost the company’s sales in the near term, it also hurt profitability. We wrote then…

Tesla’s Q1 2023 net income fell by 24% from Q1 2022, from $3.3 billion to $2.5 billion. This drop in profitability came despite Tesla selling more cars and growing its revenues by 18%, to $20 billion, over the same period.

In other words, Tesla is now being forced to compete on price and sacrifice profitability in order to keep the ‘growth story’ alive – moving more units, but generating less income.”

We also warned that cutting prices was likely to be a losing strategy in the long run as well…

… in a prolonged price war, Tesla would be at a significant disadvantage. All its eggs are in the EV basket – while its competitors have other ‘legacy’ vehicles to fall back on if EV sales slow.

But more importantly, if Tesla keeps cutting prices, it risks destroying its ‘brand power.’ Consumers will eventually see it as just another mass-market vehicle like a Honda or Kia, which means it won’t be able to charge higher prices in the future.”

Less than one year later, it looks like we were right.

Tesla Faces a “Perfect Storm” of Problems

Over the past 11 months, competition in the global EV market has increased dramatically. In addition to a slew of new offerings from domestic and European automakers – there are now more than 40 models available, compared with about nine in 2010 – Chinese EV manufacturers have also been flooding the market with several lower-priced models. These include the Seagull – the first-ever EV available for less than $10,000 – recently introduced by China’s leading EV maker, BYD.

In the meantime, sales growth for EVs in general has been slowing significantly in the U.S. as the realities of ownership become more apparent to non-enthusiasts and mainstream consumers. As we mentioned above, EVs were 7.6% of total car sales in 2023, up from 5.9% in 2022. However, EV sales in Q1 2024 were 15.6% less than in Q4 2023 – the first quarter-over-quarter decline since 2020.

Limited battery range and a relative lack of charging infrastructure in the U.S. and in Europe make EVs less attractive for those who regularly drive longer distances.

The total number of public and private EV charging stations in the U.S. has nearly tripled over the past five years, from around 23,000 in 2018 to 68,000 today. Yet this is still less than one-third the nearly 200,000 retail gasoline stations in the U.S. And while the Biden administration has directed $7.5 billion toward its goal of having 500,000 charging stations in the next few years – that goal is unlikely to be achieved.

Even that unachievable goal is short of the 1 million charging stations that consultancy McKinsey & Co. projects is needed by 2030. EV charging stations are also far less equally distributed than gas stations, with many rural routes and even bustling suburban communities lacking places for EV drivers to plug-in.

Even as the charging infrastructure grows, there is a psychological shift for some drivers known as “range anxiety.” With gas stations dotted throughout the country, it’s rare for an internal combustion engine (“ICE”) driver to be in a position of not being able to fill up – which takes only five minutes for most vehicles. EV chargers are not only in short supply but they are also hard to find. There are no 100-foot-tall Shell signs in sight from the interstate to reassure drivers that a charging station is nearby. The apps that provide EV-charging locations are unreliable. And reports of broken chargers, once found, are common. Plus, if the one charger shown on the app is in use, it means around a 30-minute wait before spending an additional half hour to charge yourself.

Despite lower-priced options, cost is still a big issue as well. Many consumers balk at paying a premium price for an EV relative to a traditional ICE vehicle. While the cost of EVs is falling closer to that of ICEs, the average EV still sells for roughly 17% more than the average ICE vehicle ($55,353 versus $47,401), according to automotive research company Kelley Blue Book.

However, Tesla is particularly exposed to consumers’ price aversion. Even after its recent price cuts, Tesla’s cheapest current vehicle – the Model 3 sedan – still carries a hefty price tag of nearly $40,000 in the U.S.

Meanwhile, the company’s focus on profitability in recent years (prior to Musk’s price cuts last year) came at the expense of continued investment in innovation that had made Tesla a leader in EVs in the first place.

Of Tesla’s four flagship models (S, 3, X, and Y), all but one (the Model 3) have gone stale and are in need of a refresh. The company has introduced only one new model in recent years – that unusual-looking Cybertruck, which since its bungled debut has been plagued by rollout delays, quality concerns, and has sold poorly so far. And it has repeatedly delayed the release of long-promised new models, including its high-end Roadster sports car and its low-cost Model 2 mass-market sedan.

