The tiny, gas-rich country is opulent, uptight…and weak on the rule of law.

Editor’s Note:

We’re turning this week’s issue of Something You Don’t Know over to Porter & Co. publisher Kim Iskyan, for a boots-on-the-ground report from the Middle Eastern country of Qatar – which is at the crossroads of the global fossil fuels renaissance that’s one of the big, long-term, generational-wealth-producing investment themes that’s a big focus of ours at Porter & Co. You can learn more about our energy ideas here.

Qatar is also – as you might have heard – the host this month of the world’s biggest sports tournament, soccer’s (or, if you prefer, “football’s”) World Cup. And that’s where we start…

What would the inside of a prison cell in the autocratic Middle East state of Qatar look like… or: How many Ben Franklins would it take to not find out?

This was on my mind last week while I was jet skiing with my son in Doha Bay, by the capital of Qatar – a Connecticut-sized, thumb-shaped peninsula in the Persian Gulf, bordering Saudi Arabia and staring across the sea at Iran. We’d gone to Qatar to see some games – and were on the water during some downtime. And, distracted by the view of the extraordinary Doha skyline (see below) while skimming the waves, we had – we were about to be informed – strayed into the wrong waters.

Seemingly out of nowhere, a quiet sleek steel-gray patrol ship emblazoned with the words QATAR COAST GUARD on its hull sidled up to us. The two maritime police guys on the deck waved us over.

We had apparently gotten too close to the shore… or the nearby stadium… or the city… or, in any case, committed some other – the details of were lost in translation – minor seaborne sin. After addressing the standard “Where from?” query, I scooted up to the starboard of the vessel to show our inquisitors the jet ski rental agreement. They scowled at me.

It didn’t matter that we hadn’t done anything wrong – or that if in fact we had, it was the jet ski equivalent of jaywalking. We were the honey – the only humans in the bay as far as the eye could see – and the bored, self-important (the World Cup is in Qatar, after all!) Coast Guard gentlemen were the flies.

The question staring me in the face was the price we’d pay… or whether we’d get back in time to make that evening’s soccer game.

Two Things About Quirky Qatar

It was a bad moment in a very strange country – made all the more weird when under the magnifying glass of the 5 billion people who will be watching the World Cup, or the 1.2 million who will be visiting Qatar during the tournament.

