Today, we’ll introduce a security that offers a higher margin of safety than the common stock, while still offering plenty of upside for investors.

A Genuine “Insiders” Security Offering a 20% Yield

How to Invest Alongside America’s Best CEO of All Time

Who is the best CEO in the history of the United States?

Every investor should know the answer to this question. And every investor ought to understand why no other CEO of the modern era even comes close.

But, even if we gave you ten tries, we’re willing to bet that you’d never guess.

Here are a few hints. And no Google allowed.

During his first 25-year tenure as CEO, from 1973-1998, the compound annual return of his company’s shares clocked in at 30.3%. That’s a long-term average annual return that’s roughly 50% higher than Buffett’s at Berkshire Hathaway over the same period. Perhaps even more impressive, America’s best CEO earned these incredible returns without booking much, if any, net income or earnings per share during the entire period.

No earnings? Yep. You see, even though earnings per share growth was, and still is, the “holy grail” for institutional investors, this CEO understood that in his industry, earnings were worse than irrelevant – they led directly to taxes. With marginal corporate tax rates of roughly 30%, virtually all of this CEO’s incredible performance can be explained by his unique ability to avoid paying taxes. As he has famously explained: I’d rather pay interest than taxes.

So, rather than listening to Wall Street, the greatest CEO in history created an entirely new growth strategy, and a lexicon of financial terms, to better manage his company’s extraordinary growth. He invented the concept of EBITDA (earnings before interest, taxes, depreciation and amortization) to measure his company’s ever-increasing earnings power. And, to fuel his company’s incredible growth and insatiable appetite for more debt, he conducted 482 acquisitions during his first 15 years as CEO, or about two a month.

By 1982, just ten years into his tenure, his firm had grown from a small regional player, into the largest company of its kind in America, with 2.5 million subscribers.

This CEO’s genius wasn’t limited to running his core business better than anyone else. With virtually unlimited access to capital (better to pay interest than taxes) he made more than a dozen legendary investments and spin-offs across related industries. Among the best was building Teleport, one of the first urban fiber optic cable communications companies, and selling it (before it ever earned a profit) to AT&T for $11 billion, at 22x revenue. That sale netted his company an incredible 28-fold return on its investment. Similar returns were made via investments in cellular communications, $9 billion selling PCS to Sprint, and $11 billion from Motorola’s purchase of General Instruments.

But his biggest coup came in 1998 from selling TCI, his core business and at the time America’s largest cable network, to AT&T for $2,600 per subscriber. AT&T paid $55 billion in cash and assumed debt for what was, in reality, a badly depreciated cable network that needed billions in technology upgrades. AT&T’s legendarily expensive cable acquisitions led directly to the company’s financial demise, and its eventual sale, for pennies on the dollar, to Southwestern Bell in 2005.

Among the assets that he didn’t sell in the deal for TCI was one of his earlier spin-offs, Liberty Media.

Originally created in 1991, Liberty Media made acquisition after acquisition in the 1980s and 1990s, buying content and creating new cable networks for distribution on TCI’s cable networks.

After the sale of TCI, Liberty Media became the CEO’s main corporate vehicle. And, as he always had, he immediately began using complex corporate structures and debt to drive acquisitions and growth (and avoid taxes!).

Almost immediately after the TCI sale, he created his first spin-off from Liberty Media, Liberty Interactive. This was going to be his foray into interactive content, which he thought at the time would depend on digital cable set-top boxes. But then the Internet came along, making cable boxes obsolete. Liberty Interactive made some early bad investments, including stakes in ill-fated start ups iVillage and TiVo, but later made much better investments into Expedia and TripAdvisor.

And, almost forgotten by the rest of the world, the company’s best interactive assets were already there – and always had been.

One of Malone’s “Secret” Securities

The big secret on Wall Street this week is an incredible security, one that we’d argue could have only been created by the legendary CEO we’ve just introduced… John Malone.

Malone is a business magnate worth $10 billion, and the largest private landowner in the United States. He’s also made billions for shareholders through his stewardship of TCI.

