Every once in a while, a financial panic or deep recession provides the rare chance to buy quality merchandise at fire-sale prices. The time isn’t now, but it’s coming.

Don’t Believe in “The End of America”…?

Then Watch Gold

Gold is the best-performing asset class since 2000.

It has outperformed stocks, bonds, cash, real estate, and all other commodities. Gold, of course, hasn’t really changed. It is just as difficult to find, mine, process, and distribute. It’s nature’s perfect form of money because it’s easy to divide, it never tarnishes, and it has almost no industrial uses.

What’s not a perfect form of money? The legal tender of a bankrupt government that continues to bail out its banking system (and its own Treasury) by printing more dollars.

Gold hasn’t “gone up.” It is the U.S. dollar that’s gone down, and is going down — faster and faster.

As inflation makes it harder and harder for global trade and our internal economy to function, it’s likely that gold (and yes, Bitcoin) will continue to outperform over the long run.

Porter Stansberry first warned about this outcome and the inevitable decline of America in 2010, in his famous “End of America” documentary. Porter predicted that once America began printing money, it wouldn’t ever be able to stop, leading eventually to a complete collapse of our monetary system and much of our civil society along with it.

Few investors realize how poorly our country is being run. They don’t consider the lasting impact on our economy (and society) as the government continues to run trillion-dollar annual deficits. The same investors who look forward to the next Fed “pivot” don’t understand it is impossible for our economy as a whole to outrun the consequences of these actions. What’s good for speculators is rarely (or never) good for the country.

Gresham’s Law is a timeless economic theory that explains human behavior that’s consistent throughout history. People do not save currency that’s being debased. Or, as Gresham explained: bad money forces good money out of circulation.

Nobody in America wants to save, because the government is debasing the dollar, more and more, every year.

These cycles – printing and spending, followed by a deflationary collapse – are classic economics. And we are heading directly into the biggest deflationary collapse yet.

