Daring “Regulatory Entrepreneurs” Who Rewrite the Rules

Capital Efficient… and Taking Market Share

| Welcome to Porter & Co.! If you’re new here, thank you for joining us… and we look forward to getting to know you better. You can email Lance, our Director of Customer Care, at this address, with any questions you might have about your subscription… The Big Secret on Wall Street… how to navigate our website… or anything else. You can also email our “Mailbag” address at: [email protected]. Paid subscribers can also access this issue as a PDF on the “Issues & Updates” page here. |

“Gene” clearly was not short for “genius.”

Gene (short for Evgeny) Freidman apparently thought he could outwit the New York Police Department – and beat a $200,000 failure-to-pay child-support rap – by climbing to the roof of a three-story apartment building and hiding in a tiny elevator shed.

It didn’t work.

New York’s finest dragged Freidman off the roof, and four days later he found himself sitting in a Manhattan courtroom across from his stony-faced ex-wife Sandra, offering a lame defense: “I don’t have any money.”

The rooftop hideout was a dramatic comedown for the former “Taxi King” of New York City, who just four years earlier, in 2014, owned 900 of NYC’s 13,500 taxi medallions, and had manipulated medallion prices up to as much as $1.3 million apiece.

| The Big Secret With millions of property listings and even more active renters, this company dominates the home-sharing industry. And as it expands its listings, it draws in even more renters, and as it draws in more renters, it increases its new property listings. This network effect, in turn, powers its remarkably capital efficient business. |

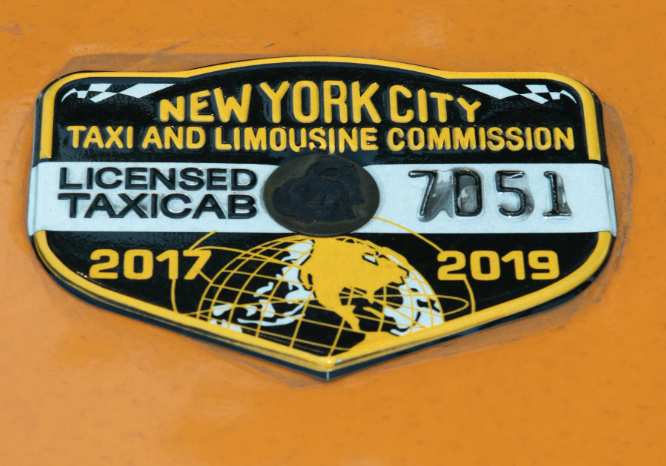

If you’ve been to New York – or one of many other cities with a medallion system – you’ve likely seen metal emblems that look like an oversized police badge bolted onto the hoods of city taxis. The medallion is the city’s official license to operate a taxicab – and the supply of medallions is capped to ensure that cabs stay in demand (a system that started in the 1930s to cut down on Depression-era taxi turf wars).

Medallions, like all artificial constraints on the free market, fail in the long term. And in the meantime, “geniuses” like Gene Freidman often find ways to exploit the system.

Starting around 2006, Freidman – the son of a cab driver – decided to buy as many medallions as he could, and bid them up (to what he described as “crazy prices”) at auction. That way, his own medallions would be worth more on paper… and he could lease them out to cab drivers at ever more-exorbitant rent.

The plan worked out great for Freidman… for a few years.

It didn’t work out so well for cab drivers – often immigrants, like Freidman’s own father, struggling to make ends meet in the Big Apple.

Drivers who lease a medallion start every workday underwater: they must make enough money to pay back the daily lease, before they can start earning money for their shift. In New York in 2015, drivers had to make $100 a day just to break even.

The medallion owner, of course, makes out like a bandit. That’s why, in addition to operating the largest taxi fleet in New York, the “Taxi King” amassed a net worth of $525 million, bought swathes of pricy NYC real estate, and paraded around a series of model girlfriends… while starving cabbies fought over the diminishing supply of medallions, and took out hefty loans to buy or even lease one of the tiny metal badges.

Then… Uber came to town. And the taxi medallion bubble imploded.