Among all the feathers that Malone collected in his cap over the course of his storied career, one of his best “interactive” assets was a legacy cable channel – home shopping network QVC.

In 2003, Malone saw that QVC’s traffic and revenue were still growing fast, despite the rise of online shopping. (We’ll discuss why below.) That year Liberty acquired the 56.6% of QVC it didn’t already own in a $7.9 billion deal with Comcast, giving it full control of the leading direct retail shopping channel. Then in 2017, Liberty Interactive bought the remaining shares of the Home Shopping Network (HSN) it did not already own for $2.1 billion, creating a virtual monopoly around the world in TV shopping.

To focus on this business, in 2018 Liberty Interactive spun off its legacy cable holdings and other non-core assets and changed its name to Qurate Retail Group, which owns QVC and HSN.

It was great timing. In 2020, the Covid lockdowns led to a mini-boom for TV shopping. But, much like Max Bialystock in Mel Brooks’ The Producers, this unexpected windfall left Malone facing an existential challenge: net income! More than $1 billion worth of net income! Almost $3 per share! The company paid over $200 million in taxes that year.

Something had to be done…

In September 2020, in part to get around paying taxes on soaring earnings, Malone had Qurate pay a special dividend to every shareholder: a share of preferred stock that pays a $2 per quarter dividend. Interestingly, this new class of stock wasn’t convertible into common shares. Instead, it is mandatorily redeemable (on March 15, 2031) at $100 per share – which means that, in the eyes of the IRS, it’s debt.

It’s textbook Malone – and his preference for paying interest, instead of taxes. Even better, this security allows him to pay interest to himself (he and his partner Greg Maffei own about 8% of the offering). And it might be the single best investment opportunity we’ve ever seen in our careers, measured on a risk-to-reward basis.

As we’ll explain, Qurate has stumbled and the market seems to have lost faith in John Malone, the greatest CEO of all time. The result? An opportunity to participate in a John Malone-led business with a 20% yield and a preferred position in the capital structure.

It’s like Christmas in July. Or, well, Christmas in late January.

Let’s get started…

The Business of World-Class Salesmanship

Qurate Retail (NYSE: QRTEA) is the global leader in video commerce, also known as home shopping. It owns the two dominant brands in this category, QVC and Home Shopping Network (HSN), which together generate roughly 80% of the company’s sales.

The QVC and HSN channels are broadcasted “over the air,” meaning that viewers can tune in without a cable subscription – they only need a $35 digital antenna. QVC and HSN together reach over 200 million households worldwide, and have more than 9 million paying customers in the U.S. and 4.5 million abroad.

Across its QVC and HSN channels, the company broadcasts live 20 hours each day, 364 days per year. Through its sales presentations, the company puts nearly 1,200 products in front of customers each week.

But more important than the sheer number of products, is the quality of the offerings and the sales pitches that promote them. Qurate doesn’t aim for the quick one-off sale… it’s looking to build long-term customer relationships that drive repeat sales.

In 2021, roughly 94% of QVC’s sales came from repeat customers. The brands use two key strategies to foster loyal, long-term customers that drive repeat business.

First, both QVC and HSN delight consumers with unique, high-quality merchandise and world-class customer service. This requires a robust product sourcing network, paired with an efficient supply chain. A key part of keeping customers happy means getting their merchandise delivered as soon as possible and quickly processing returns (more on this later).

The second secret to Qurate’s business model is world-class story-telling and salesmanship. The goal is to build personal relationships between top salespeople and top customers, keeping the audience engaged and thus driving repeat sales. That’s why the company emphasizes salespeople who resonate with the audience, and doubles down on top sellers who successfully build long-term relationships with customers.

Lori Greiner is a perfect example. She started hosting her own QVC show – Clever & Unique Creations by Lori Greiner – in 2000. She developed a large and loyal customer following, and came to be known as “The Queen of QVC”.

In an interview with Parade.com, she described the philosophy that made her so successful on the network – focusing on products she believed in, and making them come to life:

“When your name is on the product, you have a responsibility to make sure it’s as good as it can be. Being genuine to my customers about my products is really important to me… I’d look for problems that people experience in everyday life. Then I would think about how an item could come to life.”

