The Quiet Wealth Compounder That Beats Berkshire Hathaway

These M&A Gods Defy All Odds and Grow, Grow, Grow

| Welcome to Porter & Co.! If you’re new here, thank you for joining us… and we look forward to getting to know you better. You can email Lance, our Customer Care Concierge, at this address, with any questions you might have about your subscription… The Big Secret on Wall Street… how to navigate our website… or anything else. You can also email our “Mailbag” address at: [email protected]. Paid subscribers can also access this issue as a PDF on the “Issues & Updates” page here. |

“I made a costly mistake.”

Warren Buffett, in his annual shareholder letter last month, admitted for the first time that his massive investments into regulated utilities and railroads have been disastrous for Berkshire Hathaway. In fact, Berkshire Hathaway Energy company is now at risk of bankruptcy because of wildfire liabilities, Buffett writes:

“the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy.”

Meanwhile, Berkshire’s railroad is a terrible business, as it has been since Buffett bought Burlington Northern Santa Fe (“BNSF”) Railway in 2009:

“BNSF must annually spend more than its depreciation charge to simply maintain its present level of business. This reality is bad for owners…”

| The Big Secret This business continuously boosts the profit margins of the companies it acquires, while also constantly upgrading the quality of its portfolio. This simple but powerful formula has created one of the greatest wealth creating vehicles of all time, even better than Berkshire Hathaway – compounding shareholder capital at more 20% per year for nearly four decades running. |

Many consider Buffett to be the greatest investor of all time. And for good reason: he has the numbers to back it up. In 2017, quantitative research firm AQR ranked the performance of Berkshire against all 186 investment funds and 1,111 U.S. stocks with a 40-year trading history. The results show that no other fund manager or single stock beats Berkshire’s record of wealth compounding over the full period.

