A Blood-in-the-Streets Moment for This Industry Leader

These Preferred Shares Offer Lots of Upside and Limited Downside Risk

| Editor’s note: Below, we share a very special combined issue of Distressed Investing and The Big Secret on Wall Street. The recommendation in this report is a preferred stock, which is a hybrid mix between a stock and bond. Analysts from both advisories walk readers through the complexities of a bond-like instrument that also acts as a stock… We hope you enjoy the collaboration. Paid subscribers can also access this issue as a PDF on the “Issues & Updates” page here. |

John Irons had escaped the most common symptoms of cholera, including violent vomiting, a weak pulse, rice-watery discharge, and cramps in the legs, toes, and hands. He should have felt lucky.

Too bad he was about to get his skull crushed in.

It was the bitter winter of 1834, and a major cholera outbreak had just ravaged the makeshift shanty towns of western Maryland, where John and his fellow Irish laborers lived while on the job.

The destitute immigrants couldn’t afford to take time off – even for a life-threatening disease.

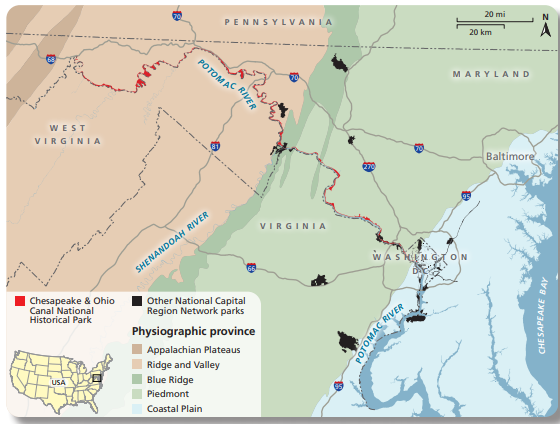

So, vomit or no vomit, they had to keep digging the Chesapeake and Ohio Canal… an ill-fated project that could almost be described as cursed.

The digging of the canal had been inching westward since 1828, when Virginia Congressman Charles Mercer launched the Chesapeake and Ohio Canal Company (C&O Co.) in an ambitious bid to connect the Potomac and Ohio rivers via a new, 360-mile trade route. The Maryland, Virginia, and Pennsylvania governments, all of whom provided initial funding, were enthusiastic about the C&O project… at first.

At the launch ceremony, President John Quincy Adams kept hitting rocks with the shovel he was using to break ground for the canal. And things just went downhill from there.

One reason was politics. Georgetown, Alexandria, and Washington, D.C., nearby cities, had all bought stock in the canal company, and each thought the canal should run through their city. Eventually, D.C. – the largest stockholder, with $1 million in shares – won out. But the chosen route was full of rocks, and difficult to excavate.

Further west, more setbacks loomed. Building materials were scarce. Labor was hard to find (and mortality among cholera-ridden workers in the filthy canal-side camps was high). And a rival trade route, the Baltimore and Ohio Railroad, kept throwing up legal roadblocks to try to force the C&O Canal off its turf.

Meanwhile, the price tag for the canal kept rising. The company’s initial estimate of $4.5 million climbed to $5 million… $8 million… then $12 million. To try to cover the gap, the Maryland state government grudgingly issued a $2 million loan.

As legal fees and building costs mounted, it got harder for the C&O Co. to pay the “shanty Irish” who, between rounds of cholera, did the backbreaking excavation work. In January 1834, foremen began dismissing entire crews of Irishmen, without paying them.

That’s when John Irons got his head smashed in… and when the real trouble began.

As (paying) jobs dried up, two rival crews of Irishmen from different parts of the “Old Country” – the Corkonians (from County Cork) and the Fardowners (from Ulster) – began fighting over one of the few remaining profitable job sites, a section of canal in Williamsport, Maryland.

Whiskey mixed with fisticuffs and things turned deadly. Irons, a Fardowner, “came to his death from blows received on several parts of his body and head, from persons unknown,” according to the inquest.

As a local paper proclaimed, that was the opening salvo of the “WAR ON THE CANAL.” On January 24, some 700 Fardowners, armed with guns and clubs, marched on the Corkonians and burned down their shanty town. In the ensuing battle, about 10 men were killed – five of whom were shot execution-style in the back of the head.

Terrified Williamsport residents called on the Maryland legislature for help, which in turn petitioned President Andrew Jackson. The next day, Jackson dispatched two companies of federal troops, ordering them to “put down the riotous assembly” and remain on guard at the canal for the next two months. (This was one of the earliest applications of the Insurrection Act, which gives the president emergency powers to deploy troops within the U.S.)

And that is the backstory of how preferred shares became a form of equity. Keep reading…

The Legacy of the Eight-Million-Dollar Bill

The “War on the Canal” wasn’t the end of the C&O’s woes… or even the midpoint.

Over the next few years, there would be close to a dozen more major outbreaks of Irish labor unrest… as well as increasing legal perplexities and an ever-growing pile of debt. The cost of the canal eventually ballooned as high as $22 million – four times the original estimate.

Maryland’s earlier $2 million loan didn’t go far. In 1836, the C&O Co. went back to the Maryland state legislature, hat in hand. After eight years of disaster, public enthusiasm for the canal project had waned, but the C&O still had enough backers that, after deliberation, the legislature proposed a funding compromise.

Rather than loan the canal company more money outright, the state decided to create a form of “mini-mortgage” that would ensure at least partial repayment. In a piece of legislation known as the “Eight-Million-Dollar Bill,” Maryland outlined a new form of equity that would come to be known as preferred shares.

(Preferred shares act as a kind of hybrid between stocks and bonds. Like stocks, they can appreciate in value, though they don’t fluctuate quite as much as common stocks do. However, they also possess a bond-like feature. As a general rule, preferred stocks offer higher dividend yields than their companies’ common stocks, which is what makes them somewhat “bond-like.” That is, investors buy them for high current income, while common stocks – as evidenced by the present 1.5% yield on the S&P 500 – are bought primarily for their prospective appreciation.)