Her unique connection with her audience and passion for the products she presents shows up in the sales results. As just one example, consider the case of Aaron Krause and his left-for-dead “Scrub Daddy” household cleaning sponge. Krause unsuccessfully tried marketing this product himself for years.

But after partnering with the Queen of QVC, the entire inventory of Scrub Daddies sold out in under seven minutes. This blitz launched Scrub Daddy from a fledgling product into a powerhouse brand that went on to generate over $200 million in sales. And it all started with the dynamic duo pitching Scrub Daddy in a live sales presentation to millions of QVC viewers:

The success of QVC and HSN rests in how they build enduring brands around their top sales people and products. Those investments can pay off for years. The successful Scrub Daddy pitch set the stage for over a dozen follow-on products, like the “Scrub Daisy Dishwand System.”

Combining world-class sales presentations with a massive audience of ready-to-buy customers is how QVC and HSN transform everyday products into pure gold. Before suffering a series of operational hiccups last year (more on that later), the business reliably produced $1 billion in annual free cash flow over the preceding 10 years.

Critics contend that QVC and HSN are old-school brands reliant on linear TV, a slowly-dying business. But QVC and HSN now have a greater presence in U.S. homes via streaming devices than they do on linear TV.

When The Going Gets Tough, The Tough Go Streaming

Qurate already taps into a large audience outside of TV, through online sales via its websites as well as through its mobile applications. Last year, the company generated roughly $5 billion through its online and mobile orders, or more than a third of total revenues.

But it’s also taken a giant leap into streaming over the past year – with phenomenal results.

Last year, Qurate management officially launched the “Video Commerce Ventures Group” to develop online and streaming distribution. The new division was led by Soumya Sriraman, who previously headed up Amazon Prime Video and spearheaded leading UK streaming service Britbox.

Following Sriraman’s arrival, over the past year Qurate’s engaged streaming audience has grown by more than 70%, to more than 600,000 monthly active users. And thanks to the company’s direct sales model, that growth translated to immediate profit.

As management explained on a recent investor call:

“Let me also point out that an MAU [monthly active user] for us, is more valuable than an MAU for a normal streaming service because we monetize through multiple sales and not through a flat low fee or from advertising. Further, unlike the wider streaming industry, our expansion is profitable. It is impressive growth from a small, but solid and profitable base. The future of television, the future of the television screen is streaming, and we will be there.”

Today, QVC and HSN are available on nearly every major streaming service, including Hulu, Roku, Apple TV, YouTube TV, Samsung TV, Amazon Fire, and others. Streaming is only a small part of Qurate’s business today (less than 10%) but the rapid growth rate and profitability of this new segment could set the business up for a long runway of opportunity for shareholders in the years ahead.

Best of all, this is a business built for returning capital to shareholders. That’s largely due to chairman John Malone, who owns the majority of voting shares in Qurate and helps guide the company’s capital allocation strategy.

John Malone, the Master Capital Allocator

Malone, the maverick CEO, has long wielded debt as a precision tool. His signature capital allocation strategy uses debt to optimize tax efficiency, boost returns on equity, and then send those returns back to shareholders through dividends and buybacks. (This tactic is detailed in the Wall Street classic The Outsiders – a book we highly recommend.)

During COVID-19, Malone used capital allocation to return significant cash to Qurate shareholders…

With consumers trapped at home and stimulus checks flowing, Qurate enjoyed a record influx of new customers that drove a new record high in sales in 2020. And investors pocketed a significant portion of that windfall, including three special dividend payments from September 2020 through November 2021 totaling $4.25 per share – which is more than double the current share price of around $2.