I’ll get to the cost of my jet ski error. First, what makes Qatar unusual…

1. It floats on natural gas…

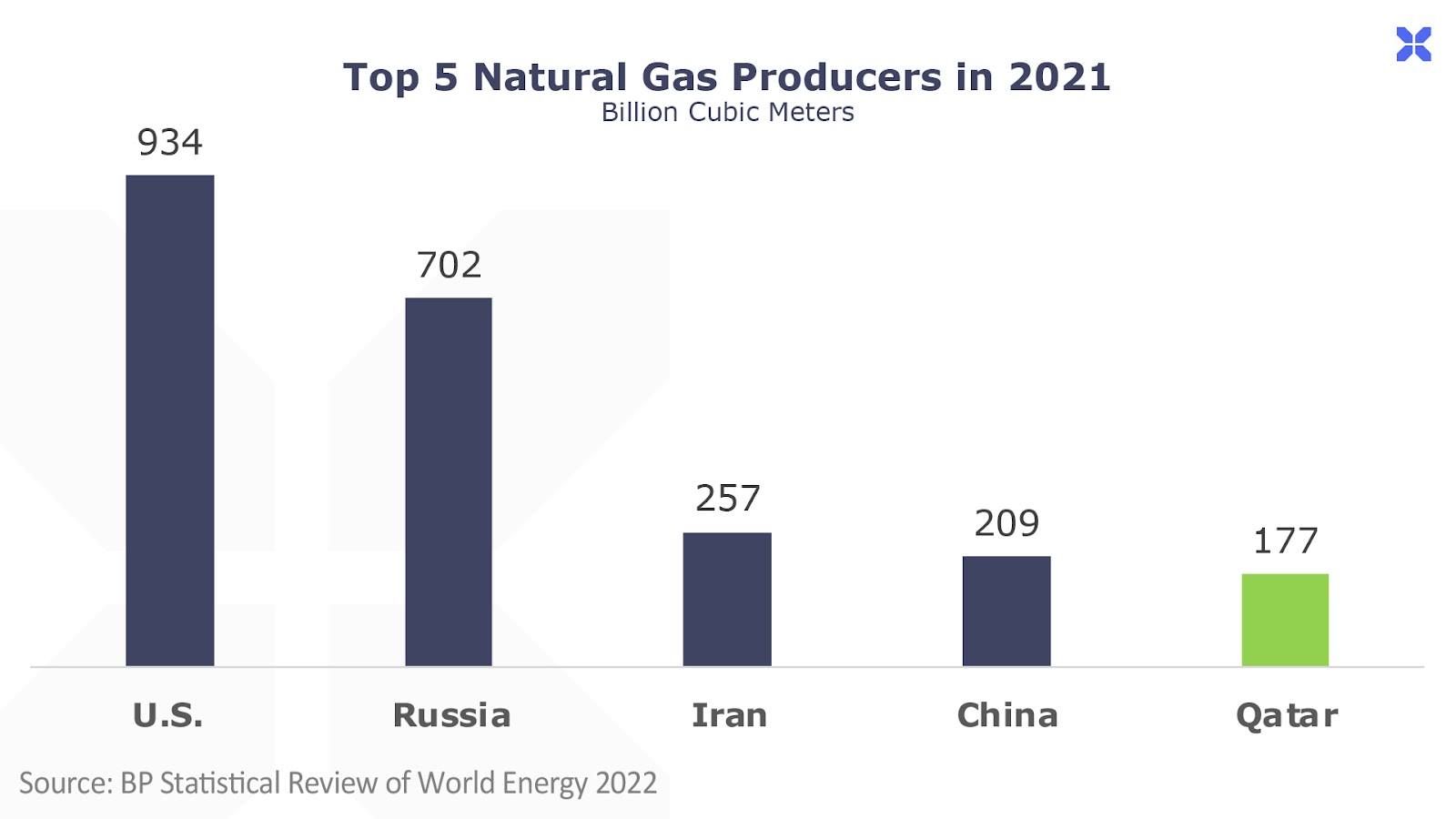

Not literally… but, literally. It’s the world’s fifth-largest producer of natural gas (the U.S. is number one). Qatar accounts for around 13% of the Earth’s natural gas reserves, trailing only Russia and Iran (the U.S. stands at number five). And Qatar is tiny – it’s one-tenth the size of Pennsylvania.

Natural gas has the scope to make a lot of Americans very rich. That’s already happened for Qatari citizens.

Tapping into its vast gas reserves transformed Qatar from a relatively poor country in the early 2000s, into one of the world’s richest economy, on a per capita basis, as we wrote in the Gods of Gas:

Beginning in 1997, Qatar began to quietly dominate the world’s global trade in LNG. Qatar shares a huge offshore natural gas field with Iran, known as the North Field. The field is an enormous resource—one of the world’s largest proven natural gas fields, with reserves of at least 896 trillion cubic feet (tcf). But Qatar didn’t begin exporting natural gas in large quantities until 1997, sending its first LNG shipment to Spain.

Qatar’s GDP grew from $9 billion annually in 1996 to over $200 billion in 2014. Qatar’s economy grew 21-fold in less than 20 years.

On the basis of economic output per capita, Qatar is one of the wealthiest countries in the world (based on purchasing power parity). With gross domestic product (GDP)/capita of around US$100,000, it trounces the U.S. ($69,000) and all but three other countries in the world (and by comparison, China’s GDP/capita stands at $12,500).

What does that money buy? Well… it bought Qatar the right to host the World Cup – via outright, proven bribery, which almost destroyed FIFA, the soccer’s international governing body. But that was pocket change compared to the cost of preparing for and staging the event, which has been estimated at upwards of $220 billion (as a share of the country’s GDP, it would be similar to the U.S. spending $25 trillion – for a sporting event.) That bought seven soccer stadiums, hotels, roads, bridges and a brand-new, world-class metro system, and a world-class infrastructure.

2. Not everyone in Qatar has money, though

You could easily spend a week in Qatar and never even interact with a real-live Qatari. That’s because only around 10% of the country’s 3 million people are Qatari citizens.

Everyone else – the people who build stadiums, clean the streets, cook food, take care of spoiled brat children, iron thobes (the ankle-length robe that’s worn throughout the region), wait tables, drive Ubers, and most everything else – are from India, Nepal, Bangladesh, the Philippines, elsewhere in Asia, and a number of countries in Africa.

Non-Qatari residents suffer under what the United Nations in 2019 labeled a “de facto caste system”. One credible analysis suggested that an extraordinary 6,500 workers died on the job preparing for the World Cup, mostly due to the extreme heat (Qatar in the summer makes Phoenix in the summer feel balmy) and terrible living conditions for migrant workers. Every single of the ten or so taxi and Uber drivers I rode with – from a veritable rainbow of developing countries – sounded like he couldn’t wait to leave Qatar.

War, What is it Good For? Qatar

The Russian invasion of Ukraine, and the subsequent sanctions on the export of Russian fossil fuels to Western Europe and elsewhere, has been a boon to Qatar. Enormous swatches of the global economy need energy, and America can’t sell it to all of them. Just within the past week – despite the intense focus of the country on the World Cup – Qatar signed a deal to supply Germany with liquefied natural gas (LNG) equivalent to around 6% of total pre-invasion German demand.

