How to Build a Billion-Dollar Business with No Capital

Welcome to Porter & Co.! If you’re new here, thank you for joining us… and we look forward to getting to know you better. You can email your personal concierge, Lance, at this address, with any questions you might have about your subscription… The Big Secret on Wall Street… how to navigate our website… or anything else. You can also email our “Mailbag” address at any time: [email protected].

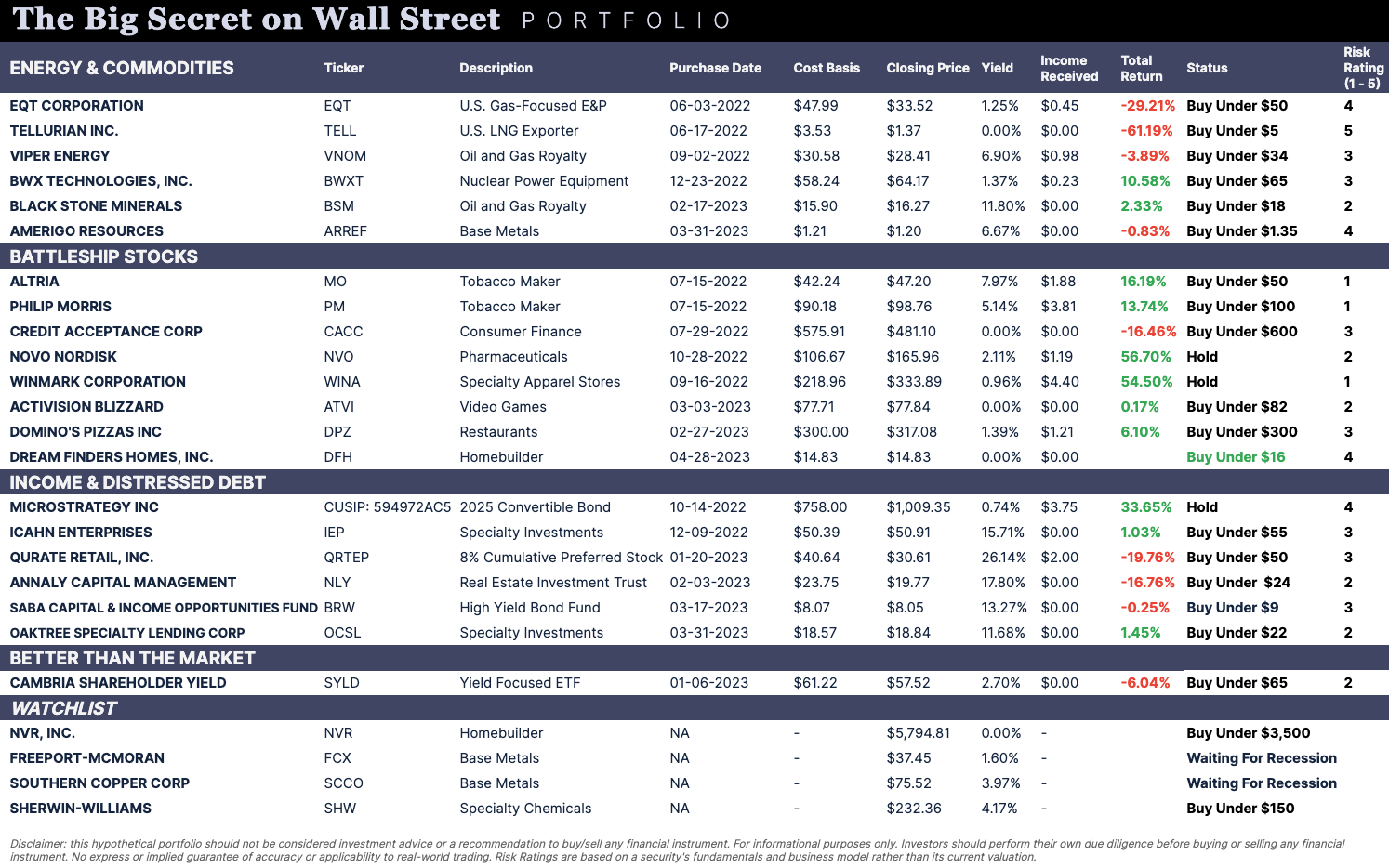

At the end of this issue, you’ll find our model portfolio and watchlist (which is also here) — as well as a “Best Buys” section, where we’ll briefly cover three portfolio names that we think you should consider buying first.

In addition to hosting The Big Secret on our website, it is also available as a downloadable PDF. Click here to download the full report.

Again… we’re excited that you’re with us…and we’re looking forward to a long and fulfilling relationship.

If you’re not a member and would like to learn more, click here.

Patrick didn’t set out to revolutionize an industry.

He just wanted to build houses.

During the roaring housing mania of 2005, the business he was building was a tiny fish swimming in a giant pond. He was trying to find empty lots to build new homes on. But land was scarce, and expensive. His competitors were multi-billion-dollar corporations, and they were scooping up property like marbles on the sidewalk.

At the time, young Patrick hardly had two nickels to rub together. A recent college grad, he’d just moved to Jacksonville, Florida to help his realtor mother buy and sell homes. He also helped buy foreclosed properties and fix them up for resale.

Patrick learned about houses by laying tile, hanging drywall and putting up siding on recently foreclosed properties. He also learned how to identify the right land at the right price for building new homes.

But at the peak of the housing boom, any price was a “right price.” Home builders merrily shelled out ever-larger bales of cash to scoop up vast expanses of land at rich valuations, believing there was a fortune to be made by selling new houses back into the bubble.

As Patrick later explained, in an October 2020 interview:

“Running up to the recession, you couldn’t find a way into the market because the national builders were buying up 500 lots at a time.”

It didn’t end well, of course. When the housing boom went bust, demand for new homes fell by 90%. The buy-it-all-at-any-price builders were forced to liquidate their land holdings at fire-sale prices. Prices for plots of land in Jacksonville fell by 70% from peak levels.

Amid the carnage, Patrick spotted a bargain: three promising empty lots, selling at a deeply discounted price. He figured he could build three homes on the lots for $200,000.

Patrick wanted to buy and build. He had just one problem… he didn’t have $200,000.

What he did have, though, was charm. He visited the Clay County Housing Finance Authority – a local government lender in Jacksonville that funded home construction to support affordable housing – and sweet-talked his way into a $200,000 loan to build three homes on the vacant lots.

But that was only half the battle. Besides buying the land, he’d have to pay for labor and materials. The cost of the land plus construction would be a lot more than $200,000.

Out of options, Patrick came up with a crazy idea.

He’d use other people’s money.

Specifically, the money of the developer who currently owned the lots.

Activating his powers of persuasion, Patrick convinced the developer to accept an IOU to wait for payment until he’d built and sold three houses on the land. That freed up the $200,000 he’d borrowed for construction.

That’s how college grad Patrick discovered the “asset-light” method of homebuilding… transforming the traditionally capital-intensive business of home building into a capital-efficient enterprise. Other companies, including many in our model portfolio, use an asset-light model, but Patrick’s brainstorm was a first for the real-estate business.

Or, so he thought…

We recently wrote about “simultaneous inventions”. Asset-light building is another innovative idea that evolved separately in two different places.

When Patrick issued an IOU to the developer, he was unknowingly following the playbook of NVR – a publicly traded homebuilder that had a very similar brainstorm in the 1990s. We wrote about NVR in July, in an issue that featured a tongue-in-cheek headline: The New “ENRON”.

Like Patrick, NVR was desperate. The company had gone bankrupt in April 1992 after being overexposed to inflated land values during the 1990 – 1991 recession that hit the real estate market.

When NVR emerged from bankruptcy, it figured out how to avoid the risk of holding too much land at the wrong point in the cycle. Instead of buying land outright, the company made deals with land developers to secure land using upfront deposits, which they could walk away from (forfeiting the deposit) if the market soured. This lowered their risk during downturns, and transformed the traditionally capital-intensive home building business into a beacon of capital efficiency.

Porter identified the brilliance of this business model back in October 2007 in Stansberry’s Investment Advisory:

“NVR pioneered a “land-lite” homebuilding business model. While most homebuilders buy vast tracts of land and develop them over years, NVR doesn’t own any raw land – none… As a result, NVR only maintains a small amount of lot inventory compared to other builders… I’m sure my timing is way, way too early. But I’m prepared to average down and be very patient… Don’t use a stop loss on this position, as NVR stands almost no chance of going bankrupt, but sentiment in the sector is very likely to decline.”

Investors who followed Porter’s advice posted total returns of 1109% from the October 2007 recommendation through today, compared with a 163% gain in the S&P 500 over the same period.

NVR is a perfect example of the “inevitable” stocks we track – companies with entrenched competitive advantages and stellar economics that make them “when,” not “if,” buys. That’s why NVR is on the watchlist in The Big Secret on Wall Street model portfolio to buy at the right price.

Patrick learned about NVR’s model after he’d launched his own company. He studied up on NVR, and became even more convinced that “other people’s money” was a winning approach. As he explained in his company’s 2021 annual shareholder letter:

“After several years, people began to mention that we reminded them of a builder called NVR out of Reston, VA. I had never heard of NVR because they were not actively building in any of our markets then, so I began to research their track record. I was astounded to appreciate that they had some of the best historical returns of any business, regardless of industry. Once we researched their performance through the financial crisis, it became very apparent this was going to be the only way we would ever run [our company].”

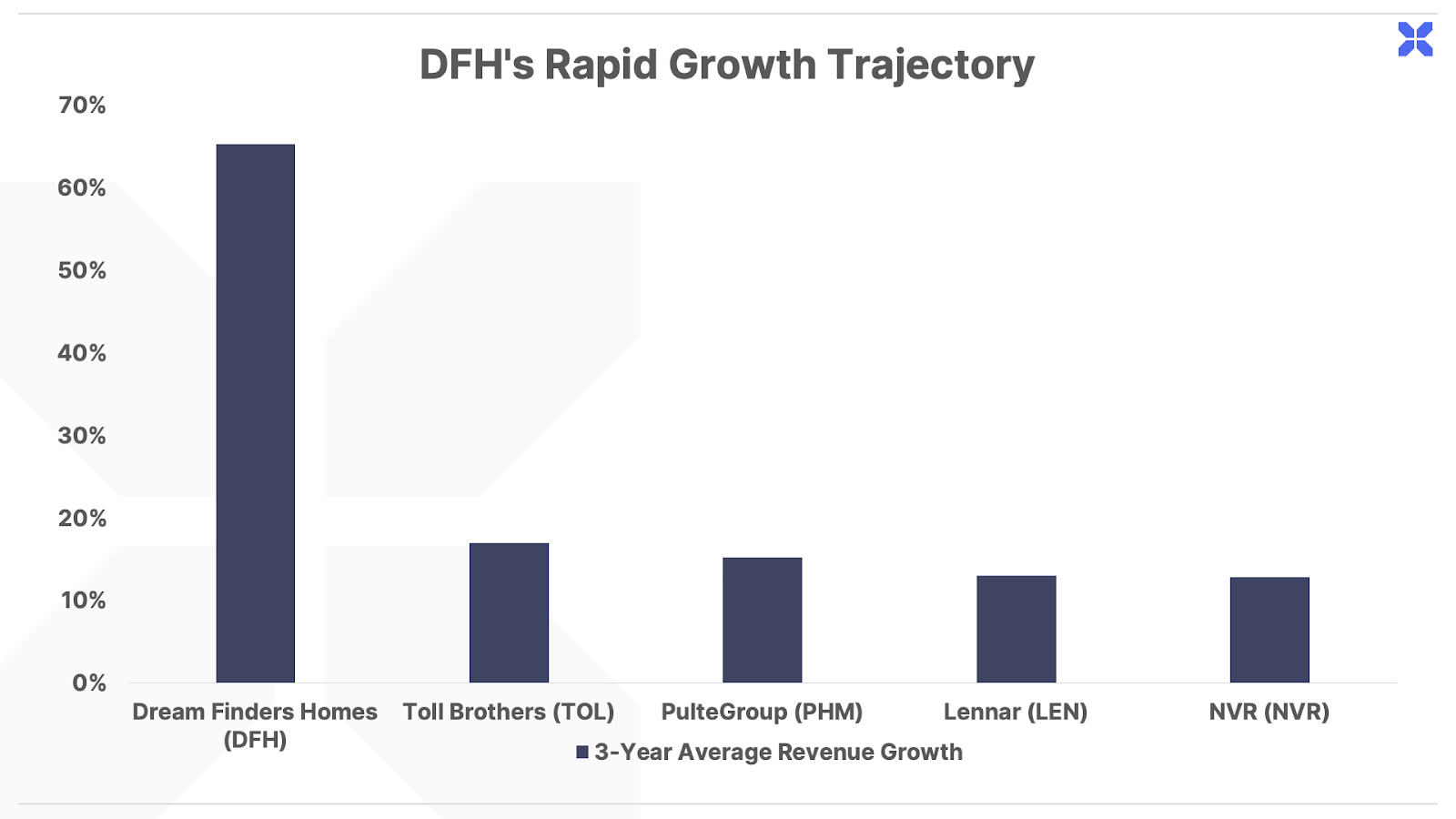

Over the last 14 years, Patrick has grown his upstart home builder by nearly 50% every year, starting with 27 homes in 2009, growing to 85 in 2010, then 150 in 2011 and 260 in 2012. The company crossed $1 billion in sales in 2020, and increased revenue by an average of 65% per year over the last three years. Perhaps the most impressive part is how he achieved this meteoric growth with no upfront capital, while generating positive earnings every year along the way.

