Issue #34, Volume #1

When Smart People Do Dumb Things

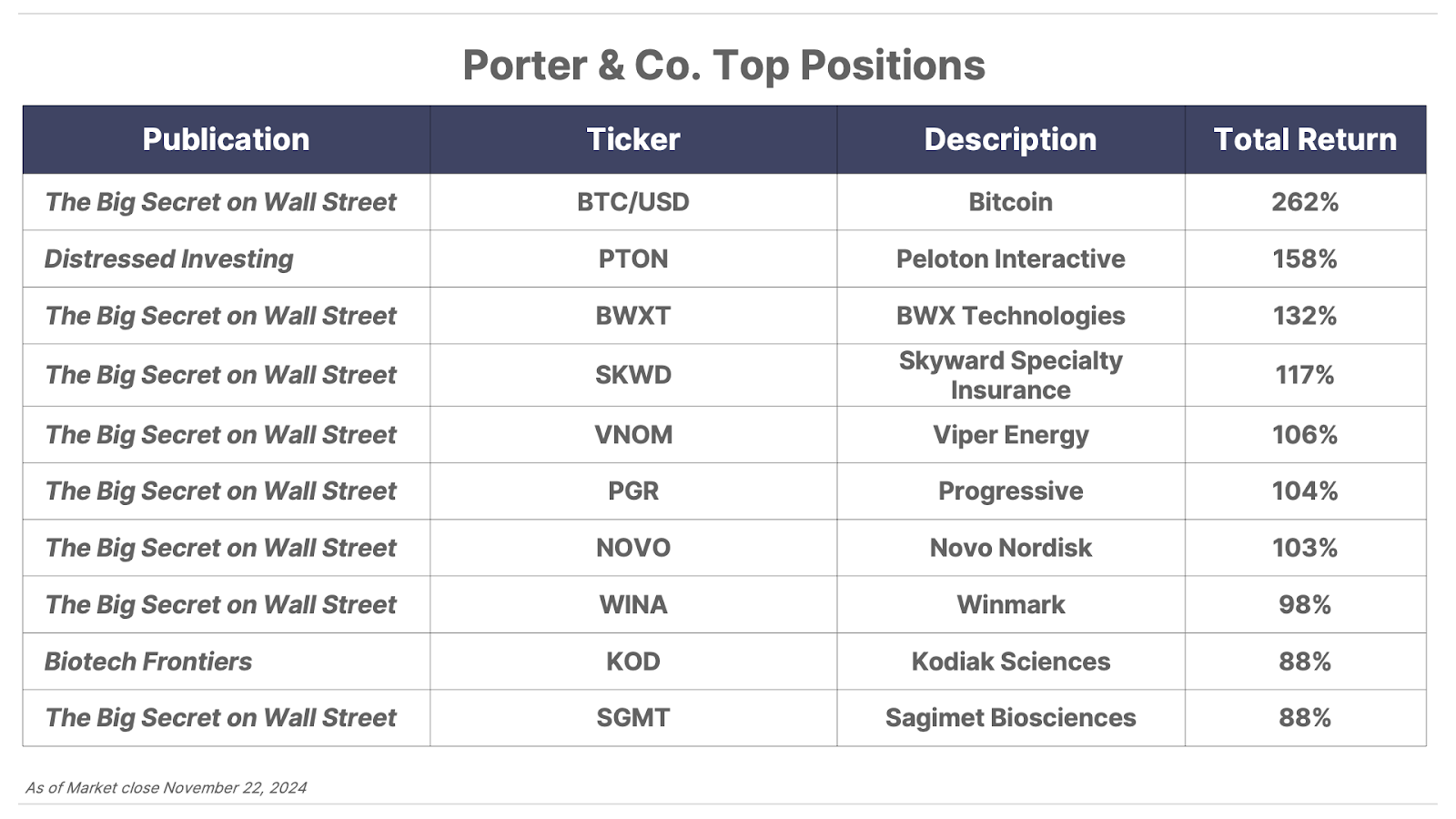

| This is Porter & Co.’s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here. |

Important announcement: Due to the Thanksgiving holiday this week, there will be a few changes to our publishing schedule. Though you’ll get Porter’s Daily Journal as regularly scheduled on Wednesday and Friday, you’ll receive The Big Secret on Wall Street a day early, at 4 pm ET on Wednesday. Subscribers will also get their Investment Chronicles and Distressed Investing reports on Wednesday, as the Porter & Co. team is taking Thursday and Friday off to be with our families.

As we tuck into our turkeys and green-bean casseroles, we’ll remember to say thanks to all of our paid-up subscribers who’ve given us the best job in the world. Thank you all.

