Issue #33, Volume #1

And Why $100,000 Is Just The Start

This is Porter & Co.’s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Three Things You Need To Know Now:

1. Nvidia delivers another blowout quarter. On Wednesday, Nvidia (NVDA) reported better-than-expected revenue and net income for the three-month period ending October 31. The chip maker is a growth monster: Its profits for the quarter ($19.4 billion) were more than its total revenue for all of 2021 ($16.7 billion). The company has beaten Wall Street’s expectations every quarter for the past two years. Earnings expectations – now at $4.33 per share for the next fiscal year (FY 2026) and up 81% since January – will continue to rise, driven in part by enormous demand for Blackwell, Nvidia’s newest artificial-intelligence (“AI”) chip. With a market capitalization of $3.5 trillion, Nvidia is now the most valuable publicly traded company in the world. Still, and even after appreciating 185% over the past year, the shares are trading at a relatively (considering continued earnings growth) inexpensive valuation of 33x forward earnings.

If you think Nvidia is only about AI… you’re wrong. It’s central – though only a part of – the parallel-processing revolution, which is (far) bigger than AI. To help you understand what it’s all about (in plain English) and the investment ramifications, Porter put together a video… you can watch it here.

2. The euro is tumbling. The European currency fell to a two-year low of $1.03 versus the U.S. dollar this morning, following a report of unexpectedly weak business activity in the Eurozone. The euro had already been moving sharply lower after Donald Trump won the U.S. presidential election earlier this month, on expectations that tariffs may slow growth in an already sluggish European economy, and push the European Central Bank to cut interest rates more aggressively… and this morning’s report is adding fuel to the fire. The upside: That European vacation is getting cheaper (for U.S. dollar holders, that is) by the day.