Less Money, Mo Problems

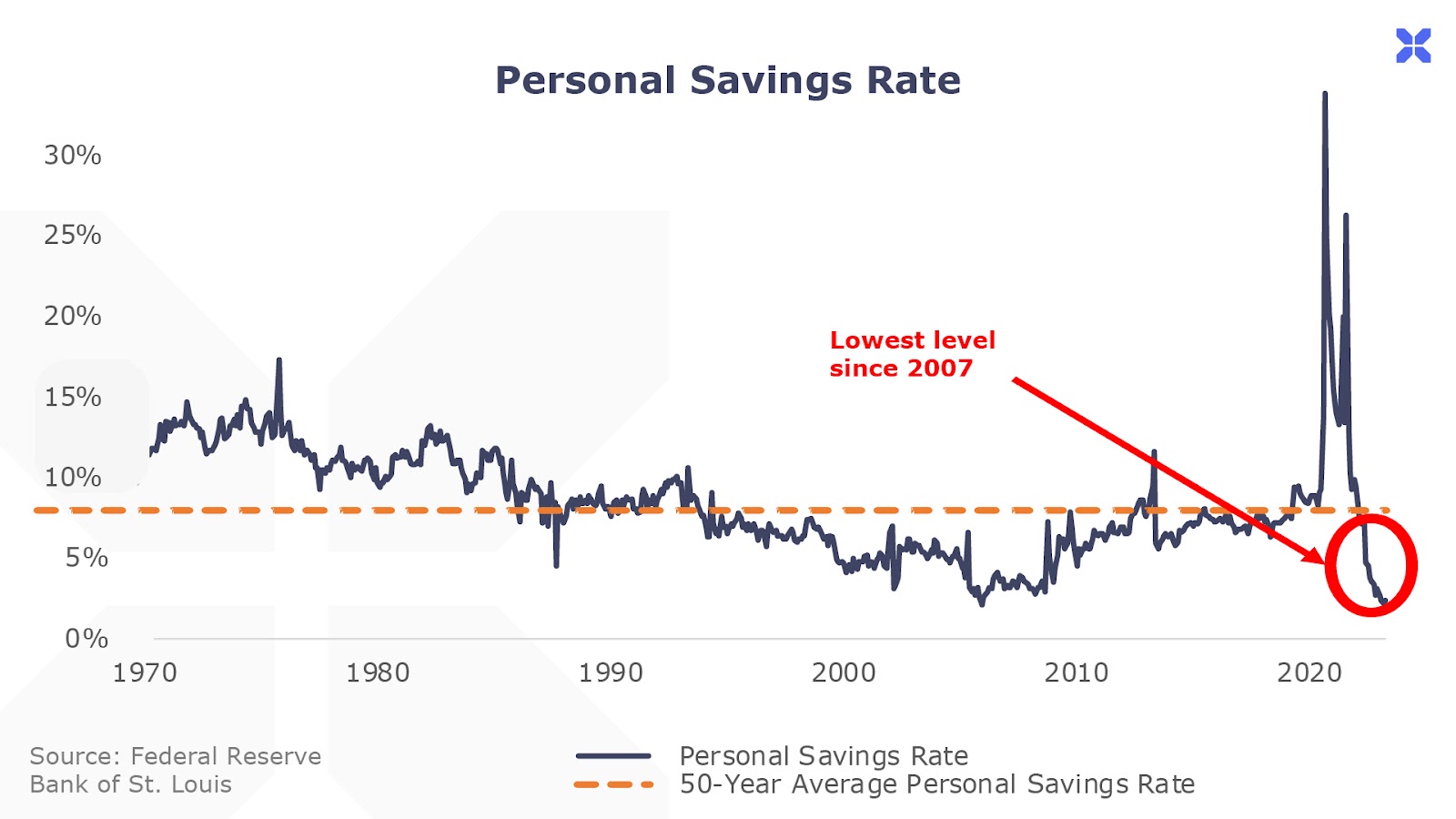

Few Americans save much at all. A study last year found that 56% of Americans didn’t have enough savings to cover an unexpected emergency expense of $1,000.

And chances are that even fewer people today would have 10 Ben Franklins on hand if necessary. That’s because right now, Americans are saving less than they have at any point over the past 15 years.

In the third quarter of 2022, the personal savings rate of Americans hit 2.2%… that’s down from an historic pandemic- and stimulus-driven high of 33.8% in the second quarter of 2020. It means that today, out of every $100 in after-tax income, Americans have been saving – for their kids’ or grandkids’ college fund, retirement, a shiny new car, a kitchen renovation, or a vacation – just $2.20. Over the past 50 years, the average personal savings rate has been 8.8%..

A declining savings rate suggests that the cost of living is rising faster than earnings. And it suggests that it’s a matter of time before consumers are forced to cut back on spending… say, to cook store-brand pasta instead of going out to Olive Garden, visit Grandma instead of Disneyland, and keep the old Camry another year.

For markets and the economy, spending matters. A quick Economics 101 primer: The most widely used measure of economic output is gross domestic product (GDP), which is the value of the goods and services produced by a country. It’s the sum of consumption, investment, government spending, and net exports.

And the most important of those, by a nine-foot pole, is consumption, which last year accounted for 68% of America’s total economic output.

So if people are spending less – which is the inevitable result of having less money to spend – it’s a serious problem for the economy. And it means that a recession is almost inevitable.

