Editor’s Note: On Tuesdays we turn the spotlight outside of Porter & Co. to bring you exclusive access to the research, the thinking, and the investment ideas of the analysts who Porter follows.

If you’re new to The Big Secret on Wall Street and want to find out more about this membership benefit, you can read all about it here.

And finally, by popular demand, you can now access all previous (and future) Spotlights inside the Porter & Co. website.

You can only pick one…

Bitcoin, Nvidia, AMD, or Tesla.

For most people, getting in early on just one of these companies would forever transform their finances. But our Spotlight guest this month wasn’t content with recommending just one.

Years before these names were on the mainstream’s radar, my friend Jeff Brown named each of them as the companies that would go on to dominate the field.

The results?

Since 2015 Bitcoin is up 26,613%.

Nvidia since 2016… 10,422%.

AMD since 2017… 1,229%.

In fact, name any major tech shift over the last several decades and chances are Jeff was on the bleeding edge of it. Semiconductors… tech infrastructure… IT networking and security… video technology… and so much more … you name it, he was talking about the latest innovations and their impact, often years before anyone else.

It’s why, whenever I want to understand a new technology shift, Jeff Brown is one of the first people I consult.

Not only because he has a deep, intuitive understanding of how new technologies are going to reshape how we work, live, communicate, and transact but because he’s got an unparalleled ability to pick the winners of these emergent trends. In today’s Spotlight, Jeff is sharing his report on the company he says “could become the market’s next AI darling ”.

As always, this is research that’s typically only available to Jeff Brown’s paying subscribers but is free for the Porter & Co. family… and if you want to find out more about Jeff’s research or get his future recommendations, go here now.

Given the nature of investing in technology, the ideas that Jeff shares are often more speculative than what we at Porter & Co. typically focus on. But as Jeff’s track record proves, when you’re right, the upside potential is off the charts. Jeff has one of the best track records of any analyst I’ve ever worked with.Below (and also here) is an example of Jeff’s work…

The Future AI Software King

The news sent shockwaves through the software community.

On June 4, 2018, Microsoft announced its intent to acquire GitHub for $7.5 billion in an all-stock deal.

GitHub was the brainchild of Linus Torvalds – founder of the Linux operating system and unassuming leader of the open-source software movement. Git was a software version control system that allowed developers to co-develop software in an organized way.

And GitHub’s superpower was its simplicity and user-centric design. It provided an intuitive interface for Git, making it accessible to developers of all skill levels. The platform’s social features – such as repositories, pull requests, and issues – transformed how developers worked together.

And that was the key. GitHub wasn’t just another tool. It was a community.

Many developers feared that Microsoft’s acquisition would compromise GitHub’s independence and open-source ethos.

It didn’t take long for the users – and investors – to find a new community.

The Rise of a Competitor

Three months after Microsoft acquired GitHub, a young start-up and key competitor closed on a $100 million venture capital (VC) round.

The company had only managed to raise $58 million in the three and a half years prior… but it had become a hot commodity given the clouds surrounding GitHub.

That upstart was GitLab (GTLB) – the very competitor that found itself onboarding more than 50,000 new customers in the week after Microsoft bought out GitHub.

GitLab had largely been an afterthought in the industry until then. But suddenly Goldman Sachs, Google Ventures, and several notable VC firms were rushing to invest in the company.

GitLab went on to raise more than $1 billion in venture capital over the next few years. And that kicked its growth into high gear.

GitHub had over 28 million developers on its platform and claimed half the Fortune 100 as its customers around the time that Microsoft bought it for $7.5 billion.

Today, GitLab has over 30 million registered users on its platform… and half of the Fortune 100 are now its customers.

GitLab is on pace to do more than $700 million in revenue in the current fiscal year. And the company is still growing revenues by over 25% a year.

And what’s most impressive is that GitLab is running at 90% gross margins. That means 90 cents of every dollar the company makes flows through as gross profit.

So GitLab is clearly hitting its stride right now. And that’s because its software developers are flocking to its platform.

