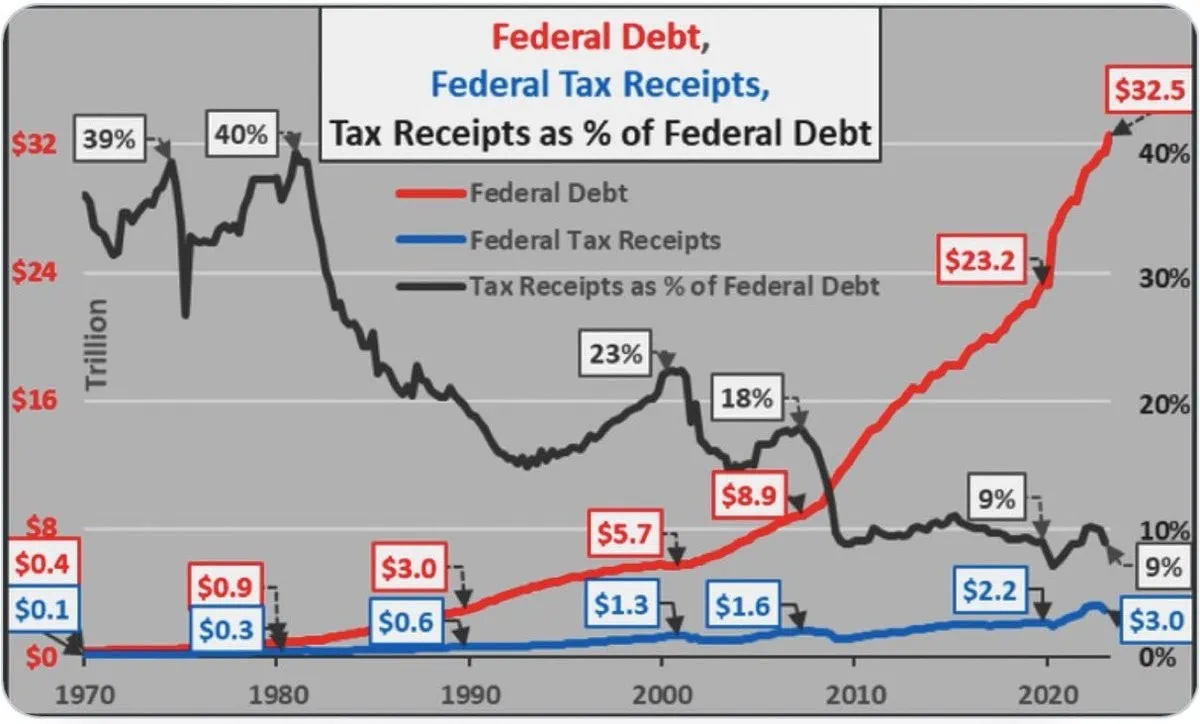

This chart from Chris Hamilton at Econimica grabbed our attention, not as an immediate indicator, but rather, as a jaw-dropping piece of context. An attempt to see the forest for the trees, if you will.

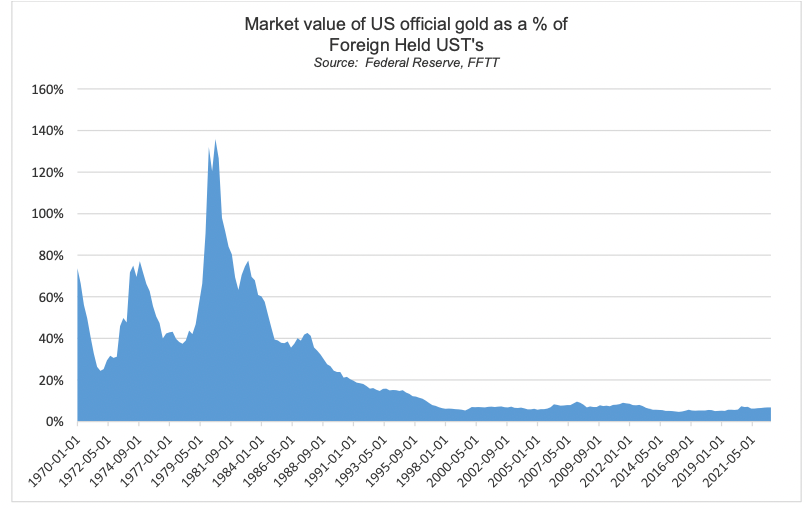

1980: Everybody hates the [US Dollar (USD)] and [US Treasury Bonds (USTs)], even as US Federal debt is 40% collateralized by US Federal tax receipts, the foreign-held portion of USTs are ~130% collateralized by the market value of US official gold, and long-term USTs are yielding nearly 15%.

2023: Everybody loves the USD and USTs and gold is significantly under-owned by western investors, even as US Federal debt is now only 9% collateralized by Federal tax receipts, the foreign-held portion of USTs are only ~7-8% collateralized by the market value of US official gold, and 10y USTs yield under 4%.

Via Econimica

In 1980, nobody wanted USTs at 15%, despite the facts that US debt/GDP was down to 30%, US tax receipts were collateralizing 40% of total Federal debt, and the market value of US official gold was 130% collateralizing the foreign-held portion of the debt (that was the very definition of a gold bubble.)

In contrast, today everybody wants USTs as “risk free collateral” despite the US government mathematically requiring negative real rates to sustain its 120% of GDP debt load, US Federal tax receipts collateralizing less than 10% of total US Federal debt and the market value of US official gold collateralizing only 7% of foreign-held USTs.

We have no idea when this astonishing contrast will matter, but as we noted earlier, we hold our gold and gold miner positions unlevered so we can wait. In the unipolar world that existed, the above might have never mattered; in the multi-polar world that is evolving, it will likely matter at some point.

The chart below elaborates on this point: During the Cold War (1970-89 shown), the market value of US official gold as a % of foreign-held USTs never fell below 20%. As soon as the USSR broke up, gold fell below 20% to as low as 5%.

This chart then ties into the point we made in the second Tree Ring point – if the USD has to compete on its merits in a multi-polar world, the implied gold backing of US foreign debt will likely have to rise, meaningfully.

With the market value of US official gold back to only 7% and a multipolar world clearly re-emerging, the chart above suggests to us that gold may be one of the cheapest assets on the board (it would need to triple just to get back to 1989 valuations relative to foreign-held USTs, and would have to rise nearly 20x to return to 1980 levels relative to foreign-held USTs)…at a time when investors cannot get enough of USTs on which the US government cannot sustainably afford positive real rates (as we showed above.)