Less Cash In The Economy

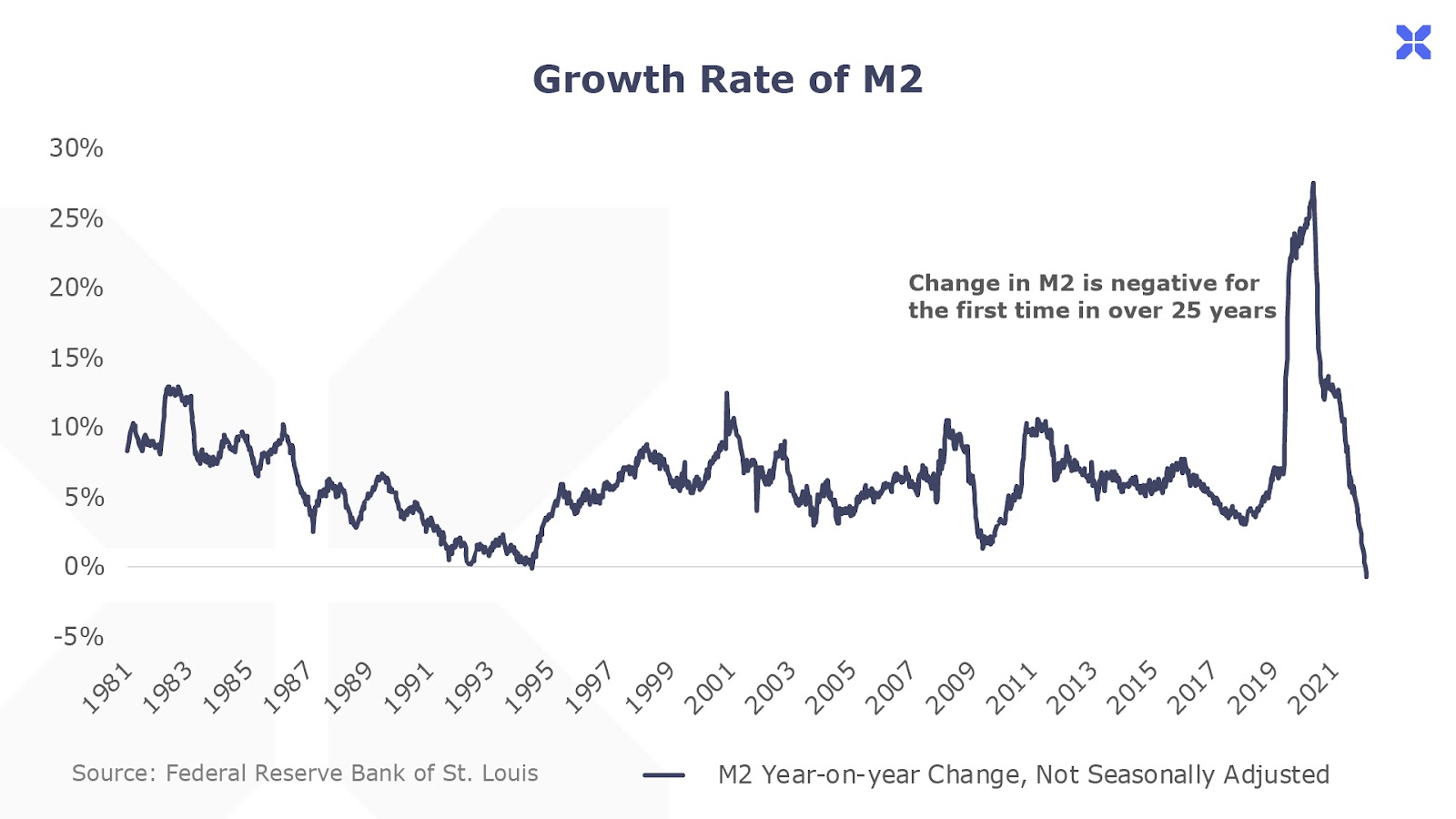

Meanwhile – another California king-sized red flag, and a drag on savings – the amount of cash in the economy overall is falling.

Cash in the pockets of consumers, plus money that’s readily available in checking and savings accounts (in economics-speak, this indicator is called M2) has fallen on a year-on-year basis for the first time in 27 years. And it’s declining at the fastest rate – ever.

The current state of savings is also a Jekyll-and-Hyde level reversal: Thanks to unprecedented Covid-19 era stimulus, total cash in the economy increased by around 40% from $15 trillion in January 2020 to a peak of $22 trillion by April 2022. That meant more money in wallets and purses of consumers…

But in December 2022, M2 posted its sharpest decline on record – falling by 0.7% year-on-year.

Here’s the problem…

America’s debt-based economy requires an ever-expanding supply of new money to keep the economic engine humming. Historically, when money supply growth slows, the economy slows with it.

With central banks likely to continue to tighten in 2023, M2 will probably continue to fall.

A tapped-out consumer that isn’t saving, plus a record decline in liquidity, is a toxic brew for the economy – and financial markets. It means that a recession is virtually inevitable.

What’s more, the bear market in U.S. stocks isn’t over.

Here’s Why Stocks Haven’t Bottomed Yet

Recessions and bear markets are a process – not a single event. And they follow a well-worn playbook.