This has resulted in a dramatic drop-off in demand for Tesla vehicles. We won’t learn the full impact on the company’s top and bottom lines until they release Q1 earnings later this month. However, if the company’s recent deliveries report – released on April 1 – is any indication, it’s likely to be ugly.

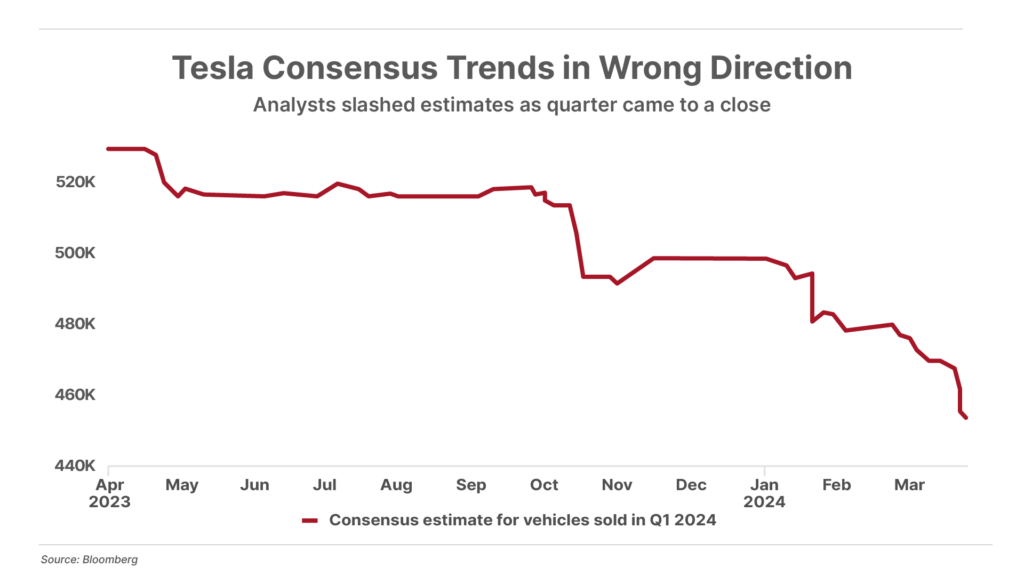

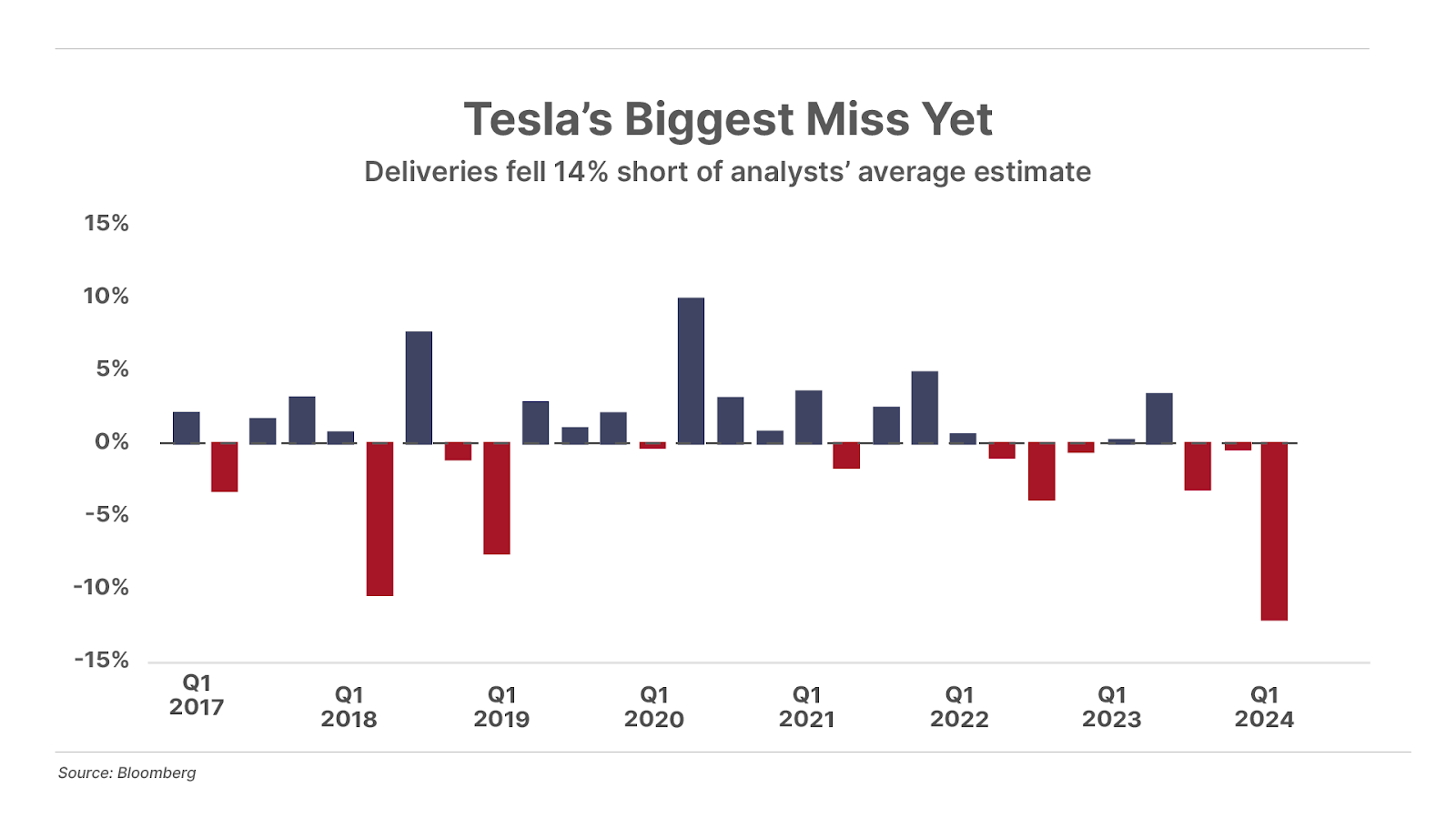

Prior to this deliveries report, analysts had already slashed delivery expectations to just under 450,000 vehicles, representing a 7% decline from the fourth quarter of 2023.

However, even after this plunge in estimates, the company still missed deliveries by 14%, the biggest production miss in its history. Tesla said it delivered just 387,000 vehicles in the first quarter – a decline of 9% year-over-year, and a whopping 20% decline from the previous quarter.

Based on these results, analysts expect Tesla to report a steep year-over-year sales decline – its first since the post-COVID boom in 2020.

Between a Rock and a Hard Place

Tesla’s best hope at slowing this trend likely lies with the development of the low-cost Model 2 mentioned earlier.

This vehicle has supposedly been one of Tesla’s top priorities from the beginning. In his first Tesla master plan released in 2006 (18 years ago), Musk laid out the goal of producing luxury models initially – and then using the profits from those early models to finance the production of a “low-cost family car.”

However, like many other Tesla initiatives, the Model 2 has been delayed repeatedly for years.

As of the company’s last official update in January, it doesn’t expect to start producing the Model 2 until the second half of 2025 at the earliest. If history is any guide, that forecast may be too optimistic.

