What the Biden LNG Ban Means for Energy Stocks…

… And for Our Big Secret Portfolio

Every fall I host “Meat Day” at my farm, during which my friends and family gather to – as the name implies – eat meat… all day. Here is a recent Meat Day menu:

- 9 am: 20-hour smoked brisket with poached eggs and hollandaise sauce

- 11 am: Venison chili / hot dogs / ground ribeye burgers

- 12 pm: Oyster bar

- 1 pm: Smoked chicken-wings lollipops, sriracha glaze / lamb lollipops, salsa verde

- 3 pm: Peel-and-eat shrimp

- 5 pm: Smoked duck and brie, house honey cornbread / U10 diver scallops, yuzu beurre blanc

- 7 pm: Rigatoni bolognese

- 9 pm: Lobster tails and ribeye

There are persistent rumors that I fly meat-filled private planes to and from exotic locations to ensure that wherever I am, I’ll have meat to spare. I can neither confirm nor deny these rumors.

While the vegans are taking some market share, America remains a land of glorious meat.

I would immediately leave, though, if the U.S. government were to issue an edict to this effect:

“Our country has ample meat, and ample means to produce more meat, and ample data showing that U.S. citizens enjoy eating meat. However, after consultation with Dr. Fauci, we’ve decided that fresh meat is no longer healthy for U.S. citizens.

“We’ll be halting domestic meat production immediately, and instead, will import low-quality frozen burgers from abroad. Eventually, we plan to phase out meat entirely and replace it with the Beyond Burger. Enjoy!”

That would be outrageous, of course.

But it’s strikingly similar to what the Biden administration is doing to the U.S. energy industry.

On January 26, the White House announced a “temporary pause” on approvals of liquefied natural-gas (“LNG”) export facilities, in an effort to reduce the amount of natural gas used globally.

The administration announced it will use this period to “take a hard look at the impacts of LNG exports on energy costs, America’s energy security, and our environment. This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time.”

Currently, there are eight LNG terminals operating in the U.S., with a total LNG export capacity of approximately 14 billion cubic feet per day (bcf/d). That’s roughly 13% of all the natural gas produced in the U.S. each day.

The pause will immediately put on hold at least four new LNG export projects – representing approximately 12 bcf/d of additional LNG export capacity – that are currently pending approval by the Department of Energy (DoE). And it throws up potential regulatory roadblocks for another nine projects – representing an additional 22 bcf/d – that had previously been approved, but not yet built.

In other words, forget that we have plenty of domestic natural gas, the means to produce it and transport it, and that consumers find it cheap and useful. (The energy industry does not go so far as to host a yearly “Nat Gas Day,” but maybe it should.)

Instead – says Uncle Sam – let’s shut down our pipelines, forget about building new LNG export terminals, and just ship in lower-quality, expensive fuel from other countries. (And, ultimately, maybe get fed up and switch to something like solar power… the Beyond Burger of energy.)

Practically speaking, the Biden administration announcement will leave us vulnerable to higher energy costs, with continued reliance on energy imports from flaky foreign countries, and – interestingly – bigger environmental problems.

Here’s why that is – and what it all means for the U.S. natural-gas investments we’ve previously recommended in The Big Secret on Wall Street…

The Gods of Gas Are Watching

Longtime subscribers to our work know we’ve been covering the shale energy revolution for well over a decade now. Beginning in the early 2000s, tremendous technological advances – including horizontal drilling and hydraulic fracturing (fracking) – enabled U.S. energy producers to unlock vast quantities of previously inaccessible or uneconomical oil and (especially) natural gas.

We’ve long believed this trend is one of the most important in the world – for both investors and the long-term health and stability of the U.S. economy. In fact, we dedicated the very first issue of The Big Secret on Wall Street – titled “The Gods of Gas” – to detailing the massive potential of the U.S. shale-gas industry.

The numbers are staggering.