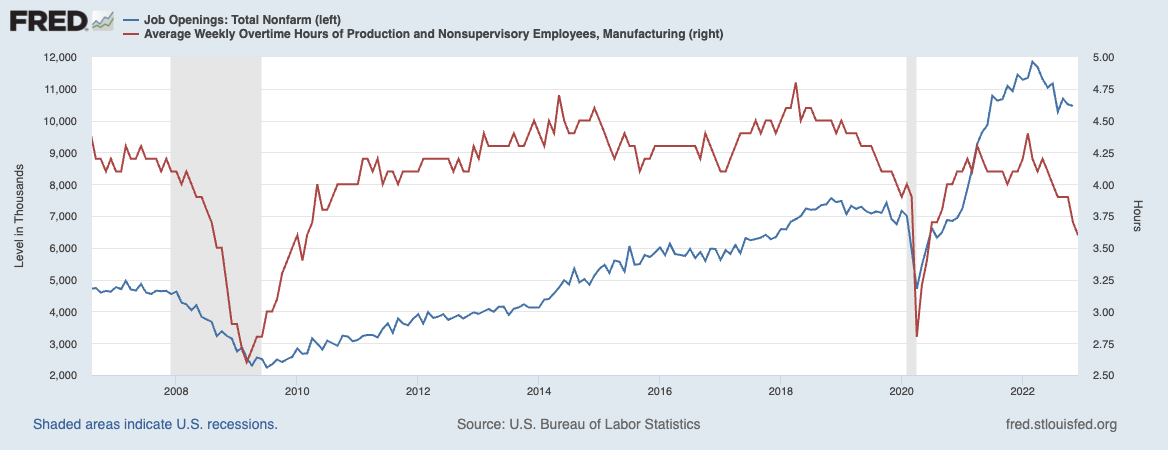

First, consumers are pinched by falling real wages. We’re already seeing this now in the form of the collapsing savings rate. Next, businesses suffer the implications of slower consumer demand. They don’t immediately start firing employees – but instead reduce overtime, and slow the pace of hiring.

We can see both of these trends today, with a sharp drop in overtime hours and a decline in job openings.

As the slowdown progresses and hits profit margins, layoffs rise. That’s when the real impact of the recession hits, as millions of consumers downgrade from earning less – to earning nothing.

It’s around then that the Federal Reserve – or the central bank of your choice elsewhere in the world – relents, and starts to ease rates. But the damage is done by then, and it’s too late… the Fed can’t prevent the recession from accelerating.

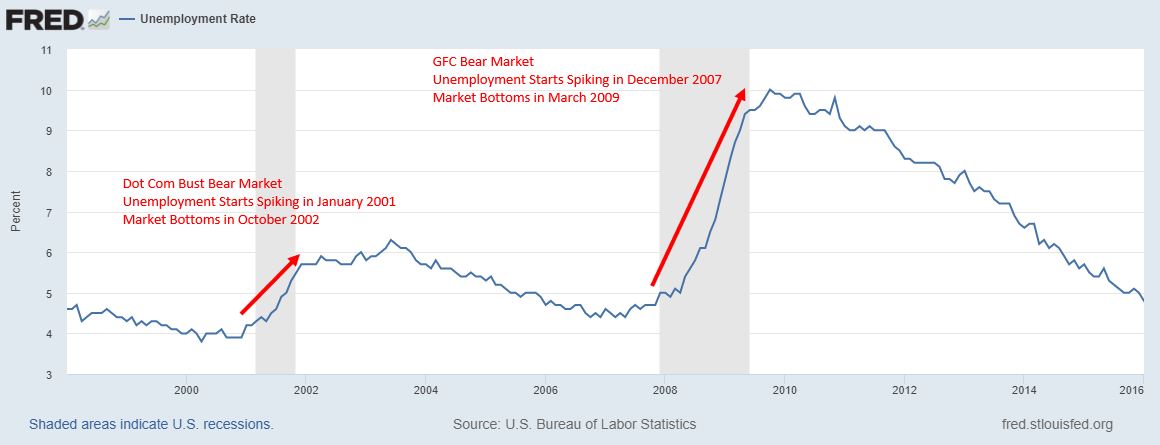

Today, unemployment is at the rock bottom rate of 3.5%. In a typical recession and bear market, the stock market finds a floor about 12 months after unemployment begins spiking. So we’re not close to the end of the current bear market.