The Maryland state legislature agreed to buy $8 million worth of C&O shares (hence the title of the bill), on the condition that the canal company paid the state a fixed 6% dividend every year based on the issuance price.

C&O didn’t have much of a choice. They accepted the conditions, and every year coughed up the dividend. The project limped along for another 14 years, until 1850, when it finally ground to a halt. (Today, the 184.5-mile abandoned canal is a national historical park and a popular hiking and camping venue, so it wasn’t a total loss.)

The idea of “share preference” had cropped up informally in English business in prior decades, but the C&O Canal legislature codified the concept for the first time and introduced it as a new form of investing. It did not meet with universal acclaim – one outraged 1836 letter to a D.C. paper called preferred shares “an instance of monstrous injustice and inequality,” since the shareholder enjoyed the double advantage of stock ownership and bond-like interest.

It’s a form of “injustice” that works out quite well for the preferred shareholder… who gets the advantage of a higher interest income versus common stocks (where the dividend can get cut at any time), while also standing ahead of equity holders to get repaid in the event of bankruptcy (though behind bond holders).

That’s still the case 200 years after the rocky launch of the C&O Canal. Since that time, preferred shares have evolved from a form of “temporary rescue capital” to a standard form of equity issued by many major corporations.

We’re recommending a particular type of preferred share in this special joint issue of The Big Secret on Wall Street and Porter & Co.’s Distressed Investing. It’s known as a “convertible” – meaning it comes with a feature for converting preferred shares into shares of common stock. In this way, the preferred shares benefit from an extra layer of downside protection versus the common stock, but with significant upside potential.

The preferred shares issuer in this recommendation is one of the largest, lowest-cost lithium miners in the world. By far the greatest source of lithium demand comes from electric vehicle (“EV”) batteries. As we wrote about in last week’s issue of The Big Secret on Wall Street, U.S. automakers have struggled to produce mass-market EVs that consumers want and can afford. But the EV revolution is still alive and well – now it is led by Chinese companies like BYD, which has dethroned Tesla as the world’s best-selling EV maker.

As BYD and other low-cost EV manufacturers lead the transition to electrified transport, the global economy will need vast quantities of processed lithium for the foreseeable future. And with lithium prices down 85% in the last three years, the lithium mining industry has become one of the most beaten down and hated sectors in the entire stock market.

That has created the ultimate contrarian opportunity we’ll introduce in this issue.

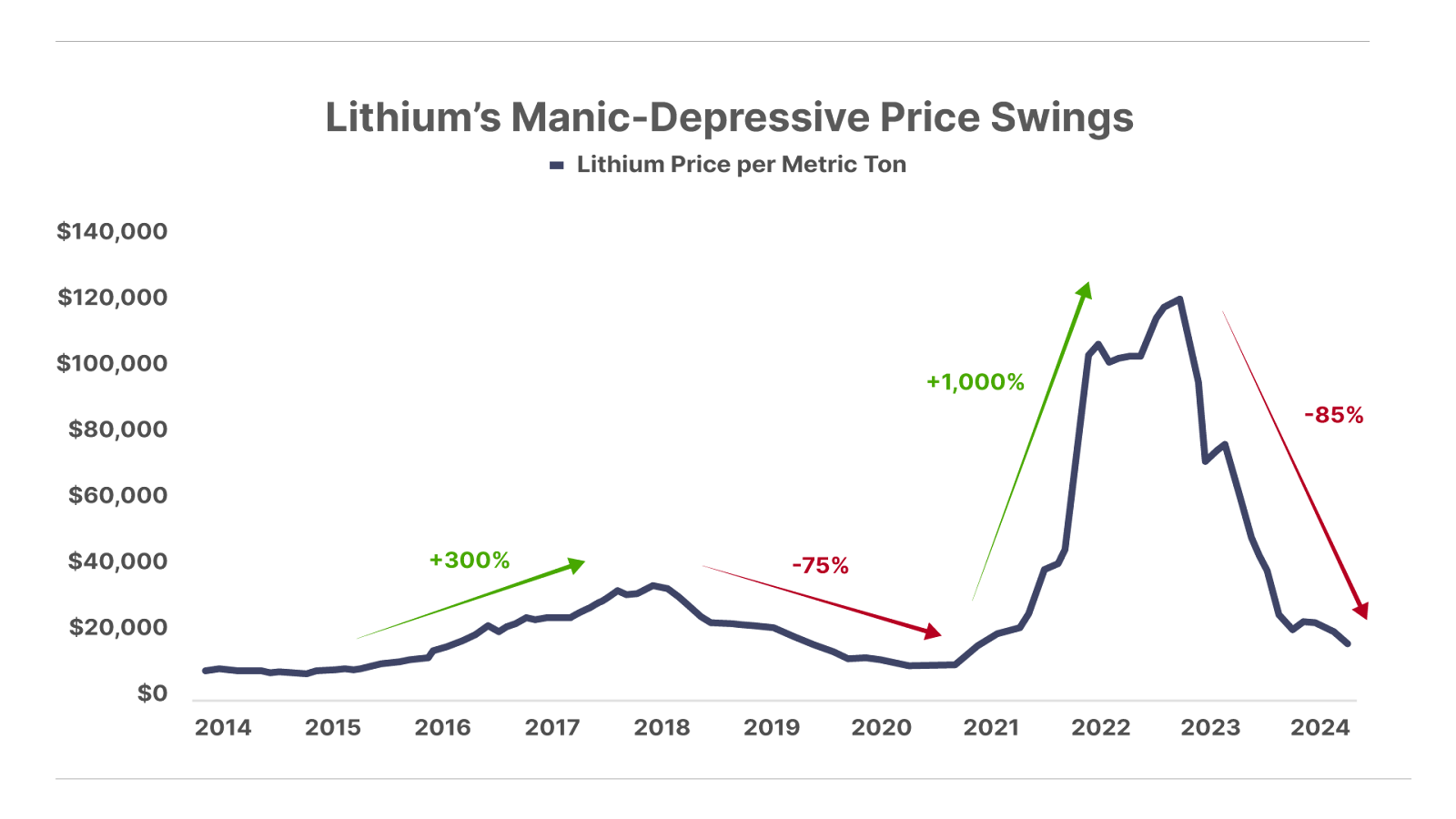

The White Metal Widow Maker

Over the last decade, lithium has changed from a lightly traded industrial chemical into the most sought-after and volatile commodity on the planet. For the most part, the metal is sold via private contracts, with some limited trading on commodities exchanges in futures markets. The prices shown below come from an industry data provider, Benchmark Mineral Intelligence, which produces an index that attempts to track the prices. As you can see, since 2014, lithium has gone through two raging bull markets that sent prices soaring first by 300% from 2016 to 2018 and then by 1,000% from 2021 to 2022 – followed by extreme bear markets, with a decline of 75% beginning in 2018 and 85% this year.