The company is still in the early innings of rapid expansion, and we believe the best is yet to come.

That’s why today we’re recommending Patrick’s home building company. Outside of NVR, it’s the only other publicly traded home builder using this 100% asset-light playbook.

And because it’s much earlier than NVR in its growth trajectory, we believe the returns from investing today could exceed the market-crushing results that NVR has delivered since Porter’s original recommendation back in October 2007, which has outperformed the stock market by a factor of more than 8-to-1.

The Next NVR

[ntzcrm_restrict

Patrick Zalupski founded Dream Finders Homes (NYSE: DFH) with his original $200,000 loan in 2008. In 2009, the company profitably built 27 homes, and continued reinvesting 100% of its profits to grow nearly 10-fold to 261 home sales by 2012.

Zalupski bought out his partner’s half of the company in 2013. That year, DFH began expanding outside of Florida, starting with Georgia, followed by Colorado, Texas and every state along the southeast coast from Maryland down to Florida.

Last year, the company sold 6,878 homes, up 41% from 4,874 homes sold in 2021. Over the last three years, revenues have grown by more than four-fold from $744 million in 2019 to $3.3 billion in 2022. It’s one of America’s fastest growing publicly traded home builders:

Unlike many businesses that must make a trade-off between growth and profitability, DFH becomes more profitable as it grows. While revenues grew by 4-fold over the last three years, earnings grew by nearly 7-fold from $39 million to $262 million. DFH’s ability to produce rapid growth, and an even faster-growing profit stream, is a testament to its capital efficient, asset-light business model.

The “Buy Now, Pay Later” Land Builder

Most developers pay for land upfront, and then find buyers before beginning construction on empty lots that eventually become future home sales. The problem with this approach is that it ties up vast amounts of capital into expensive land for many months, even years, before ever earning a return on that capital. (Anyone who has ever bought or built a home, or regularly observed an active construction site, knows just how long this can take.)

DFH, on the other hand, never pays in full for land. Instead, it buys “land options,” the updated version of Patrick’s IOU.

These options are the layaway of buying land, where DFH puts down a deposit worth a fraction of the total land value (typically around 10%) to secure empty lots for future home sites. When DFH finds a home buyer willing to sign a contract for a new home on the optioned land, it then proceeds with paying in full for the land, and building the house.

This dramatically shortens the window between when DFH outlays capital for land, and when it earns a return on that capital. It also allows the company to expand at a rapid rate, with minimal capital requirements.

Rather than issuing a lot of new equity and diluting existing shareholders to finance expansion, the company mostly funds growth by reinvesting profits, creating a rapidly growing profit stream relative to shareholder equity.

That’s how DFH generates industry-leading returns on equity (which is net income divided by shareholder equity), beating both traditional home builders and its fellow asset-light peer, NVR:

The superior ROE for DFH and NVR versus its traditional home builder counterparts is a result of their asset-light business model, which unlocks a substantial improvement in capital efficiency by minimizing the amount of shareholder capital sitting idle in vacant land. That’s how NVR has led the pack in shareholder returns since its transformation in the 1990s, and we expect DFH will deliver similar market-beating returns using the same model.

“Asset-Light” Means Less Downside in Downturns

Land options also significantly reduce DFH’s risk during downturns in the real estate market. If the housing market slows, and DFH can’t find home buyers at the right price for its optioned land, it can simply walk away – no strings attached. DFH only forfeits the small upfront deposit… and, unlike traditional developers, it doesn’t carry the cost of that land.

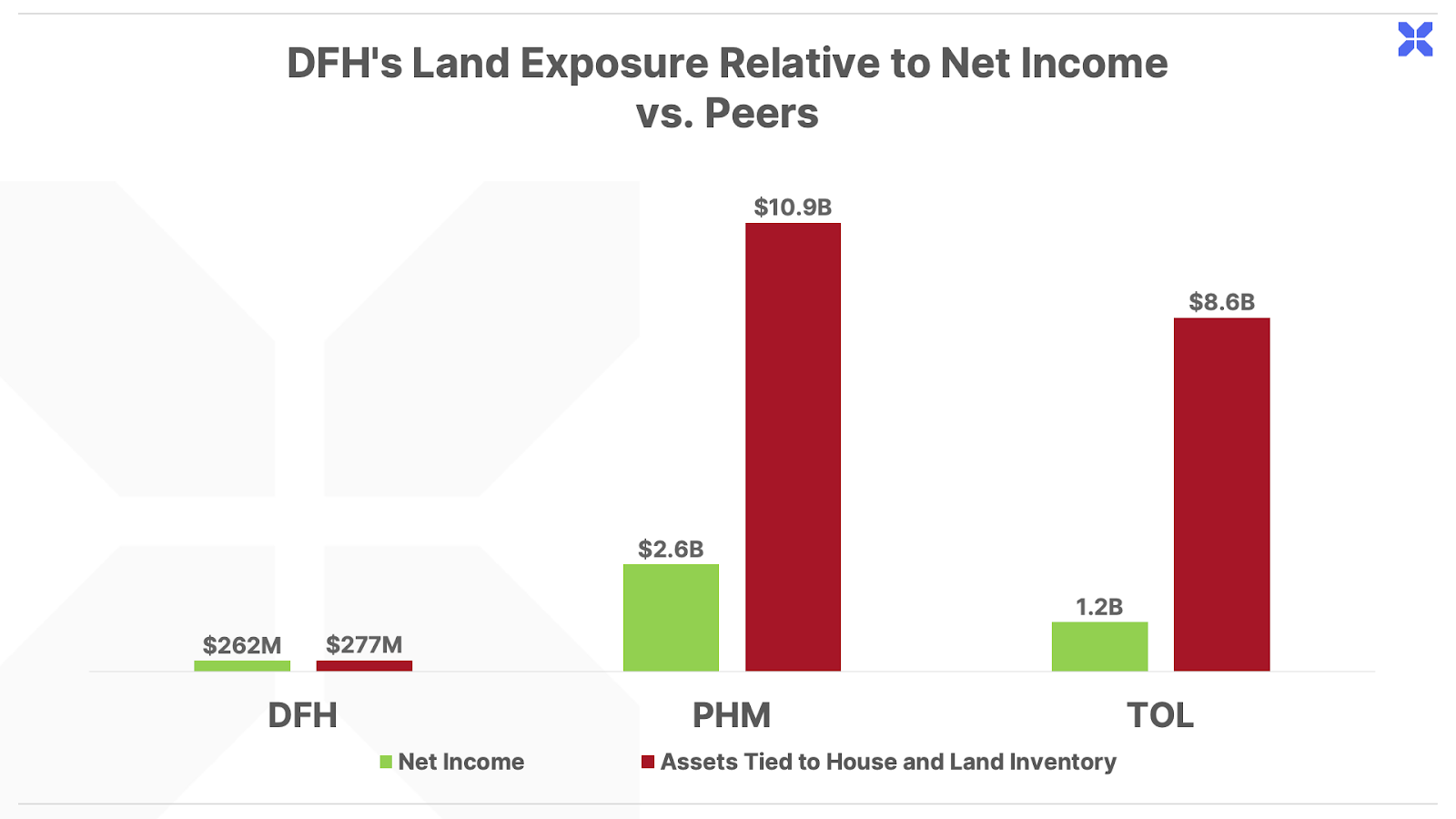

As of year-end 2022, DFH held option contracts worth approximately $277 million, on 37,615 lots. For perspective, DFH generated net income of $262 million last year.

Compare this against a competitor like PulteGroup (PHM), which had $10.9 billion tied up in house and land inventory as of year-end 2022 compared with net income of $2.6 billion. Another competitor, Toll Brothers (TOL), had $8.6 billion in inventory compared with $1.2 billion in net income at the end of 2022.

In the traditional home building model, builders effectively make a big bet on the future direction of home prices. During housing bull markets, home builders generally bid up land values as they expand production.

When times are good, these companies don’t mind paying up for land, because they expect to develop lots into homes that they can sell at ever-higher prices.

But when the cycle inevitably turns, home builders can get stuck with huge inventories of expensive land that they’re unable to convert into profitable home sales. If housing demand falls between the time of purchasing land and building homes for sale, builders can suffer large losses on their land holdings.

That’s precisely what happened from 2007 – 2010, when the housing boom went bust, and traditional home builders were left holding huge inventories of expensive land on their balance sheet.