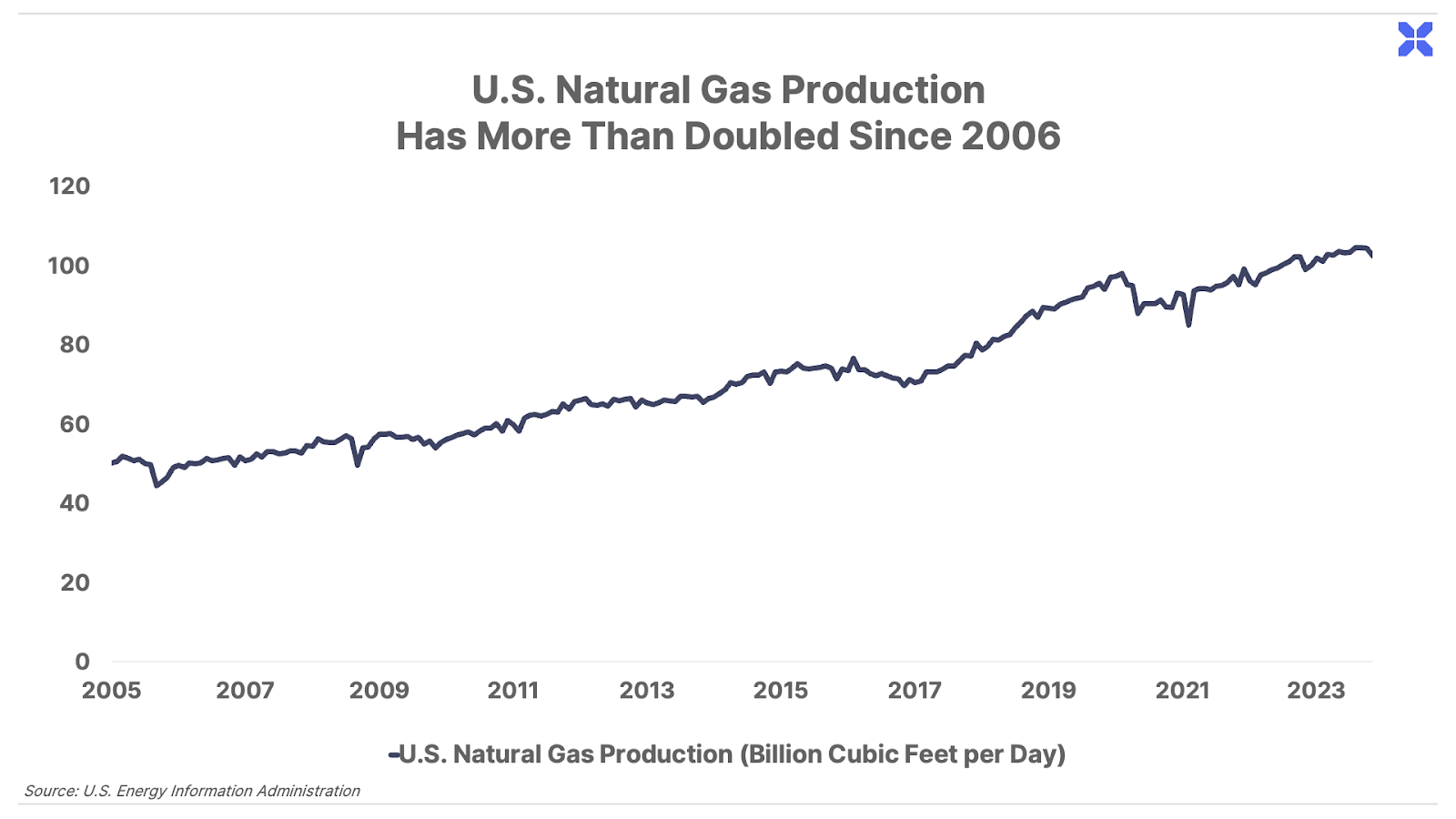

Over the past 15 years, U.S. natural-gas production has more than doubled from around 50 bcf/d to 105 bcf/d – equivalent to roughly one-third of total U.S. energy consumption each day.