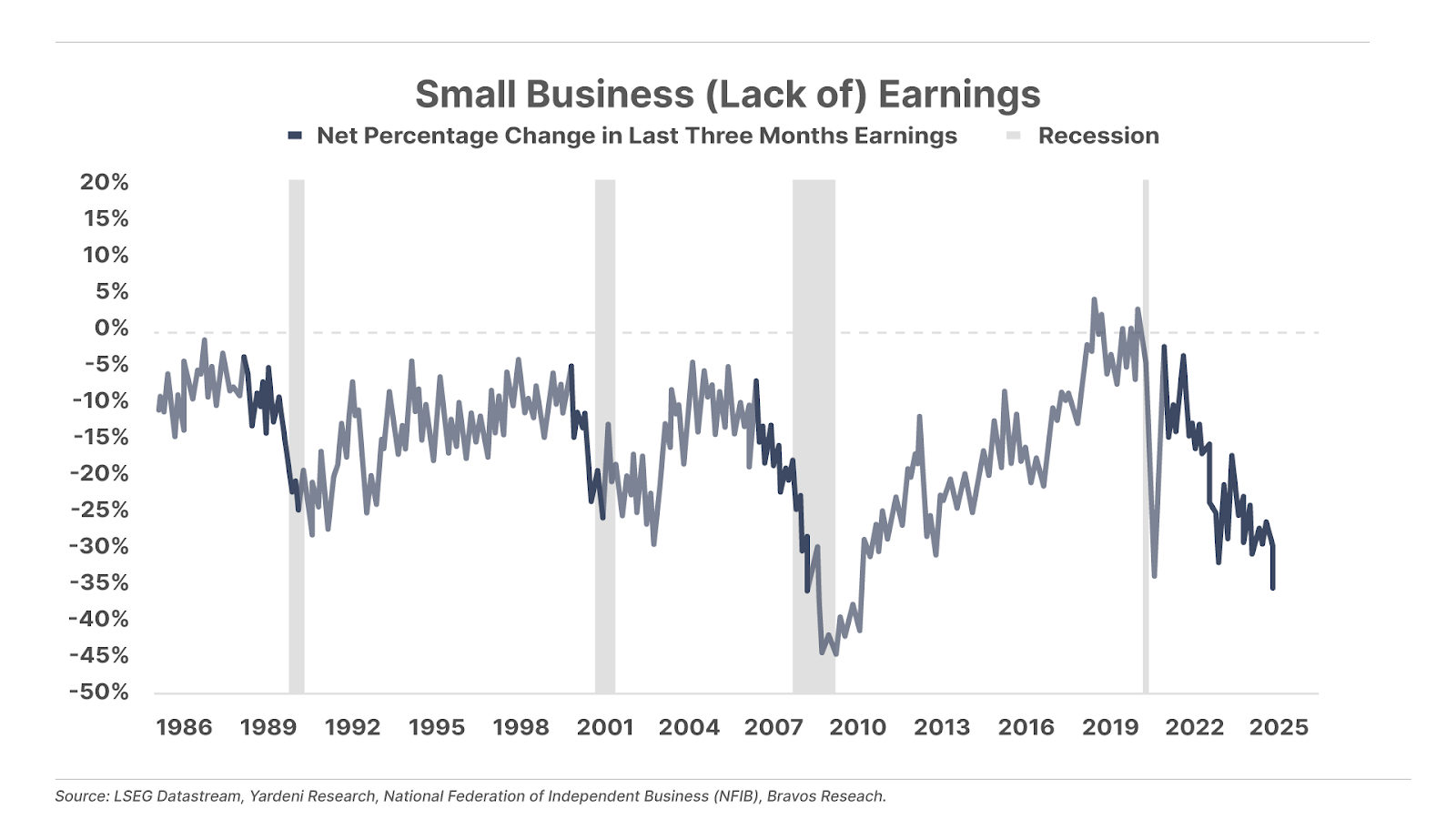

3. Small businesses are getting crushed. Small businesses in the U.S. have seen their sales drop for 29 consecutive months. And as the chart below shows, deterioration in earnings is even more abysmal. Small businesses employ 46% of American workers (59 million people) – so small-business struggles are a big red flag for the broader economy. As we noted recently, the restaurant sector – a key small-business employer – is on track to post the highest number of annual bankruptcies in decades, and it’s becoming more challenging for consumers to access credit, which will slow spending even more. It’s official… the small business recession is here:

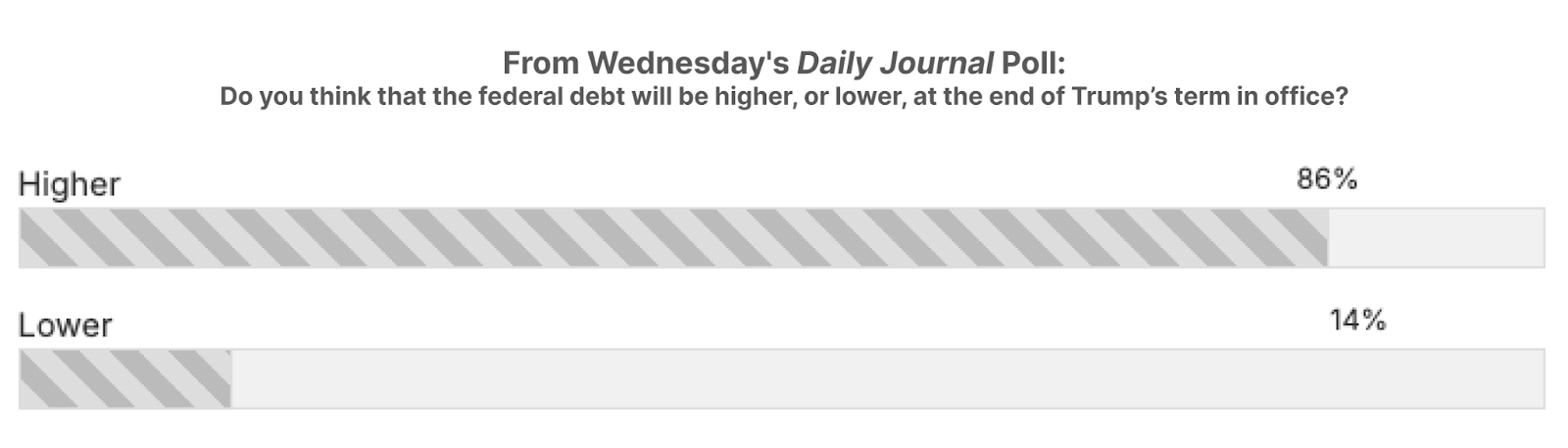

And one more thing… U.S. debt will rise, Daily Journal readers say

President-elect Donald Trump’s economic plans – including various tax cuts, new tariffs, and stricter border enforcement – are expected to add an additional $7.5 trillion to the current $36 trillion U.S. federal debt over the next decade (besides the trillions in debt that’s already baked in to budget expectations due to entitlements and other required spending). Meanwhile, Trump tapped Tesla CEO Elon Musk and former pharmaceutical CEO Vivek Ramaswamy to oversee the Department of Government Efficiency (“DOGE”), whose mission is to recommend ways to slash $2 trillion in U.S. government spending.

In that context we asked readers on Wednesday: Do you think the federal debt will be higher, or lower, after Trump’s term in office? An overwhelming 86% of you say Trump will have added to the nation’s debt.

How Bitcoin Works

And Why $100,000 Is Just The Start

Bitcoin is having a moment.

Thanks in part to the anticipated pro-cryptocurrency attitude of the incoming Trump administration, Bitcoin is up 47% over the past month (and 165% over the past year), and today is within whispering distance of the $100,000 level.

A great time, and way, to buy Bitcoin: Two years ago, when we recommended the MicroStrategy “Bitcoin bond.”

Until August 2020, MicroStrategy (MSTR) was a ditchwater-dull software-as-a-service company that offered enterprise analytics and services to help companies make smarter, data-driven decisions. Then, though, MicroStrategy then-CEO and founder (and controlling shareholder) Michael Saylor found crypto religion, and replaced the company’s treasury cash with Bitcoin. MicroStrategy converted its $500 million cash pile into the cryptocurrency – and also issued $2.4 billion in low-cost debt (Bitcoin bonds) to accumulate roughly 130,000 Bitcoins.

On October 14, 2022, in The Big Secret on Wall Street we recommended the MicroStrategy 2025 0.75% Convertible Bond, as a way to profit from the likely appreciation of Bitcoin (then trading around $19,000).

At the time, the bonds were trading at around $750. And the prospects for Bitcoin were positive. We wrote then…

As global central banks, including the Fed, return to their familiar playbook of cutting interest rates and expanding the money supply to deal with unsustainable global debt burdens, we see Bitcoin reaching new all-time highs and hitting $100,000… and that could be just the beginning of the next leg higher.

The MicroStrategy 2025 bonds were called (which means holders could convert their bonds to 2.51 shares of MicroStrategy’s class A common stock, reflecting a $398 price per share) by the company on July 15, 2024 – up 406% from where we recommended them (in the Big Secret portfolio, we took profits early, for a still-solid return of 82%).

Since then, Saylor has doubled (and then some) down: The company recently announced a three-year plan to raise $42 billion (!) to buy more Bitcoin. Yesterday it increased the size of a convertible-note offering, from $1.75 billion to $2.6 billion, in response to soaring demand. The market capitalization of MicroStrategy has become Bitcoin on steroids, soaring nearly 800% over the past year.

Saylor has – for now – created an infinite money machine: He’s borrowing U.S. dollars – a debased currency that has lost 40% of its buying power over the past two decades alone, and is the vehicle of an epic debt bubble – and buying Bitcoin… which is in many ways the anti-dollar (or rather… the anti-fiat currency).