It all comes down to GitLab’s not-so-secret weapon. It’s what sets the younger competitor apart from GitHub.

We’ll talk about that in just a minute. But first, we need to discuss a key law in the software industry. Understanding this will help us understand why GitLab is in such a prime position right now.

Conway’s Law and the Rise of DevOps

Melvin Conway submitted what’s become a famous paper to the Harvard Business Review back in 1967. He titled it “How Do Committees Invent?”

The publisher rejected that paper… but it’s now a classic in the annals of technology history. The paper’s thesis came down to this:

Any organization that designs a system (defined broadly) will produce a design whose structure is a copy of the organization’s communication structure.

Conway argued that the organizational structure of a team strongly influences the software it designs.

In other words, small, nimble teams create smaller, more modular software in shorter periods. But bloated, hierarchical bureaucracies create a product that matches that structure.

Today, this seems like common sense. But back in 1967, it was the very early days of computing. Massive mainframe computers took up entire rooms and had a fraction of the processing power we carry every day in our smartphones.

Yet Conway’s thesis is easy to understand. Think about how terrible Microsoft’s software was in the 1990s and even the 2000s.

The massive technology company was mired in hierarchy from the top down. And it built more and more complex software that consistently gave its users the “blue screen of death.

The Blue Screen of Death (Source: How-To Geek)

The blue screen of death plagued us far too often back in those days.

Like many other great thinkers, Conway’s contributions were ignored or underappreciated for decades.

For the 40 years that passed after Conway wrote his paper, the field of software design did the exact opposite of what he proposed. Software got larger, bulkier, slower, and more complex.

The software industry would write millions of lines of code. This code became nearly impossible to debug and troubleshoot. Publishing a new software release was a monumental undertaking… and it rarely went well.

Finally, just over a decade ago, the industry recognized that things had to change. There was way too much complexity in software design. It became necessary to break up software into smaller modules. This is known as modular programming.

Because of the urgency to simplify and speed up software development, the concept of DevOps was born. DevOps stands for software development (Dev) and information technology operations (Ops). The industry rapidly migrated toward developing “microservices.” That way features and new updates could be rolled out as frequently as necessary instead of in one massive release.

This shift toward smaller, flexible, and agile software development teams led to an explosion in accelerated software development. Multibilliondollar businesses have been created using this development ethos, and an entire industry has been built up around supporting DevOps.

But this created a new problem.