Not even natural gas – known as the “widow maker” commodity for its extreme price volatility – has shown the wild oscillations seen in the price of lithium.

But with volatility comes opportunity, at least for those investors willing to go against the herd. As veteran commodities investor Rick Rule says, “In commodities, you’re either a contrarian or a victim.” With lithium currently trading near its lowest level of the last 10 years, we’ve found the ultimate opportunity.

It’s a special type of security: it’s neither a stock nor a bond, but a hybrid of the two. In this

issue, we will recommend an investment opportunity that:

- is in a world-class company that has nearly $2 billion in cash and net debt that is super-low 2.1x operating profit

- provides a dividend yield of 8.5% (versus 1.8% yield of the company’s common stock)

- pays dividends between now and March 1, 2027, that work out to roughly $9 per share, or 21.1% of the current market price of $42.89 per share

The EV Revolution Transforms the Lithium Market

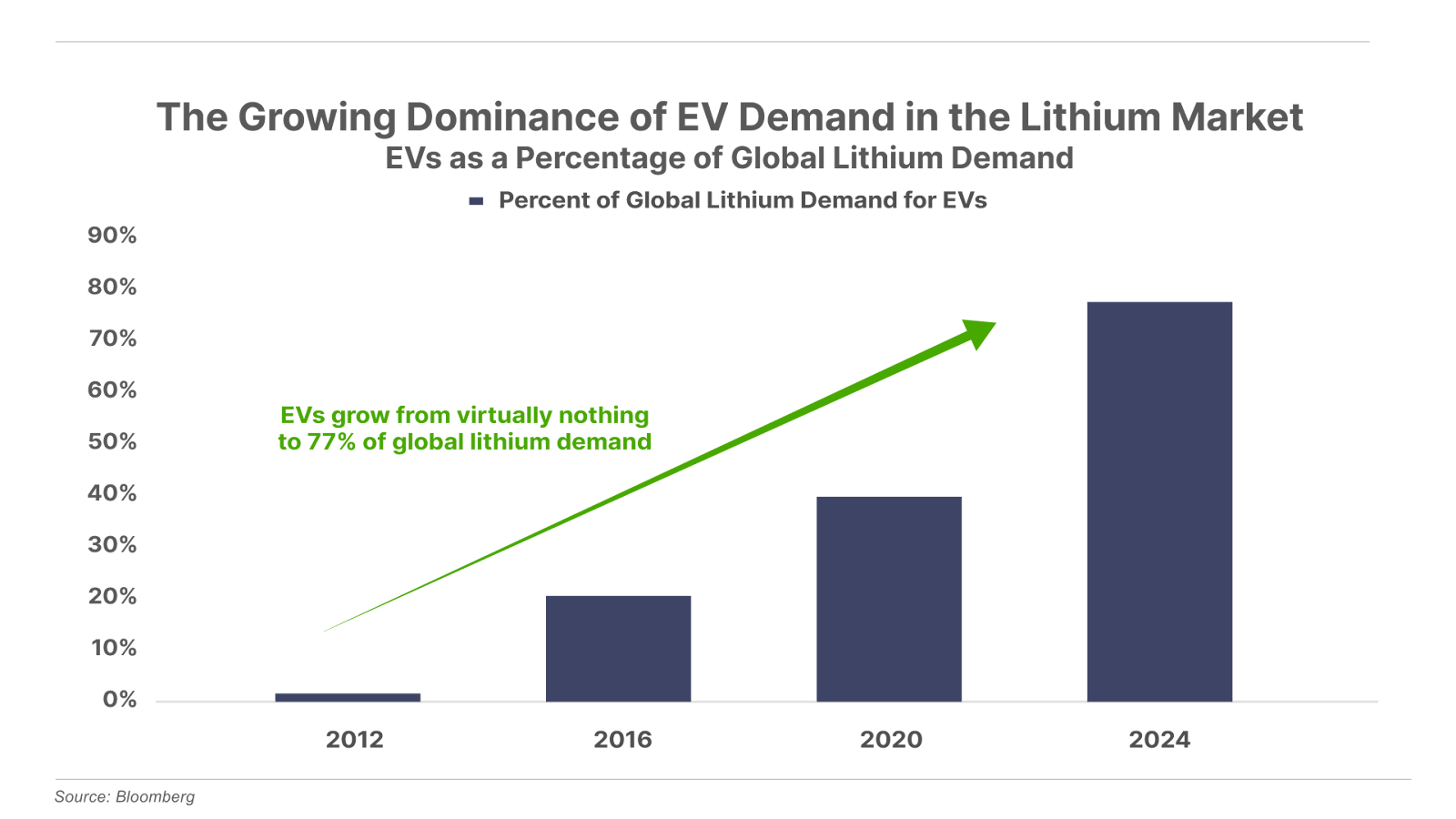

In order to capitalize on lithium’s price volatility, it’s critical to understand what’s driving it: the growing popularity of electric vehicles (“EV”) and the lithium-ion batteries that power them.

Until the end of the 20th century, lithium was mostly used as an industrial chemical in things like ceramics, lubricating greases, and chemical processing. This made the lithium market relatively stable and predictable where demand generally grew in line with the global economy.

Starting in the late 1990s, rapid advancements in lithium-ion-battery technology provided a modest new source of demand. As scientists found ways to pack more energy into these batteries, they became the go-to choice for laptops and cell phones beginning in the 1990s, followed by a second wave of demand from iPods, tablets, and smartphones in the 2000s.