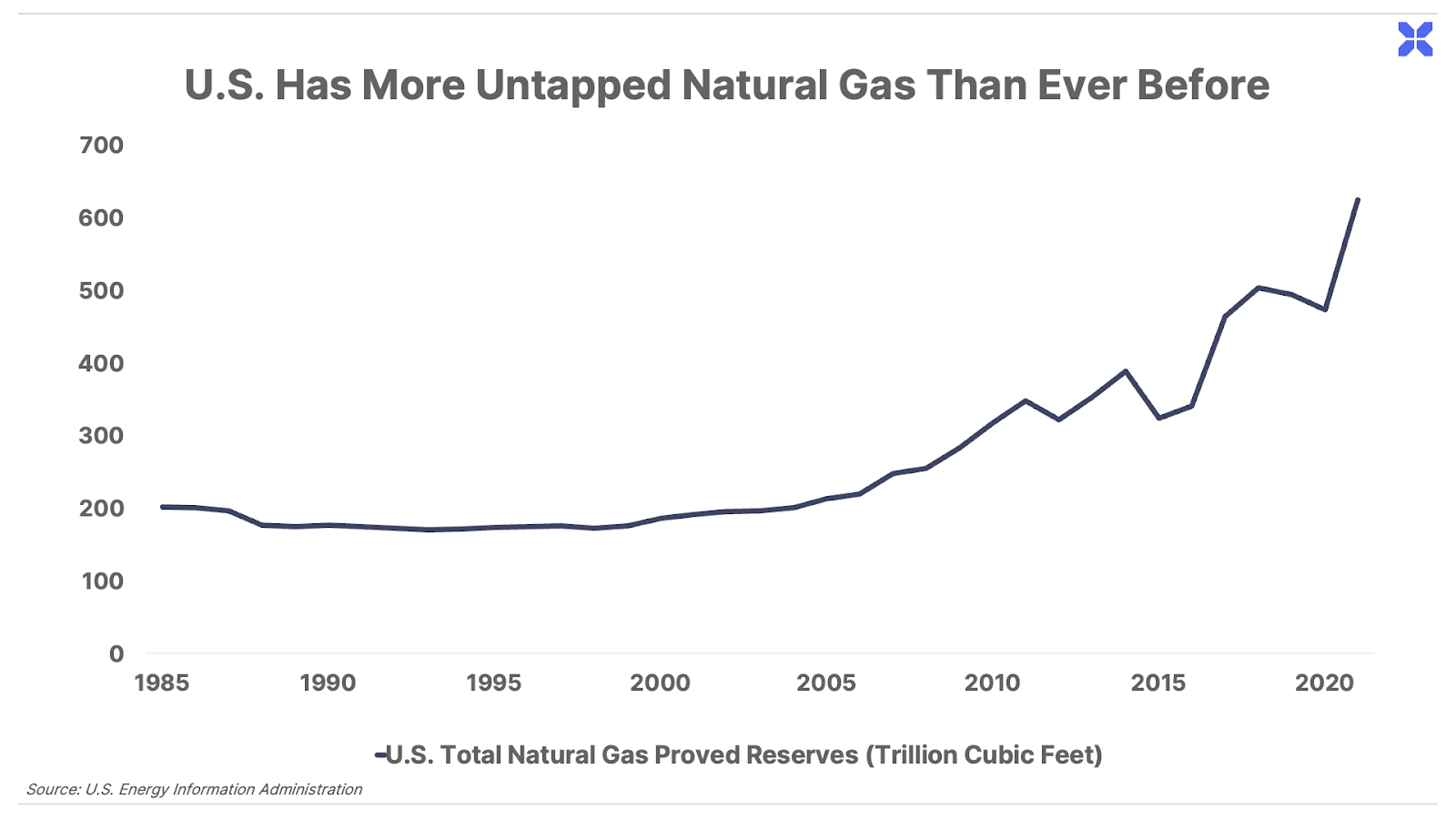

Yet, despite surging production, the U.S. now also has more untapped reserves of natural gas than ever before. As the shale revolution has driven continued technological advances, total proven reserves have nearly tripled over the same period – from 220 trillion cubic feet to well over 600 trillion cubic feet.

Today, the U.S. has a virtually unlimited supply of one of the cleanest, most dependable energy sources on Earth – enough to replace much-despised coal as the world’s leading baseload power fuel, while at the same time unlocking vast amounts of wealth in the American economy. (Baseload power refers to the minimum amount required to sustain the electric grid.)

