Issue #9, Volume #1

Good Food, Great Ideas, and Fantastic People

Three Things You Need To Know Now:

1. China announces even more stimulus. Following Tuesday’s unprecedented monetary stimulus from the People’s Bank of China, the Chinese government on Thursday announced plans to issue 2 trillion yuan ($284 billion) in fiscal stimulus to boost consumer spending. The plan includes subsidies for a “cash for clunkers”-type program to encourage companies and households to trade in old cars, appliances, and capital equipment for new items, as well as direct payouts to households. This week’s stimulus announcements helped drive Chinese equities to one of their best weeks on record. China’s large-cap CSI 300 Index rallied nearly 16%, its biggest weekly gain since November 2008.

2. Japan will continue to ease as well. The country’s incoming prime minister, Shigeru Ishiba, said this morning that his government will continue to maintain “accommodative” monetary policy and will also “deploy fiscal stimulus if necessary.” With three of the world’s largest and most important economies – the U.S., Japan, and China – now aggressively stimulating their economies, more inflation appears certain.

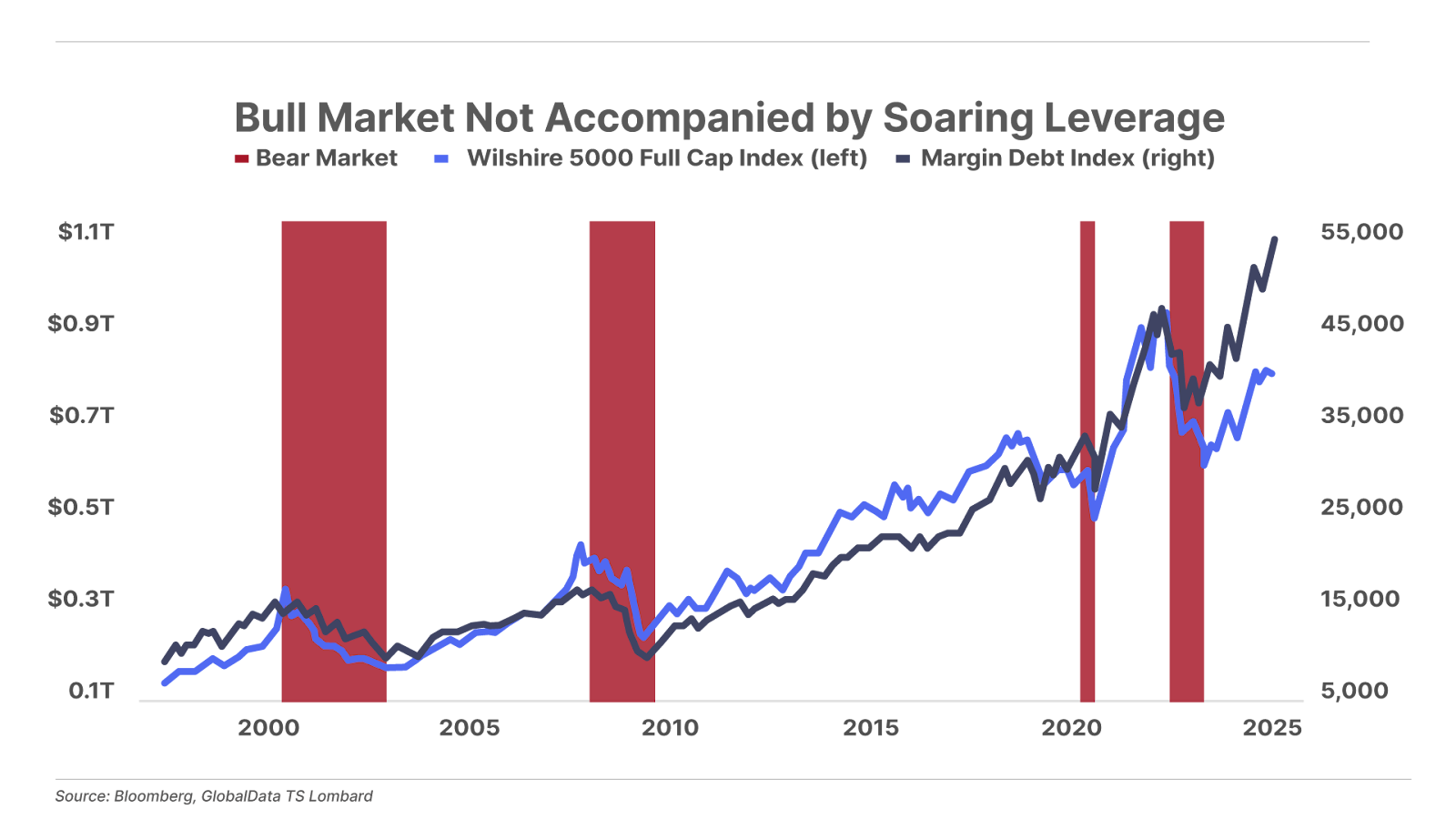

3. Margin debt is relatively subdued. We recently highlighted the record inflows into highly leveraged ETFs, a clear sign of an emerging bubble in equities. However, recent data show margin debt (that is, money borrowed to buy equities directly) remains well below its prior highs. Despite near-record high valuations in the major U.S. indexes, this data point suggests the current asset bubble may have quite a bit further to inflate.

And one more thing…

A looming strike could disrupt the economy… just before the election. The president of the International Longshoremen’s Association – which represents the tens of thousands of workers who load and unload cargo at ports along the east coast of the U.S. and in the Gulf of Mexico – is threatening to strike if the union’s demands aren’t met by October 1. This could effectively cripple a large part of the U.S. economy, and would only add to inflationary pressures.

Highlights From Day 2 of the Annual Porter & Co. Conference