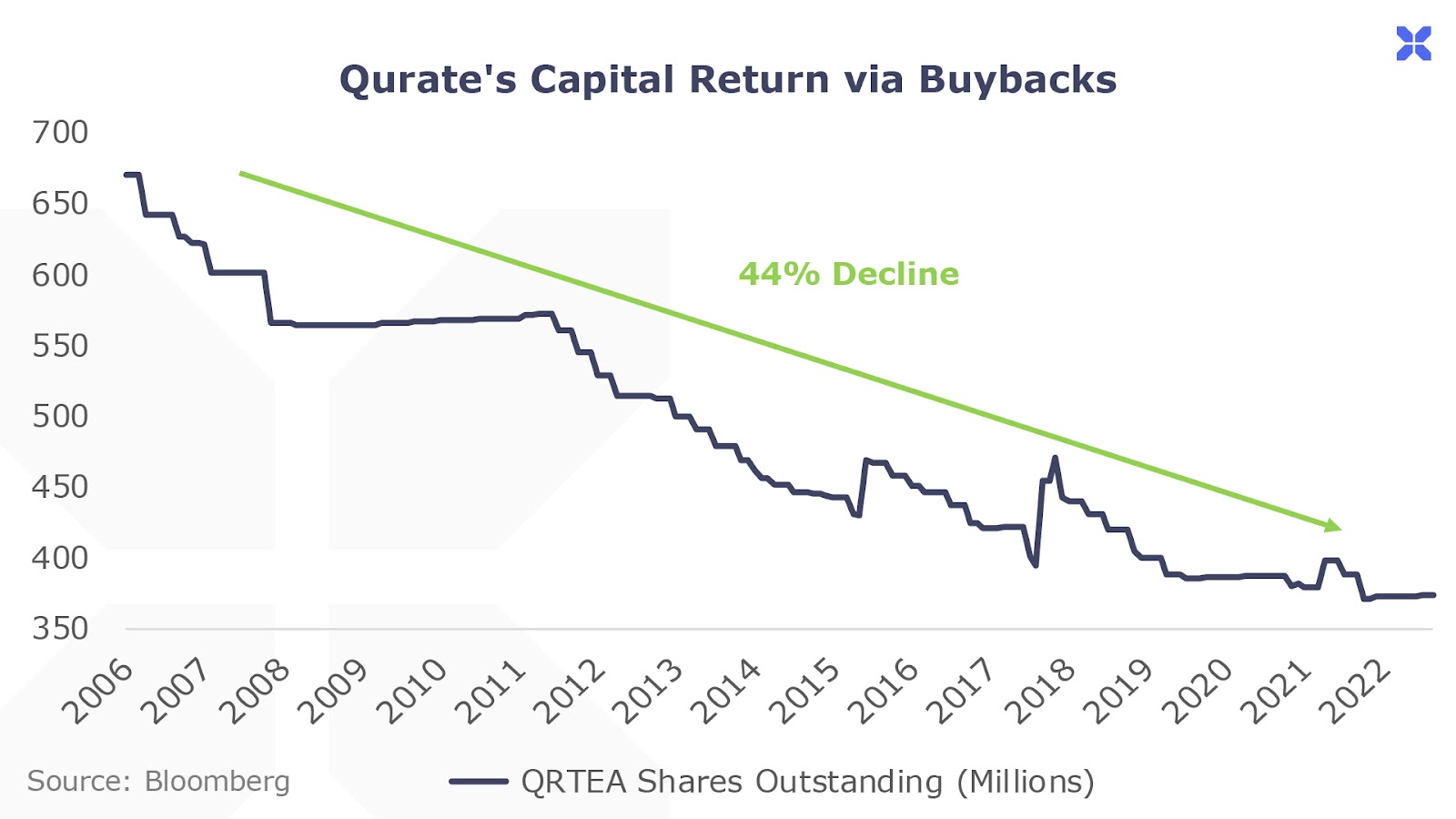

Management has also made use of buybacks as a shareholder return vehicle, which has cut Qurate’s share count by roughly half since 2006:

Malone walks a delicate line by using leverage to boost shareholder returns. An elevated debt load can place the business at risk in the event that operating results and cash flows stumble.

Malone and the Qurate management team have been adept at managing this risk. As one recent example, when business slowed in 2019 and earnings fell from $823 million in the prior year to a loss of $405 million, Malone suspended share buybacks to preserve cash. The business ultimately recovered from the short-lived blip, and went on to post record results in 2020.

