We’re With Druckenmiller on This Undervalued E-Commerce Giant

Food, Sports, and Consumer Goods… It Delivers It All

| Welcome to Porter & Co.! If you’re new here, thank you for joining us… and we look forward to getting to know you better. You can email Lance, our Customer Care Concierge, at this address, with any questions you might have about your subscription… The Big Secret on Wall Street… how to navigate our website… or anything else. You can also email our “Mailbag” address at: [email protected]. Paid subscribers can also access this issue as a PDF on the “Issues & Updates” page here. |

B.K. was weeks away from life-changing wealth – when he decided to throw it all away.

In 2014, the Harvard dropout had spent the previous four years building a thriving online marketplace. Similar to eBay, the business allowed third parties to buy and sell a wide range of merchandise. Within three years of its founding, the business was making more than $1 billion in sales and was profitable.

B.K.’s investors urged him to partially cash out through an initial public offering (“IPO”). But as the IPO date neared, B.K. couldn’t shake the nagging feeling that he had fallen short of his founding vision for the company – which he described in a 2018 Business Insider interview:

“We don’t believe that a company should exist or that a company should be created to strive for a 5% or 10% better customer experience… Our vision, our goal, what we aspire to, is to create a customer experience that’s 100 times better…. I had this moment of clarity where [I asked myself], ‘Is this really living up to that mission?’ … Not even close. We’re still a long ways away.”

So at the 11th hour, just as the IPO documents were about to be sent to potential investors around the world, B.K. pulled the plug – walking away from a nine-figure windfall, more wealth than the average person could achieve in several lifetimes. He later said it was the hardest decision he’d ever made.

| The Big Secret The under-the-radar e-commerce giant has developed the largest and most sophisticated logistics network in its market. Harnessing the power of cutting-edge robotics and AI technologies, it continuously finds new ways to get more products to more consumers faster than any of its competitors. |

After canceling the IPO, he began retooling the business to deliver his vision of a revolutionary customer experience. B.K. started by addressing the biggest customer pain point at the online marketplace he previously founded: product delivery. This required a massive investment into building the largest logistics and delivery network in the country. In the process, he transformed the business from a marketplace into an e-commerce juggernaut.

By 2021, the business had displaced its larger and most established rivals with record-fast delivery speeds and unmatched levels of customer service. B.K. had built a company that lived up to his vision, as the country’s dominant e-commerce company. And seven years after turning down a personal fortune, he went ahead with the IPO in early 2021.

The company raised $4.6 billion in a public offering priced at $35 per share. On its first day of trading, the shares opened at $63.50, or 81% above the IPO price. B.K.’s 10.2% stake in the company was worth over $10 billion, making him, on paper, one of the world’s richest men (and more than 100 times what he’d have earned if he’d gone public in 2014).