Bitcoin is created at the nexus of computation and energy. With supply capped at only 21 million coins (but divisible into virtually limitless fractions), Bitcoin could become a much better, new global reserve currency. It’s by definition immune from currency devaluation, and eliminates the silent theft of purchasing power through inflation that plagues sovereign currencies.

How Bitcoin Works

Every Bitcoin transaction is digitally encrypted onto a decentralized network, known as the blockchain. The blockchain is essentially a public ledger, maintained through a network of thousands of “nodes.” At each node, high-powered computers – known as miners – keep track of every Bitcoin transaction. These miners compile real-time Bitcoin transactions into data blocks.

When a given data block fills up, the miner adds it to the pre-existing block series. This process forms a chain of continuous transaction blocks. Thus the name blockchain – which is a self-regulating network with built-in incentives for computers around the world to compile and keep track of every transaction.

In exchange for lending their computing power to the Bitcoin network, miners are rewarded with entries into a lottery for each data block they create. The number of actual Bitcoins awarded in these lotteries declines over time, to ensure that the total number doesn’t exceed 21 million coins.

Bitcoin’s “productivity curve” is predicated by the extraordinary advances of digital technologies. It is a currency that’s designed to be stable relative to advances in computing. As a result, its value has soared relative to other currencies.

To ensure the security and integrity of the blockchain, 50% of the network nodes must approve each data block before adding it onto the blockchain. A bad actor looking to hack Bitcoin would need to rewrite the entire blockchain history with the new false version: Which is simply impossible.

The result is a secure self-regulating decentralized network, governed by a series of rules that eliminates the need of any central authority. That’s what makes Bitcoin the ultimate candidate for a global reserve currency – a neutral asset that exists outside the realm of sovereign governments and banking cartels.