But the amount of lithium used to power these portable devices is minuscule compared to what is needed for an EV. The average iPhone battery contains around one gram of lithium, while modern laptop batteries use about five grams. So even as recently as 2010, when smartphones and laptops became ubiquitous, lithium demand for batteries made up just 23% of total consumption.

But everything changed over the last 10 years when the EV revolution began taking hold.

The average battery for a fully electric vehicle contains roughly 17 pounds of lithium, or the equivalent amount used in 1,500 laptop or 8,000 iPhone batteries. In the early 2010s, global EV sales began increasing exponentially, rising from 130,000 in 2012 toward an estimated 17 million in 2024 – making up a record 22% of global auto sales. As a result, lithium demand for EVs has grown to dominate the market, rising from 1% of global lithium production in 2012 to a whopping 77% this year:

Miners Caught Off Guard as the EV Revolution Takes Hold

Never before has the global economy experienced such rapid growth in demand for a major commodity. This boom in demand helps explain the extreme volatility in lithium prices over the last decade, as the mining industry was caught in a cycle of undersupplying and then oversupplying the market.

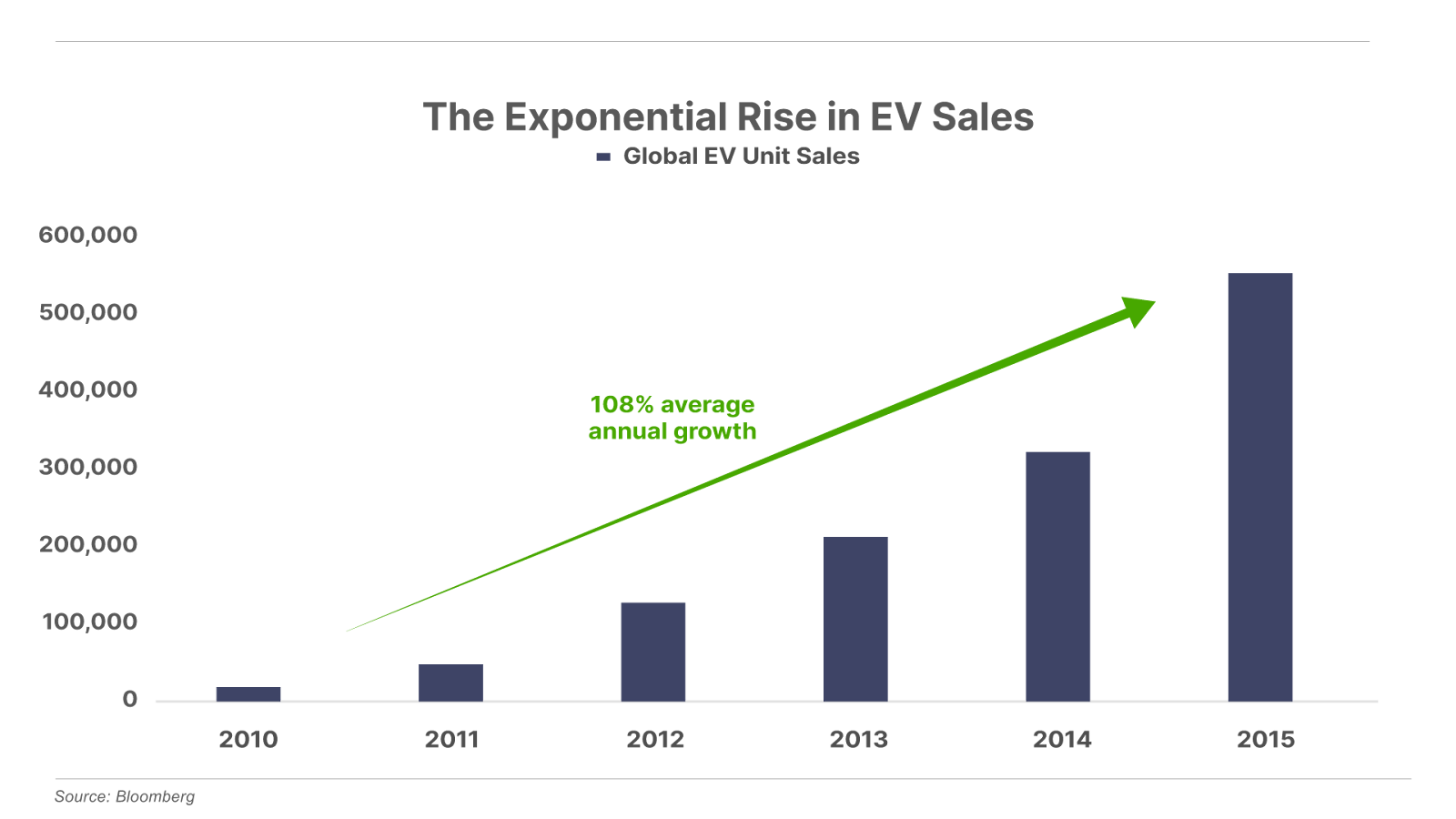

The first lithium boom of the last decade began in 2015, when the mining sector failed to anticipate the exponential rise in lithium demand from manufacturers of EV batteries. Over the previous five years, global EV sales increased by 108% annually from 17,000 in 2010 to 550,000 in 2015. With EVs starting from almost zero in 2010, it took several years before the rapid rate of growth translated into a meaningful amount of new lithium demand.

By 2015, the boom in EV sales added roughly 4,000 metric tons of annual lithium demand into the market, representing about 12% of total global supply that year. But instead of rising to meet the demand, the mining industry remained complacent, with global lithium production falling by 7% from 34,000 tons in 2010 to 31,500 tons in 2015.

This supply-demand imbalance caused a major lithium shortage by 2015, sending prices soaring nearly fourfold from $9,000 per ton to a peak of $35,000 by late 2018. As the price rose, lithium producers sprung into action by 2016, with the industry pouring a record amount of capital into new mining activity over the next two years. Global production grew threefold from 2015 to reach an all-time high of 95,000 tons in 2018.