According to a Reuters report last week – citing “three sources familiar with the matter and company messages” – Tesla has officially canceled plans to deliver the Model 2 to consumers altogether. Instead, the company is planning to focus solely on developing self-driving robotaxis on that same small-vehicle platform.

Musk replied to the story via his social media site X – saying “Reuters is lying (again)” – but he did not specifically address what was untrue.

This situation leaves Tesla shareholders nervous about holding shares.

On one hand, if Tesla is, in fact, still prioritizing the development of the low-cost Model 2, then perhaps the company will ultimately be able to recapture its dwindling market share in the EV industry – though at the expense of its once-impressive profits and all-important profit margins.

Musk likes to think of Tesla as a world-changing technology company focusing on an array of “green energy” initiatives like EVs, solar panels, and battery technology. Yet the vast majority of Tesla’s revenue comes from its EV business. And doubling down on the Model 2 would only further cement Tesla’s primary position as an automaker rather than a technology company.

As we noted last spring, manufacturing automobiles is generally a terrible business…

It’s a highly competitive industry that requires huge sums of capital to constantly introduce new vehicles each year (or risk losing market share, as Tesla is finding out the hard way). It’s also a low-margin and highly cyclical business, where razor-thin profit margins can quickly turn into buckets of red ink when the economy turns and auto demand drops.

And the poor economics of the auto business are generally reflected in the relatively low equity valuations of the companies that operate in it.