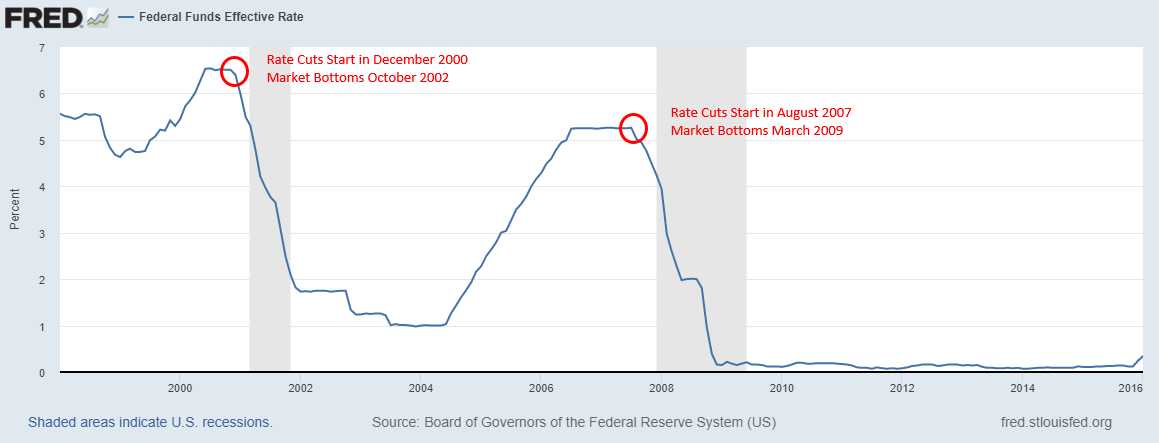

Cutting rates, though, isn’t a bullish signal for stocks. It’s usually the opposite – the starting gun of a prolonged bear market. It took roughly 18 months for the market to bottom after the Fed started cutting rates during the dot-com bust in December 2000. Similarly, the Fed started cutting rates in August 2007, and stocks didn’t hit their low until March 2009.

By studying previous economic and market cycles, we know that the market won’t bottom until roughly 12 months after unemployment starts to surge, and the Fed begins cutting rates. We haven’t even seen the start of this process yet, and that’s why we think there’s more pain to come in both the economy and the stock market.

But there’s a silver lining in every recession…

How to Prepare (And 15 Companies to Buy… Soon…)

As Benjamin Franklin said: “He who can have patience can have what he will.”