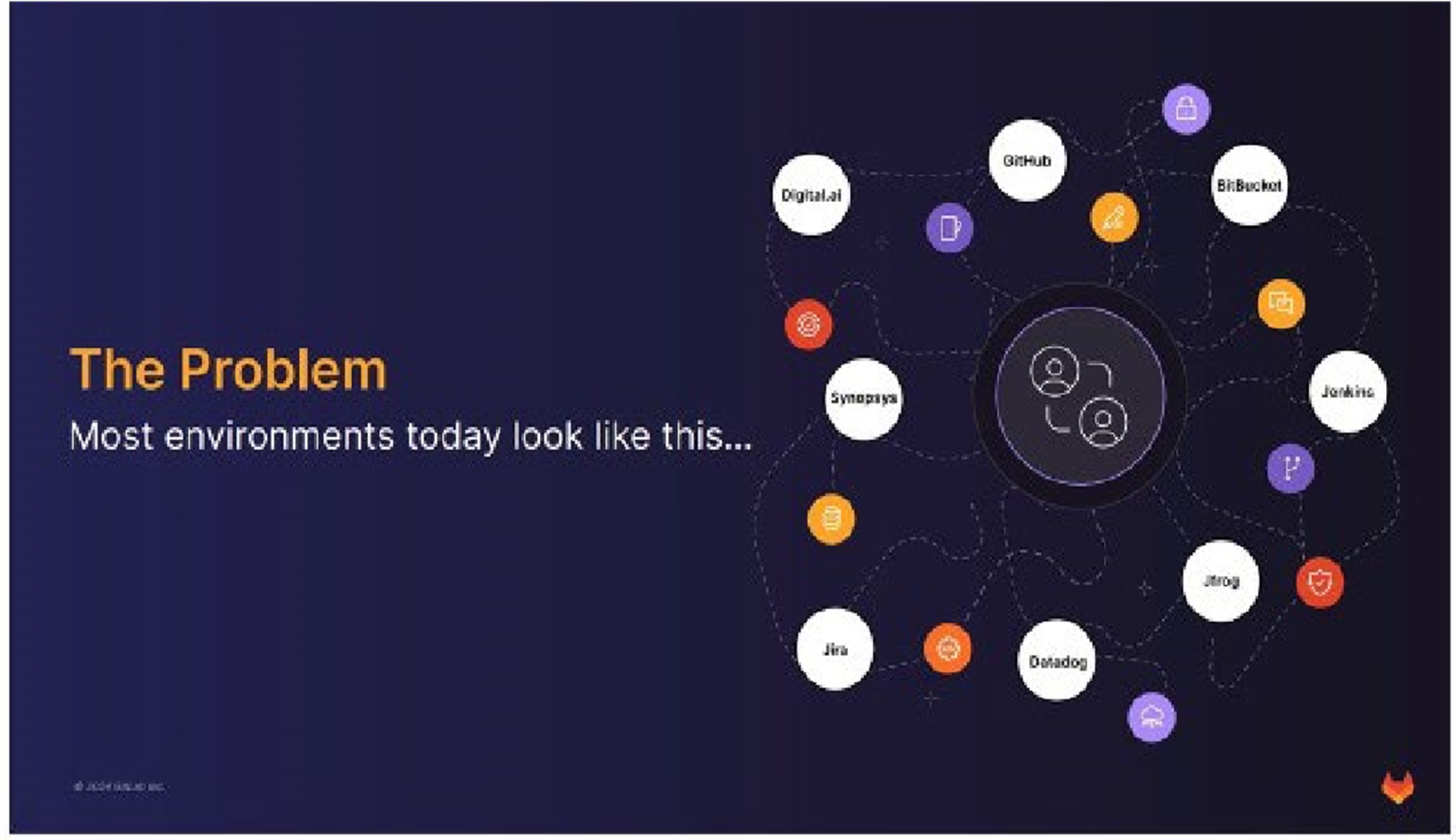

This focus on microservices created a dynamic where developers needed to use multiple DevOps platforms to accomplish their goals. They had to build environments that stitched multiple platforms and multiple services together. Like this:

As we can see in this graphic, most companies are utilizing a variety of systems and platforms today. That creates complexity. And these different platforms don’t always play nice with one another.

This dynamic requires companies to retain large IT departments. It takes a full staff of IT professionals to manage such complex systems.

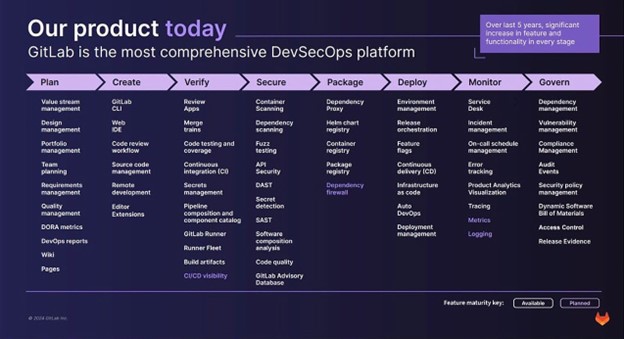

GitLab’s solution is to condense as many core “microservices” onto the same platform. And the company has spent the past five years doing just that. Today GitLab sports the most comprehensive DevOps platform on the market… which is why developers are flocking to it.

On the next page is a visual that highlights just how comprehensive GitLab has become. This gives us a feel for all the services GitLab packs into a single platform.

Many of these items will sound like jargon to those of us not familiar with the software industry – and that’s okay. The key takeaway here is that GitLab helps companies put Conway’s Law on their side.

And that’s just the start when it comes to GitLab’s offering.

