Finding A Winner On The 52-Week-Low List

In today’s Saturday Stock Screen, we’re taking a look at high-quality companies trading at discounts to their historical valuations.

Each week, here at Porter & Co. we apply our brainpower to uncover the most compelling, highest-upside investment ideas. And with this complimentary issue of the Daily Journal, we draw the curtain back to show you how we do it.

An important tool in our analytical toolbox is our stock screens, in which apply a list of criteria – relating to different financial, accounting, and performance parameters – to sift through the 3,000+ publicly traded stocks on U.S. markets. That’s how we are able to identify the tiny fraction of the universe of U.S.-listed stocks that offer the best opportunities for making money.

We often use the results from these screens as a starting point for more in-depth analysis for possible inclusion in The Big Secret On Wall Street portfolio.

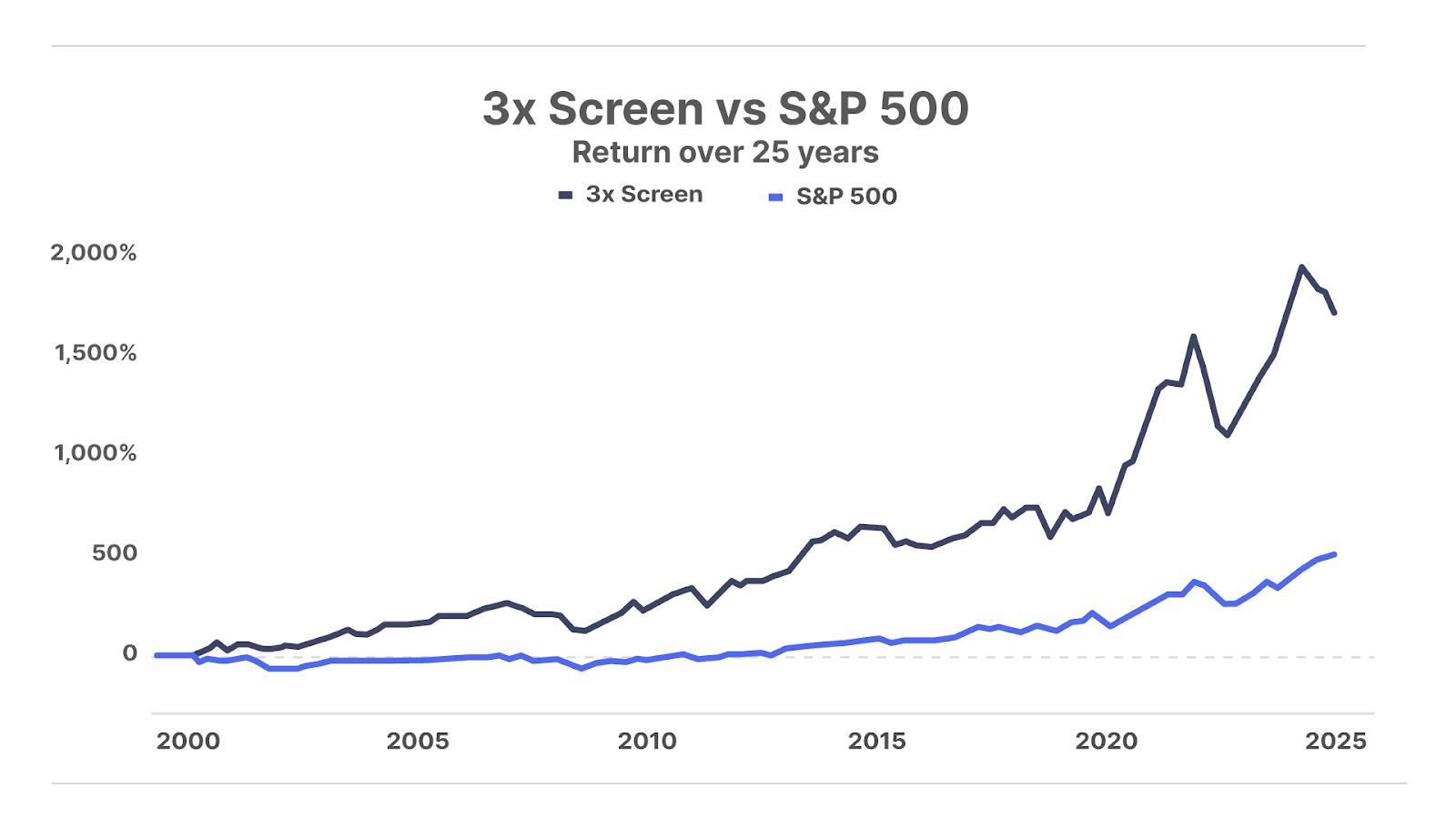

This week, we’re revisiting a stock filtering tool we call “The 3x Screen.” Over the last 25 years, buying an equally-weighted basket of stocks generated from this screen has tripled the return over the overall stock market (the S&P 500). Below we also show the names of significant stocks hitting 52-week highs and lows – a helpful list that we use to guide our analysis.

For Partner Pass members, in the Saturday Stock Screen we’ll sometimes highlight an opportunity that we found from the screen, or elsewhere, that appears particularly compelling (see below) – not as an official recommendation, but as a stock that’s on our radar. In this issue, we’ll analyze one of the stocks from the 3x Screen that has been swept up in the recent market volatility, dropping 50% from an all-time high set just seven weeks ago, to see if this price decline presents an investment opportunity.