But in 2021 and 2022, a much larger wave of disruption hit Qurate. A series of both external and internal shocks threw the business into total disarray, and the carnage is still ongoing.

From a post-pandemic high of $14 per share, Qurate’s stock has plunged by 90% to as low as $1.42. And market savant Michael Burry smells blood in the water.

Betting with Burry on a Qurate Turnaround

Qurate’s share price decline recently caught the attention of Michael Burry, the trader famously profiled in The Big Short for predicting the 2008 housing bubble. In Q3 of last year, Burry purchased 5 million shares of Qurate common stock, making it his second largest position at roughly 24% of his portfolio:

Around the same time that he bought Qurate, Burry warned on Twitter of a sharp recession that would “last several years.”

When Burry goes long in the face of a recession, we sit up and take notice.

To understand why Michael Burry sees Qurate as a buy, let’s review the business disruption in 2021-2022… and why we see good odds of a turnaround.

Pandemic Lockdowns Plus Stimulus Bonanza Snarl Supply Chains

In the wake of the COVID-19 outbreak in 2020, consumers and businesses enjoyed a short-lived sugar high from the greatest government stimulus bonanza of all time. All together, the fiscal and monetary authorities injected over $5 trillion of new money into the economy. But of course, there’s nothing more expensive than free money from the government.

It turned out that flooding the economy with free money – including juiced-up unemployment benefits that exceeded many people’s previous paychecks – created a powerful incentive for people to stop showing up for work. Meanwhile, consumers with cash and time on their hands went on a record buying binge.

COVID supply chain bottlenecks are already the stuff of cautionary legend. Booming demand, fewer workers, and a paralyzed infrastructure all combined to paralyze supply chains across the U.S. in early 2021. Those shortages caused prices to spike… and inflation soared to the highest levels in over 40 years.

Retailers were hit with a one-two punch: higher operating costs, and difficulties in getting enough goods to meet consumer demand.

Then, for Qurate, all hell broke loose.

On December 18, 2021, a big fire broke out at the company’s Rocky Mount fulfillment center in North Carolina. Rocky Mount was QVC’s second-largest logistics center, handling 25-30% of QVC’s U.S. order volume.

For a normal retailer, a perfect storm like this would have been a five-alarm fire… and for Qurate and its unusual business model, it was an extinction-level series of events.

A Burned-Out Warehouse Leads to A Literal Fire Sale

Qurate thrives on a constant supply of new products. The company turns over its inventory on a daily basis. The two key features that drive roughly 25% of its business are the “special value” offerings at HSN and “today’s special value” at QVC.

In normal times, Qurate’s flexible product lineup was a great advantage. It helped Qurate avoid tying up low-selling merchandise for extended periods – a problem that plagues traditional retailers. And it drove engagement, giving loyal customers a reason to repeatedly tune in or visit the QVC/HSN websites each day to check out exciting new products and deals.

But this advantage only worked as long as Qurate could source new inventory… deliver orders… and process returns on time.

And during the Covid-fueled supply chain chaos, none of those things were possible.

Then, the Rocky Mount disruption made a bad situation far worse. The fire destroyed substantial inventory, and also created follow-on bottlenecks that flowed into the rest of the company’s distribution network.

As the CEO explained on Qurate’s Q1 2022 earnings call:

“It destroyed significant inventory, of course, and we’ve talked about that. But as I’ve also talked about, it also took out 20% to 30% of our most efficient capacity, both the store and process inventory. This in turn overstressed our capacity in our remaining fulfillment center network, exceeding capacity in some parts of our network, which reduced the productivity throughout the full distribution network.”

A few statistics paint the picture. In the first quarter of 2022, QVC was unable to keep its scheduled rollout of new daily products for over half of QVC’s daily specials and 60% for HSN. (These daily offers comprise 25% of Qurate’s business.) Meanwhile, 72% of the orders across both QVC and HSN were late, and average delivery times came in at four and a half weeks compared with their normal target of 3 – 5 days.