But just as this record new production came onto the market in 2019, global EV sales stalled, growing by just 5% that year. That was the slowest pace of growth since the start of the EV revolution, and a major deceleration from the 75% annual increase in 2018.

The primary cause of the slowdown came from the leading EV maker, Tesla, which faced numerous struggles in ramping up production of its first mass-market vehicle, the Model 3. (Tesla CEO Elon Musk later said the Model 3 production woes had put the automaker within “single-digit weeks” away from bankruptcy.) Making matters worse, the COVID-19 outbreak in early 2020 triggered a sudden halt in global auto production and sales.

The one-two punch of slowing EV sales and record lithium production created a supply glut that caused prices to fall by 75% to $12,000 by mid-2020. The industry responded by curtailing production and slashing capital budgets for opening new mines and expanding existing ones.

But the slowdown in EV sales didn’t last long. Tesla resolved its manufacturing issues and went on to nearly triple its production from 368,000 in 2019 to 936,000 in 2021. And as sales of the Model 3 proved the mass-market demand case for EVs, virtually every other global automaker began releasing their own EV models. Meanwhile, in response to the economic fallout from COVID-19, governments around the world went on a stimulus spree. This included an expansion of EV tax credits and other incentives in the U.S., Europe, and China.

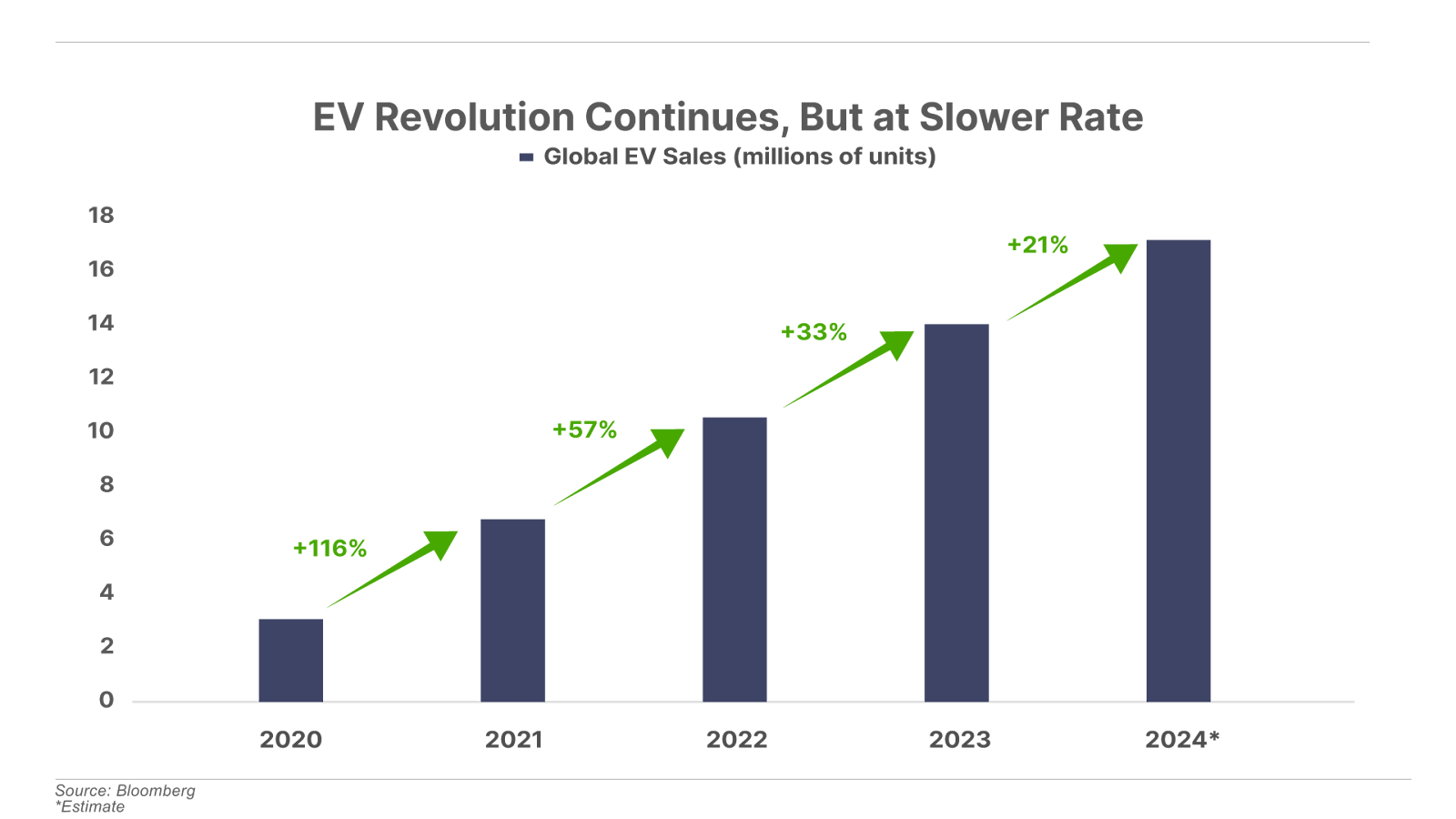

This confluence of events pushed EV sales higher, more than doubling from 3 million units in 2020, to 6.5 million in 2021. Sales then doubled again over the next two years, with 14 million EVs entering the market in 2023.

This second boom in EV sales pointed to another lithium supply crunch by mid-2020, but once again mining companies were slow to respond. The financial stress imposed by the previous bear market left most miners with little choice but to proceed with caution. Capital expenditures (capex) among the largest lithium miners ended 2020 one-third lower from 2019 levels, causing global production to drop 13% from a high of 95,000 tons in 2018 to 83,000 tons in 2020.

When EV sales recovered by year-end 2020, it sparked the mother of all lithium supply shortages. Prices rose 10-fold from the pandemic-era lows to an all-time high of $120,000 per ton by late 2022.

By now, the pattern should be familiar enough to guess what comes next…

The 10x price rally ultimately fueled another record capex and production boom from lithium miners. Global supply more than doubled from 2020 to 2023 to reach a high of 180,000 tons last year.