And that was just a side dish compared to a deal sealed the previous week, in which China signed a $60 billion, 27-year agreement to buy 4 million tons of LNG every year starting in 2026. And a month before that, global fossil fuel giant Shell announced that it was paying $1.5 billion for around a 9% stake in a giant Qatari gas field.

All told, Qatar’s energy exports will approach $120 billion this year, up 20% from 2021. Sure, that’s only around one-third of ExxonMobil’s total revenues for 2021… though remember: There are just 300,000 Qatari citizens.

Beware of Qataris Breaking Contracts

Back to the World Cup… and the question of beer.

Two days before the football tournament kicked off, FIFA – obviously under pressure from the Qatari government – announced that the sale of beer at World Cup stadiums would be banned completely (except in luxury suites). Previously, beer made by Budweiser – a sponsor of the tournament since 1986 — was going to be sold within the ticketed perimeter that surrounds the eight stadiums for a period before and after each game. So it went from the exclusive supplier – to not supplying anything at all.

As it’s a conservative Muslim country, Qatar isn’t big on alcohol. A single heavily regulated store in the entire country sells alcohol. Drinking in a public place could land you in prison for up to 6 months, except if you’re in one of the country’s high-end hotels with bars that cater to thirsty foreigners. And it’s not cheap: Prior to the World Cup Qatar imposed a 100% tax on alcohol imports, which made it the most expensive country on earth to sip a chilled brew – at an average of $11.26 for a 330 cl bottle. (In the U.S., it’s $4.75/bottle.)

But under the terms of its $75 million sponsorship deal, Qatar had signed the contract and agreed to allow Budweiser to serve at stadiums… until, suddenly, it didn’t. (Budweiser subsequently said it would gift its unsold beer to the winner of the soccer tournament.)

Instead, all that was available at the stadium – for the bargain price of 30 rials, or around $8 – was a can of Budweiser Zero, which has as much alcohol as tap water. And it tastes about the same, I found out during the Canada vs. Belgium game.

Where Money Flows

One of the hallmarks of a developed economy is that the rule of law matters. Contracts are made – and the parties to the deal stick to it. And if one of them doesn’t, there’s a clear and defined path to redress, through a fair and impartial judicial system.

The likes of Shell, and ConocoPhillips – which signed the Germany deal – and Sinopec (the counterparty on the China arrangement) and the other who’s-who of global energy majors involved in Qatar are accustomed to doing deals in markets where the rule of law isn’t as robust as it could be. So is Budweiser, which is owned by AB InBev, the world’s biggest brewer. And the government of Qatar didn’t blink twice to break its deal with Bud.