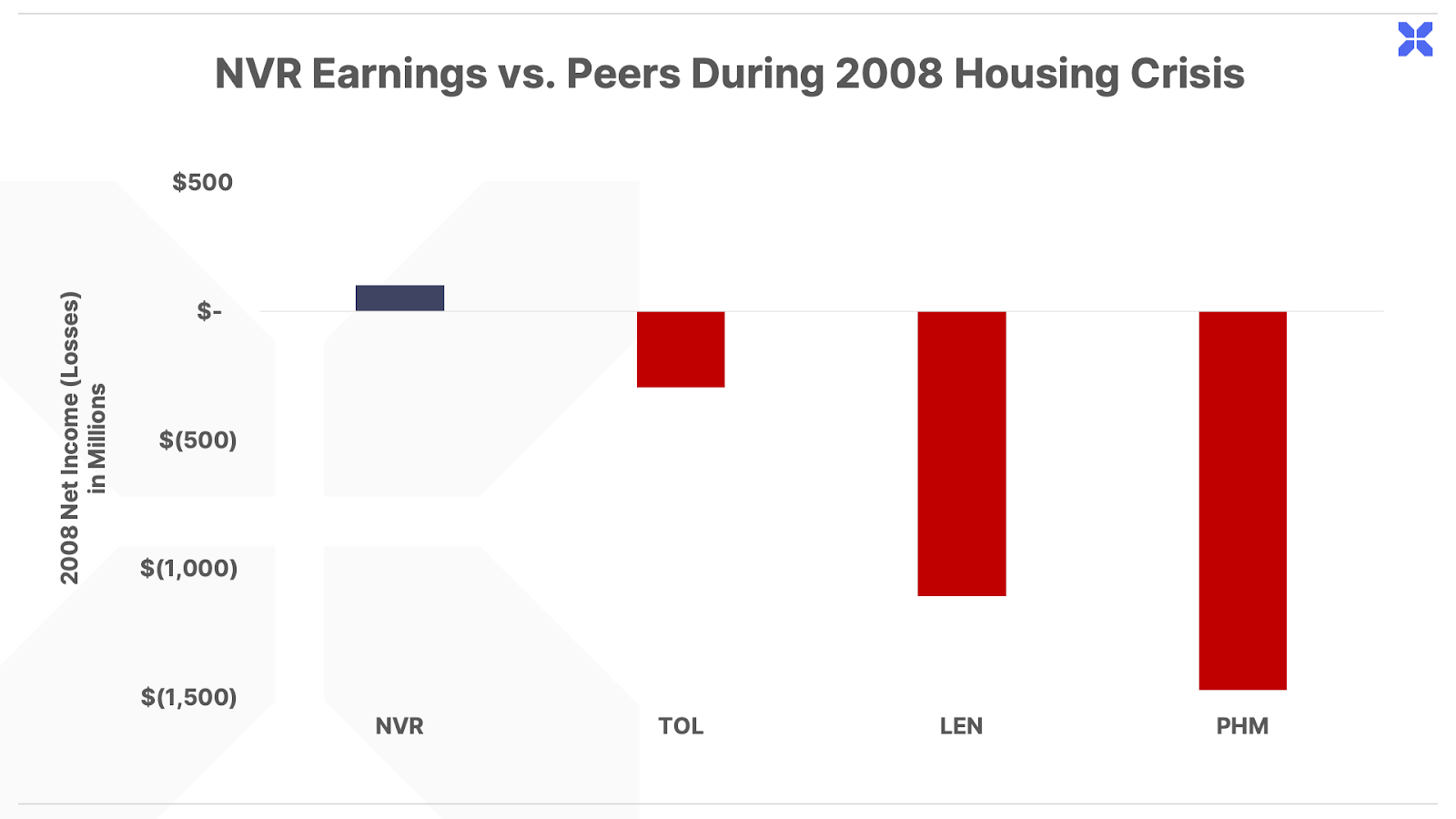

During that time, nearly every major publicly traded home builder went from record profits to bleeding red ink… except for the only asset-light builder at the time – NVR.

Thanks to land options, NVR sailed through the biggest housing market downturn since the Great Depression without suffering a single year of negative earnings, while its traditional home builder peers incurred hundreds of millions or more in losses:

While DFH pursues a similar 100% land option strategy, it’s not a one-for-one copy of the NVR model. DFH adds in an extra layer of high-end customer service that makes it unique to the target market.

Customization as a Competitive Advantage

NVR and DFH both serve first-time homebuyers, who are often entry-level buyers with a limited budget. But, while NVR builds standardized, mass-produced homes, DFH works one-on-one with customers and offers unique customization options.

Zalupski explained in October 2020:

“When you start a company in the depths of a recession, you have to do whatever it takes to be successful. So, if a buyer came and said ‘I found this online’, or ‘I want to use this sink from Home Depot’, we were going to do it. It’s just a core value of the company… if someone comes into our production communities, they can literally get a price request for a custom feature from our purchasing team.”

These custom features include everything from customized floor plans and finishes to upgraded cabinetry, countertops and flooring. DFH manages this extra level of service by requiring customers to put up a layaway fee of their own – a nonrefundable deposit on the customization options they’ve chosen.

Once a custom feature has been added into any single home, DFH can then build that into future home models, allowing additional customers to request the extra features as a standard option.

Only about 5% of DFH’s homebuyers request customization options. But it gives DFH a key competitive advantage… one that its mass production counterparts don’t offer.

DFH’s excellent customer service and commitment to delivering unique entry-level homes is a big factor fueling the company’s meteoric rise in the U.S. housing market. The home builder trade publication Builder100 releases a list of the top 100 home builders by number of homes closed on each year. DFH’s status has steadily risen over the last five years from #52 in 2017 to #17 in 2022.

DFH has brand power, a strong growth trajectory, and capital efficiency (high ROE) on its side. But it does have a few challenges on its plate.

DFH’s Margin Challenges, and Opportunity

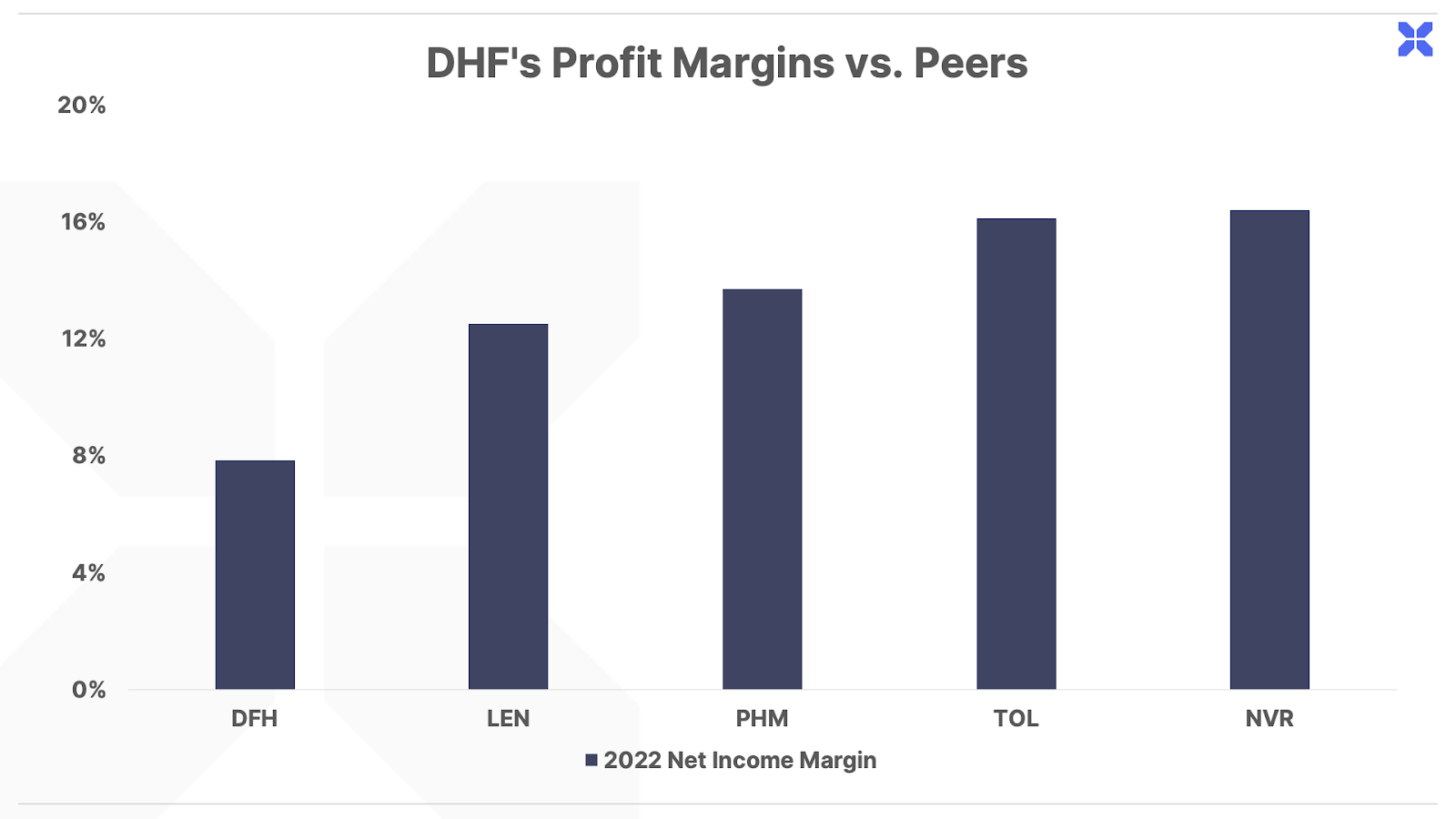

As a small player in an arena full of bigger companies, DFH lags behind its more mature competitors in one area: net profit margins (net income divided by revenues).

Even though DFH doesn’t pay for its land up front, it still incurs substantial costs for labor and materials. (Recall that Patrick’s initial $200,000 loan went straight to construction.) And, unlike its larger competitors, DFH can’t spread those costs across a huge customer base.

Established home builders typically generate net profit margins ranging from 12 – 16%. Because DFH has not yet grown to similar levels of sales volumes, the company’s current profit margins are roughly half of its peer group’s, at 7.8% in 2022:

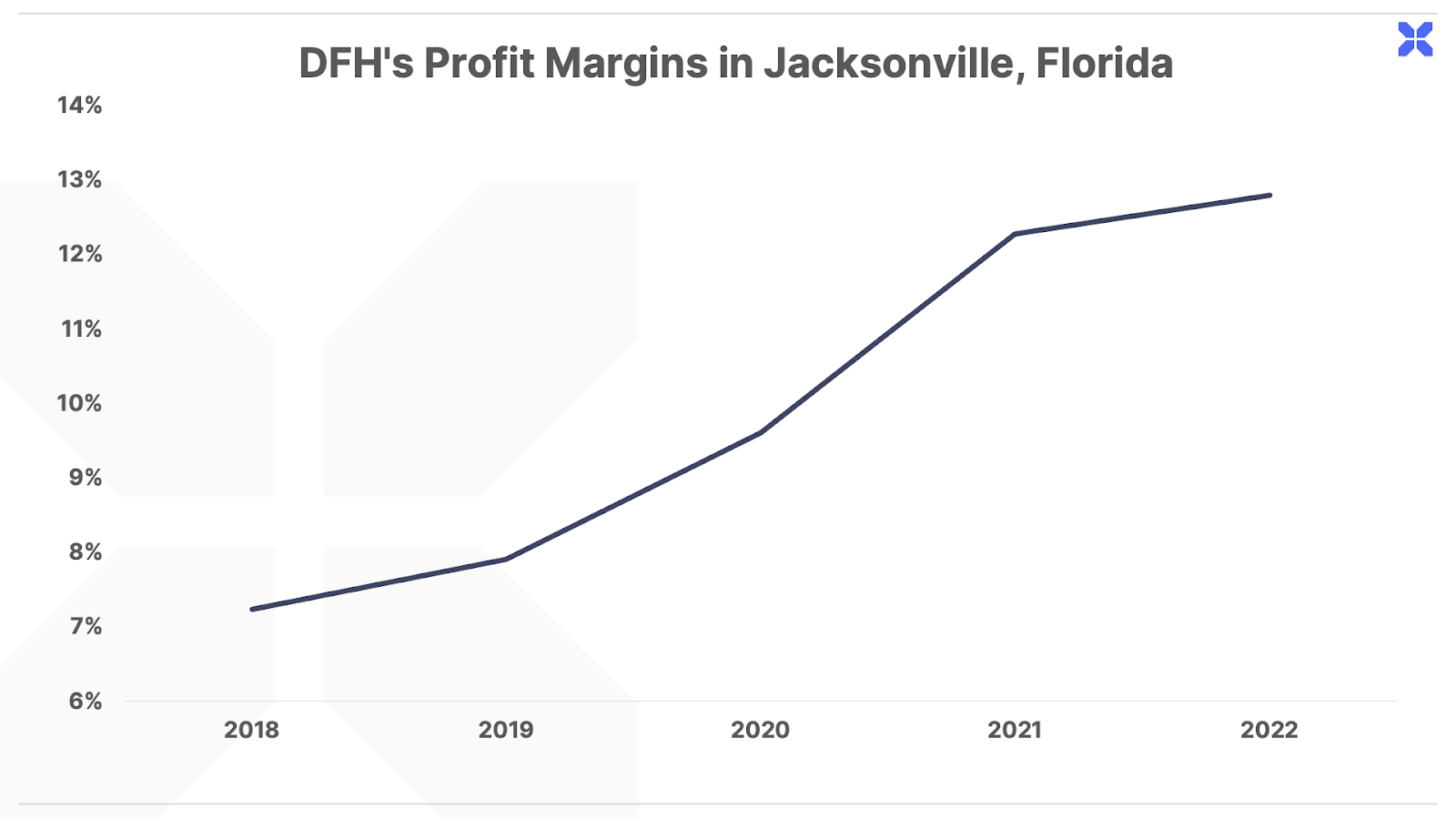

But thanks to DFH’s rapid growth profile, the company is quickly expanding its profit margins. Over the last four years, profit margins have more than doubled from 3.3% to 7.8%.