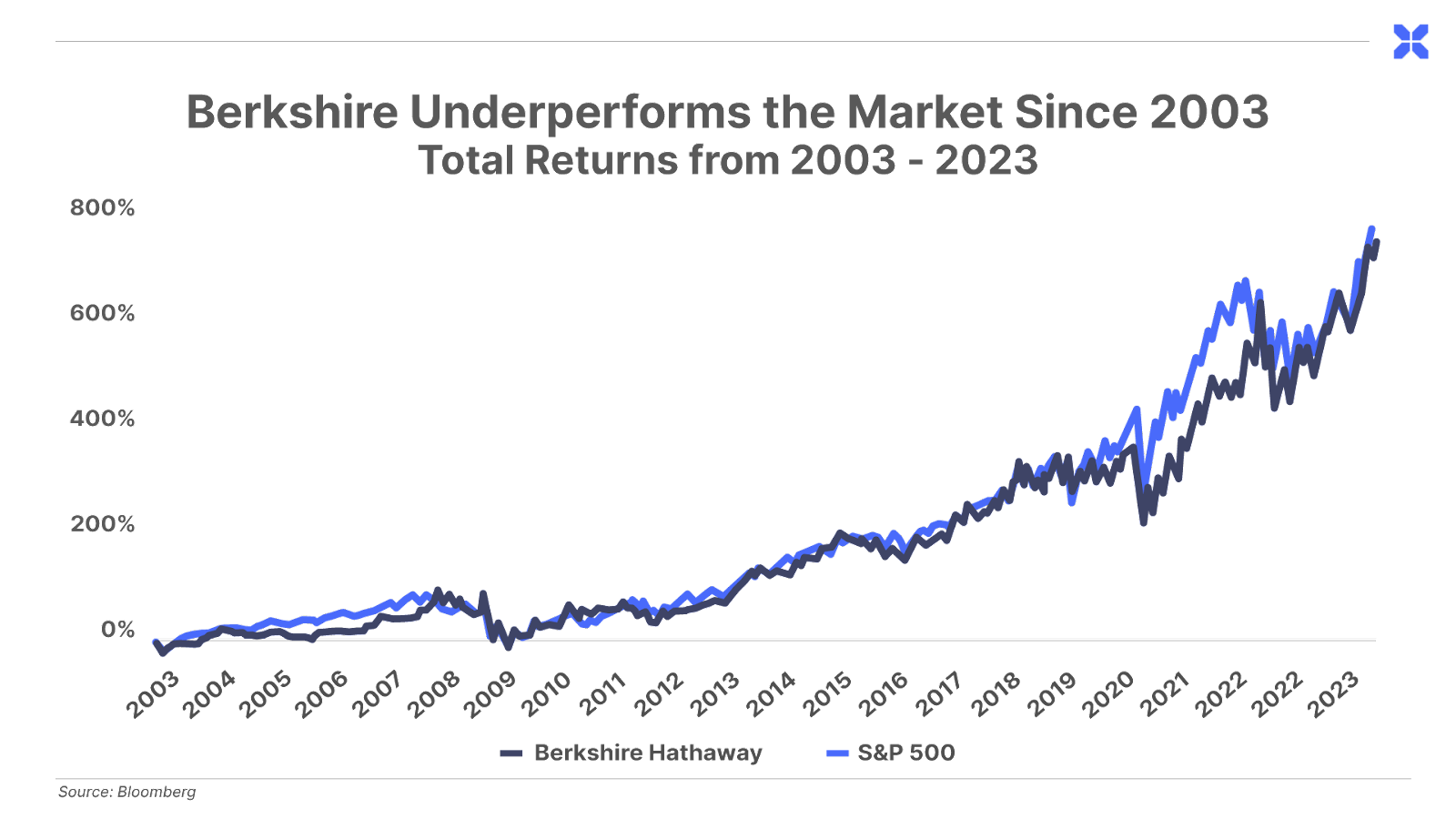

But there’s a wrinkle in this 40-year comparison… the world-beating returns Berkshire generated came from the first half of Buffett’s investing career.

If we change the starting period and analyze Berkshire Hathaway over the last 20 years, beginning in 2003, Berkshire has merely matched the returns of the S&P 500 – including several stretches of prolonged underperformance:

The Big Secret about Berkshire Hathaway is that it’s no longer one of the world’s greatest wealth compounding vehicles… and it hasn’t been for two decades.

But that’s not a secret to long-time subscribers.

On March 2, 2018, in a hugely controversial Stansberry Research Digest (“The Massive Hidden Problem at Berkshire Hathaway”), Porter explained why Buffett had lost his Midas touch.

Porter said Buffett had broken Berkshire’s “magic compounding machine” by placing a huge amount of capital into bad investments – specifically, into two highly capital-intensive, regulated businesses: MidAmerican Energy (now Berkshire Hathaway Energy) and BNSF Railway.

These investments were Berkshire’s largest ever (at the time) and these businesses were a stark departure from the style of investing that made Buffett and Berkshire great.

Starting in the late 1960s, Buffett followed a simple but incredibly powerful investing formula – one that Porter himself has advocated for the last 25 years: Focus on highly capital efficient businesses (like property-and-casualty insurance companies and consumer-product brands), that can consistently grow earnings without sinking a ton of money into capital expenditures. Ensure these companies enjoy competitive advantages so dominant and so entrenched that their future success is “inevitable.” Don’t overpay for them. And re-invest all of the capital they provide. Rinse and repeat. The strategy was a perpetual money machine.

Beating the market was virtually assured because so much of Berkshire’s investment capital was provided, for free, by its insurance companies. Thus, all its investments needed to do was be capital efficient (send dividends to Omaha) and be “inevitable.” Buffett piled into companies like American Express (AXP), Coca-Cola (KO), and McDonald’s (MCD) – businesses that simply couldn’t fail and wouldn’t require much capital to grow.

But starting in the early 2000s, Buffett strayed from this proven approach. He began investing into low-margin industries that required enormous amounts of capital. And, even worse, these businesses were also highly regulated.

As Porter wrote back in 2018:

“In short, over the past 20 years, Buffett has gone from powering his incredible compounding machine with ‘inevitables’ – the greatest businesses ever built – to powering his empire with cash-eating, regulated utilities. And the future value of these investments, assuming he can actually turn the railroad around, rely on the honesty and integrity of our elected officials. Buffett has gone from investing with the ‘inevitables” to investing at the mercy of the ‘incorrigibles.’”