Even worse, operating costs spiked. The company was forced to stockpile merchandise in a series of makeshift tractor trailers. And the highly automated 1.5 million square foot Rocky Mount facility was replaced by less efficient and much more expensive manual labor.

As a result, customer count fell by 8%. Higher costs caused gross margins to fall from a peak of 36% in mid-2021 to a near record-low of 30% in the third quarter of 2022. A 10% drop in sales and higher costs caused operating income to drop 40% from $2.1 billion in 2021 to $1.3 billion over the last 12 months.

Meanwhile, free cash flow – the all-important metric that reflects how much cash is available for servicing debt – plunged from a record high of $2.2 billion in 2020, to just $227 million over the past 12 months.

That’s a big problem for a company with a net debt load of $7 billion, and annual interest expense of $468 million. Absent a turnaround in its cash flow, the company faces the prospect of defaulting on its debt obligations.

That’s the prospect the market sees for Qurate right now… and that’s why its stock and bond prices have collapsed, leading to the fire sale opportunity spotted by Michael Burry.

Like Burry, we believe this is one case where market panic is unwarranted. The problems facing Qurate are temporary, and management has laid out a credible plan for restoring cash flows over the coming 18 months.

Project Athens

During a Qurate shareholder meeting on June 27, 2022, the company unveiled an aggressive turnaround plan named “Project Athens,” which management describes as “a rigorous, detailed plan revisiting almost every part of the business.”

First of all, Project Athens addresses Qurate’s most pressing issue – restoring disrupted supply chains.

Fortunately, the Rocky Mount facility was insured, and the company has received $280 million to date. Over the last six months, the company has begun investing the insurance payout into new fulfillment center infrastructure.

During its November 21, 2022 investor day, management announced that it had eliminated 80% of its makeshift tractor trailers – one of the key sources of higher costs and delayed shipping times in the wake of the Rocky Mount fire. More than half of the roughly $600 million drop in operating income is attributable to fulfillment and freight costs. The company anticipates that improvements here will drive roughly $300 – $600 million in annual cash flows through 2024.

That would allow Qurate to pay its interest expense, and to chip away at its debt load.

Qurate is also using the insurance payout to overhaul its logistics. Longer term, management set a goal of delivering over 90% of customer orders within five days, and the vast majority within three days.

While the company is making stellar progress on both logistics and infrastructure, the full overhaul will take time. During Qurate’s latest earnings call on November 4, management guided investors to “expect to see the impact of these [supply chain improvement] efforts flow through in 2023 and to pick up momentum through 2024.”