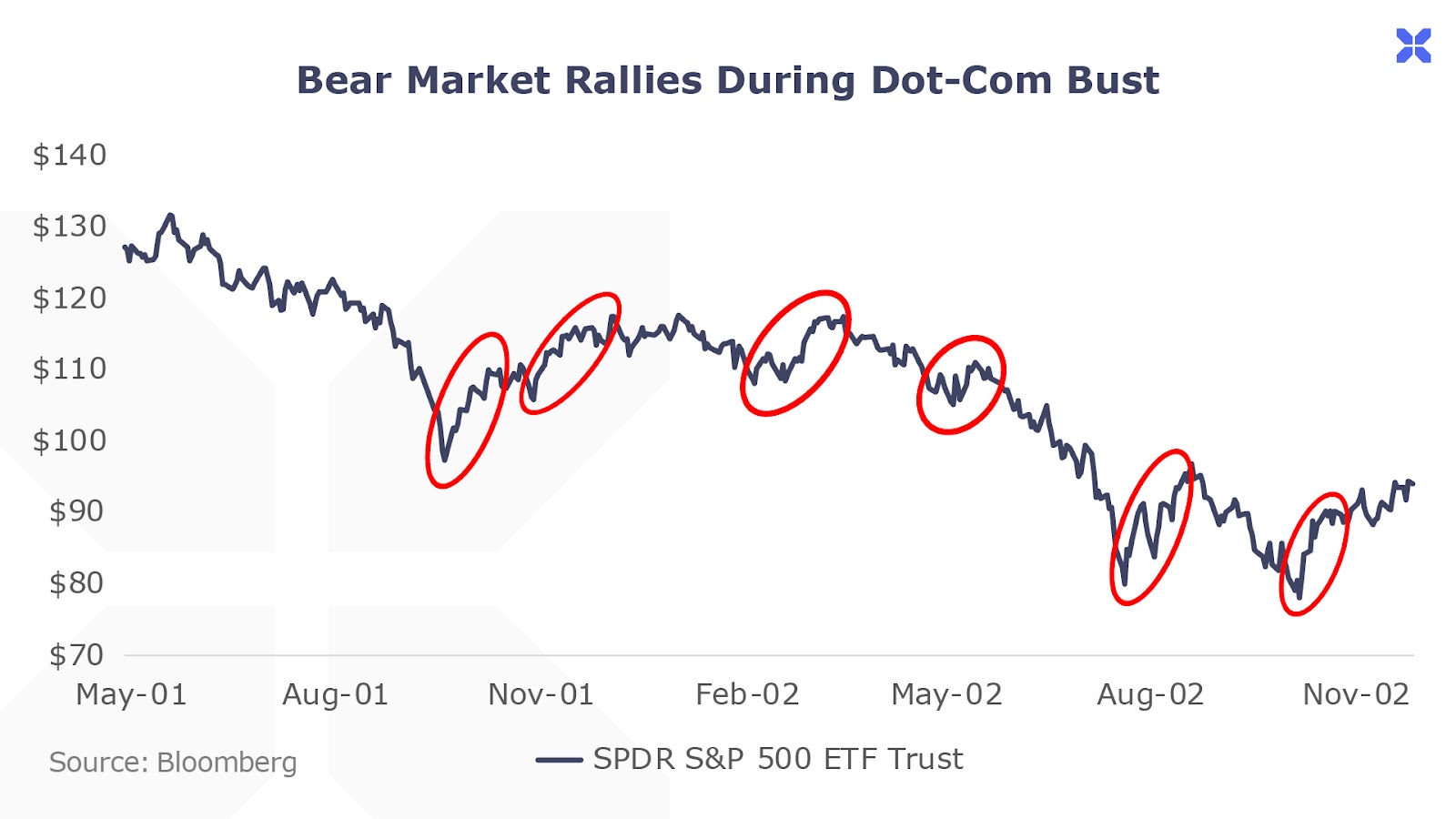

Dead-cat bounces – that is, counter-trend rallies – are the meat and potatoes of bear markets. The dot-com bust featured no fewer than six rallies of 10% plus, on the way to a peak-to-trough decline of 76%. It’s what bear markets do: Pull in suckers who think it’s over.

The key is to listen to Ben… and be patient.

The upcoming recession will present a once-in-a-decade buying opportunity for stocks. But that requires cash (which… Americans have less of these days, remember) in your brokerage account to capitalize on the opportunity.