But that’s not happening, for one reason…

In the name of fighting climate change, the U.S. government has increasingly stymied access to America’s abundant supplies of natural gas. As we wrote in the June 17, 2022, issue of The Big Secret…

“Net zero has become a major cudgel of the so-called ESG (environment, social, and governance) investment trend, which seems like an effort to starve private companies of capital unless they adhere to progressive political orthodoxy…

“Whatever you think of the legitimacy of the ESG movement, it is having a profound effect on America’s most vital economic industry – oil and gas.

“Suddenly it’s virtually impossible to get access to large-scale project funding to drill new oil wells. Or to build a pipeline anywhere… Currently there’s zero political will to build these energy assets – mostly because of politicians like [liberal N.Y. Rep. Alexandria] Ocasio-Cortez and investors in the Net Zero Asset Managers Initiative.”

You see, the key to unlocking the full potential of U.S. natural gas is efficient transportation – pipelines that can send gas from shale basins to domestic consumers, and export facilities that can cool gas into LNG for economical shipment overseas.

This lack of infrastructure has led to a backward and convoluted situation where vast amounts of cheap, clean U.S. natural gas sit unused while a huge swath of the northeast imports LNG from overseas. More from that issue of The Big Secret…

“Roughly 40% of all New England’s electricity is generated using natural gas. But no new pipelines have been built in years… The result: New England residents pay obscenely high prices for electricity and natural gas – the highest in the nation, by far. Natural gas costs almost six-times more in New England ($30) than it does in most of the other parts of the U.S. And electricity ($208) costs about five-times more than it does in most of the U.S.

“And there’s another, more serious problem. Thanks to laws regulating shipping inside the U.S. (the Jones Act), Boston must buy the natural gas it can’t get from pipelines via LNG from foreign countries. That’s why you have consumers in Boston, just a few hundred miles from one of the world’s largest natural gas fields (the Marcellus), paying through the nose to import natural gas from Tobago. If there’s anything dumber happening in global economics right now, [we] haven’t seen it.”

It has also driven foreign importers that would otherwise buy relatively cheap U.S. natural gas to purchase gas from other producers, like Russia and Qatar, or to increasingly turn to dirtier energy sources like coal.

If there was a bright spot in the U.S. government’s otherwise-disastrous energy policy, it was that most of the current administration’s meddling had been focused on halting the construction of U.S. natural-gas pipelines – because pipelines, they say, have the potential of leaks, fires, and damage to the surrounding environment.

The government had generally not interfered with the construction of LNG export facilities (like the one in Texas pictured below) – projects that allow abundant, and otherwise-stranded, U.S. gas to reach foreign markets via ships.

But that all changed last week with the Biden administration’s latest decision.

What the White House LNG Announcement Means

In our view, the Biden administration’s decision on January 26 to pause the approval of any new LNG export facilities will do absolutely nothing to achieve its stated aims of 1) reducing domestic energy costs, 2) increasing U.S. energy security, or 3) helping the environment. Instead, it is likely to do the opposite.

- Limiting LNG Exports Will Not Reduce U.S. Energy Costs in the Long Run

As the charts above show, America has abundant supplies of natural gas… plenty to both fuel our domestic economy and supply the world with cheap, clean baseload power for decades.

Slowing the growth of the LNG export industry may temporarily lower domestic prices by stranding more production – and thereby increasing the supply glut – here in the U.S.

However, in the long run, this pause could lead to higher prices by scaring off new investment in natural-gas production and ultimately making the available domestic supplies more scarce. A similar phenomenon is already playing out in the conventional oil industry, where producers are returning significant amounts of capital to shareholders – rather than reinvesting in new production – following years of increasingly punitive regulations.

If the Biden administration truly wanted to reduce energy prices for Americans, it would encourage investment in both natural-gas pipelines and export facilities. Allowing the shale industry to produce, transport, and export America’s massive supply of natural gas would allow our economy to benefit from cheap, stable energy prices at home and profitable trade overseas.