Three Things You Need To Know Now:

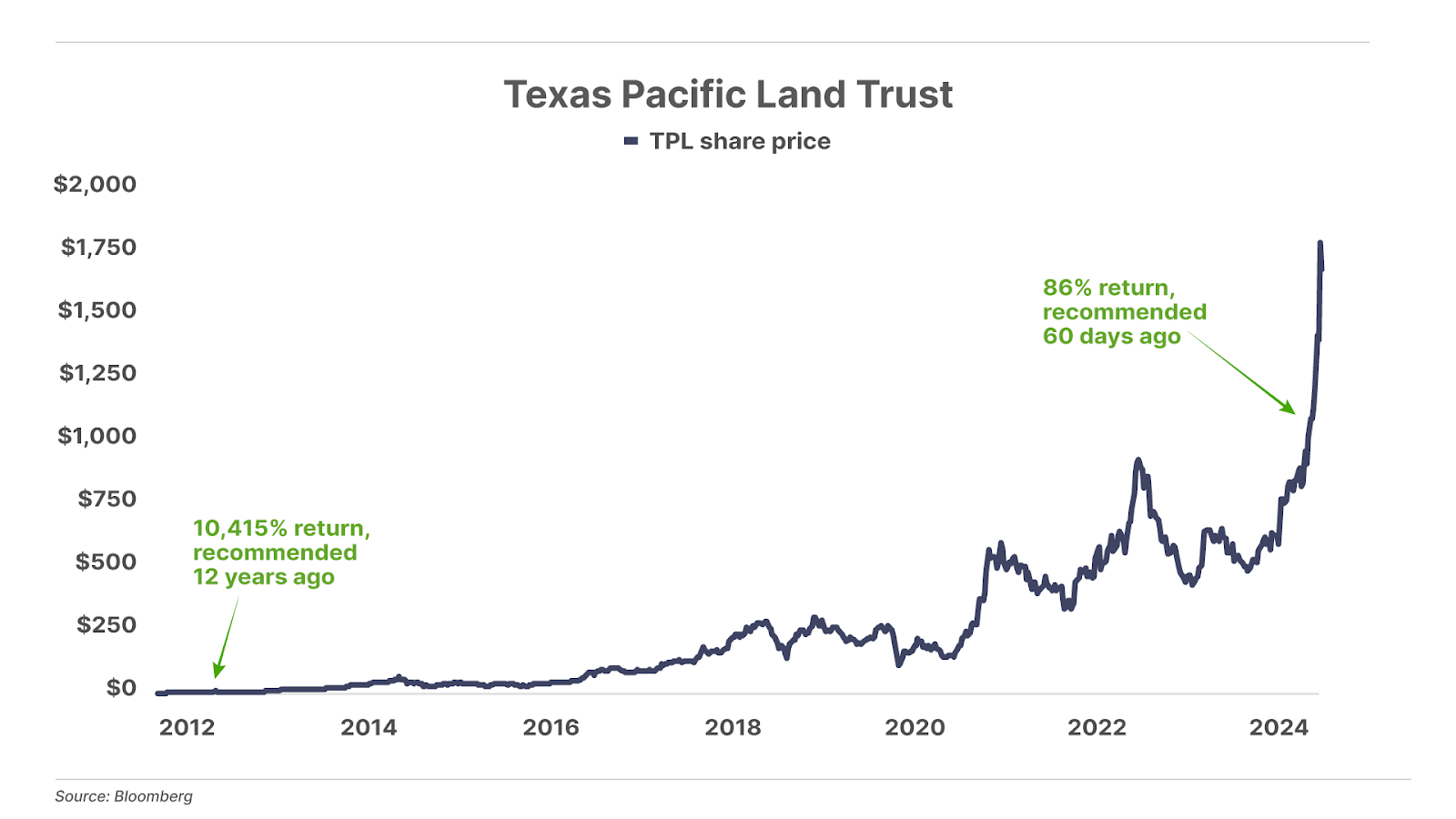

1. Texas Pacific joins S&P 500. Congrats to investors who followed our recent recommendation in The Big Secret on Wall Street of Texas Pacific Land (NYSE: TPL). The $36 billion West Texas energy and land holding giant will join the S&P 500 tomorrow. The stock has had a blistering run and is now trading above $1,700, up more than 80% since our late-September recommendation. Subscribers who think they missed the boat should know this: I (Porter) first recommended the stock back in 2012… at prices below $30. So, while you should possibly wait for a pullback before establishing a new position, this company will continue to generate wealth for decades to come.