The flood of new supply caught up with demand by 2022, just as the post-pandemic demand surge from EVs began decelerating. The annual pace of global EV sales growth peaked at 116% in 2021, slowed in each subsequent year, and is currently on track to hit a post-pandemic low of 21% annual growth in 2024, based on estimates of 17 million units this year.

By 2023, lithium production began overshooting demand – a trend that has continued into 2024. As a result, the record supply shortage from 2020 to 2021 has seesawed into a glut, sending prices down 85% to around $18,000 per ton today.

This price collapse has again ravaged the industry, pushing share prices of the world’s top lithium miners down 50% to 75%. And, just as during the 2019-2020 bear market, miners are once again cutting back on capex – not out of choice, but out of necessity. Meanwhile, all signs point to surging EV growth in the years ahead. Despite the recent slowdown in U.S. EV adoption, global sales are on pace to reach a record 17 million in 2024. While forecasts among analysts vary, there’s a uniform consensus that sales will continue moving higher with each passing year – reaching anywhere from 30 million to more than 40 million by 2030. Thus, the stage is set for the oscillations in the price of lithium to repeat once again, with today’s bust sowing the seeds of tomorrow’s boom.

Lithium Capex Cycle Points Toward Looming Shortage

The key for companies in this business is putting capital to work precisely when the commodity producers are doing the opposite. This is exactly the situation that’s unfolding in the lithium market today.

There are hundreds of lithium producers globally, but supply is concentrated at the top. Roughly two-thirds of global production is controlled by the Big 5 lithium miners. They are:

- U.S.-based Albemarle (ALB)

- Chile’s Sociedad Química y Minera de Chile (SQM)

- Australia’s Mineral Resources (MALRY)

- China’s Ganfeng Lithium (GNENF)

- Hong Kong’s Tianqi Lithium (9696.HKG)

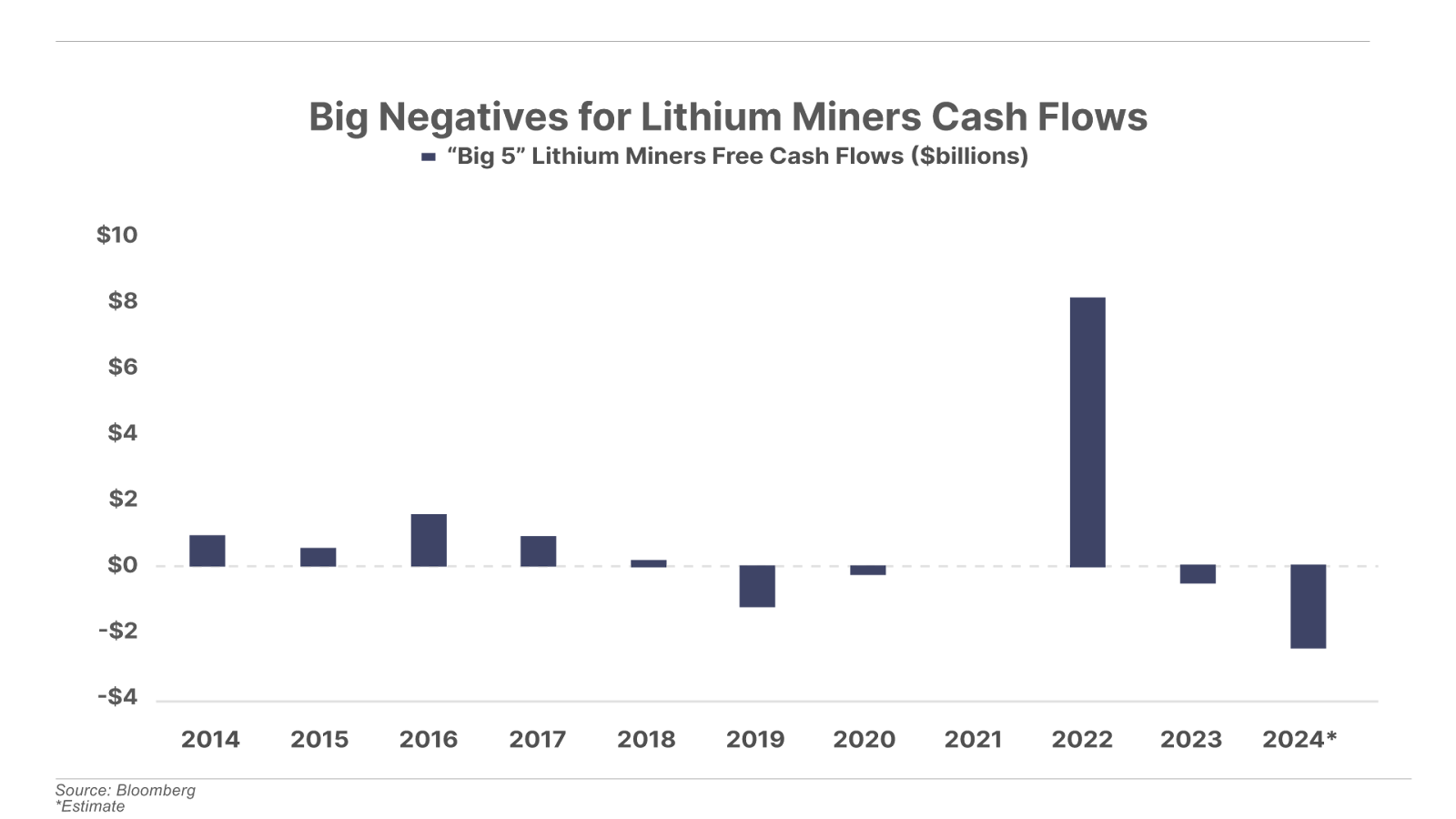

This group controls the majority of the world’s lithium supply, and are all low-cost operators. This fact is an important indicator of where the market might go: if the largest, low-cost producers aren’t generating cash, the smaller, high-cost competitors aren’t either.