Drilling down a bit further, we can see a clear path of what the future holds by zeroing in on DFH’s original market of Jacksonville, Florida, where the company began building its first homes in 2009. Last year, the company completed 1,439 homes in Jacksonville, making it the company’s largest single city market.

The profit margins for DFH’s Jacksonville segment have steadily increased, from 7% in 2018 to 13% today – approaching comparable levels of its leading peers:

And we see a similar pattern across the board… in each of DFH’s new markets.

DFH first entered Colorado in 2014, when it built 9 homes. Last year, it built 300 new homes, improving its net margins from 1.8% in 2018 to 10.5% in 2022. The same thing happened in Orlando, Florida, where profit margins have expanded from 4% in 2018 to 10.5% last year – thanks to the $35.6 million acquisition of local home builder Century Homes in January 2021.

That brings us to the next part of Zalupski’s savvy strategy: acquisitions.

The larger DFH becomes, the more it can spend scooping up smaller rivals. This includes a two-pronged expansion into the Carolinas: a $24 million acquisition of South Carolina home builder Village Park Homes in 2019 and the $44 million acquisition of H&H Constructors of Fayetteville in 2020 in North Carolina. Last year, net profit margins for its Carolinas segment came in at 5.4%, up from 3.9% in 2021.

The company’s largest acquisition to date was the $582 million purchase of McGuyer Homebuilders (MHI), a Texas-based home builder in October 2021. DFH had entered Texas organically in 2015, but the new purchase expanded the company’s reach in the high-growth real estate markets in Austin, Dallas, Houston and San Antonio.

In Texas, net profit margins grew from 6% in 2021 to 8.5% in 2022 following the MHI acquisition.

Zalupski’s company makes wise acquisitions because Zalupski himself has skin in the game – another key tell for capital efficient companies. He’s the single largest shareholder, owning 65% of the company, and his personal net worth is almost entirely tied to the fortunes of DFH shares.

Even better, DFH’s relatively low (but improving) profit margins today have created a tremendous opportunity for investors who can zoom out and analyze the long term picture.

How DFH Could Deliver 10x Returns in the Next 10 Years

Today, DFH is trading at a depressed valuation of just 6x earnings, or a 50% discount to NVR’s 12x earnings multiple. We believe the market is making a mistake in punishing DFH with a discounted valuation, by over-emphasizing the company’s low profit margins today, and ignoring the company’s outsized growth and potential for margin expansion in the years ahead. We just showed how DFH’s profit margins are increasing as it grows in each of its markets, and that’s a trend we expect will continue over the long term.

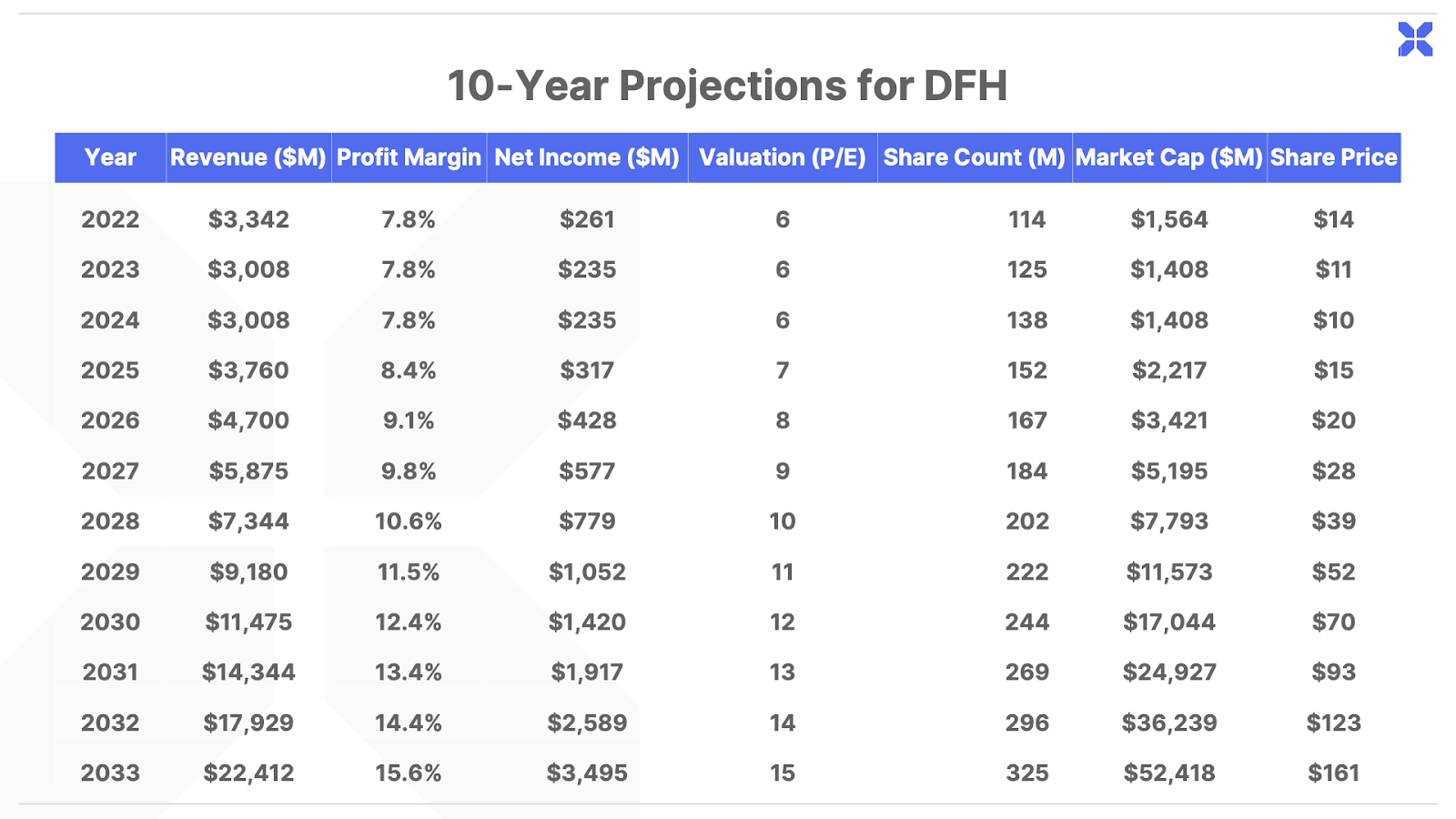

To show just how much future upside is on the table for long-term investors in DFH, we created a simple model with a few basic assumptions about what the future trajectory of the company could look like.

First, DFH, like other home builders, will likely suffer in the near term from a slowing economy and higher interest rates, which will likely create a drag on the housing market in 2023 – 2024.

So we conservatively estimate that DFH’s revenue will reverse from its previous 50 – 70% annual revenue growth to a decline of 10% in 2023 and then flat revenue in 2024…

Then, as the economy improves and lower interest rates drive demand for more housing, DFH will return to top-line growth in 2025, averaging 25% until 2033. (Note: This level of growth may sound aggressive on the surface, but in the next section, we explain the key driver that will support this growth in the coming decade). This brings revenue from $3.3 billion in 2022 to $22 billion by 2033.

Next, we assume that the company’s profit margins flatline as growth stalls through 2024. As growth resumes in 2025, we assume an average increase in net profit margins of 8% per year to reach 15.6% margins by 2033. For a frame of reference, DFH has increased profit margins by 27% per year over the last four years, and its asset-light peer NVR generated 16.4% margins last year.

As DFH’s profit margins expand, we expect the market to assign a higher valuation multiple to its more profitable business. This leads to an increase in its price to earnings multiple from 6x today to 15x by 2033. (For perspective, NVR has traded in a range of roughly 10 – 30x earnings over the last decade.)

Finally, there’s the question of share count. We expect DFH will continue reinvesting nearly all of its profits into growth over the coming decade. But we also expect the company will continue issuing share-based compensation to attract and retain talent needed to support this growth. As a conservative assumption, we assume an annual increase of roughly 10% of the share count for the next decade. This will cause modest dilution to existing shareholders (meaning existing shareholders will own a smaller slice of the pie) – but that dilution will be minor in comparison to the far greater growth in DFH earnings (i.e., shareholders will own a slightly smaller slice of a much larger pie).

Putting it all together, the following 10-year projection shows the path for DFH’s share price to appreciate from around $15 today to $161 by 2033, or an increase of more than 10x.

We believe this upside scenario may even prove conservative over a 10-year time horizon, given our assumptions of a near-term decline in DFH’s business, as well as a future growth rate of less than half of its recent trajectory when the housing market recovers.

That near-term decline may mean extra long-term upside for DFH… but there are a few cautions to note.

DFH’s “Pull Back And Go” Potential

Mortgage rates have recently doubled from around 3% in 2021 to just over 6% today, the highest level since 2009. That’s caused a significant slowdown in the U.S. housing market – and short-term vulnerability for homebuilders like DFH.

Higher borrowing caused U.S. home sales to fall in 12 of the last 13 months, reaching an annualized rate of 4.44 million homes sold in March 2023, the lowest level since 2010.

In 2022, DFH’s cancellation rate – the rate of buyers who back out of the purchase before closing – jumped to 22%, up from 12% in 2021. Other builders have suffered even sharper cancellation rates, including America’s largest homebuilder – KB Homes – which reported a 68% cancellation rate in the fourth quarter of 2022.

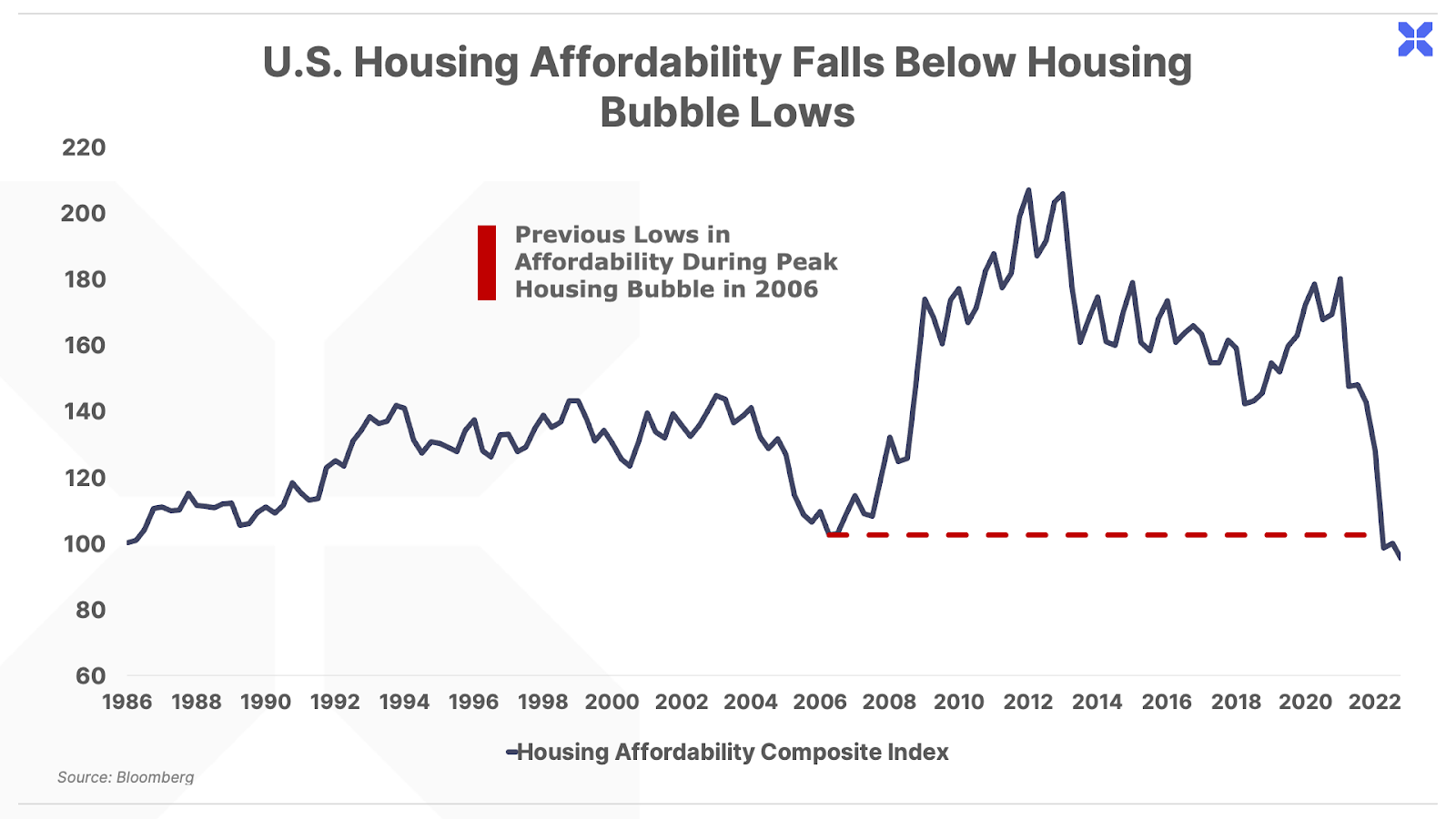

Home buyers are grappling with higher mortgage costs, as well as the highest home prices on record. This one-two punch has recently depressed U.S. housing affordability below the levels reached in the lead up to the Great Financial Crisis. The Housing Affordability Index, shown below, measures whether or not a typical family can qualify for a mortgage for a house at average national home prices.

