The Most Critical Investment Decision Is Not What You Think

| Editor’s Note: If you fear this bull market is built on weak foundations and could collapse at any moment… watch this discussion between Porter Stansberry and TradeSmith CEO Keith Kaplan as they explain the portfolio protection steps to take now. |

George Maddox went “all in” on one stock with his retirement savings… and it almost worked out for him.

George had played by the rules and done just about everything right.

For more than 30 years, he had been a loyal, hard-working employee at what was one of America’s largest companies. He scrimped and saved, putting money into his employee stock plan every month. And by the time he retired, he owned more than 14,000 shares – a holding that was eventually worth well over $1 million.

George was set for life… or so he thought.

Unfortunately, George’s former employer was Enron.

When the now-notorious energy-trading firm went bankrupt following massive accounting fraud in 2001, its stock price cratered from more than $90 per share to just 26 cents… and George’s nest egg collapsed in value to just $3,600.

When the media caught up with him a decade later – following news that convicted ex-Enron CEO Jeffrey Skilling’s 24-year sentence would likely be reduced – the 79-year-old Maddox was living in a rundown farmhouse in East Texas and mowing pastures to help pay the bills Social Security didn’t cover. And he was still furious…

“When I get up in the morning, I’m still mad at Jeff Skilling for what he did to us. And not just me, but hundreds of families that he put in poverty.

“It would be OK with me if they would force him to live on $2,400 a month like he has forced me to live… I think he should serve [his sentence] like any other common criminal.”

If not for his predilection for women dancing in skimpy outfits, Lou Pai likely would have been in a similar position to George.

Lou was the head of Enron’s Energy Services division in Houston. And like George, he had virtually all of his (significantly larger) net worth invested in Enron stock.

But Lou had developed an obsession with Houston’s high-end strip clubs… and their dancers in particular. As best-selling author Bethany McLean noted in her excellent book on the Enron scandal, The Smartest Guys in the Room, “only two things seemed to motivate Lou Pai. Money, and a peculiar fascination with strippers.”

When Lou’s wife found out he was having an affair with one of these dancers, she filed for divorce and he was forced to sell his Enron shares – before the accounting scandal erupted in 2001. So when the company folded not long after, and the stock plunged, Lou’s $280 million net worth was safely not invested in Enron shares.

While George Maddox was mowing lawns in East Texas, Lou Pai would go on to marry that stripper and become the second largest landowner in Colorado.

What ultimately separated George and Lou – besides dumb luck – was one of the simplest yet most important concepts in investing.

This Decision Contributes to 80%-Plus of Your Returns Over Time

At Porter & Co., we provide world-class investment research for individual investors. We write about the stocks and bonds of individual companies, their current and anticipated valuations, the timing of buying and selling them, and the risk involved in owning them.

But there is one more step involved to bring it all together.

Asset allocation – how investors invest, or “allocate,” their capital across (and within) different asset classes like stocks, bonds, real estate, and commodities – is critical.

In fact, research suggests (and stories like those above confirm) that asset allocation can play a more important role in investors’ long-term success than which individual investments they own. Various studies have shown that the specific combination of assets in a portfolio explains between 80% and 94% of its total return.

However, proper asset allocation is also a highly individual matter. No one-size-fits-all allocation is appropriate for every investor in every situation.

The academic foundation of asset allocation dates to the early 1950s, when Nobel Prize-winning economist Harry Markowitz showed that investing in a combination of stocks and bonds produced better risk-adjusted returns than investing in either asset alone.

Markowitz’s research led to the development of the popular “60/40 portfolio” – consisting of a 60% allocation to stocks and a 40% allocation to bonds or fixed income – which is still widely recommended by financial advisors, more than 70 years later.

Of course, this is just one way an investor might assemble a portfolio. Another popular approach is the “100 minus your age” rule, which designates a gradually smaller percentage to stocks (and therefore, a larger percentage to bonds) as an investor grows older.

The idea here is to reduce investors’ exposure to riskier and more volatile stocks, as they move closer (and into) retirement – a time when they’re more likely to need to access their capital. This is generally an improvement over the static 60/40 portfolio, but still excludes allocations to other assets – like real estate, commodities, gold, and even Bitcoin – which can add further diversification and potentially produce better risk-adjusted returns than stocks and bonds alone.