What’s Next for Bitcoin

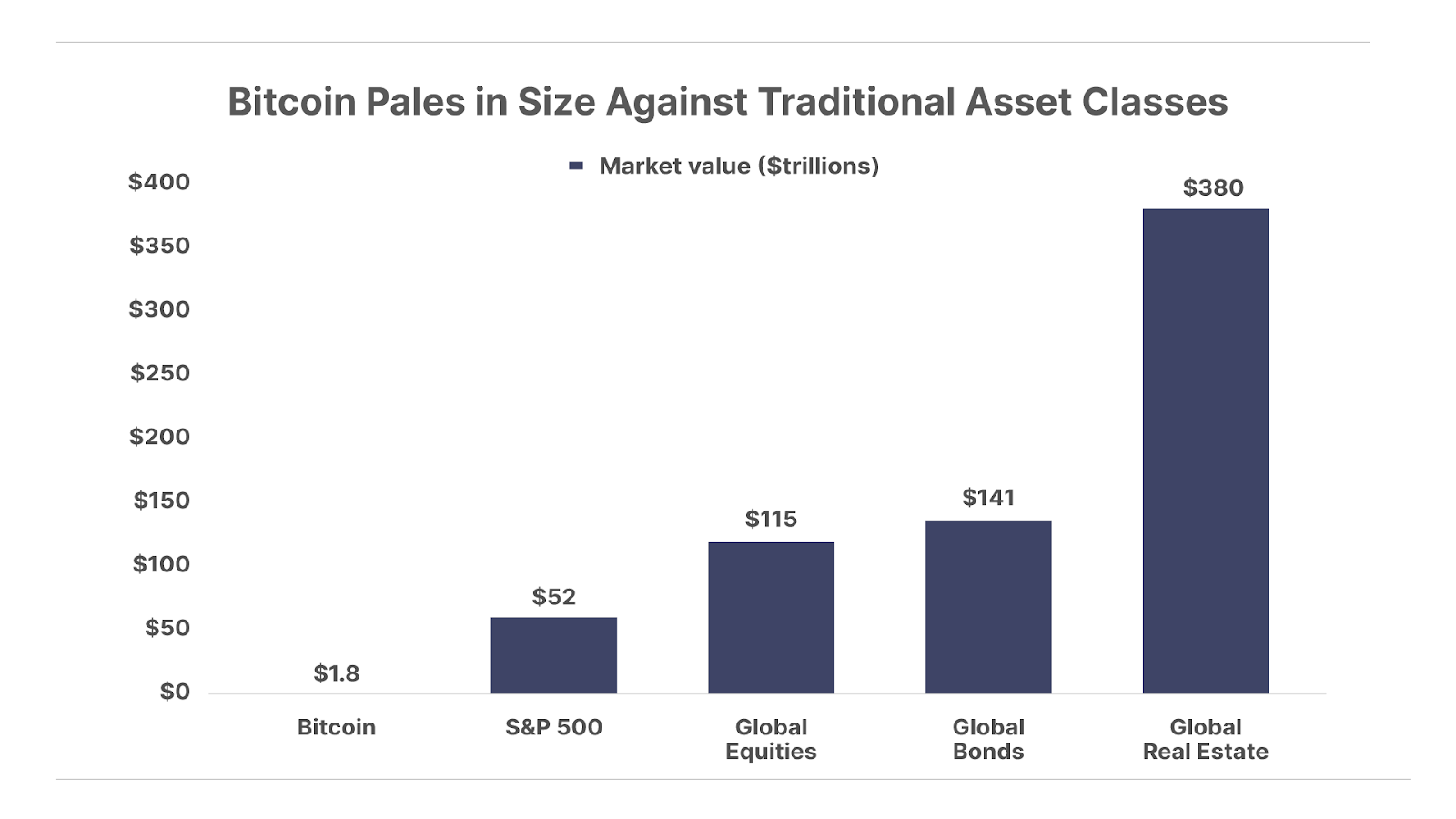

Globally, the M2 money supply is nearly $170 trillion. Meanwhile, the total size of traditional asset classes is in the hundreds of trillions of dollars.

This wealth is mostly concentrated in stocks, bonds, and real estate. Bitcoin’s current $1.8 trillion market capitalization is a rounding error compared with these traditional stores of wealth.

If just a small percentage of global wealth – and central bank reserves – found its way into Bitcoin, the cryptocurrency’s price would soar to levels that are orders of magnitude higher… to millions of dollars per coin, perhaps.

Why? In a world where overly-indebted governments print more and more of their fiat currency, inflating away their obligations, an increasing amount of those currency units will flow into alternative stores of value, like Bitcoin. And don’t forget… beyond providing a source of stable money, Bitcoin also allows seamless, secure peer-to-peer transactions with anyone around the world at the click (or two) of a button. Often referred to as the “internet of money,” Bitcoin’s decentralized nature eliminates interference from governments, thereby eliminating the threat of censoring transactions and currency devaluation.