Record low housing affordability, coupled with the prospect of an upcoming recession, create the biggest near term risk for the broader housing market and for DFH.

But there’s one giant difference between today and 2007…

Before the Great Financial Crisis,developers went on an ill-advised over-building spree that ended in a historical collapse in pricing and demand. But today, America faces the opposite problem – a crippling housing shortage that will persist for many years to come.

Being a homebuilder during a housing shortage is like being the Good Humor Man in the Sahara. That’s where we see the long-term upside for DFH.

Why America Faces A Decade-Long Housing Shortage

Before the birth of the U.S. housing bubble in the mid-1990s, the market did a reasonably good job of balancing the supply and demand for homes.

Specifically, the rate of new U.S. home construction roughly matched the rate of household formation (defined as a group of people occupying a private home, regardless of their relationship status). During the 1970s, for example, 11.5 million new homes were constructed versus the 11.2 million new U.S. households that were formed. Likewise, in the 1980s, 15.3 million new households were formed and 14.7 million new homes were built.

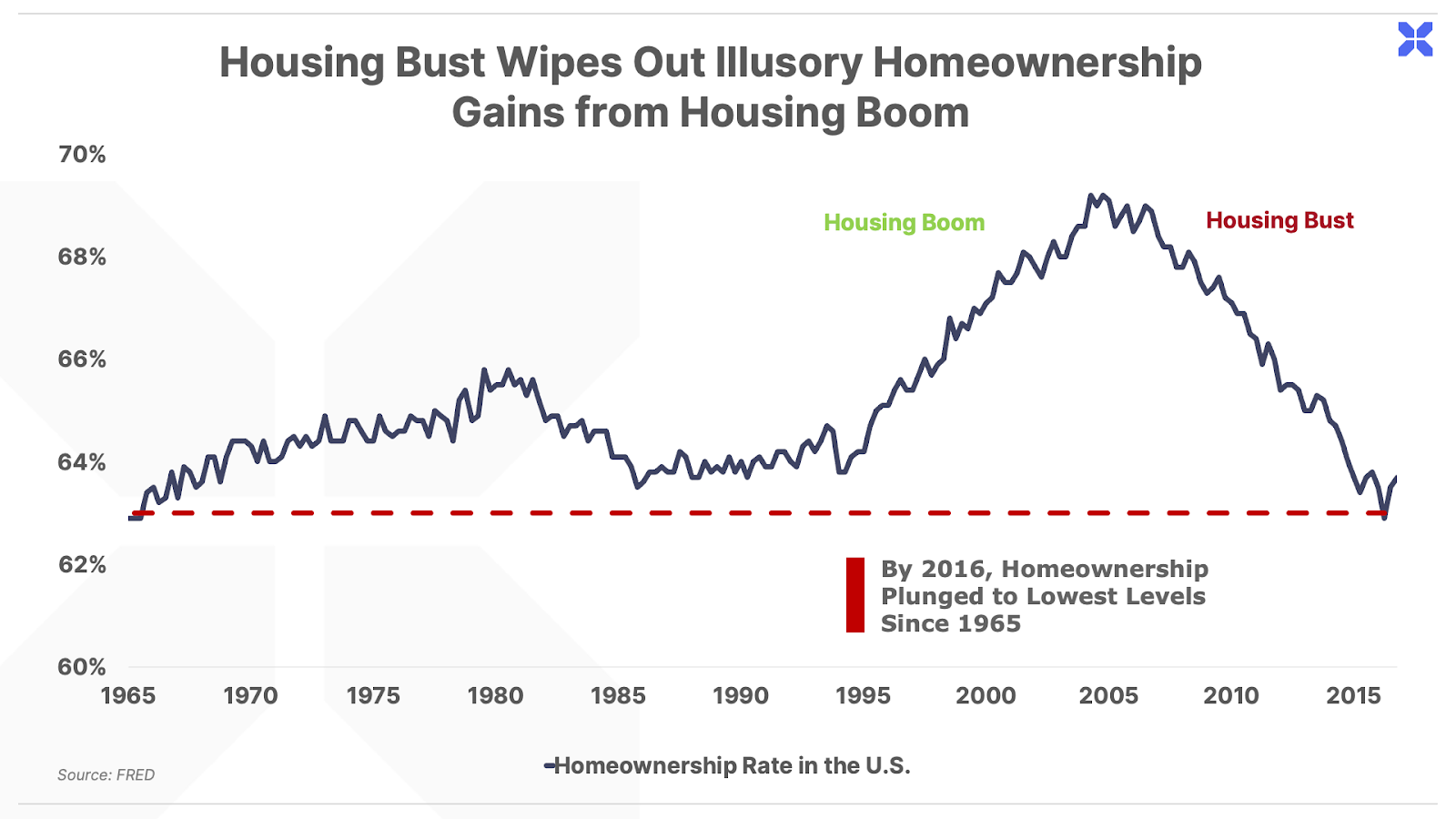

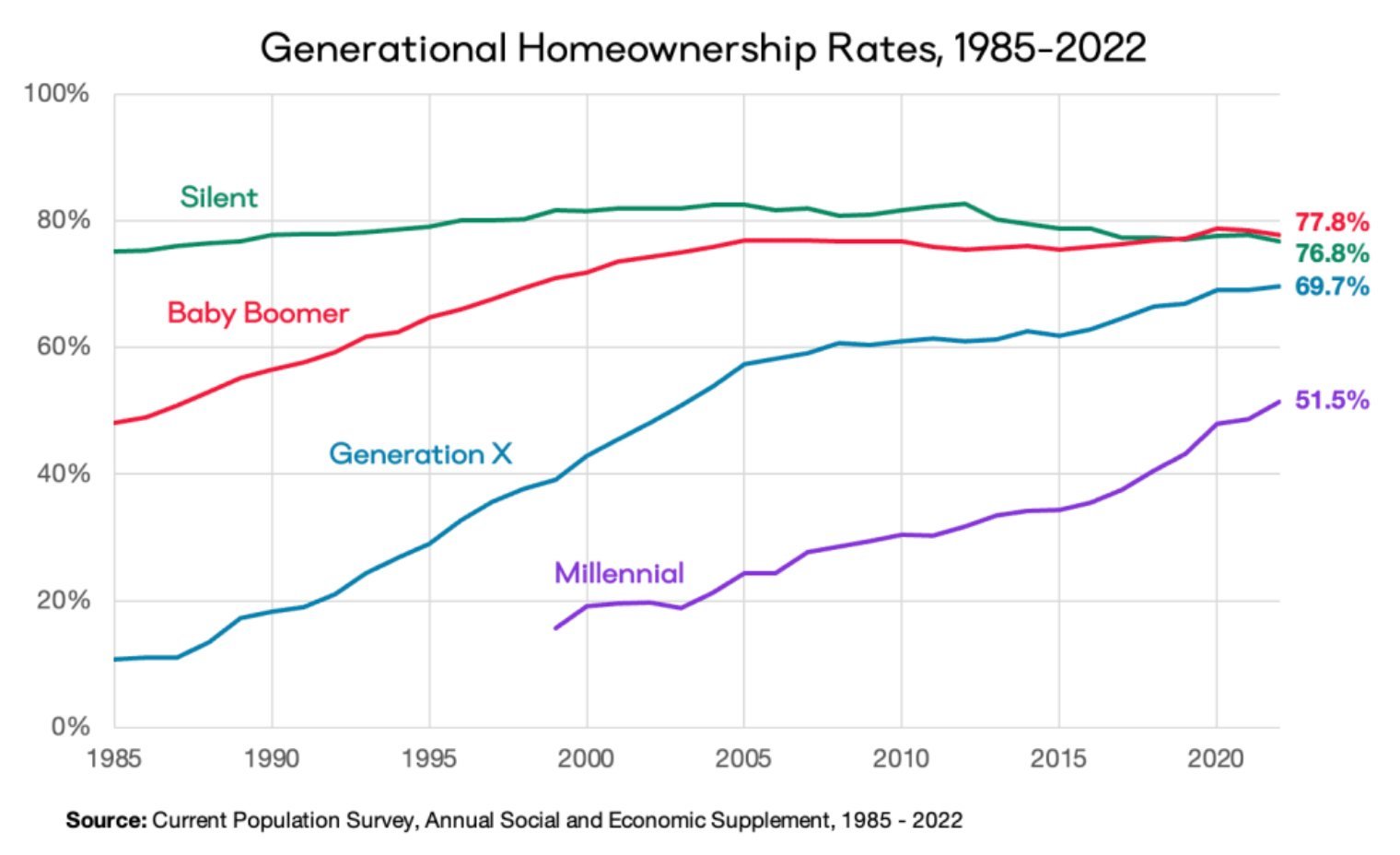

But starting in 1996, aggressive regulations forced the U.S. banking sector to extend credit to uncreditworthy home buyers. These “bad risk” buyers promptly took out expensive mortgages, and the U.S. homeownership rate surged from 64% in 1995 to a record high of 69% in 2004.

This created a record boom in housing demand and profitability for homebuilders, who went on an unprecedented 14-year streak of constructing more homes than the number of households formed. From 1996 – 2009, 21.5 million homes were built compared to just 12.3 million household formations.

And then, we all know what happened next…

Supply began overwhelming demand by 2005 just as borrowing costs spiked, as the Fed raised rates from 1% to 5.25%. Higher borrowing costs caused default rates to creep higher, which was compounded by the Great Financial Crisis from 2008 – 2009.

Millions of borrowers (especially the uncreditworthy ones) defaulted on their mortgages, and credit standards tightened dramatically in the wake of the housing market meltdown and recession following 2009. Millions of excess homes that had flooded the market from 1996 – 2009 were foreclosed on and converted to rental units, as America became a nation of renters instead of homeowners.

By 2016, the homeownership rate plunged to 63% – the lowest level since 1965 – wiping out all of the illusory gains in homeownership created from the housing bubble starting in 1996:

Within this context, we can make sense of America’s unprecedented housing shortage today.