The magic – and GitLab’s not-so-secret weapon – is the company’s suite of artificial intelligence (AI) tools.

AI Changes the Game

GitLab has emerged as the leader in integrating artificial intelligence (AI) into the DevOps lifecycle. In addition to a streamlined platform, the company now offers a suite of AI-powered tools under the umbrella term “GitLab Duo.” That’s GitLab’s AI service offering.

The name “Duo” signifies the collaborative synergy between users and GitLab’s AI capabilities. And GitLab Duo aims to enhance every aspect of the development cycle. These tools leverage AI to enhance productivity, streamline workflow, and dramatically improve the efficiency of entire software development teams.

That’s because they can suggest code, find community reviewers, explain vulnerabilities detected, and even generate tests.

These tools ensure that all team members are on the same page and can access critical information efficiently. Rather than having to parse through comments line by line, developers can use AI to find exactly what they are looking for.

Any one of these AI-powered tools would augment software development tremendously. Combine all six and it’s like developers working on GitLab have an AI assistant for every step of the development process.

And make no mistake about it – GitLab’s tech is on the bleeding edge.

GitLab’s AI Is the X-Factor

GitLab Duo’s AI capabilities are built on advanced machine learning models and generative AI technologies. These models are trained on vast amounts of data from GitLab’s own platform and other sources. Because GitLab has a massive repository of software code on its platform, that means that it has the best possible data to train its generative AI. This is what makes GitLab’s AI tools so powerful.

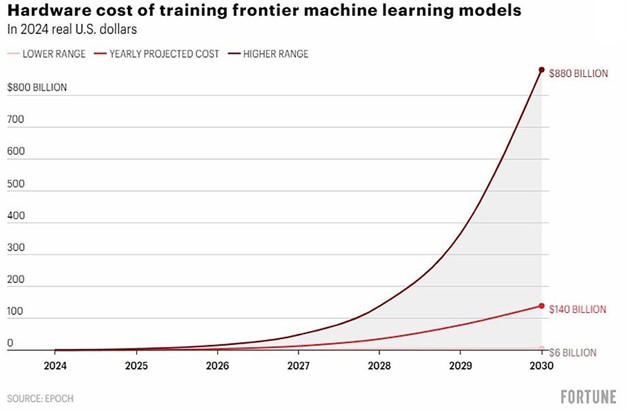

We should always remember that an AI is only as good as its training. And training an AI well is incredibly expensive. Companies don’t disclose the precise costs of training their AI models, but we do have rough estimates.

OpenAI hasn’t disclosed the size of GPT-4, which it released a year ago, but reports range from 1 trillion to 1.8 trillion parameters. CEO Sam Altman vaguely pegged the training cost at “more than” $100 million.

And here’s the thing – the bigger and more capable these AI models get, the more it costs to train them. Anthropic CEO Dario Amodei suggested that models costing over $1 billion would appear this year and that by 2025 we may have a $10 billion model.

The chart on the right from Fortune helps us visualize it.

Needless to say, these training expenses are a massive barrier to entry. But it’s GitLab’s extensive (and expensive) training that enables its AI to provide developers with accurate and contextually relevant suggestions and insights in real time.

And the fact that GitLab integrated AI into every step within the development workflow is quite a feat. It’s easy to take for granted just how difficult it is to pull this off seamlessly.

And here’s what’s underappreciated about this…By augmenting themselves with AI, software developers can focus on more complex and creative aspects of software development. The AI handles all the tedious tasks and troubleshooting… freeing developers to pour their energy into the human ingenuity aspect – something that cannot be assigned to an AI.

I think we’ll be amazed at what comes from this.

Just as important, GitLab’s AI enhances and even automates security practices.

Up until this point, developers had to debug their code line by line. That was easily the most tedious part of the process.

With GitLab, the AI handles that work. And the AI is much faster and far better at it. It doesn’t have eyes that get tired after staring at a computer screen for hours on end.

Simply put, GitLab’s AI suite of tools is what will power continued growth for years to come. And this is what sets the company apart from GitHub.