The average price-to-earnings (P/E) multiple for publicly traded automakers is just 6.4 today. By comparison, Tesla currently trades at a sky-high multiple of 66.8.

In other words, if Tesla does continue to pursue the Model 2, its valuation is likely to trade even more in line with that of other automakers over time – which means its stock price could ultimately fall as much as 90% more in a long, painful process of revaluation.

On the other hand, if Reuters’ reporting is correct and Tesla is abandoning the Model 2 to pursue its robotaxi network – a self-driving version of the Model 2 that acts as a hail-riding service – the downside risk for shareholders could be even greater. Robotaxis would be built in far fewer numbers than a low-cost model aimed at mass-market sales, losing any cost savings derived from economies of scale.

Musk has been promising this network would debut “next year” since at least 2016. Yet despite offering its $15,000 Full Self-Driving (“FSD”) package on Tesla vehicles for years, the reality is the company has yet to achieve full autonomy for a single car – let alone for an entire fleet of vehicles worldwide. And unfortunately, it’s not clear it ever will.

That’s because Tesla chose to adopt a visual/camera-based system rather than the more accurate (and more expensive) laser-based Light Detection and Ranging (LiDAR) systems used by autonomous driving competitors such as Cruise and Waymo.

Musk says Tesla chose a visual system because it operates more like a human driver. But the reality is LiDAR systems were far too expensive at that time to use in a consumer vehicle even if he wanted to. And now Tesla has invested too much time and capital in this existing FSD system to pivot.

The competitors who adopted these more advanced systems have no plans to sell their cars to consumers. Additionally, as the price of these technologies have come down in recent years, newer autonomous EV entrants – such as China’s XPeng Motors – are using a combination of cameras, radar, and LiDAR that is already outperforming Tesla’s FSD system.

If Musk gives up on making cheaper cars and instead doubles down on robotaxis, he’s essentially betting the company’s entire future on a technology that may never actually work as promised.