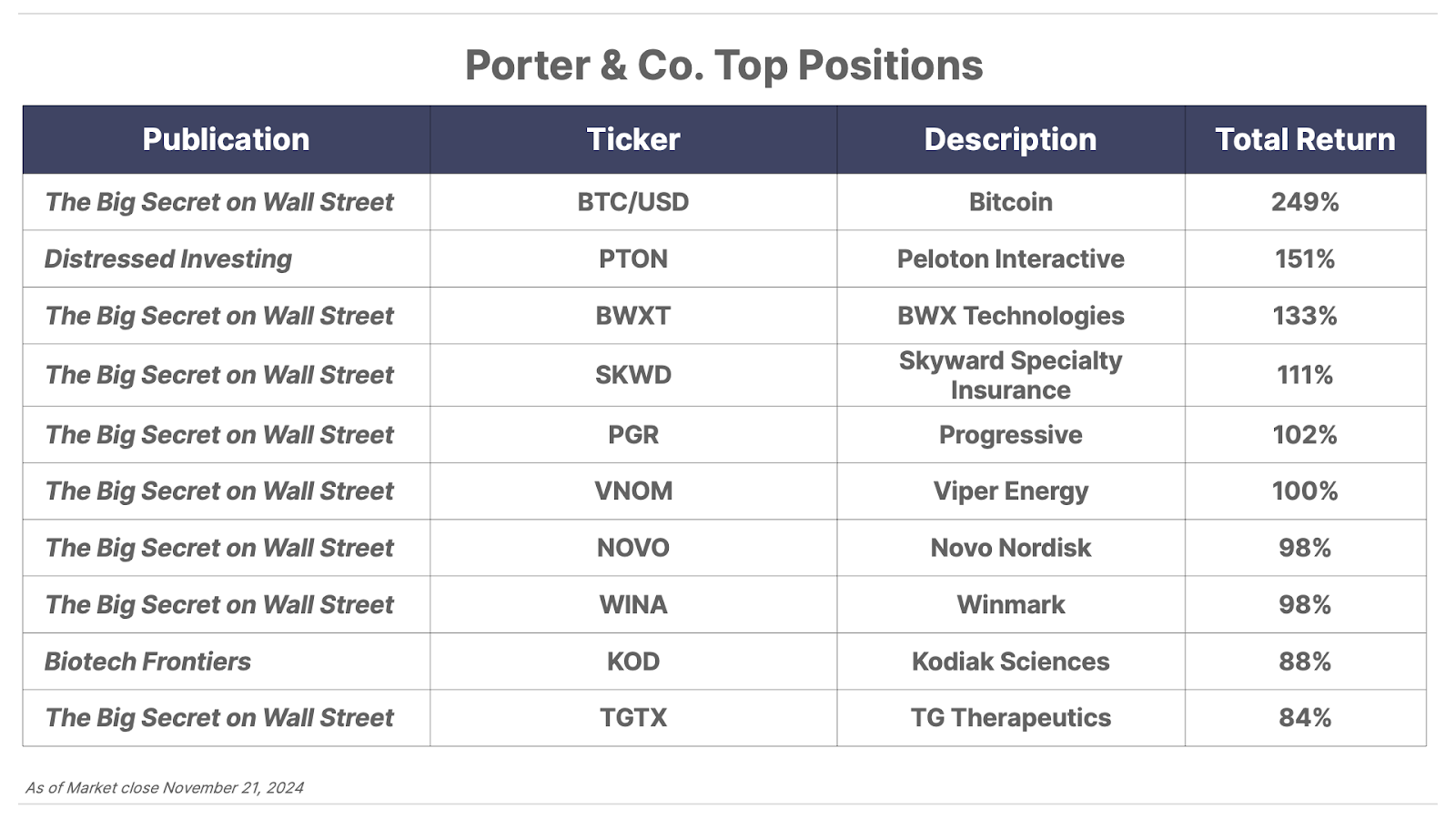

As you can see in the Porter & Co. Top Positions table below, we recommended Bitcoin in May 2023 and it’s risen 249% since then. And in Porter’s Permanent Portfolio, we recommend holding 12.5% of the portfolio in the Franklin Bitcoin ETF (EZBC).

However, buying an asset that’s run up 47% over the past month is generally a bad idea. Right now, Bitcoin is at the shoeshine-boy-is-buying point of the mania. Its volatility over the years suggests it’s due for a price correction. And the incoming Trump administration’s acceptance (and approval) of Bitcoin, and its path to the financial mainstream, may still face some obstacles.

But short-term noise aside, the future is clear: And it’s Bitcoin.

As always share your thoughts on this topic with Porter directly: [email protected]

Good investing,

Kim Iskyan

Free Union, VA

P.S. Another way to maintain the value of your assets, in the face of continued currency degradation, is gold.

Gold also is portfolio insurance… and has been a great investment.

But one asset class linked to gold hasn’t kept pace, and that’s gold miners.

Porter recently sat down with gold expert Marin Katusa to talk about gold – and why gold miners have so dramatically underperformed the price of gold. You can listen to their conversation here.