The reality is there are virtually endless ways to invest across various asset classes depending on personal circumstances. And we simply can’t provide the kind of individualized advice that would be required to make those decisions on your behalf.

That said, there are some general guidelines that can be helpful in making these decisions. And Porter & Co. Biotech Frontiers analyst Erez Kalir recently joined Porter for an in-depth discussion on this topic.

The full 40-minute video of their conversation – which includes how Porter allocates his own personal portfolio, some of his favorite investments, and details on the extraordinary opportunities Erez sees in the biotech industry today – is available exclusively for our Partner Pass members.

(Partners who missed this video can catch up right here. And readers who are interested in learning more about becoming a Partner Pass member can contact Lance James, our customer-care concierge, or a member of his team, at [email protected], or by phone at (443) 815-4447.)

However, given the importance of this topic, we’ve decided to share some key highlights from this discussion with all Big Secret readers this week.

Balance Your “Risk Barbell”

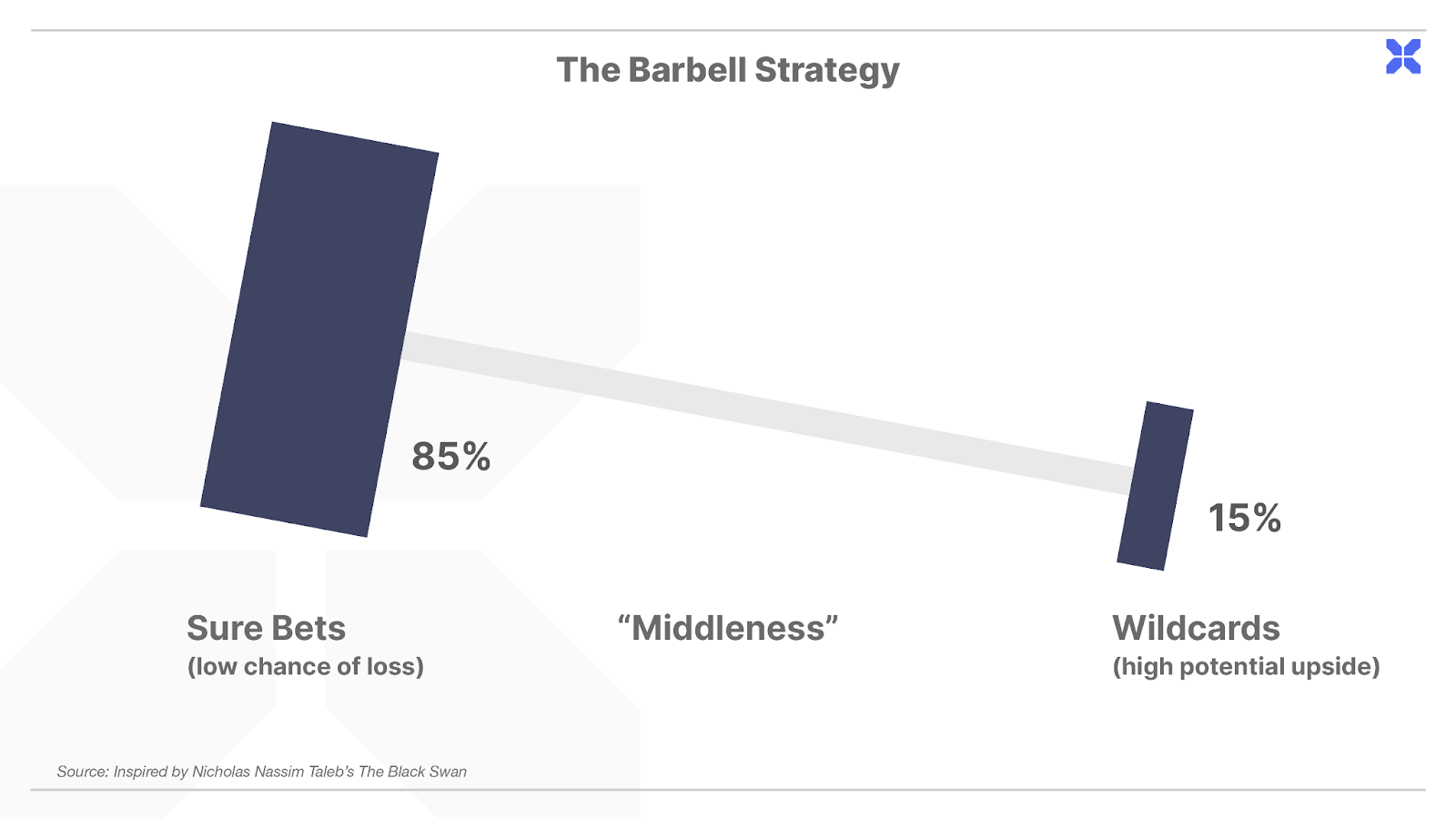

One allocation idea Porter and Erez discussed is the risk barbell.

This is the simple yet useful concept that investors should seek to balance risk across their portfolios.

If you think of an investment portfolio as a barbell, the goal is to offset any high-risk assets on one side with super-safe assets on the other, so that overall portfolio risk is balanced.

Of course, if you’ve been reading The Big Secret on Wall Street for long, you know we believe investors don’t need to take a lot of risk to earn market-beating returns over the long run.

But this rule implies that if an investor does decide to invest in riskier assets, he must take care to own super-safe and prudent investments as well. And generally, the more risk an investor takes on one side, the more conservative he should be on the other.

This idea also encourages sensible position sizing, helping to ensure an investor doesn’t invest too much capital into any one position.

Know Your Investment Horizon and Risk Tolerance

A second critical idea Porter and Erez discussed was the importance of knowing your investment horizon and risk tolerance.

One category name in The Big Secret portfolio is Forever Stocks, which are stocks you can buy and hold forever… We believe the surest way to build wealth in the market is to simply buy great businesses when they trade at good prices and never sell them – allowing the magic of compounding to multiply your capital tax-free.