Continue to Avoid TSLA… But Short It at Your Own Risk

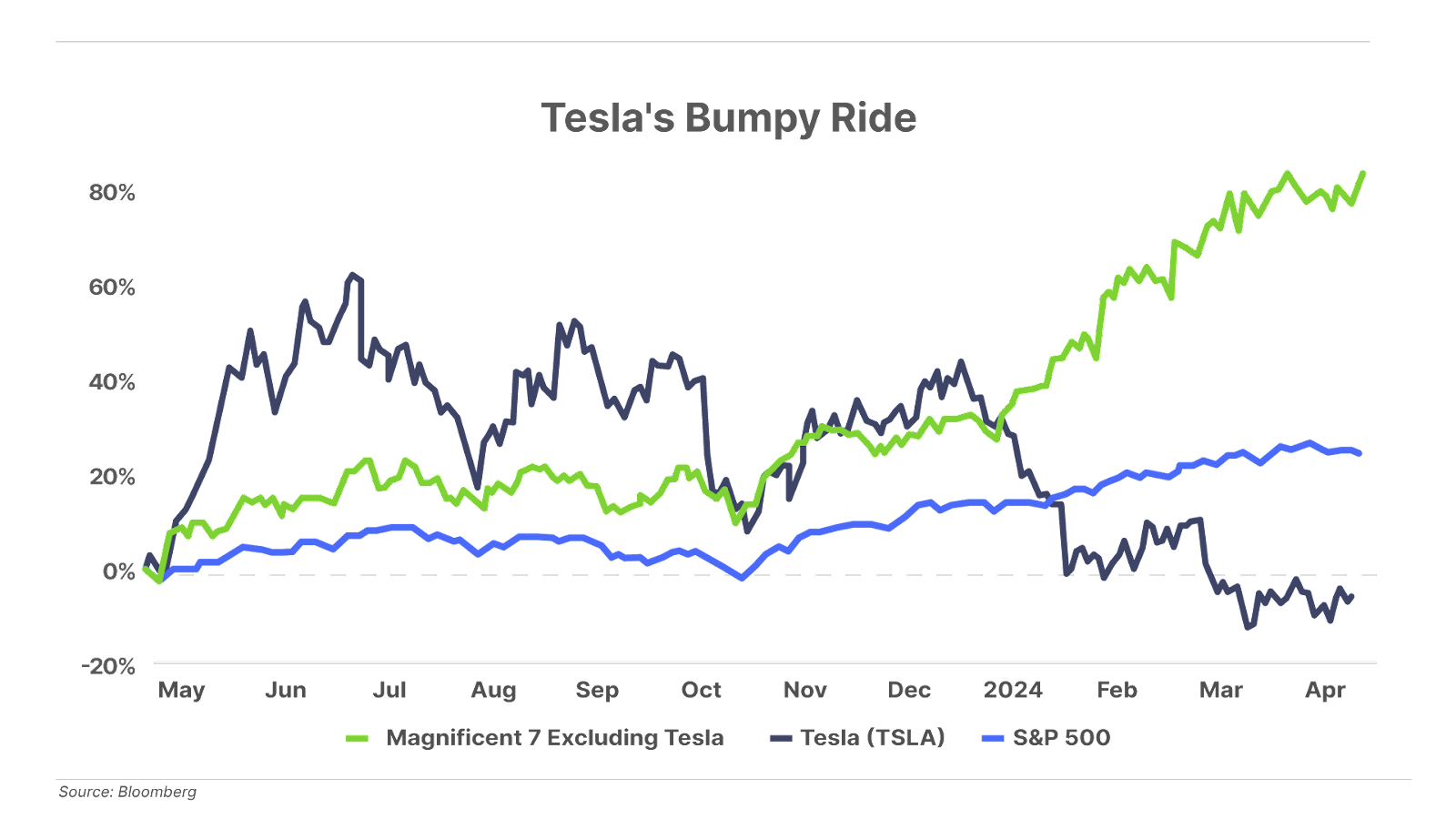

Following our warning last spring, we urged readers to avoid investing in Tesla. And that has turned out to be prudent advice…

Tesla shares are currently trading around 3% below where they were at that time. And the stock has dramatically underperformed both the S&P 500 (up 24%) and the rest of the Magnificent 7 (up 84%) – which it is part of – over the past year.

But it’s been anything but a smooth ride along the way.

Shares initially rallied as much as 66% in the two months after we recommended avoiding them last May, before giving back all those gains over the past eight months. And because of that initial jump, anyone who tried shorting shares a year ago likely would’ve been stopped out near the highs for a loss.

This is why profiting from the short side is so challenging… and why we at Porter & Co. don’t recommend short sales (of Tesla or any other security). You can be confident about the long-term outlook for a company, but it’s incredibly difficult to predict what will happen in the short run.

Today, our advice remains the same… We continue to recommend that most investors simply avoid investing in Tesla, and instead focus primarily on high-quality, capital-efficient companies trading at fair prices. Paid-up Big Secret readers can find our current “Best Buys” in our most recent issue right here… To get full access to The Big Secret portfolio, click here.

Porter & Co.

Stevenson, MD

Mailbag

In The Big Secret on Wall Street mailbag, Porter answers letters from readers. He cannot offer individual investment advice, but can respond to general questions.

Please email us at [email protected] to have your questions answered. We’d love to hear from you!

Today’s letter is from E.C., who writes:

“Porter and Erez,

Thanks for the excellent conversation regarding asset allocation [the discussion was shared with Partners last month and it was featured in The Big Secret on March 29]. I made a commitment to this last year in combination with utilizing the tools provided by TradeSmith for position sizing. It was very hard to fight my emotions in doing this because it meant cutting back on some high-volatility positions that were flying high at the time (we all like to see those big percentage increases). To my surprise, my three portfolios are up a combined 30% year-to-date, well above the major indices. Of the 10 weeks expired in 2024, I’ve had only two week-to-week setbacks and the downturns were minimal.

The point is, you are right, asset allocation works!

As a small-business owner, my time is limited, and thus why I find Porter & Co. so valuable. I read your work voraciously and find that it’s always time well-spent, whether I make an investment or not.

Erez, you have been an educational gold mine in sharing how you approach investing. I believe you are writing one of the best advisories out there right now.

In short, I cannot begin to tell either of you how grateful I am for your work and what it’s meant for me and my family. Carry on!”

Porter’s comment: Thanks very much for your kind note and your support.

While I think our research on individual investments is extremely valuable, I think teaching investors how to build a portfolio (and providing the tools they need to do so) is the most useful content we offer.

It’s awfully hard to get people to try it. But… once they do…

I’m very happy for your success!

Congrats.

Porter