Loopholes and A**holes

Uber Technologies Inc. (UBER) – the $134 billion market cap rideshare giant launched in 2009 by Garrett Camp and Travis Kalanick, after they had trouble getting a car to take them home from a party – is so big these days that it’s a standalone verb. “I’ll Uber.”

But when Camp and Kalanick first debuted their app in New York City in 2011, Uber was a fledgling startup… small enough to squeeze through a loophole in the city’s taxicab regulations.

Uber aimed to operate an unauthorized taxi service in the city – and thereby sidestep the medallion price wars and the bureaucratic licensing restrictions (including the entire 61-page rule book for official taxi drivers).

“We’re in a political campaign, and the candidate is Uber and the opponent is an a**hole named Taxi,” Kalanick told Vox Media in 2014. “Nobody likes him, he’s not a nice character, but he’s so woven into the political machinery and fabric that a lot of people owe him favors.”

Camp and Kalanick would need to wage their war on Big Taxi without going to jail or getting fined. So they pulled out one of the oldest tools in the “get s*** done” toolbox: regulatory arbitrage.

Regulatory arbitrage, put simply, is the art of finding gaps in the law that you can exploit to your benefit. It’s what businesses do when they store their money in tax-free havens like the Cayman Islands… or get incorporated in the lower-tax-rate state of Delaware.

New York taxi law stringently regulated the behavior of cars and drivers. How to get around that? Build a rideshare service that had nothing to do with cars or drivers.

How’s that, you ask? Well, according to founder Kalanick, Uber is a “technology” company, not a car company. All the app does is connect people who are looking for a service. That includes both the passengers and the drivers – who aren’t Uber employees, by the way.

“Drivers do not provide services to Uber,” a lawyer for Uber claimed earlier this year. “It’s actually the other way around. Uber provides services to its customers on both sides of its platform.” She contended that Uber and rival rideshare company Lyft were more akin to “travel agents” than to taxi services.

Oh, and while we’re on the subject… in the early days of the app, Uber riders didn’t even “pay” for services. They just tapped a little button on the app to make “donations.” That couldn’t be more un-taxi-like, now could it?

The Next Taxi King

Weasel words aside, Uber moved in on New York in a big way in 2011 – and taxi drivers, fed up with crushing medallion leases, abandoned their yellow cabs and downloaded the new app. Taxi riders, tired of trying to flag down cabbies who already had a fare, did the same.

The impact on NYC’s taxi industry was dramatic. Between 2011 and 2019, NYC yellow cab revenue plunged 30%. During the same time period, the amount of rideshare vehicles in the city roughly tripled, to 120,000. And the price of the once-coveted taxi medallion plummeted, from $1.3 million to $80,000.

Somewhere in there, Gene Freidman fell behind on his taxes… his Mercedes payments… and his child support. He climbed a roof. He landed in jail. The city repossessed his medallions. And a couple of years later, in 2021, he died of a heart attack at age 50.

The Taxi King is dead… long live the Taxi King.

In 2024, Uber is the undisputed monarch of transportation in New York City, and most other big cities, too. Regulatory arbitrage paid off for the scrappy “tech” company: by the time big-city bureaucrats had even begun to wrap their heads around the rideshare firm’s unorthodox business model, Uber had eaten the cab industry like Pac-Man. Today, Uber (trading at all-time highs) has absorbed yellow-cab industries in New York City, San Francisco, Chicago, Boston, and other major American cities – listing the cabs on its app and offering to refer riders to them. By 2025, Uber has said it hopes to add every taxi in the world to its app – and the cab companies are, mostly, OK with living in the Uberverse.

In many ways, Uber’s strategy moved beyond regulatory arbitrage into the neighborhood of “regulatory entrepreneurship.” That is, the Uber developers didn’t just slip through legal loopholes – they actively sought to create a product that would change an unfavorable legal landscape. And they succeeded. Uber has so fundamentally altered the taxi industry that it’s difficult to imagine a night out on the town without it.

We’re not recommending Uber shares in this issue… but rather, a company that’s similarly used creative “regulatory entrepreneurship” to upend an existing industry – and which, like Uber, is a household name.

The Email That Launched a Travel Revolution

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.