Questions or feedback about our Saturday Stock Screen?… drop us an email at [email protected].

The 3x Screen was inspired by Porter himself, who challenged the Big Secret On Wall Street analyst team to create a filtering tool to find companies with high capital efficiency, steady revenue growth, and that trade at reasonable valuations… and to backtest the results to ensure the screening criteria selected stocks that, on average, generated market-beating gains over time.

One of the best screens we found in this search applies the following criteria:

- Return on assets (“ROA”) of at least 15% over the previous five years

- Return on equity (“ROE”) of at least 20% over the previous five years

- Free cash flow (“FCF”) margins of at least 10% over the previous five years

- Sales growth of at least 5% over the previous five years

- Price-to-earnings (“P/E”) ratio of 25 or below

- Market capitalization of at least $300 million

We performed a backtest of these criteria on a hypothetical portfolio that held an equal dollar amount of each stock on this list, and rebalanced the portfolio each quarter – to add new stocks that met the criteria, and sell stocks that no longer did. The chart below shows that the stocks selected by this screen delivered a total return of 1,783% over the last 25 years versus a 537% return in the S&P 500, for outperformance of 3.3x.

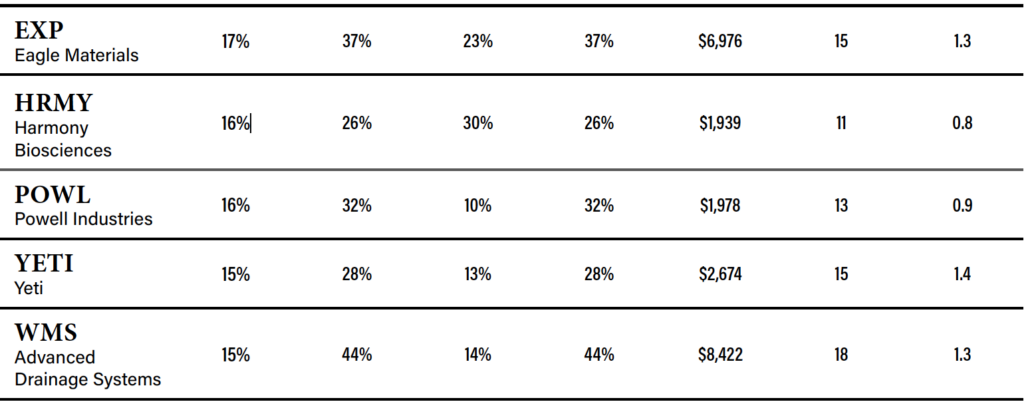

As of Thursday’s close, this screen produced the 25 stocks shown in the table below. We have displayed each of the criteria noted above along with each company and ticker symbol, as well as each stock’s beta (a measure of volatility versus the overall market). Note that beta is not used in the screening criteria, but rather to provide a reference point for noting the volatility of the stocks on the list.

Highs And Lows

Each week, we also monitor any stocks in the market making new 52-week highs. We do this because any stock on its way to generating 2x, 3x, or 10x returns will spend a lot of time making new 52-week highs along the way. Thus, the new 52-week-high list provides an opportunity to flag these potential high performers before they really break out, with a particular emphasis on lower-profile, less widely-followed stocks that might have otherwise gone unnoticed.

Notable stocks making a new 52-week high this week:

- Agnico Eagle Mines (AEM)

- Alamos Gold (AGI)

- Epsilon Energy (EPSC)

- Franco-Nevada (FNV)

- HCI Group (HCI)

- Oil-Dri Corporation (ODC)

- Pan American Silver (PAAS)

- Root (ROOT)

- VSE (VSEC)

We also monitor stocks on the new 52-week-low list. In many cases, the names on this list are there for good reason – the market is often correctly pricing in weak fundamentals. However, once in a while, a great business with excellent long-term prospects finds itself on this list due to a temporary setback. This can create the rare opportunity to buy top-shelf merchandise at bargain-basement prices.

Notable stocks making a new 52-week low last week:

- Toll Brothers (TOL)

- Bill Holdings (BILL)

- Builders FirstSource (BLDR)

- Deckers Outdoor (DECK)

- Dick’s Sporting Goods (DKS)

- Dentsply Sirona (XRAY)

- FedEx (FDX)

- Fidelity National Information Services (FIS)

- Floor & Decor (FND)

- H.B. Fuller (FUL)

- IDEX (IEX)

- Ingersoll Rand (IR)

- Novo Nordisk (NVO)

- RH (RH)

- RingCentral (RNG)

FOR PARTNERS ONLY

Turning A $3 Million Investment Into A $1.8 Billion Business

For Partner Pass members, we take a closer look below at one business that popped up on The 3X Screen this week. We’ve followed this company for the last few years as it’s a competitive threat to a favorite “forever stock” in The Big Secret portfolio. Over the last decade, the company transformed a business with $3 million in sales into a global juggernaut with $1.8 billion in revenue last year. Below, we explain why we believe both this company and our forever stock can both win in the long run, and why this business may have finally reached an attractive valuation after years of trading between 30x and 50x earnings.

(To become a Partner Pass member, contact Lance James, our Director of Customer Care, at 888-610-8895, internationally at +1 443-815-4447, or via email at [email protected].)

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care team at 888-610-8895.