By comparison, GitHub does leverage Microsoft’s connection to OpenAI to provide code suggestions for users. But that’s it. It does not integrate AI into the entire development process.

And with Microsoft in charge, GitHub does not provide users with specific access controls over their data. Nobody knows for sure what happens to the data that OpenAI ingests. Famed technologist Elon Musk has raised this point quite a bit in recent years.

Meanwhile, GitLab’s AI toolset is far more extensive. And the company maintains a focus on privacy and security. GitLab does provide users with fine-grained access controls to keep their data secure. Nobody has to wonder if their data is being used without their knowledge or consent.

The bottom line is that GitLab’s comprehensive AI offerings represent a massive competitive advantage over GitHub. And as a bonus, GitLab is a better choice for privacy and data security.

These capabilities not only differentiate GitLab from competitors like GitHub… but they also position the company for sustained growth in the rapidly evolving software development landscape. And the numbers bear that out.

Massive Adoption

As we noted earlier, GitLab now has over 30 million registered users – more than GitHub at the time of the Microsoft acquisition. In addition, over 100,000 organizations now collaborate on GitLab’s platform.

Large organizations are increasingly adopting GitLab for its comprehensive DevOps and artificial intelligence capabilities. Notable enterprise customers include Goldman Sachs, Nvidia, T-Mobile, and many others.

The latest projections suggest that the global DevOps market will grow at a compound annual growth rate of about 20% for the next several years. As such, we’re going to see sustained growth in GitLab’s customer count for years to come.

And it’s not just large enterprises who are migrating to GitLab. The company’s flexible pricing makes it attractive to small and mediumsized businesses, start-ups, and even individual developers.

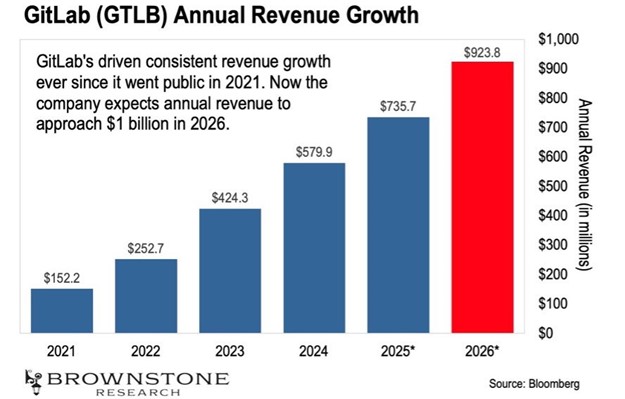

By catering to a diverse range of customers like this, GitLab has established itself as a versatile and powerful platform. Naturally, this has driven explosive revenue growth. Have a look at the chart above.

Look at how consistent GitLab’s revenue growth has been since going public. This chart looks like a perfect staircase.

We should note that GitLab’s fiscal year ends in January. So the bar for 2024 here represents GitLab’s revenue from February 2023 through January 2024. That’s the most recent fiscal year.

The bar for 2025 projects revenue from February 2024 through January 2025. And in just the same way, the bar for 2026 represents revenue projections from February 2025 through January 2026.

As we can see, GitLab expects its annual revenue to be pushing the $1 billion mark by 2026. That’s a great milestone for a company of this size.

Even more exciting, GitLab is beginning to throw off serious free cash flow. The chart on the right paints the picture.

Here we can see that GitLab turned cash flow positive this past fiscal year, throwing off $33.4 in free cash flow. The company expects to generate about $68 million in free cash flow during the current fiscal year. And it expects free cash flow to hit $117 million in fiscal year 2026.

What I love about this chart is that it’s another perfect staircase… just as we saw with the annual revenue chart. Although, sharp-eyed readers will notice that the final step is steeper than the others.

That tells us that GitLab expects its free cash flow margin to expand over the next year and a half. That means a greater portion of GitLab’s revenue will convert into free cash flow.