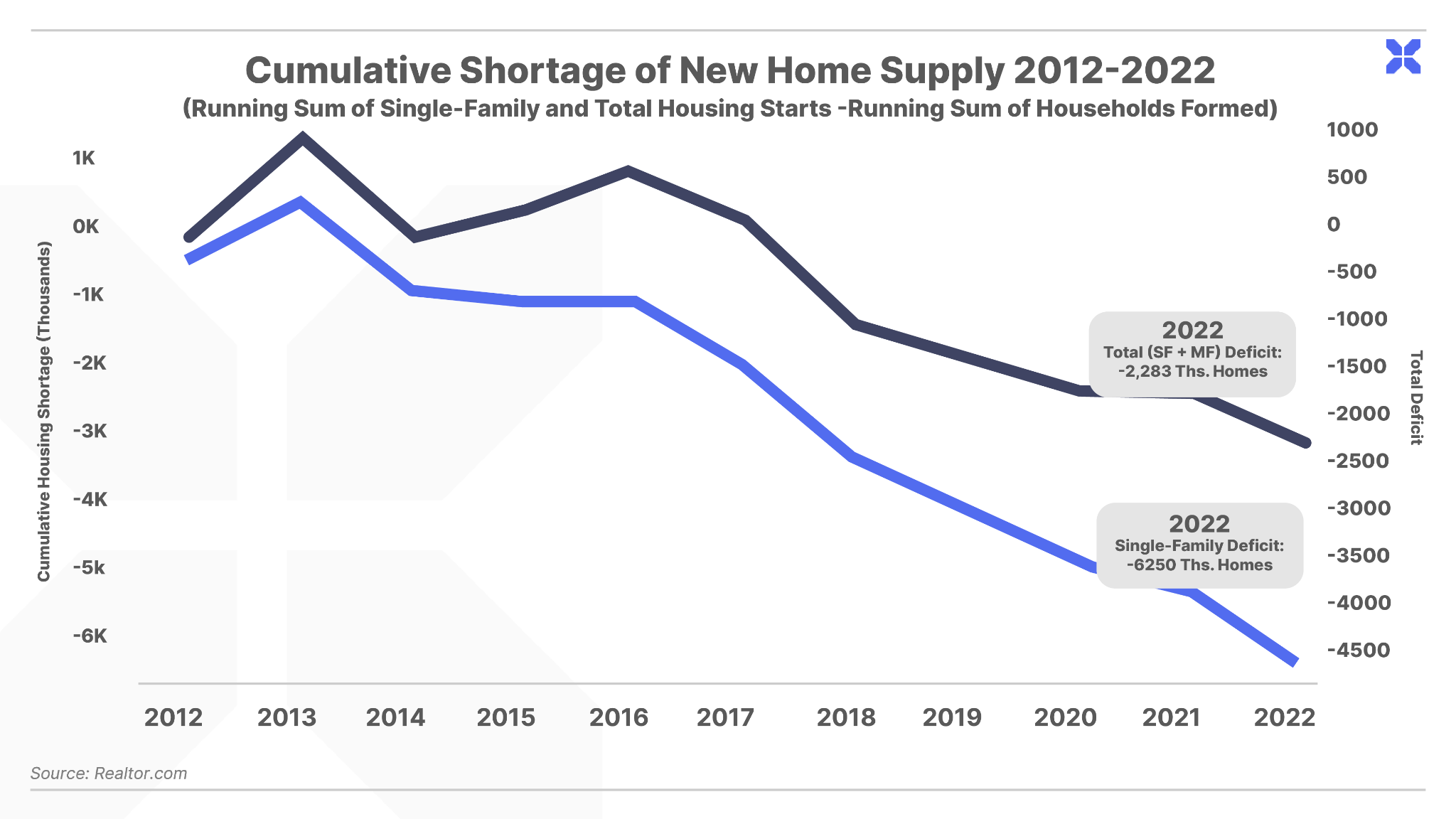

As demand for homes collapsed and the market was left with a supply overhang in the wake of the 2008 housing bust, home builders pulled back on construction. From 2012 – 2022, U.S. builders completed only 11.9 million new homes, compared with 15.6 million household formations.

The Fed helped juice housing prices with nearly $3 trillion in purchases of mortgage-backed securities since 2008. Meanwhile, over the same period, millions of single family homes were converted to rental units.

The end result: a record 6.5 million gap has emerged between household formation and single family homes as of year-end 2022.

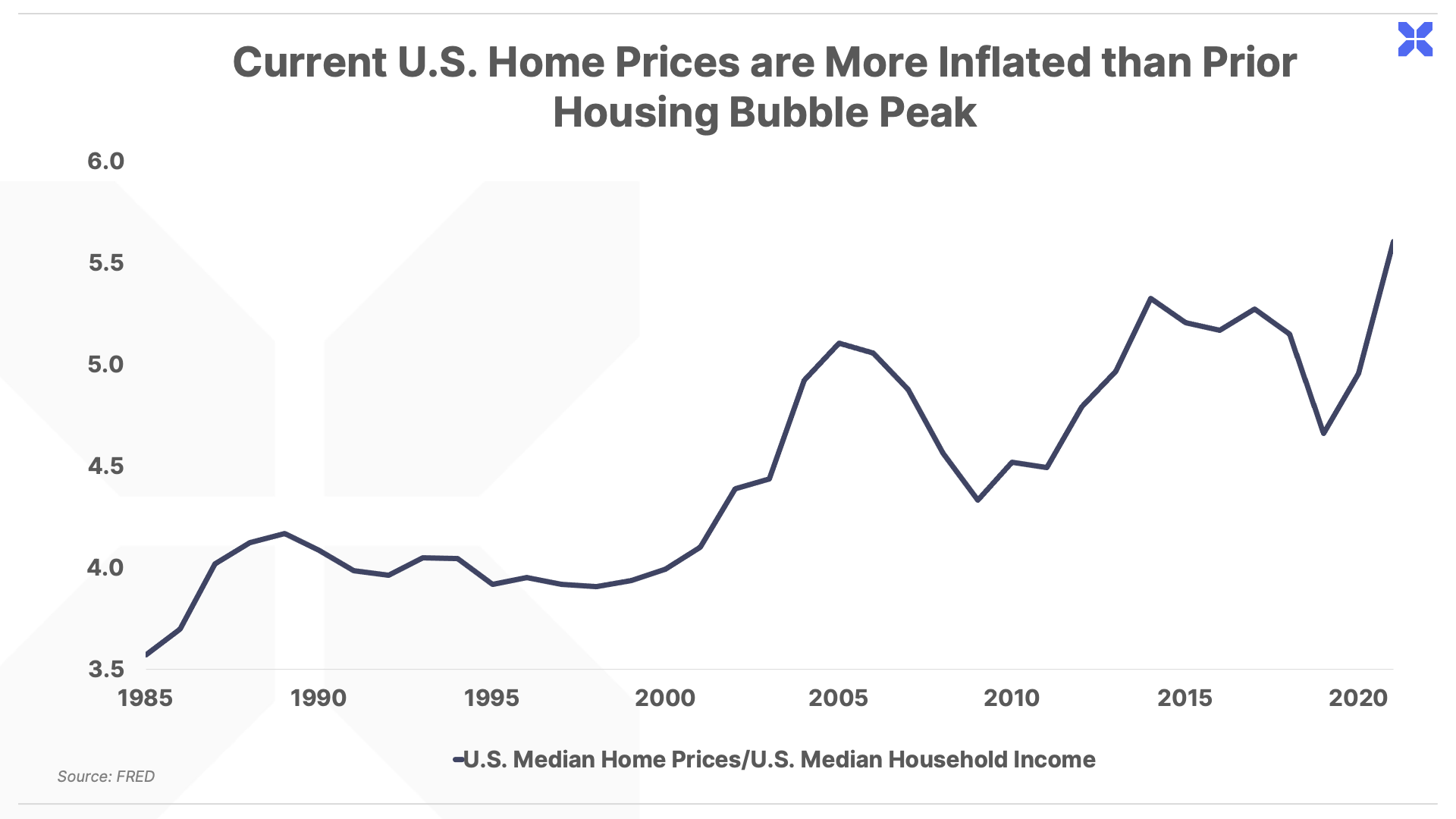

This confluence of events has transformed the U.S. housing market from a record glut to a record shortage, and driven up home prices to their highest levels relative to household income on record, even exceeding the prior housing bubble peak in 2006:

This is a big problem for the current generation of homeowners – the millennial cohort, whose homeownership rate is trailing the pace of prior generations by a wide margin:

Today, the “majority of millennial and Gen Z Americans, born between 1981 and 2013, now believe their best chance at affording to buy a home is to win the lottery,” according to a recent survey by Zillow, an online real estate listing service.

Part of the solution is for American home builders to build more houses.

According to a recent analysis by the National Realtor Association, “the rate of housing starts would need to triple to keep up with demand and close the existing 6.5 million home gap in 3 to 4 years.”

And therein lies the critical difference between today’s housing market slowdown and that of 2007. Back then, cheap credit had allowed anyone who could fog a mirror to take a mortgage loan, resulting in home prices being bid up to unsustainably high prices. And when the bubble burst, the market drowned in excess supply for years.

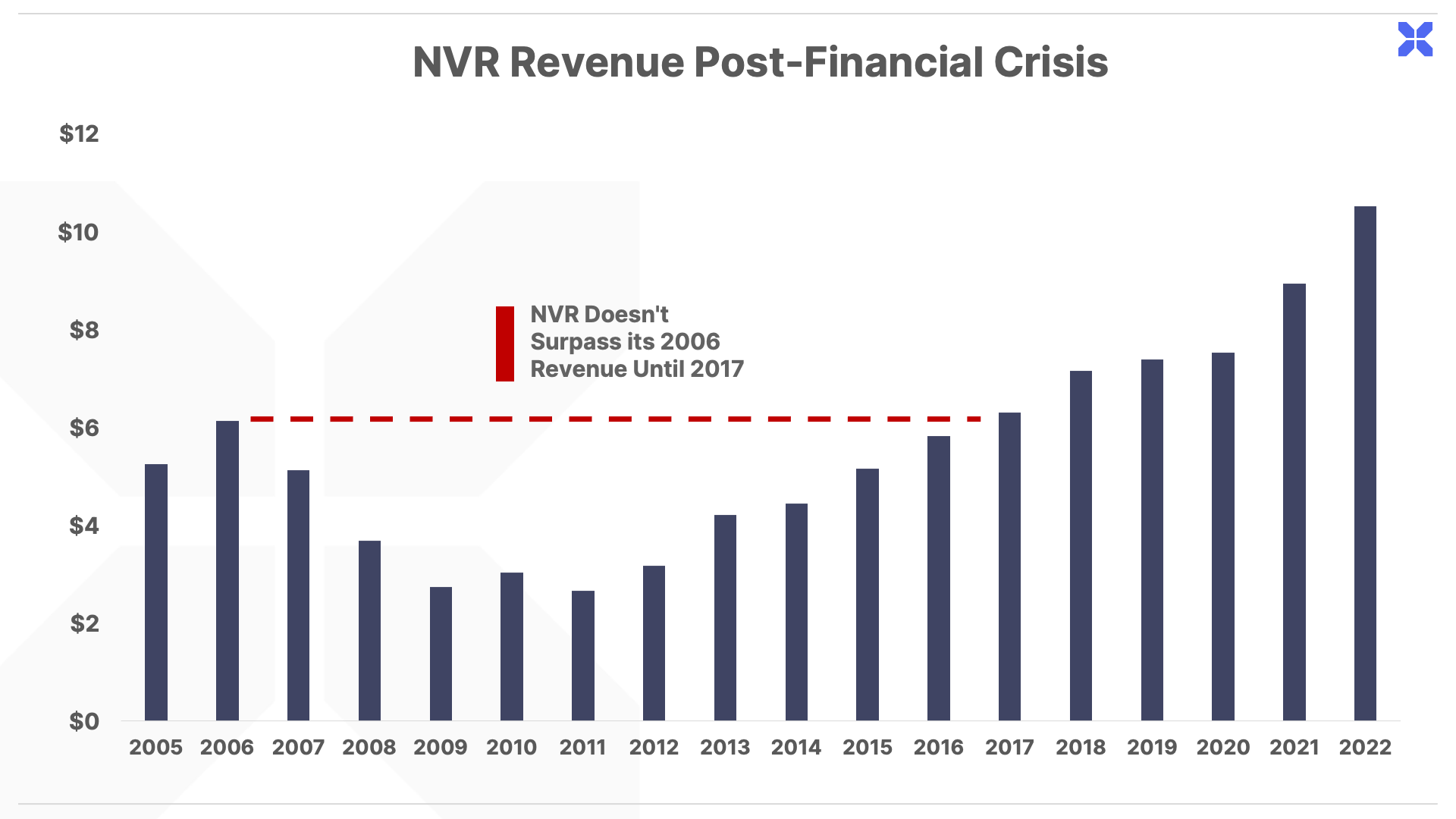

This meant that developers didn’t reclaim their prior highs in revenues for years. NVR, for example, didn’t regain its 2006 revenue peak until 2017:

Today, homes are more expensive than they were going into the Great Financial Crisis (based on the ratio of home prices to incomes). But there’s one major difference: In 2008, prices were inflated due to reckless lending standards. Today, they’re sky-high due to a structural supply shortage of U.S. homes.