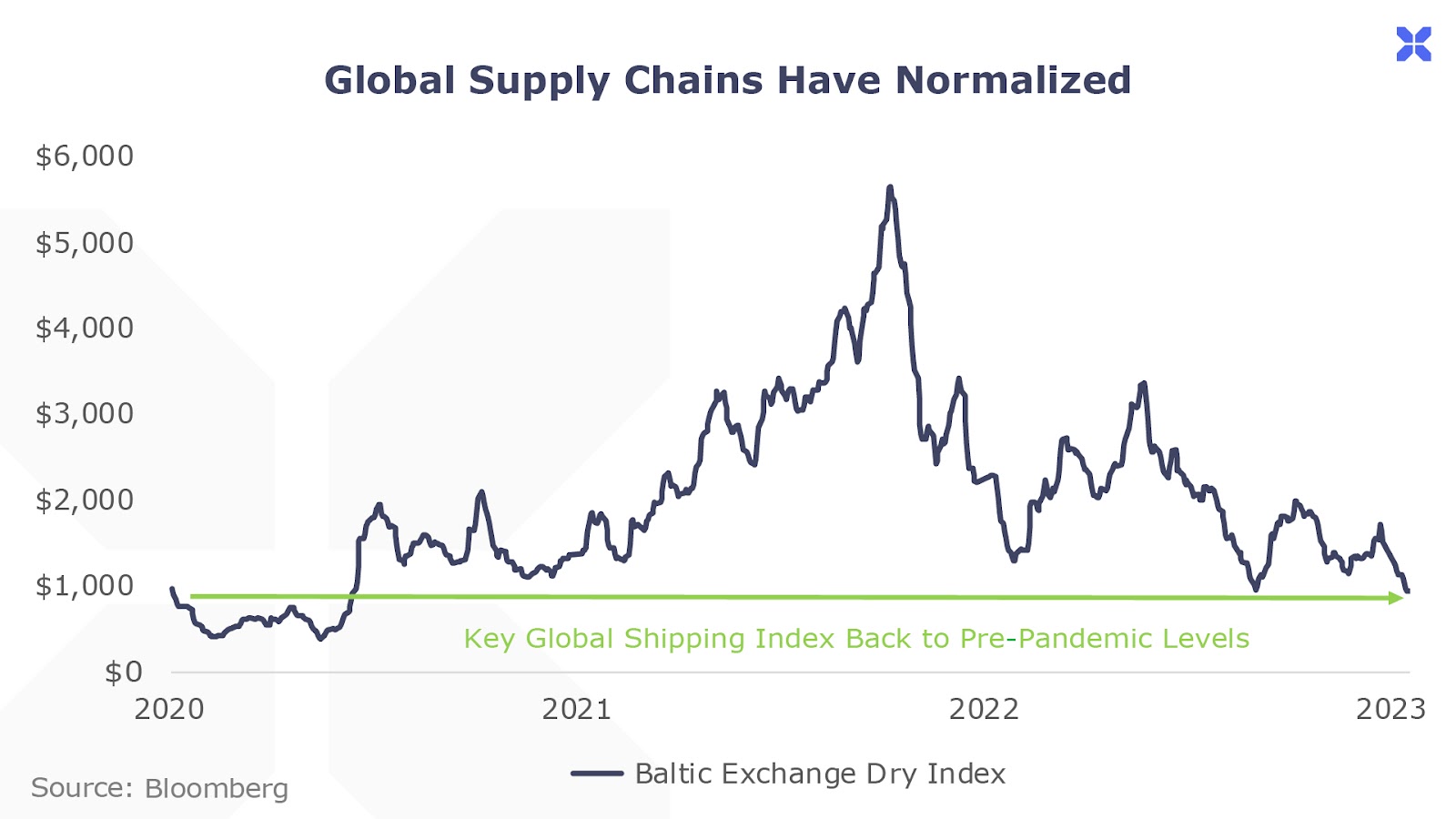

In the meantime, macro supply chain constraints are also easing – and that takes pressure off Qurate, too. The Baltic Exchange Dry Index, a key global shipping benchmark that tracks changes in the cost to ship raw materials, has fallen to pre-pandemic lows:

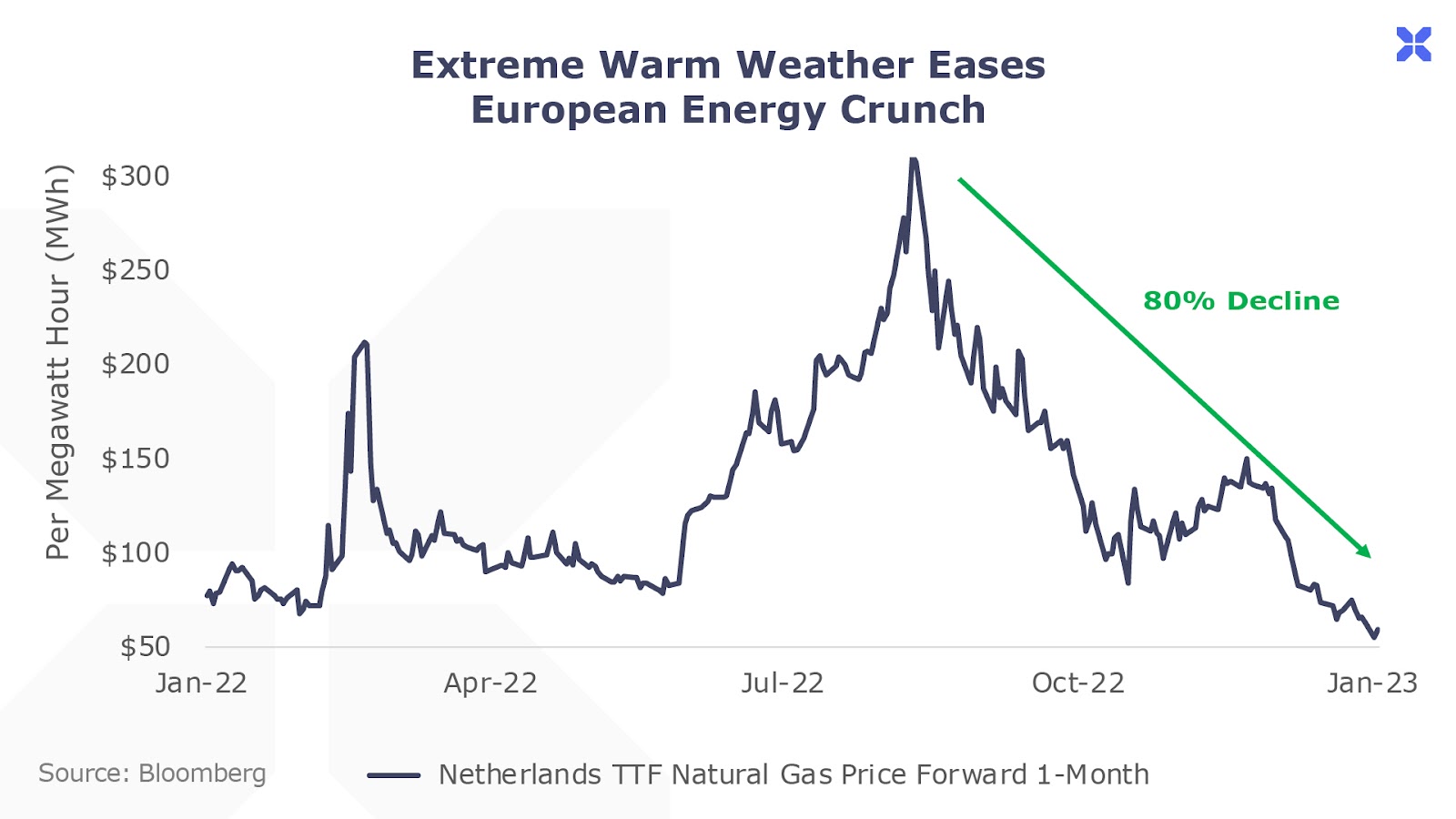

On the energy front, Qurate does a substantial portion of its business in Europe, and the spike in European gas and power prices were among the inflationary cost headwinds it faced in 2022. Now, Qurate will benefit from the unseasonably warm weather that has sent European natural gas prices plummeting, which will filter into a similar drop in power prices across the continent.

The chart below shows that prices have fallen by 80% from $311 per megawatt hour (MWh) to $59 per MWh.

As we’ve written previously, the global energy crisis isn’t over. But favorable winter weather has provided temporarily lower energy prices at a critical time for Qurate’s cash flow inflection journey.

The bottom line today: both the improving macro backdrop and ongoing progress on Qurate’s company-specific supply chain disruptions should set the stage for a substantial recovery in cash flows this year and next.

In the meantime, Qurate’s core customer base remains engaged and willing to spend. In the third quarter, the average number of items ordered per customer grew by 6%, while the average spend per customer grew by 3%. The number of minutes viewed across all of its platforms was up 8%.

So, to review: Qurate has an intact customer base, a working plan to restore supply chains, and a strong growth outlook in streaming channels.

The market has made a mistake leaving this company for dead.

With the common stock trading at a record-low valuation of $700 million, or less than 1x operating income, a successful turnaround could send shares 5x-10x higher from here.

But while there’s a lot to like about Qurate’s turnaround potential, there’s no denying the elevated risks involved given the stretched balance sheet. That’s why we’re not adding the common shares of Qurate to our portfolio.

Instead, we’ll introduce a security that offers a higher margin of safety, while still offering plenty of upside for investors.

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.