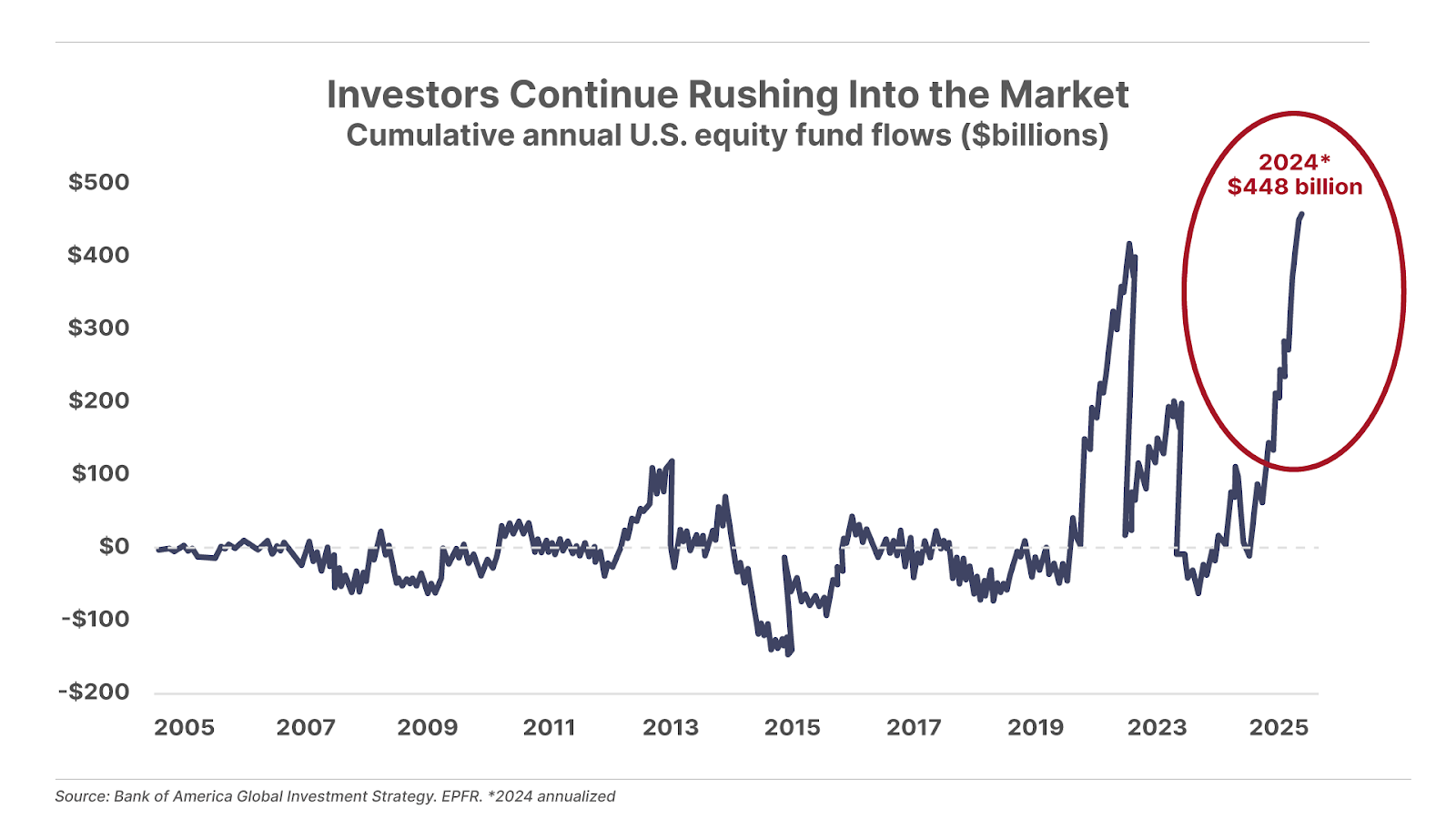

2. Investors are rushing into U.S. stocks like never before. Cumulative U.S. equity inflows are on pace to reach an all-time high of $448 billion this year. This is nearly $50 billion more than the prior record of $400 billion set in 2021, and nearly double the inflows of 2022 and 2023 combined.