Any short term pullback in housing construction will only further widen the already-record high 6.5 million deficit in single-family homes. That would set the stage for an even wider deficit until construction activity ramps up, creating the conditions for a prolonged housing shortage that could extend throughout the next decade or longer.

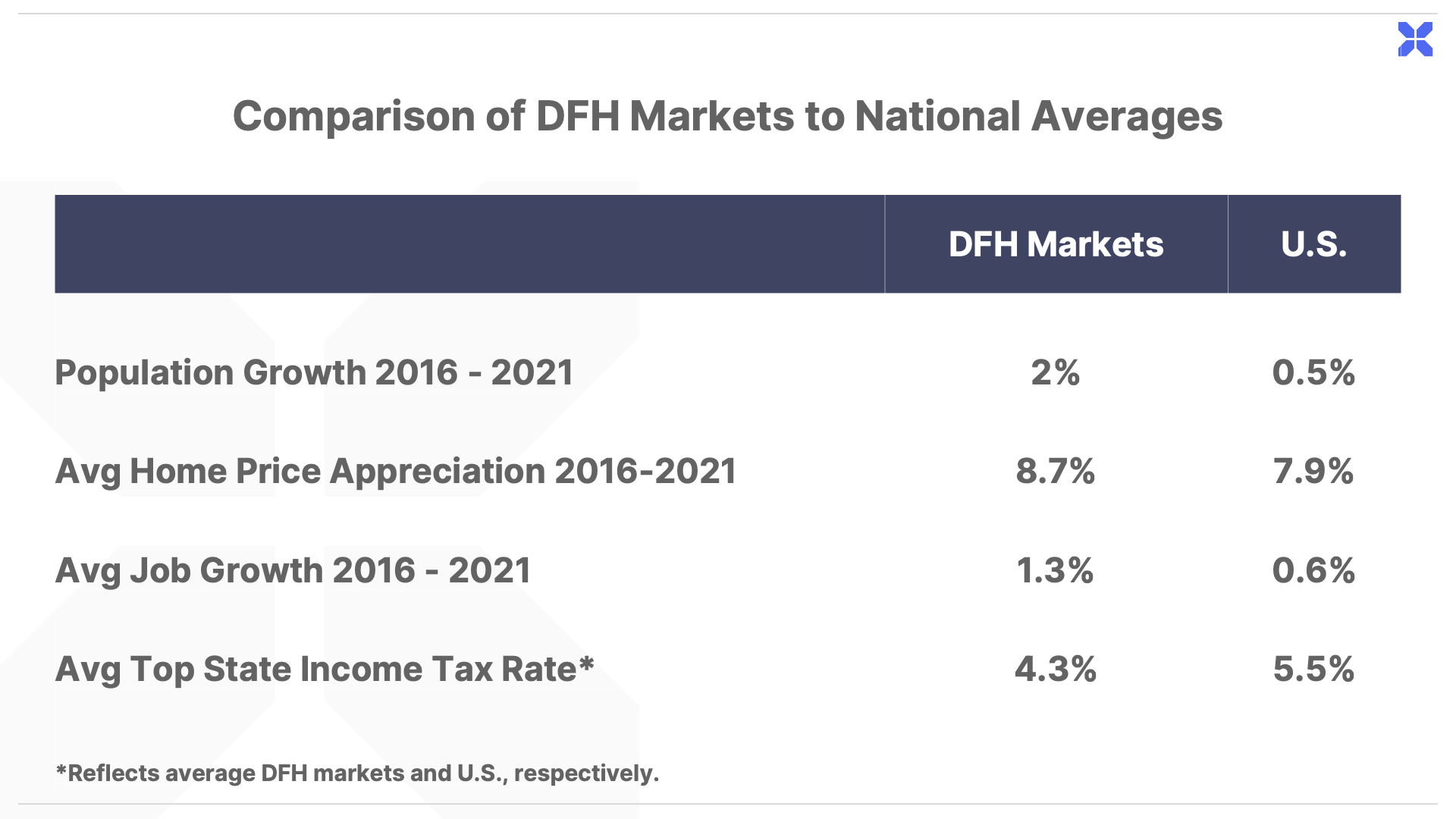

DFH is not only positioned to benefit from this broader U.S. housing shortage, but it also has a concentrated position in some of America’s strongest housing markets… including Texas, Florida, and the southeast coastal regions. These areas all have above-average population growth, robust job markets, and low tax rates:

That’s why we believe that our 10-year DFH projection of lower/flat revenue growth in 2023 – 2024, and 25% annual increases starting in 2025 could ultimately prove to be conservative.

DFH has successfully grown from a standing start in 2009 to completing over 22,000 homes last year. It has also shown a consistent ability to wisely allocate capital in a way that generates a growing profit stream, expanding margins, and industry-leading returns on equity.

Even with the recent headwinds from slowing sales and elevated cancellation rates in 2022, DFH closed on 6,878 homes last year, or 41% growth from 2021’s 4,874 closings. Looking ahead, the company had a healthy backlog of 5,548 homes contracted for sale as of December 31, 2022, worth approximately $2.5 billion.

That said, investors should be wary of the risks of a further decline in home sales, which could impact DFH’s short-term growth trajectory and operating results.

Just like Porter’s original NVR recommendation back in October 2007, there’s a good chance we’re early in recommending DFH as the housing market and broader economy come under further pressure in the months ahead. But the scope of long-term upside from today’s current valuation gives us the confidence to make a recommendation to buy shares today.

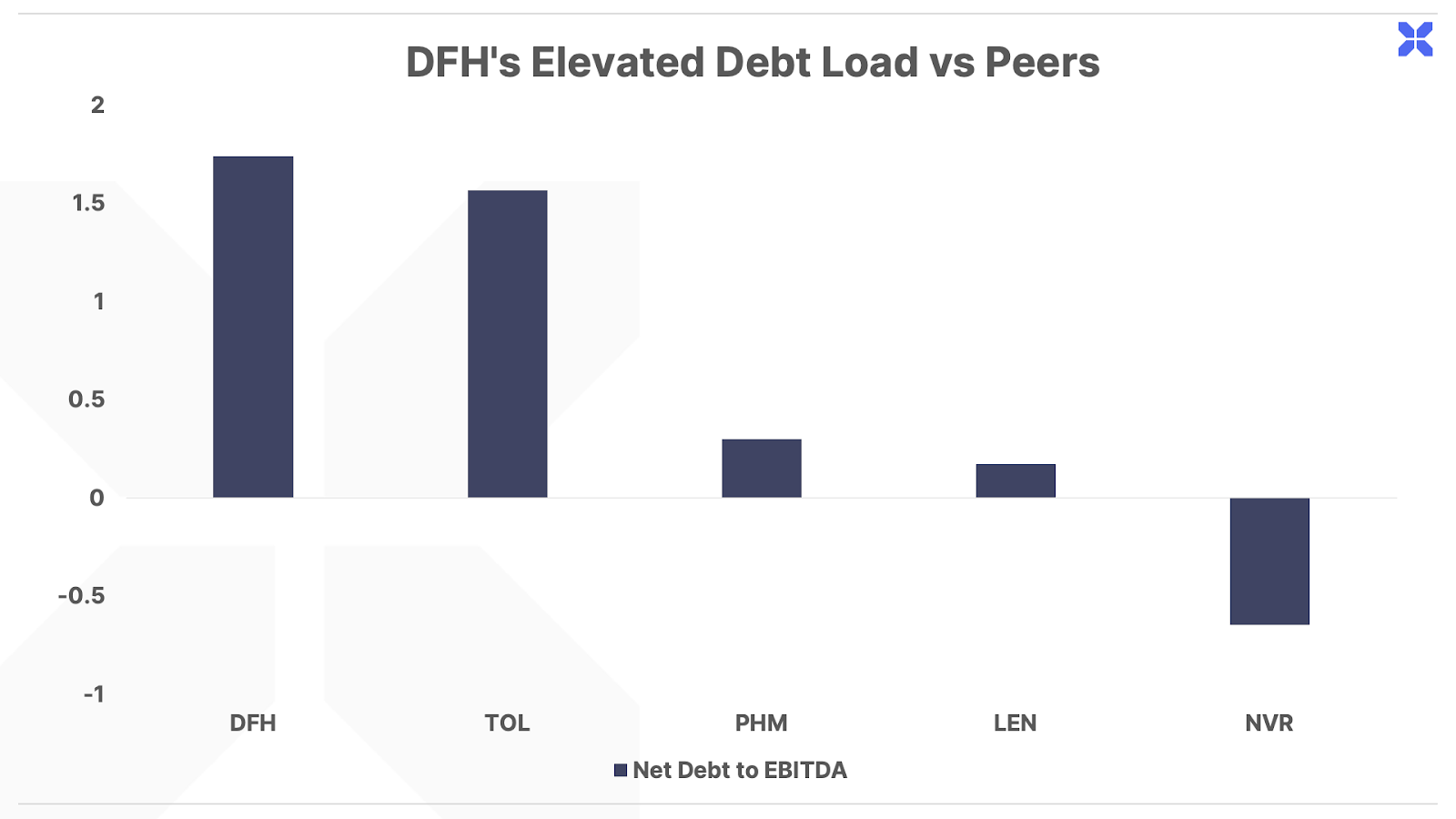

Finally, we will note that DFH’s aggressive growth profile also brings an elevated risk profile too. Even though its asset-light strategy is inherently less risky than the traditional home building model of buying land outright, DFH has taken on debt financing to support its rapid expansion in recent years.

As of year-end 2022, the company had $990 million in debt outstanding, all concentrated in a revolving credit line that matures in June 2025. But the company also has a healthy cash balance of $365 million, resulting in net debt of $625 million. Last year, the company generated $372 million in EBITDA (earnings before interest, tax, depreciation and amortization), for a net leverage ratio of roughly 1.7x. For perspective, DFH’s leverage is at the high end of the range among its peers, which range from 1.6x at Toll Brothers to a positive cash balance (i.e., negative debt position) for NVR.

While DFH’s leverage is not concerning today, it’s important to note that if the company suffers from a substantial decline in sales and earnings, its leverage ratio could increase further from here (as the ratio of debt to earnings increases).

For this reason, we’re assigning DFH with a relatively high risk rating of 4.

New to the Porter & Co. Portfolio? Start With Our Top 3 “Best Buys” Today

The goal of Porter & Co. is to bring you world-class investment research, focused on “inevitable” businesses that you can buy and hold forever. This is the surest and safest path to building permanent wealth.

While we don’t believe in timing the market, we do keep a constant eye out for bargains. In each edition of The Big Secret, we highlight three current portfolio picks that are at an attractive buy point. In addition to today’s recommendation, we suggest you start with these:

- Credit Acceptance Corp (CACC) is a leading subprime auto lender, which we call the Goldman Sachs of White Trash. The business of making subprime loans isn’t glamorous, but it’s tremendously profitable and highly capital efficient. CACC has generated 63% free cash flow margins over the last five years, and today trades at just 12x earnings. (It’s at a buy point of $481 per share, or less than 13x earnings.) Shares have recently sold off on fears of a subprime auto lending meltdown, but as we explained in a recent portfolio update, CACC is uniquely positioned to benefit from spiking default rates – and that’s already showing up in its latest quarterly earnings report. With lending standards tightening and auto delinquencies on the rise, more consumers are entering the subprime category. This was confirmed last quarter as CACC’s loan growth surged by 26%.