My team and I are gathering on my farm today for a quiet lunch, to celebrate another fantastic Porter & Co. conference. Our speakers were fascinating, the food was great, and the company – our Partner Pass members – was world-class. (The weather didn’t cooperate… but it hardly mattered!)

On Monday I’ll be writing about what I learned at our conference. One of the best things about being in the company of such an insightful, accomplished, and impressive group of people is that you can’t help but to come away smarter. And today, I want to share some highlights from Day 2 of this year’s event.

Our first presentation was a talk by the energy expert known as Doomberg. If you’re not familiar, Doomberg writes the most widely read financial publication on the popular Substack platform, delivering concise, entertaining, and provocative insight on the intersection of energy, finance, and geopolitics – under the guise of a googly-eyed green chicken avatar.

Doomberg highlighted several critical ideas that should resonate with Porter & Co. subscribers. He explained why “peak cheap oil” is a myth… why nuclear energy is on the verge of a global renaissance… and why wind and solar remain “greater fools” trades. Doomberg also shared his framework for successfully investing in the volatile energy markets, including the four best avenues to invest in energy – the underlying commodities, producers, “picks and shovels” (companies that provide the means for producers to produce), and arbitrage opportunities – and explained why the latter two tend to be far more lucrative.

Next up was my old friend – and one of my personal heroes – best-selling author, investor, and futurist, George Gilder.

One of the best parts of writing about finance and economics for the last 30 years is that I’ve had the privilege to meet many of my heroes. And George is at the top of that list.

When I was in college, I read George’s book, Wealth and Poverty, cover to cover at least a dozen times. It taught me the basics of sound money and sound economic principles, and it taught me the beauty of capitalism. (I was so excited to have him join us that I asked him to sign my copy.)

George has been one of the foremost thinkers, writers, and defenders of capitalism for roughly 50 years. He is an outrageously brilliant intellectual and economist. George has written about two dozen books, including, in 1989, Microcosm, which predicted the transition from an analog world to the digital world that we live in today.