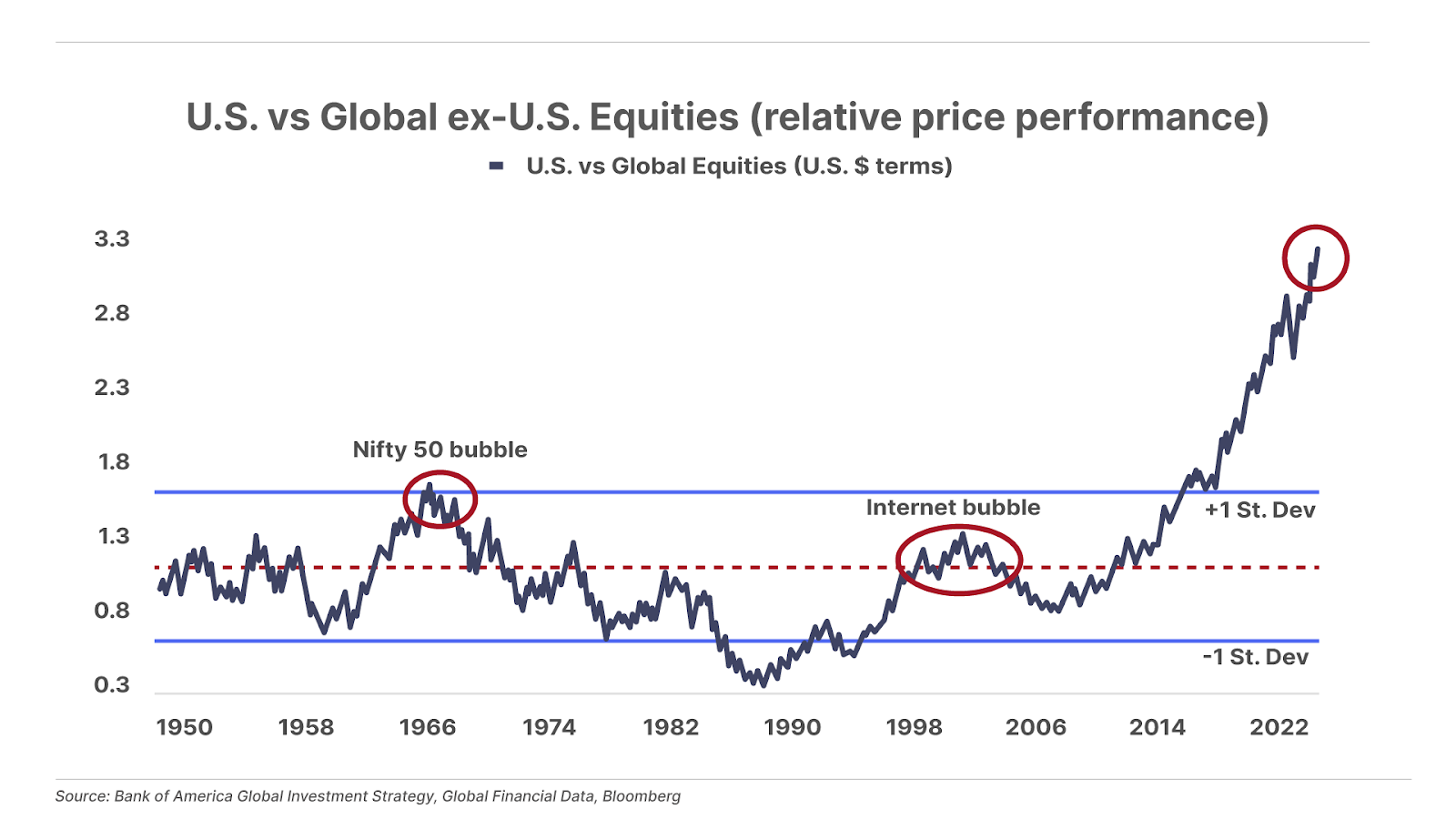

3. U.S. stocks are currently trading more than three standard deviations above global ex-U.S. stocks. That’s more than double the prior extremes seen at the peaks of the Nifty 50 bubble in the 1960s and the dot-com bubble in the early 2000s. We are in the midst of a generational financial bubble. And these things never end well. But, there’s always a bull market somewhere. And the next great bull market will be in foreign markets that adopt pro-growth policies, where you can buy good businesses at 4x or 6x earnings today. You’ll see more from us about these opportunities going forward.

And one more thing…

There are two important economic data points this week. Tomorrow the Federal Reserve will release the minutes from its November 6-7 meeting, in which they will try to justify their rate cuts in the face of soaring financial asset valuations. And on Wednesday, we’ll get the first Q3 GDP and PCE (inflation) numbers. We expect to see an economy that’s not growing (in real terms) and inflation that remains well above the Fed’s mythical 2% target. The only people getting rich in this economy are folks willing to speculate in wildly overpriced financial assets. Gee, I wonder how this movie ends?