- Viper Energy Partners (VNOM) is an oil and gas royalty company – the best business in the energy sector, and the Secret Behind T. Boone’s Fortune. Unlike oil and gas producers, VNOM never spends a dime searching for oil or drilling holes deep into the earth. It simply owns the land upon which other companies drill, and collects a percentage of the cash flow. That makes it one of most capital efficient businesses you’ll find anywhere, with 80% free cash flow margins. VNOM funnels its profits directly to shareholders, instead of back into the ground. Last year, VNOM paid out $2.44 in dividends, or roughly 9% of its current share price. The recent correction in energy prices has provided a compelling entry point in this stock, with a current valuation of just 13x earnings.

- Qurate Retail 3/15/2031 8% Cumulative Preferred Stock (QRTEP) is The Best Risk-to-Reward Opportunity We Have Ever Seen. The company is managed by the greatest CEO of all time, John Malone. This unique preferred share class offers an incredible 25.8% yield, with an extra margin of safety over owning the common shares. And there’s also 223% of additional upside if these shares are redeemed at par value ($100). As we explain in the writeup, the business suffered a temporary hiccup in 2022 due to supply chain disruptions, but we make the case for a successful turnaround effort. Best of all, you get to invest alongside America’s best CEO – John Malone and his business partner Greg Maffei, who own about 8% of these shares. With a 25.8% yield and 223% of further upside from price gains, this is our top pick in today’s market.

Portfolio Update

Winmark Hits All-Time Highs

Shares of Winmark Corporation (WINA) have risen by 55% since our initial recommendation.

Winmark is the parent corporation that owns several resale brands, including Play It Again Sports, Plato’s Closet, Music Go Round, and others. Its business model of buying and reselling gently used clothing, sports gear and music equipment makes it the ultimate recession-proof “Battleship” stock.

Like DFH, the company is asset-light. Unlike traditional retailers, who own and operate their own stores, Winmark is a franchisor. That means it doesn’t incur any of the costs associated with opening or running stores, like salaries for store employees, rent, utilities, and stocking inventory. Instead, Winmark simply lends its brand name to franchisees, and collects 5% of every dollar that flows through the registers.

Because Winmark operates with a fraction of the capital required to run a traditional retailer, it can oversee 1,290 store locations with just 90 employees at its corporate office.

Winmark’s high capital efficiency allows the company to consistently return capital to shareholders, through dividends and buybacks.

The company grew sales by 4% last year, from $78 million in 2021 to $81 million in 2022. Meanwhile, the company reduced its share count by 5% through $49 million in stock repurchases last year, boosting its earnings per share to a new all-time high of $11. The company also raised its quarterly dividend by 14% from $0.70 to $0.80 per share.

Winmark is a phenomenal example of a wonderful business that is both simple to operate and highly profitable. In the press release from the company’s first quarter 2023 earnings, Winmark’s Chairman and CEO Brett D. Heffes simply notes that “2023 is off to a good start.”

As we’ve written in prior issues, we expect high odds of a sharp recession in the months ahead. Winmark’s business of selling lightly used, discounted retail goods should hold up well during a potential recession. As incomes drop and layoffs rise, businesses like Winmark should benefit from a growing number of consumers trading down to the discount sector. If we’re wrong about the upcoming economic weakness, Winmark can still win by thriving in a positive macro environment, as it has in recent years.

Given the stability of its business, high profit margins and stellar capital efficiency, Winmark is the ultimate Battleship stock built to compound investor capital through good times and bad.

U.K. Regulators Block Microsoft’s Acquisition of Activision Blizzard

On Wednesday April 26, the U.K’s Competition and Markets Authority (CMA) blocked Microsoft’s (MSFT) $69 billion takeover of Activision Blizzard (ATVI), causing the share price to sell off by roughly 10% on the news.

In the explanation for its ruling, the U.K. business regulator claims that the deal would negatively impact the future of the fast-growing cloud gaming market, by stifling innovation and reducing the options available for U.K. gamers.

Microsoft currently controls 60% to 70% of the cloud gaming market through its Azure service and Xbox Cloud Gaming. As we noted in a portfolio update on March 31, U.K. regulators are concerned that Microsoft will withhold popular games from competing cloud gaming platforms, limiting consumer choice and allowing Microsoft to raise prices without fear of competition. Our full analysis is here.

Microsoft and Activision responded immediately following the announcement and will appeal the ruling.

While the ruling is a major setback for the acquisition, the merger agreement between Microsoft and Activision doesn’t expire until July 18. If an agreement isn’t reached by July 18, Activision will walk away with a cash windfall of $3 billion as a break-up fee. Activision could still extend the date of the acquisition agreement. If they don’t, and the deal falls apart, many industry analysts and commentators believe the CMA’s ruling could backfire and stifle growth and innovation for the broader UK economy.

While the odds of a successful merger have declined in the wake of this ruling, it’s not a death knell. If Microsoft’s appeal does not go through, and the deal gets blocked by regulators, Activision remains an attractive, capital efficient Battleship stock that will enjoy a cash injection of $3 billion.

And even if the merger gets canceled, there’s nothing stopping Microsoft and Activision from working together as separate companies to introduce existing and new games to more consumers through partnership opportunities.

That’s why we recommend investors continue to hold their shares in Activision. If you don’t yet own shares, we recommend buying up to $82 per share.

Mailbag

Starting today, we’re including a new feature in The Big Secret on Wall Street – letters from readers, answered by Porter! He cannot offer individual investment advice, but he is more than happy to respond to general questions.

Please email us at [email protected] if you’d like to be featured in this segment. We’d love to hear from you!

Our first question comes from W.S., who writes:

Hi Porter,

Thank you for being my beacon and searchlight into a world of future currency disruptions. I’ve never regretted becoming a lifetime member of Stansberry Research and continue looking forward to receiving news from Porter & Co. Your unbiased insight is far better than others and I appreciate the hours of research you expend before settling on a recommendation.

I was a bit surprised that you’ve shifted your emphasis to Bitcoin Bonds and away from gold and silver bullion and coins. I’ll read your letter again, but I wonder why gold does not maintain its 5,000-year preeminence in reliability. A scarce, durable God-created currency, limited in quantity by God, has always taken precedence in my mind over man’s corruptible currency creations. Am I missing something?

Thank you for your kind words and long-time support, W.

I remain a long-term holder and believer in gold as a store of value. I have never sold a single ounce of gold, and view it as the ultimate form of insurance against the ongoing assault of fiat currency from central banks and governments around the world.

That said, Bitcoin offers a similar level of protection, but comes with several innovative features that make it an excellent complement to gold and silver as a store of value. Unlike gold and silver, which increase in supply by roughly 2% each year, the Bitcoin protocol ensures that no more than 21 million coins will ever be created. This fixed supply makes Bitcoin the ultimate deflationary currency, allowing your purchasing power to increase in real terms at a faster rate.

Bitcoin also offers the advantage of storing a virtually unlimited amount of value on a decentralized public ledger. This reduces the risk of forced search and seizure by criminal elements (including governments). Consider a situation of a hyperinflationary collapse of a sovereign nation, where property rights dissolve along with the social fabric and rule of law. Anyone sitting on a large pile of physical gold or foreign currency would have a hard time escaping with their wealth intact.

Bitcoin allows an escape hatch. An individual could transfer millions of dollars of fiat currency into Bitcoin, memorize their unique address on the blockchain, and cross the border with their wealth intact and undetected.

Of course, that’s an extreme scenario (for now, anyway). The bottom line is that we don’t buy into the view that investors must make a choice between betting on gold or Bitcoin. We believe both offer unique benefits for investors in which to store a portion of their wealth.

We do plan on recommending investment with gold exposure in the future, including mining and streaming companies. Stay tuned!

Our next letter comes from D.F., who writes:

So what’s going on with QRTEP that you were so enthused over and wanted us to buy in the low $50s? I saw it recently at $26! Down about 50%. I was stopped out of that and also EQT. Great introductory recommendations, Porter. Makes me glad I sent you a thousand dollars. At least you can give us some update on what’s happened to QRTEP. If it was so fantastic at $50, how about at $30?

Hi D. Some of our recommendations have certainly suffered from short-term volatility, an inevitable outcome when putting capital at risk in the financial markets.

Regarding QRTEP, I would first point you to the latest update we published on this thesis, which you can find in the portfolio update section of our March 31 issue. As we wrote then, the bottom line here is that the Qurate management team, overseen by two world-class operators Greg Maffei and John Malone, is pursuing a turnaround plan that should begin bearing fruit over the coming 18 – 24 months. And we believe the company has ample liquidity to continue paying dividends on the preferred shares as it pursues this turnaround plan. This should provide a solid margin of safety in this investment, as we explained on March 31:

“Assuming that Qurate uses its available liquidity to continue paying out the $2 quarterly QRTEP dividends for at least the next three years, that alone will return $24 to shareholders – or 85% of the current $28 share price. Management confirmed on the March 1 call that the $500 million raised through borrowings on its credit revolver will go towards paying dividends on the preferred shares.

These dividends provide a solid margin of safety for limiting the downside risk, while management pursues the turnaround plan designed to unlock the upside potential here.”

Investors who bought shares upon our original recommendation have already collected $2 in dividends, and are down 17% on a total return basis. We don’t believe anything has changed in the investment thesis to warrant selling the position based on this recent volatility. At the current price of around $31 per share, we believe the dividends alone should reduce a substantial amount of the downside risk in this recommendation going forward, while still leaving over 200% of upside potential on the table. In the investment game that is taking calculated risks, we believe the risk/reward is very favorable in this idea.

One final thing to note is that these preferred shares don’t trade as actively as a typical stock, with only 50,000 – 100,000 shares trading hands on any given day (compared with millions or tens of millions of shares in the average medium or large cap stock).

This limited trading means price fluctuations can be exaggerated, on both the upside and downside. But we don’t recommend investors trade this security. We recommend holding and collecting dividends, and remaining patient with entry points – use the volatility to your advantage to accumulate shares on sell offs. We also recommend using position sizing to limit your risk. Finally, most importantly, we urge patience in waiting for the thesis to play out over the next 1.5-2 years. The company has the liquidity to manage through the next several quarters, and there are no signs yet that the dividend payments are at risk or that the thesis is invalidated.

We urge the same patience and position sizing discipline with our natural gas stocks, including EQT and Tellurian. Natural gas, an infamously volatile commodity, is known as a “widowmaker” for a reason.. As we detailed in our February 17 issue, an extraordinarily warm winter created a gas glut in the northern hemisphere. In the U.S., extreme winter warmth was compounded by the more than 6-month shutdown of the Freeport LNG terminal, America’s second-largest LNG export facility.

These are all short-term headwinds to our gas thesis that have not changed the long-term reality that Europe, and the world, will require a lot more natural gas in the years and decades to come. Most major forecasting agencies are calling for a global LNG shortage to emerge by the middle of this decade. And cheap U.S. shale gas will play a leading role in providing low-cost gas to the world for decades to come.

While the market contends with short-term oversupply, a slate of new LNG export facilities coming online in the U.S. starting in 2024 could change today’s glut into a shortage. At the least, we expect U.S. gas prices will increasingly converge with much higher overseas prices, as LNG export infrastructure comes online that transforms American natural gas from a domestic to an international commodity.

Porter & Co.Stevenson, MD

P.S. If you’d like to learn more about the Porter & Co. team – all of whom are real humans, and many of whom have Twitter accounts – you can get acquainted with us here. You can reach me (Porter) personally via email: [email protected] or follow me on Twitter: @porterstansb.

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.