However, we also understand that holding an investment for decades isn’t practical for every investor. Depending on one’s age and personal circumstances, an individual’s investment horizon may be far shorter. And this should play a significant role in their asset-allocation decisions.

For example, investors with a shorter investment horizon – if they need a specific amount of money for a home purchase or retirement, for example – would generally be well served to allocate a greater percentage of their portfolios to fixed-income investments and less to equities. Porter would go even further. As he explained…

“I would tell you that you shouldn’t own any equities in your portfolio that you are not happy to hold for at least five years. I would just say that most people’s [horizon] is just unreasonably short.

“You know, I’ve run a lot of different businesses in my life, and it takes two or three years to fix a business problem. It doesn’t disappear overnight. And so, when problems occur in companies, you have to give them time to be fixed. It would be a shame for you to go sell, say, Coca-Cola or [Hershey] because there’s a short-term market tizzy about [an issue] that sends its stock down 20%…

“So, if you have capital that you’re going to need within five years, my advice is to stick strictly with fixed income.”

(There are exceptions to this rule, such as event- or catalyst-driven equity investments – like those we focus on in Porter & Co. Activist Investor and Erez’s Biotech Frontiers service, available exclusively to Partner Pass members – which may be suitable for those with a shorter investment horizon.)

Similarly, risk tolerance should heavily factor into an investor’s allocation decisions.

For example, as Porter noted, even Warren Buffett’s Berkshire Hathaway – one of the greatest businesses in history and an extraordinarily low-risk stock – has temporarily lost 50% of its value on three separate occasions over the years before rebounding to new highs.

Investors unable to tolerate that type of volatility would be wise to minimize their equity exposure as well and focus more on lower-volatility fixed-income opportunities, such as those we focus on in Porter & Co. Distressed Investing.

Maintain a Reasonable Number of Positions

This idea should be relatively obvious – but is often overlooked.

In short, there is a limit to how many investments any investor can monitor effectively. Even full-time or professional investors only have so much time and mental bandwidth to devote to each investment position.

Yet it’s not uncommon for many investors to end up owning dozens, or even hundreds, of individual positions. This is a recipe for poor returns if not outright disaster.