And the real problem, something we don’t believe the market fully appreciates, is that rather than providing Berkshire with capital, these huge companies continue to draw ever more capital into these woefully underperforming businesses. Although Buffett paid less than $2 billion for MidAmerican Energy in 1999, he has since invested tens of billions into the low-returning utility. Berkshire Hathaway Energy is now one of the company’s largest subsidiaries, with $26 billion in revenue last year. And the company has never paid a single dime – not one penny – in dividends to Berkshire Hathaway.

Berkshire Hathaway Energy is the opposite of capital efficient. It required a total asset base of $124 billion to earn $940 million of pre-tax income in 2023, or a 3.6% pre-tax profit margin. That’s an abysmal 0.75% return on assets (before taxes). Zero-risk government bonds beat BHE’s returns on capital by a factor of more than six. Worse, BHE is a massive drain on Berkshire’s own capital, requiring $9.1 billion in expenditures last year.

The other major investment misstep – that continues to get worse – came in 2009, when Berkshire purchased BNSF Railway for $44 billion. Like BHE, BNSF has become a major drain on Berkshire’s capital. Buffett has pumped over $50 billion of capital expenditures into the railroad since 2009. By 2017 BNSF was contributing 29% of Berkshire’s earnings – and demanding ever more capital. As Porter pointed out in his now famous 2018 Digest:

“The railroad is a terrible investment. Capital expenditures continue to grow, but the railroad’s profits don’t.”

Since then, the railroad has continued consuming even more of Berkshire’s capital with little to show for it. BNSF’s capital expenditures rose from $3.2 billion in 2018 to $3.9 billion last year. Meanwhile, profits have declined, with pre-tax income falling from $6.9 billion in 2018 to $6.6 billion last year.

These investments broke Berkshire’s formula – they put sand into the “magic compounding machine.” They’ve stifled Buffett’s ability to compound wealth in the wonderful businesses that built Berkshire’s world-class track record. The end result is the subpar returns Berkshire investors have experienced over the last two decades. The once-vaunted Berkshire Hathaway has become no better than a garden-variety index fund.

Now, six years after Porter wrote that BRK was “being overwhelmed by a series of disastrous investments,” Buffett has confirmed this thesis. As we quoted above, in his shareholder letter he admitted how bad the railroad and the power investments have been. But despite admitting his mistakes, Buffett makes no mention of taking corrective action. Thus, Porter’s original prediction from 2018 remains true today: until he takes corrective action, Berkshire Hathaway investors will likely fail to outperform the S&P 500 going forward.

What should he do? It’s simple. Regulated utilities and huge infrastructure businesses like railroads, should be financed primarily with debt. They will be slow-growing businesses, but they can pay huge dividends to their owners over time – if they’re financed with debt. Berkshire, as the world’s leading property-and-casualty company, can’t hold that much debt on its balance sheet, which must remain pristine (with a AA-rating) to guarantee all of its insurance contracts.

To make Berkshire work again as the world’s best compounding machine, the capital-intensive assets (like the power company and the railroad) should be spun-off into a new, dividend-paying entity that’s financed primarily with debt. What would remain in Berkshire are the insurance companies, the equity portfolio, and the capital efficient businesses that it owns.

Until that happens, we don’t recommend buying and holding Berkshire – although, when it’s trading at a big discount to intrinsic value, it is a great trading opportunity.

What should you own instead?

We’ve found a serial acquirer – a holding company that grows primarily through acquisitions, like Berkshire. But this company, which I bet you’ve never heard of, has avoided Buffett’s mistake. Instead of downgrading the quality of its portfolio, this company has only improved the quality of its holdings over its 40-year lifespan.

This company has developed a way to systematically create efficiencies for supercharging profit margins and returns on capital, regardless of the business model or industry. Over the last four decades, this company has not only beaten the S&P 500, but it’s outperformed Berkshire Hathaway too.

Given its stellar capital allocation – including selling underperforming businesses and reinvesting into increasingly higher-quality enterprises – we’re confident this outperformance will continue.

We hope you’ll make this firm part of your portfolio because it’s better than Buffett – by far.

Better Than Buffett by Far

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care Concierge, Lance James, at 888-610-8895.