The chart below shows combined annual free cash flow of the Big 5 producers over the last decade. Note that the group is on track to burn a record amount of cash this year, with an estimated $2.4 billion in negative free cash flow for 2024. For perspective, that’s twice the $1.2 billion in negative cash flows the group posted during the worst year of the previous bear market in 2019:

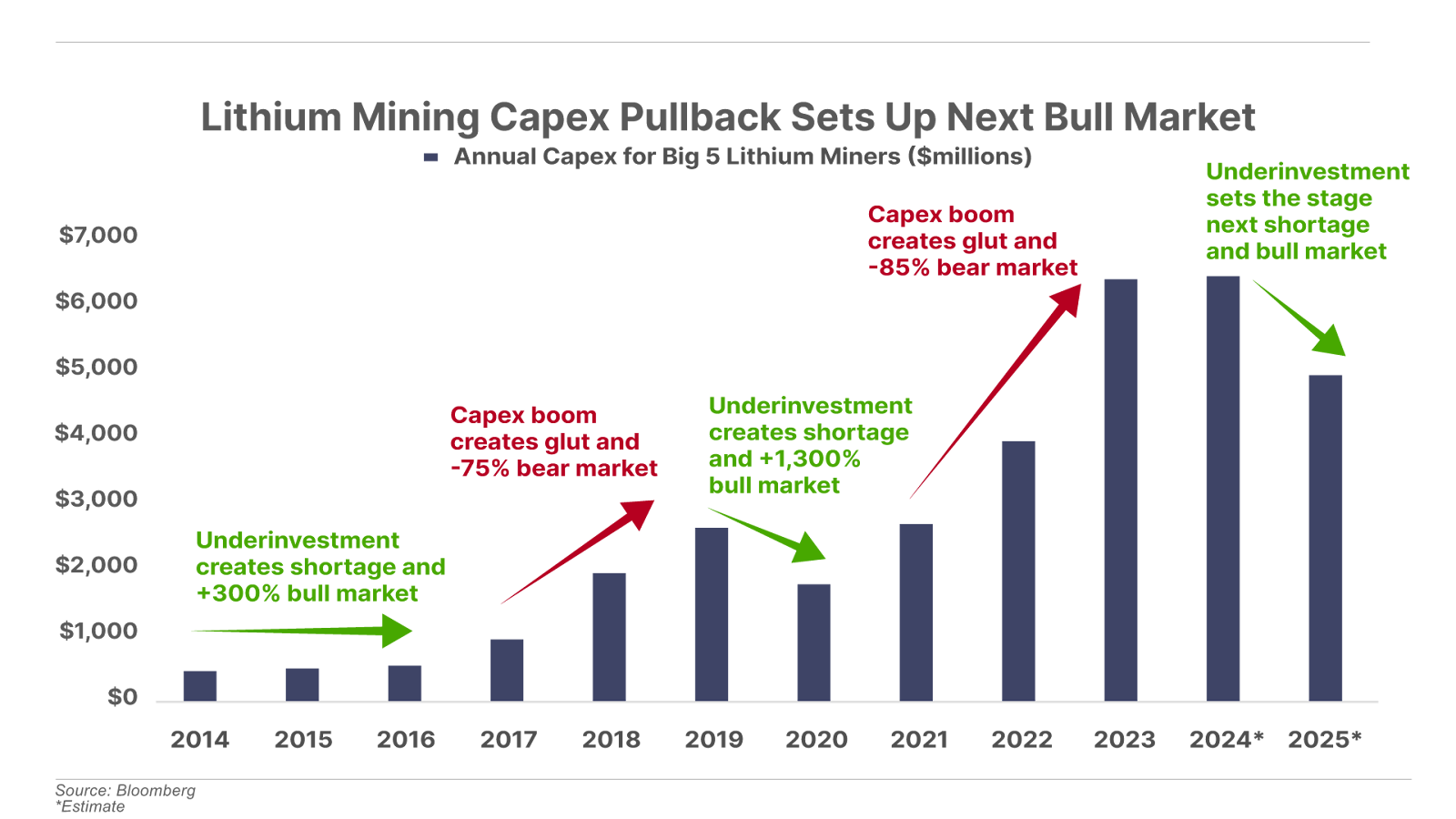

Responding to this year’s record cash burn, the Big 5 are on track to slash capex budgets by 23% next year. And when the industry giants cut back on capex, it’s a safe bet that the smaller, less well-capitalized players are doing the same.

As we said, in the capital-intensive mining industry, capex spending is the ultimate leading indicator of future supply growth. That’s because in order to pull metal out of the earth and process it into battery-grade material, companies must first sink billions of capex into the ground in the form of mining equipment and mining activity.

The chart below shows the capex trends of the Big 5 through the previous boom-bust cycles. Notice how the capex cycle for this group provides a perfect leading indicator for the boom-bust cycle in lithium prices, with falling capex budgets leading to undersupply and bull markets, and vice versa when capex budgets rise:

The fact that the capital cycle predicts the price cycle makes sense. When prices are high and cash flows are flush, miners have the financial leeway to invest in production growth. This typically sets the stage for excess supply, and lower prices. Conversely, when prices crash and cash flows turn negative, miners have no choice but to cut back on investment. That, in turn, sets the stage for supply shortages and the next bull market.

It seems that history is set to repeat once again, with supply set to undershoot demand as capex budgets shrink.

The demand side of the equation looks equally bullish. Even as the pace of EV growth slowed in recent years, all signs point toward a re-acceleration in the second half of the decade.

According to recent analysis from research firm S&P Global Commodity Insights, EV unit sales are expected to exceed 30 million per year by 2030. That’s nearly double this year’s number of 17 million. Said another way, the growth in lithium demand from EV batteries will increase nearly as much in the next six years, as it did in the previous 15. Meeting this new demand will require billions of dollars in new investments into lithium mining capex. Instead, we are likely to see a reduction in investment.

As a result, a growing number of industry analysts are projecting shortages to emerge as soon as next year and to grow through the end of the decade. What’s more, a recent report from BMI, a research division of credit rating agency Fitch, indicates that Chinese lithium demand will scoop up much of the supply, driving a global shortage beginning in 2025 and continuing through 2030.