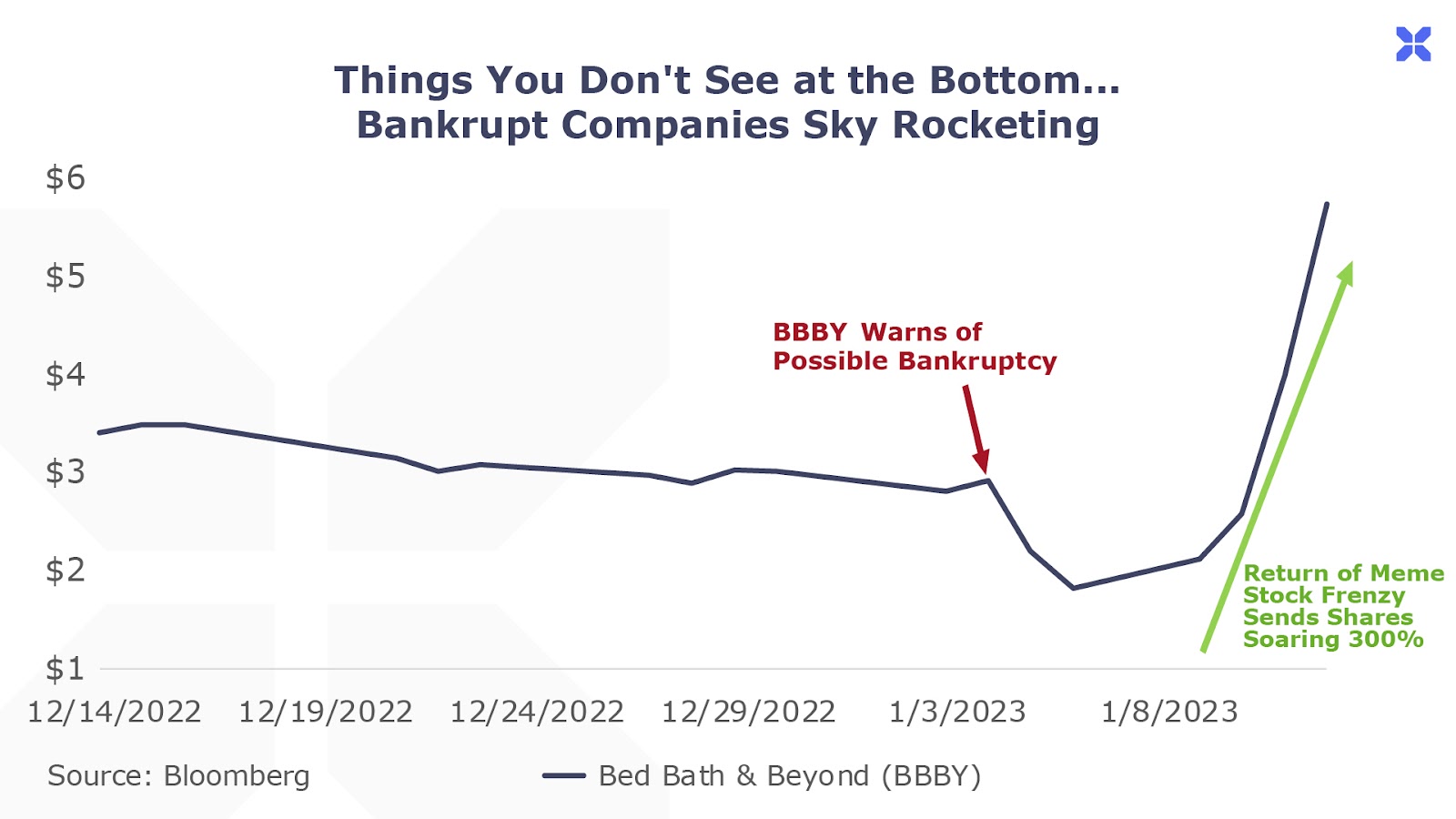

Speculative excess – of the brand that defined the now-dead bull market – is still alive and well in this market: On Thursday, January 12, former – and reborn – meme stock Bed Bath and Beyond (NYSE: BBBY) rallied 300% this week (through Thursday’s close)… after it told investors that ”there is substantial doubt about the Company’s ability to continue as a going concern.” That’s finance-speak for “we’re about to go broke.”

Initially, the share price collapsed by roughly 50% on the news… which is exactly what you’d expect to happen when a company issues a bankruptcy warning. But starting on Monday, shares turned around and staged a 300% rally as traders began frantically bidding up meme stocks across the board. Now, shares of BBBY trade higher than they did upon news of its potential imminent demise.

This is not the kind of speculative frenzy you see at market bottoms.

When the economy is in free fall, with unemployment skyrocketing, and speculative frenzy gives way to panic selling… that’s when you’ll want to begin to buy. That time isn’t now.