Porter and Erez agree that most investors should limit the total number of individual investments to no more than 18 positions. This is a small enough number to be manageable for most investors, while still allowing for a good amount of diversification.

The one major exception to this rule would be broad-market or broad-asset exposure held through mutual funds or exchange-traded funds (“ETF”) that don’t necessarily require the same degree of oversight.

Embrace Change With “Dynamic Allocation”

Finally, Porter and Erez encouraged investors to adopt a flexible approach to investing with what Porter calls “dynamic allocation.”

This idea acknowledges that markets – like the seasons – change. Some assets, sectors, and individual companies come into favor, while others fall out of favor. Some become wildly overvalued, while others are left for dead.

Investors who are willing to occasionally “break the rules” and allocate significant portions of their portfolios to extreme value can earn incredible returns with very little risk.

As Erez pointed out, this approach was a favorite of the late Berkshire vice chair and Buffett sidekick Charlie Munger, who passed away late last year.

Investors would routinely ask Munger how to get rich in stocks, and he would consistently point to these kinds of rare opportunities – opportunities that may only come along a handful of times in an investor’s entire lifetime.

The key, Munger noted, was to have the patience to wait for these “fat pitches” to come along… and then to have the courage to “swing hard” when they inevitably arrive. (Appropriately using baseball analogies as the MLB season is just getting underway.)

Porter has previously shared two quintessential examples of this approach from the Great Financial Crisis…

First, in the fall of 2008, investors were clearly panicking. Warren Buffett wrote a letter to the New York Times explaining why it was time to buy stocks hand over fist – and was criticized on CNBC for doing so! If there has ever been a better contrarian indicator, I’ve never seen it.

Meanwhile, you could have bought shares of iconic beer maker Anheuser-Busch (BUD) for around $50 for several weeks in October and November in 2008. At the time, global brewer InBev had an all-cash deal in place to buy the stock for $70 per share. I told my [subscribers] that the situation was so safe, they should put 25% of their assets into the shares.

It was the easiest and safest way to make a lot of money that I’d ever seen. Even if the deal fell through (and it couldn’t – it was an all-cash deal at a reasonable price)… the stock was worth far more than $50 a share. In my view, there was zero downside and an almost certain $15 to $20 profit in just a few days.

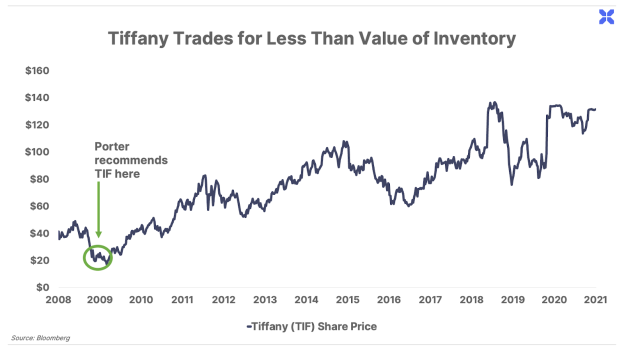

Second, a few months later – in February 2009 – shares of renowned jeweler Tiffany (TIF) were trading for less than $25. The company has large inventories of gold and precious stones. Subtracting the value of its inventory from its debt load and dividing by the shares outstanding revealed a liquidation value of around $24 per share.

In short, you could have bought Tiffany – one of the premier luxury brands in the world – for the value of its inventory. That means, you could have gotten the real estate, the brand, and all the future profits for free.

It’s at times like that when you must be willing to make large commitments.”

Putting It All Together

Lou Pai got lucky when his wife asked for a divorce, forcing him to diversify his life savings out of Enron stock. You have better options than Lou… Investors who keep these four principles in mind are likely to dramatically outperform those who blindly follow the generic allocations recommended by many financial advisors (or worse, those who don’t think about asset allocation at all).

However, if you’re interested in more hands-on guidance, we encourage you to learn more about the remarkable portfolio-management system developed by our friends at TradeSmith.

TradeSmith’s powerful yet easy-to-use software tools can help even a novice investor allocate and manage a portfolio like a pro.

Porter recently sat down with TradeSmith CEO Keith Kaplan to discuss how these tools can help you maximize the results you see from our research. Click here to learn more.

Porter & Co.

Stevenson, MD