But the victory was short lived…

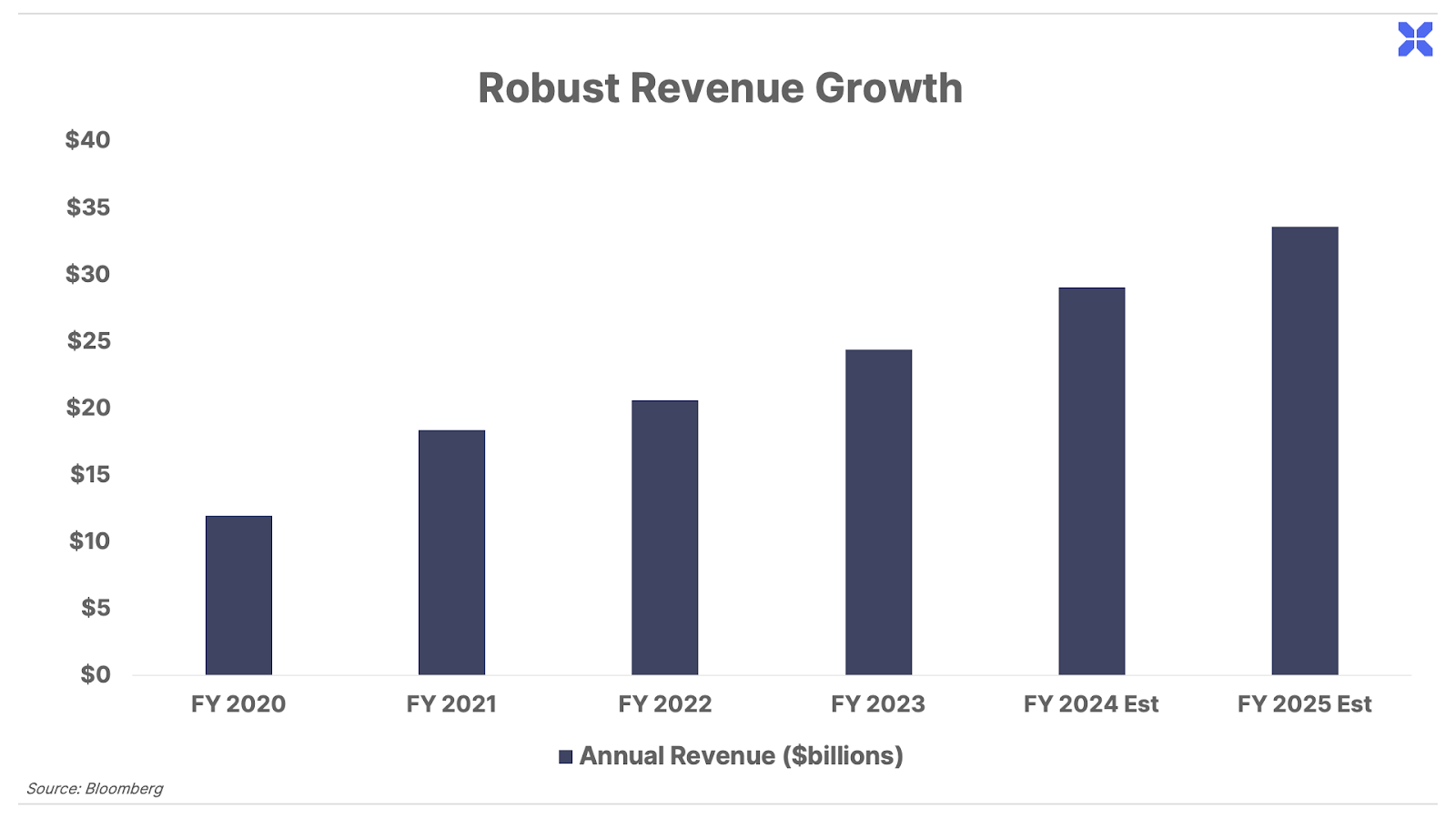

The buying frenzy priced the business to a market capitalization exceeding $100 billion during the first day of trading. With the $12 billion in sales it generated in 2020, the shares commanded an outsized 8x price-to-sales ratio. For perspective, even at today’s near-record high valuations, the S&P 500 trades for just over 2x price-to-sales. And despite the success it had achieved as the fastest-growing, most dominant e-commerce company in its home country, it had yet to reach profitability.

The early exuberance quickly turned to profit taking.

Within two months of the IPO, shares fell 50% from their peak of $69 to below the original offering price of $35. B.K.’s business had become what’s known on Wall Street as a “busted IPO” – meaning anyone who bought into the offering was down on their position. Selling begot selling as investors cut their losses, further pressuring shares.

Even the company’s pre-IPO investors began unloading their stakes to protect their profits. This included the company’s single largest shareholder – Japan’s Softbank Vision Fund, which had invested $2 billion in 2018 at a $9 billion valuation. SoftBank owned more than 35% of the company at the time of the IPO. But after selling billions of dollars worth of stock over the last three years, it owns 22% today.

The persistent selling by the company’s largest shareholder, plus by countless others who saw their early gains evaporate, caused a rout in the stock price. From their peak, the shares have lost 70% of their value and now trade around $18.

However, over that same time period, the business itself went in the opposite direction. The company used the $4.6 billion in IPO proceeds to make high-returning investments, including building the most advanced logistics hub in all of Asia. Fueled by cutting-edge robotics and artificial intelligence (“AI”), the company’s automated logistics network has transformed the business into a cash-flow juggernaut. Last year, the business produced a record $1.4 billion in net income and $1.8 billion in free cash flow.

Meanwhile, the company is growing rapidly. Since 2017, revenues have increased 10-fold from $2.4 billion to $24.4 billion last year. Analysts currently estimate the business will expand nearly 40% over the next two years to reach $33 billion by 2025.

It’s also developed several offshoot delivery and streaming businesses that have become the dominant leaders in their markets.

With the share price collapsing and the business results improving, the stock now trades at a compelling 1.3x price-to-sales ratio. For comparison, that’s a 40% discount to Amazon’s 3.4x valuation – for a business growing twice as fast.

While selling by large investors like Softbank have weighed on the share price, there’s one legendary investor taking the other side of the trade. Hall of Fame fund manager Stanley Druckenmiller, who was an early private investor in the business, went on a buying spree during its post-IPO slump. He’s bought over 10 million shares over the last three years, making it the second largest position in his $3.1 billion portfolio.

In this issue, we’re betting with Druckenmiller on this burgeoning e-commerce giant.

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.