- Limiting LNG Exports Will Not Improve America’s Energy Security

Exporting natural gas is not a threat to national security.

The U.S. has plenty of natural gas to meet domestic energy needs. Total reserves equal roughly 86 years of supply at current production rates, and continue to grow over time.

Right now, some U.S. consumers rely on foreign imports simply because they can’t make full use of these abundant resources at home. And that’s because the shale industry is not permitted to create the infrastructure that would efficiently transport gas to U.S. consumers.

Slowing LNG exports will do nothing to fix this problem – only building more pipelines will. And in the long run, it will only weaken America’s energy security by keeping significant portions of the country dependent on LNG imports from overseas, and further empowering less-than-friendly natural-gas producers like Russia.

In an effort to stop Israel’s military action in Gaza, Iranian-backed Houthi rebels have been attacking ships traveling through the Suez Canal – a major transport route between the Mideast and Europe. These attacks – which have significantly disrupted the 8% of global LNG shipments that move through the Suez Canal – are a stark reminder of the dangers of relying on imported energy.

Again, if the White House truly wanted to bolster U.S. energy security, it would help unlock – not tie up – the country’s vast natural-gas supplies.

- Limiting LNG Exports Will Not Help the Climate

Climate change is what ultimately is driving the administration’s policy against the release of domestic natural gas.

However, if reducing greenhouse gas (“GHG”) emissions is critical, halting LNG exports is not the way to do it. Quite the opposite, in fact.

According to the U.S. Energy Information Administration, since 2005, the U.S. has cut GHG emissions by more than the next eight countries combined.