Be Fearful When Others Are Greedy

When Smart People Do Dumb Things

Chase Furey, according to The Wall Street Journal, is “a 25-year-old trader in Newport Beach, California.”

Educated at Harvard University, Chase recently convinced his parents to let him manage their $700,000 retirement account. He told the Journal that he’d created a “less dangerous and smarter” strategy for his parents. He put 100% of their account into two positions: shares of MicroStrategy (MSTR) and a 2x leveraged ETF that holds options on MicroStrategy stock. Chase expects Bitcoin to hit $400,000 and for MicroStrategy to increase by 10x… by next year. And, the strategy has worked so far: his parents’ capital has more than doubled!

Educated at Harvard University, Chase recently convinced his parents to let him manage their $700,000 retirement account. He told the Journal that he’d created a “less dangerous and smarter” strategy for his parents. He put 100% of their account into two positions: shares of MicroStrategy (MSTR) and a 2x leveraged ETF that holds options on MicroStrategy stock. Chase expects Bitcoin to hit $400,000 and for MicroStrategy to increase by 10x… by next year. And, the strategy has worked so far: his parents’ capital has more than doubled!

The story reminds me, vividly, of a similar account I read in the same paper, in late 1999.

Back then a 25-year-old hedge fund wunderkind had, using the miracle of leverage, turned a small amount of seed capital into a $50 million fund in about 18 months, buying call options on the hottest tech-stock IPOs. He was making so much money that he began chartering private jets each weekend to Miami Beach. Of note: he required Count Chocula cereal to be stocked on every flight.

I certainly hope things go better for Chase Furey than they did for the Count Chocula trader, who ended up convicted of securities fraud and in jail. But, one way or another, when you’re deliberately seeking out the most volatile and inflated assets in the world at the very top of a multi-generational speculative bubble… there will be blood.

I suspect that Chase Furey doesn’t understand nearly as much about convertible bonds as MicroStrategy Executive Chairman Michael Saylor.

Saylor recently raised almost $3 billion in capital in a convertible bond, with a $672.50 strike price (a 55% premium to the current share price) and June 2029 maturity. This bond, which was only available to institutional investors (rule 144a) or foreign investors (Reg S), doesn’t pay any interest – none.

Simple question: why would sophisticated investors pay $3 billion to hold a bond that doesn’t pay any coupon and doesn’t deliver any upside until the stock trades at a 55% premium from the current price?

Makes no sense, unless you understand why hedge funds buy convertible bonds. These securities give you the right to convert the cash you’ve invested into shares, which means you can now short the stock with complete impunity. It’s a simple trade: you buy the bond, which enables you to short shares of MicroStrategy without any risk, unless the shares increase by another 55%.

Warren Buffett is famous for saying that it is wise for investors to be fearful when others are greedy and to be greedy only when others are fearful.

It’s not hard to recognize where we are now in regards to those extremes.

As always share your thoughts on this topic with me directly: [email protected]

Good investing,

Porter Stansberry

Stevenson, MD

P.S. I’ve made a career out of calling bullsh!t when I see it.

I’ve forecasted the bankruptcy of General Motors (GM)… that the shares of Fannie Mae (FNMA) and Freddie Mac (FMCC) would go to zero… and, recently, that Boeing (BA) will go bust, and that Bank of America (BAC) will suffer a run on deposits.

In investing – not to mention in life – “go along to get along” is, whether or not they want to admit it, the motto that most people follow.

Obviously… that’s not me.

And many of the people I most respect in the investment community are those who aren’t afraid not to “go along” – that is: Analysts who call it like they see it, even if it ticks off the folks who are trying to “get along.”

That’s one of the things I most appreciate about my friend and former colleague Jeff Brown. He’s not only one of the best stock pickers I’ve ever worked with, and has an uncanny ability to see the future of technology… he also is unafraid of slaughtering sacred cows.

Like this one: artificial-intelligence (“AI”) stocks are on a one-way elevator to the sky. Just look at how many times AI is being mentioned during earnings calls of S&P 500 companies:

AI is changing the world. But that doesn’t mean that every AI company, or stock, will do well. In fact, to the contrary.

And right now, Jeff is forecasting an unprecedented crash in AI, what’s been one of the market’s hottest sectors. He thinks that many in-the-headlines AI stocks will drop by 50% or more in coming weeks… including one that he calls “AI’s Most Toxic Ticker” that, if it’s in your portfolio, you should sell at once.

That ticker is part of a special presentation Jeff has put together that I urge you to watch. There’s nothing like watching a sacred cow meet its maker.