We’re talking about the company’s free cash flow margin here. It measures the proportion of revenue that turns into free cash flow. This gives us insight into a company’s operational efficiency. And that’s critical to understand in the current climate.

GitLab generated a free cash flow margin of 5.8% in fiscal year 2024 – the year it turned cash flow positive. That’s not terribly impressive, but it’s a start.

What is impressive is how the company’s free cash flow margin is expanding. GitLab expects its free cash flow margin to be around 9.6% this fiscal year and nearly 13% in fiscal year 2026. That’s why that last “step” on the above bar chart is steeper than the others.

And this brings us to our investment thesis for GitLab…

The Winning Archetypes in Today’s Climate

Right now we are laser-focused on companies that are:Growing revenues and free cash flow in a capital-efficient mannerA major player leading in a big industry trendOn the precipice of a game-changing product breakthroughThese kinds of small-cap tech companies that fit one or more of these three archetypes will make for the best investments given the current high-interest rate environment.

Interest rates are higher today than they’ve been since before the 2008 financial crisis. That’s put a tremendous amount of stress on the small-cap tech space.

Simply put, the market no longer favors growth at all costs. Not in the current climate.

Instead, institutional capital is flowing only to those companies that are both growing revenue and growing free cash flow.

At the same time, many institutional investors are desperate to participate in the big AI boom that’s been playing out in the equity markets.

As I’m sure we all know, Nvidia (NVDA) has been all the rage in the AI space. And the stock’s been on an absolute tear. It now trades at an enterprise value (EV) of over $2.5 trillion.

Those asset managers who missed out on NVDA’s big run are trying to play catch up. Which means big money is still chasing AIrelated investments – as long as the company is growing and profitable.

GitLab is perfectly positioned in this climate. It certainly fits the first two of our three core archetypes. We could make the case that it fits the third archetype as well.

GitLab’s suite of AI tools will change the nature of software development entirely. This is the first time in history that human developers can augment themselves with AI through every step of the software development lifecycle. GitLab is the only company that can make that happen comprehensively.

Yet, we’re catching GitLab at a major inflection point. Companies with consistent revenue growth and incredible margins aren’t usually cheap from a valuation perspective. GitLab is no different.

Investors should always keep in mind that a stock’s share price does not convey much useful information to us. Whether a stock is “expensive” or “cheap” has nothing to do with the nominal share price. Instead, it’s all about the valuation.

GitLab’s valuation is currently at the low end of its range if we look back to its IPO in 2022.