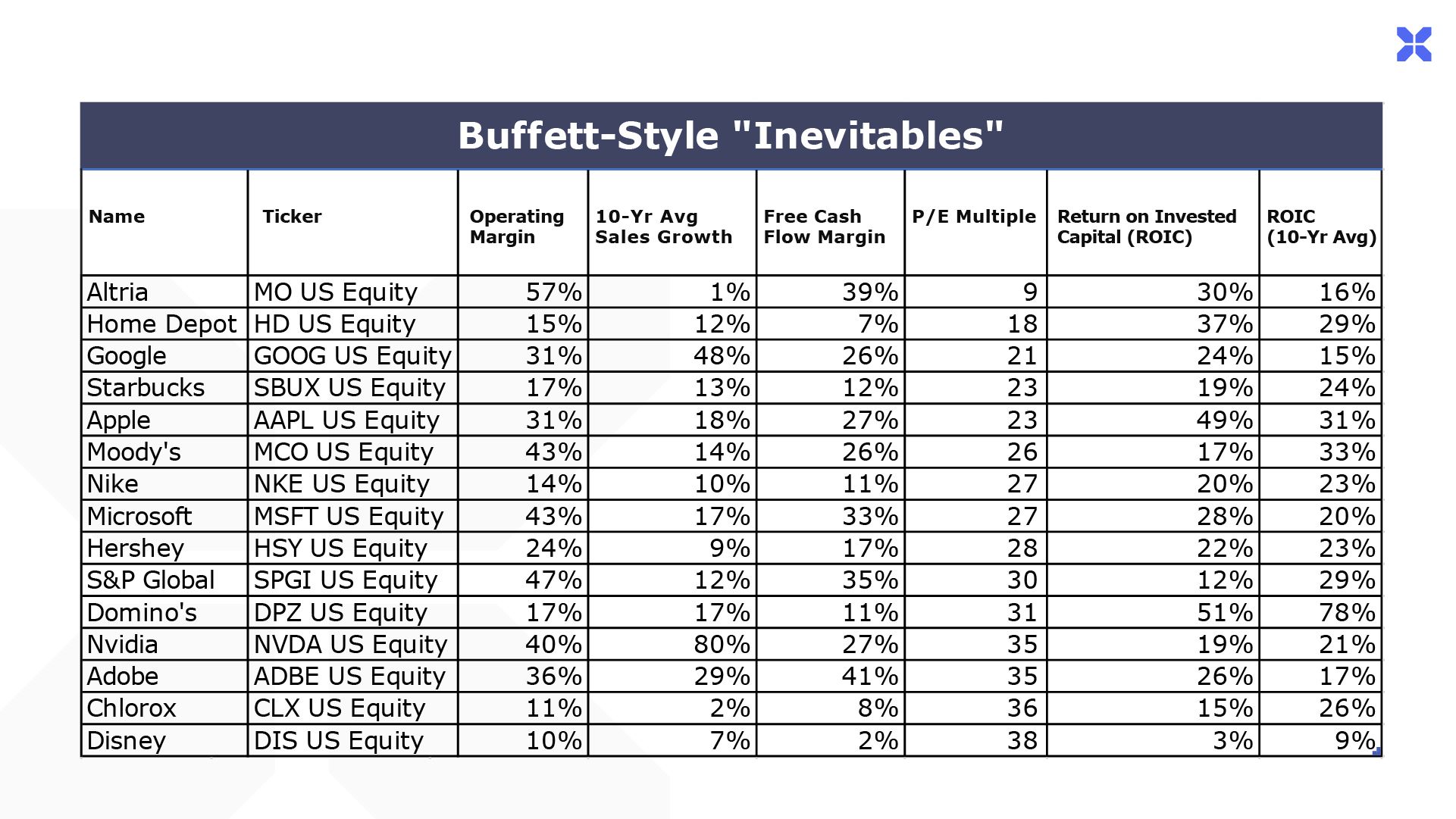

What to do when it is? Since last summer we’ve been writing about a shopping list… a centerpiece of which is “Buffett-style inevitables” to buy when the recession hits.

The “Inevitables” screen comprises 15 of the best businesses in the world… they feature high margins, are capital efficient, and earn a high return on capital.

Normally, stocks like these trade for hefty premiums… and for good reason. High returns on invested capital and a wide moat insulating their businesses from competition means that “Inevitables” can out-earn and out-return the average stock by a mile.

But every once in a while, a financial panic or deep recession provides the rare chance to buy quality merchandise at fire-sale prices. We believe such an opportunity is around the corner.

Ideally, we’ll get the opportunity to purchase these businesses at a big discount – when earnings multiples fall to the mid-teens. These stocks could fall another 30% or more, but when the time comes to start to buy, readers of The Big Secret on Wall Street will be the first to hear about it. You can become a fully paid-up subscriber here to learn more.

Porter & Co.

Stevenson, MD

P.S. If you’d like to learn more about the Porter & Co. team – all of whom are real humans, and many of whom have Twitter accounts – you can get acquainted with us here.