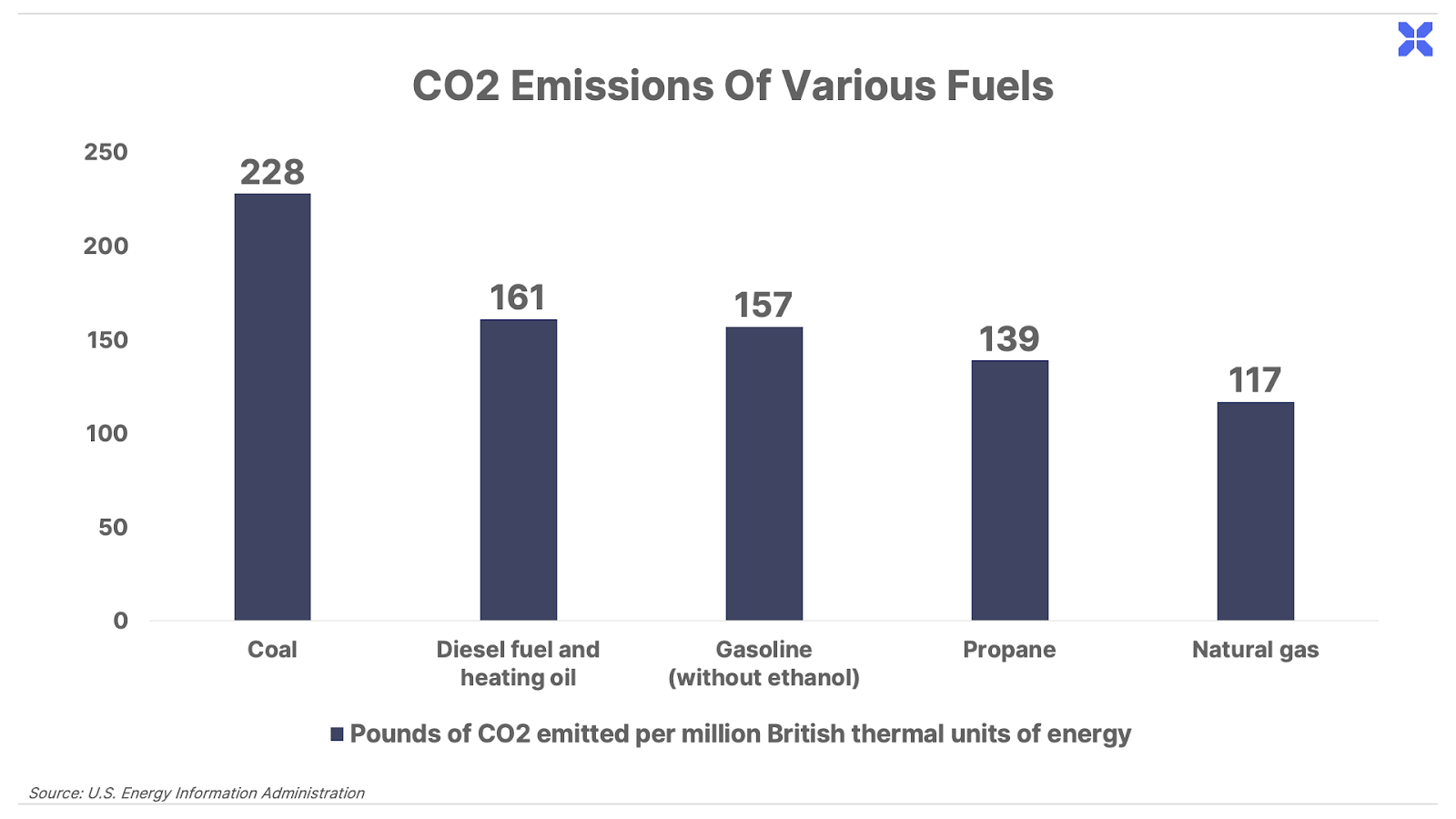

This had little to do with the rollout of solar, wind, or any other unreliable “green” energy source. Rather, this was almost entirely due to the country’s transition from coal to natural gas as a primary power source.

In 2005, coal (22.8%) and natural gas (22.6%) accounted for nearly equal portions of U.S. energy consumption. By 2022, coal consumption had fallen to just 9.8% while natural gas had risen to 33.3%.

While climate activists argue that exporting less U.S. LNG would reduce GHG emissions globally, the reality is that potential buyers of U.S. gas will simply procure their energy elsewhere. And the primary substitutes for U.S. LNG are foreign-produced LNG and, increasingly, coal.

Natural gas is significantly cleaner than coal, producing roughly half as much GHG emissions per unit of energy.

However, studies show the U.S. LNG is also cleaner than most foreign-produced LNG, particularly LNG from Russia – the other major natural-gas exporter to Europe and China.

Because of its inability to get enough natural gas, China has been doubling down on coal to meet its energy needs.

The country’s coal-power capacity has more than doubled over the past few years. China reportedly opened an average of two new coal-burning plants a week in 2023, and currently has more than 300 additional new plants in the permitting stage.

Given that China is one of the world’s leading importers of U.S. LNG, the pause in export growth is only likely to accelerate this trend.

Again, if the administration was actually concerned about reducing GHG emissions, it should encourage – not disincentivize – additional LNG exports.

And What the Directive Means for Energy Stocks

This news has mixed implications for shares of natural-gas companies.

As we mentioned earlier, if the halt on new LNG export facilities is longer than “temporary,” it could cause the U.S. gas market to become oversupplied. Domestic gas prices could drop. This would be bad news for most U.S. natural-gas producers.

This directive is also negative (obviously) for the companies whose LNG export projects are still awaiting approval. While many of these are privately held companies, this list includes publicly traded energy-infrastructure and storage firms like Kinder Morgan (KMI) and Energy Transfer (ET).

The big winners here are the companies whose projects have already received DoE approval. This list includes U.S. LNG giant Cheniere Energy (LNG), ExxonMobil (XOM), and Sempra (SRE), among others. By delaying the future construction of U.S. LNG terminals, the Biden administration just made these existing projects substantially more valuable.

Finally, while this halt is likely negative for U.S. gas prices in coming months, these restrictions could ultimately limit production – and cause domestic gas prices to rise significantly in the years ahead.

This would be a long-term boon to U.S. natural-gas producers… particularly the high-quality, capital efficient producers we’ve recommended to paid-up Big Secret on Wall Street readers. Click here to get immediate access to the full Big Secret portfolio now.

Porter & Co.

Stevenson, MD

P.S. If you have any especially delicious meat recipes or tips, please send them to [email protected] immediately.