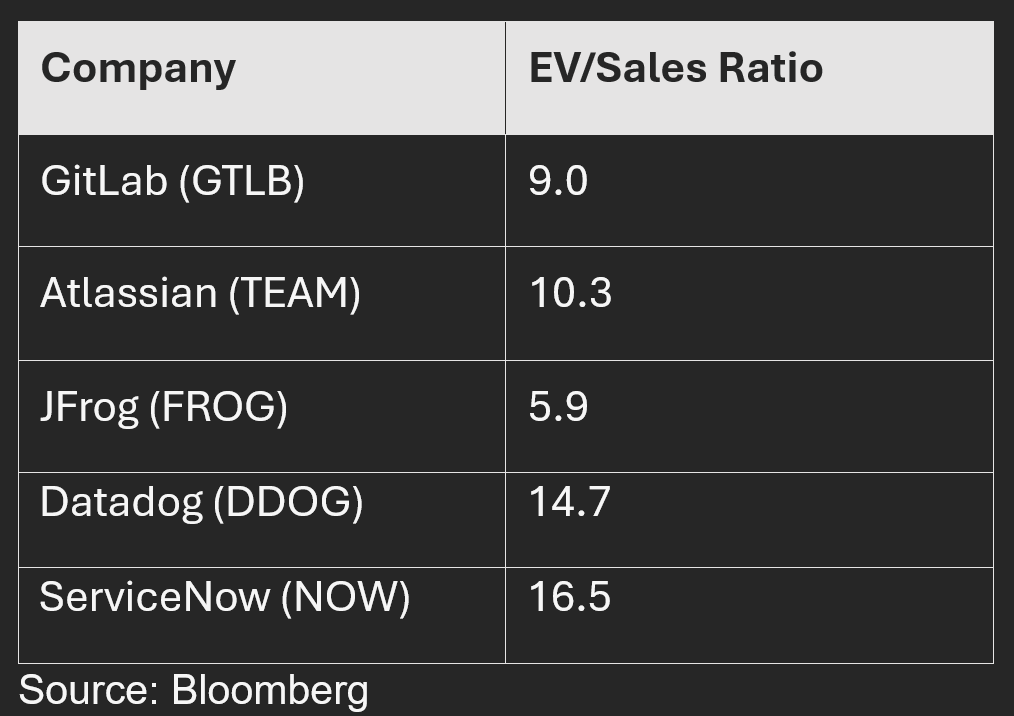

GitLab typically trades at an EV/Sales between 9 and 20. And it’s now trading squarely at just nine times sales – the very bottom of its range. GTLB hasn’t been this cheap in over a year.

[The EV/Sales ratio tracks a company’s enterprise value relative to its annual sales. This metric allows us to gauge whether a stock is expensive or cheap by comparing the EV/Sales ratio to its historical range and similar companies.]

Given GitLab’s strong financial metrics, we’re unlikely to see the stock fall much from here. If it does, any pullback will be temporary.

And just to be sure, let’s also compare GitLab’s current valuation with that of its most comparable software companies.

Source: BloombergAs we can see, GitLab’s EV/Sales valuation compares favorably to similar companies right now. In fact, only JFrog is “cheaper” from an EV/Sales perspective. That creates a great opportunity for us.

By investing in GitLab today, we’ll gain exposure to what could become the market’s next AI darling as institutional capital tries to play catch up. And we’ll establish our position at the bottom of GitLab’s historical valuation range. This suggests that there’s very little downside from here – presuming GitLab continues to execute at a high level.

Now, we can be sure that GitLab is a top-tier acquisition target right now. The company’s name has popped up as such in various industry discussions over the past year.

Our hope is that GitLab can remain an independent company for years to come. We’ll have incredible upside if it does. But we’ll make plenty of money if GitLab happens to be acquired as well. Consider this…

Microsoft bought GitHub for $7.5 billion in 2018. At the time GitHub was doing around $200 million in annual revenue. That means Microsoft acquired the company at 37.5 times sales.

We shouldn’t expect an acquisition to happen at such a lofty multiple in today’s climate. For a company like GitLab, an acquisition at 15 to 20 times sales would be more likely today.

Remember, GitLab is on track to do $735 million in revenue this fiscal year. If we assume a conservative multiple of 15 times sales, an acquisition offer would put GitLab’s enterprise value at about $11 billion. That represents a potential return of 1.6x in the event of a nearterm acquisition.

But what if GitLab can remain independent?

Remember, the company expects to generate $924 million in annual revenue in fiscal year 2026 (ending January 31, 2026).

If we assume GitLab trades back up to an EV/ Sales of 14.5 – the middle of its historical range – that would value the company at $13.4 billion… which would equate to a return of roughly 200% on our investment in the next year and a half.

And that’s just a conservative projection. Given the superiority of GitLab’s AI offering, and how fast the AI trend is moving right now, there’s a good chance we’ll do even better than that.

But we must act while GitLab trades at the low end of its valuation range. Let’s not miss this rare opportunity.

Action to take: Buy shares of GitLab (GTLB) up to $56.75.

Risk Management: We’ll hold this position with a volatility-adjusted stop loss. As always, I recommend rational position sizing. That means we should only invest an amount that is appropriate given our portfolio size and tolerance for risk. Jeff’s team has organized a special offer for my readers that will give you access to one of his premium services at an enormous discount to the normal price. Jeff’s research will make you a smarter, better investor… see the offer here.

Jeff’s team has organized a special offer for my readers that will give you access to one of his premium services at an enormous discount to the normal price. Jeff’s research will make you a smarter, better investor… see the offer here.