As mentioned before, China has emerged as a leading supplier of cutting-edge EVs, including ultra low-cost options like BYD’s recently unveiled Seagull. Created by a former designer at Lamborghini, the base-model Seagull, with a battery range of 190 miles, costs less than $10,000. An upgraded version with a battery that extends the range to 250 miles on a single charge goes for just $12,000.

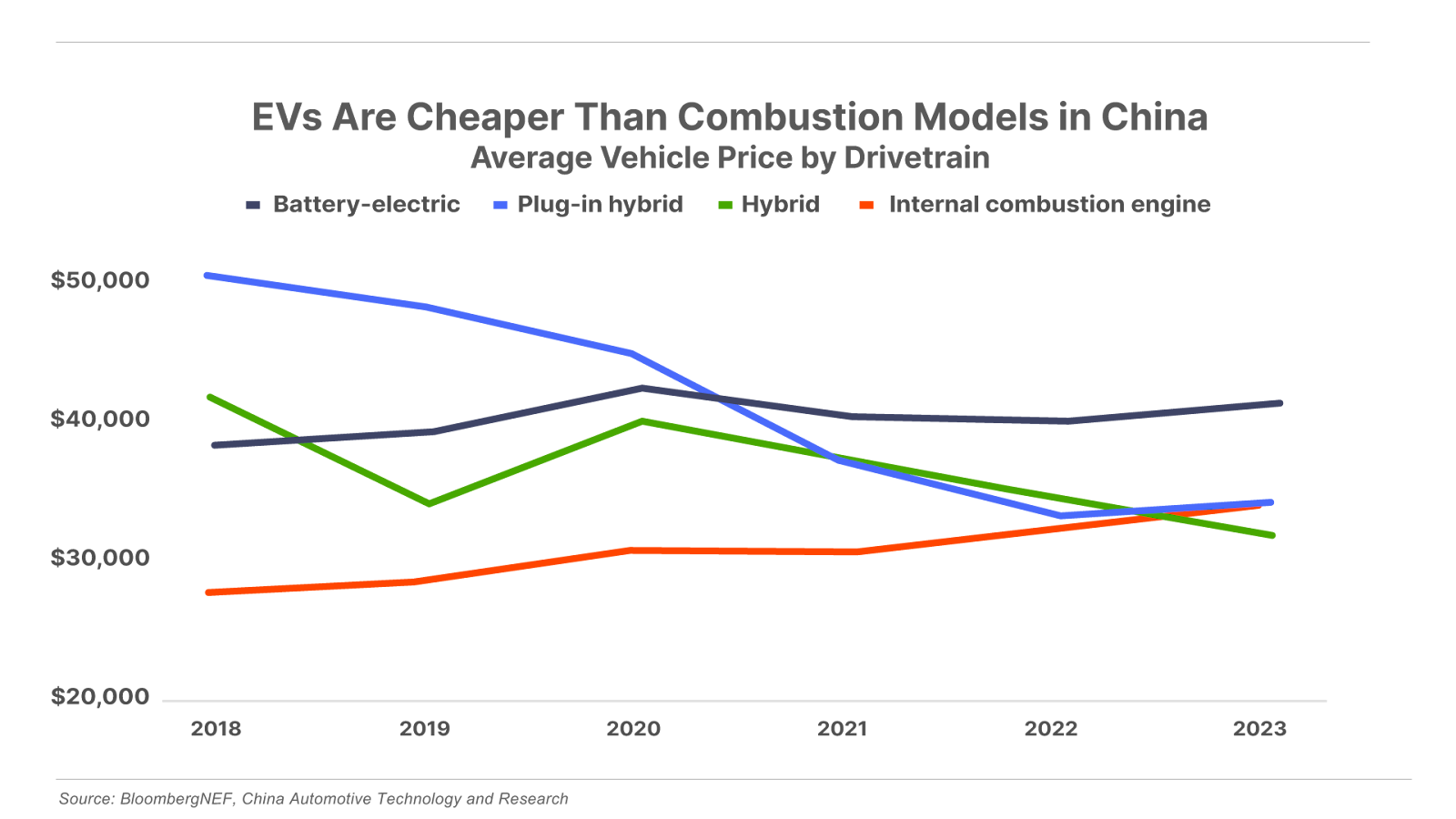

And therein lies the final component of the lithium thesis. Thanks to the combination of rapid advancements in EV drive-train technology, plus the recent collapse in lithium prices, China-made hybrid EVs are now – for the first time ever – cheaper to manufacture than their comparable internal combustion engine (“ICE”) counterparts and therefore hit the market with a lower sticker price:

During the last lithium bear market in 2019, when Tesla struggled to get its first moderately priced vehicle to market, there were legitimate questions about just how far the EV revolution could go. There were also questions about how far global governments would go in subsidizing a higher-cost form of transportation. Now, those questions are largely answered.

Chinese automakers are committed to producing millions of EVs each year, and as production costs continue coming down, the EV industry in China is beginning to succeed on its own, independent of government support. The situation is more nuanced in the U.S. Tesla can produce EVs profitably – but more established automakers like Ford, General Motors, BMW, and Volkswagen are still struggling to find consistent profitability in the EV market.

Nevertheless, the EV revolution has taken hold around the world, though the adoption rate is strongest in China. And in the regions where automakers are struggling to produce EVs profitably, like the U.S. and Europe, governments continue providing both subsidies and introducing regulations that are forcing the industry into producing more EVs. That means more lithium demand for the foreseeable future.

But as before, lithium miners, burning through their cash, will need to cut back on investment despite this impending demand tsunami.

As a result, the next lithium supply shortage and price boom will soon emerge from the ashes of today’s bust. But timing the precise bottom in a market this volatile is a fool’s errand.

The good news: that’s not necessary.

We’ve identified a hybrid type of security issued by a top lithium miner. This low-cost producer is the leading player in the market. Its strong balance sheet will enable the company to weather the current bear market, a luxury many of its smaller competitors do not enjoy. The investment opportunity we’ve identified eliminates much of the downside risk in the company’s share price, while still retaining significant upside.

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.