In this presentation, George explained how the microcosm is now giving way to the nanocosm, as a revolutionary new material – graphene – is set to replace silicon-based computer chips and unleash previously unthinkable new technological developments in computing, medicine, and more.

George’s presentation was easily the pinnacle of this year’s conference for me personally. He is a rare genius, and we were incredibly fortunate to have him at our conference.

Another highlight was a presentation from Dave Lashmet. As longtime readers may recall, Dave is the brilliant editor of Stansberry Venture Technology and one of my first hires at Stansberry Research when I founded the company decades ago (I first met Dave in college – he was a professor of mine in the early 1990s). As editor of Venture Technology, Dave is focused on a “venture capitalist” approach to investing, seeking out compelling opportunities that are producing the next wonder drug or technology… he’s behind some of the biggest share price gains in Stansberry Research history.

Dave revealed the story of consumer-electronics giant Apple’s (AAPL) next ground-breaking initiative – which has nothing to do with artificial intelligence (“AI”), electric vehicles, or anything else you’ve heard about in the financial media – and shared three little-known stocks you can buy today to profit from this breakthrough.

Attendees also heard from Pieter Slegers, publisher of the popular Substack publication Compounding Quality. Pieter is a former finance professional who started Compounding Quality in July 2022 to help individual investors find the best companies in the world at fair and reasonable prices. Like Porter & Co., Pieter subscribes to the Warren Buffett philosophy that ”it is far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Pieter explained how he finds great companies – including the six critical hallmarks of the highest-quality stocks – and three of his favorite undervalued quality stocks investors can confidently invest in today. Pieter also joined Aaron Brabham and me for a live recording of our Black Label podcast.

We also enjoyed hearing from Bryan Beach, a former Big Four auditor and the editor of Stansberry Venture Value. Like Dave Lashmet, Bryan is a fantastic analyst who worked closely with me for many years at Stansberry Research. At Venture Value, he combines a venture capital approach with deep value investing to identify high-quality micro-cap stocks that Wall Street has overlooked. During his talk, Bryan explained why the unprecedented rise of “passive investing” over the past decade has created a generational opportunity to invest in the market’s smallest stocks today.

These were just a handful of presentations from our fantastic lineup of speakers, including best-selling author and veteran real-estate investor Brad Thomas, international asset-protection attorney Joel Nagel, Stansberry Asset Management Chief Investment Officer Austin Root, and others.

As I mentioned on Wednesday, Porter & Co. Partner Pass members and paid-up subscribers to The Big Secret on Wall Street will receive free access to the complete video footage of the conference – including copies of every presentation – to watch and review at their convenience. Keep an eye on your inbox next month.

Good investing,

Porter Stansberry

Stevenson, MD

P.S. Our Porter & Co. Spotlight for this month has been on Bonner Private Research’s Tom Dyson, another old friend of mine who I like to call “the greatest investor you’ve never heard of.” On September 10, in a report in The Spotlight that was available to all Porter & Co. readers, Tom recommended buying shares in Zim Integrated Shipping Services (ZIM), an ocean liner that moves containers across the oceans on boxships. Tom had tracked the company for a number of years, including its three-year round trip ($4/share, to $42/share, and then all the way back down to $6/share) due mostly to COVID-related supply challenges. What drew Tom’s eye more recently was when Houthis in the Red Sea – a critical passage to the Suez Canal – began attacking ships, sending freight rates through the roof.

Since Tom’s recommendation to Porter & Co. readers, Zim shares are up around 50%. Tom asked me to pass on to Porter & Co. members that he recommends selling shares of Zim at around $30/share (up from around $17 when it was recommended… and $25 now).

Of course, not every recommendation that Tom makes moves up by 50% in three weeks. But this kind of investment idea – founded on deep research, a long-term view, possible only with a unique vision of how markets work – is part of why I’ve followed Tom’s research for decades. It’s also why my team and I have arranged to make Tom’s research available to you at a special rate. Click here for details.