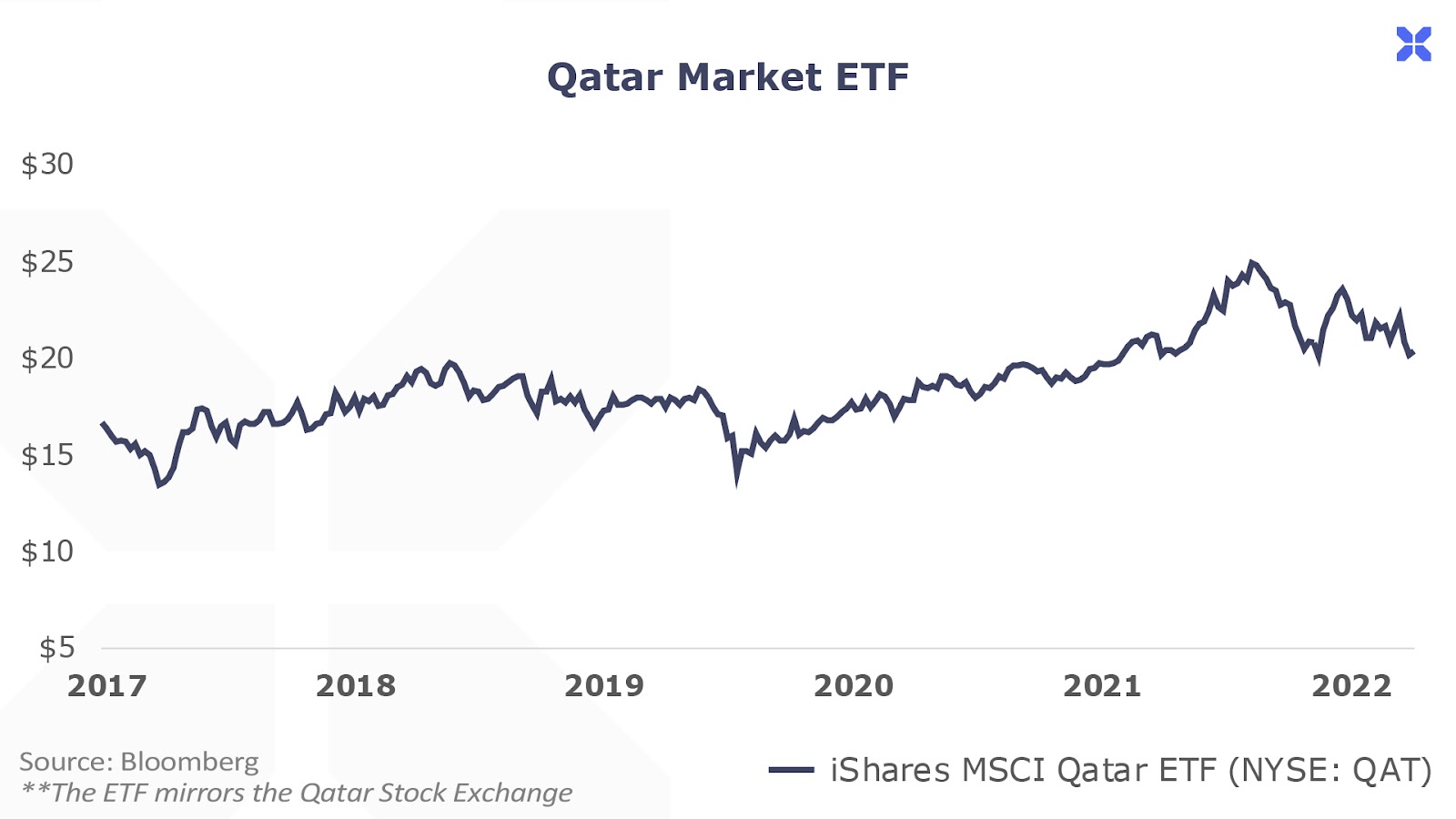

That kind of risk is reflected in asset prices, and the level of investor interest in Qatar, more broadly. The double shot of adrenaline to the Qatari economy of investment for the World Cup, along with the surge in fossil fuel prices, should – in theory – be a boon to the stock market. But the iShares MSCI Qatar ETF (NYSE: QAT), a proxy for the country’s stock market, is flat over both the year to date and the past year.

That’s better than the S&P 500 (down 15% and 12%, respectively)… but still an anemic performance. And over the past five years, QAT has appreciated 42%, compared to 52% for the S&P 500.

Of course, there are a lot of inputs to a stock market’s performance. Four of the five biggest holdings in QAT are financial companies, which are only indirect beneficiaries of rising energy prices. Qatar’s is a small stock market that slips under the radar of many investors. The market trades at a relatively low price-to-earnings ratio of 15, which is a substantial discount to a P/E of 18 for the S&P 500.

But the underperformance of Qatar’s stock market is a function of the bigger issue of the Budweiser problem: The weak rule of law.

Money flows to where it’s treated best… and – world-class infrastructure and the Architectural Digest skyline featuring some of the world’s finest architects notwithstanding – Qatar’s investment infrastructure is lacking. That’s the only way that a written-in-stone deal like Budweiser’s can be overturned at the last moment.

And over the long term, that’s a problem for Qatar… as it is for every other emerging market where the same thing can happen, no matter how slick and smooth the packaging.

My Coast Guard Run-In – And What it Means for the LNG Market

Which brings us back to my run-in with Qatar’s seaborne finest. If they were looking for a little baksheesh, they were out of luck, as I hadn’t brought any crisp Ben Franklins with me on the jet ski. After some hemming and hawing, my son and I were mercifully waved away.

If we hadn’t been, this story might have had a very different ending.

We didn’t go to jail in Qatar, but we could have, very easily. This is just one example of the lack of rule of law which will hinder the vibrancy of this country’s economic and social system. Qatar became rich in spite of itself, thanks to its vast natural gas resources.

For America, the opportunity is even greater. The U.S. not only has a larger scale of low-cost gas reserves, but it also enjoys one of the world’s strongest legal systems for exploiting this natural source of wealth. And that will create a tremendous opportunity for investors who get on the right side of this trend.

Over the next decade, billions of dollars of capital will go into infrastructure designed to transport cheap American shale gas around the globe.

In particular, I’m talking about LNG terminals and export facilities. These massive, multi-billion projects super-cool natural gas into liquid form, allowing it to be transported around the world in specially made vessels.

This infrastructure is the key that will enable America to export cheap shale gas around the globe. In fact, it’s happening as we speak…

This year, America became the single largest exporter of LNG, displacing long-time front-runner Qatar. And it’s only the start.

We’ve identified one company poised to profit from this trend. It’s currently building out one of America’s largest LNG export terminals. And it’s also secured a cheap source of input gas to feed its mammoth export facilities, making it the first fully vertically integrated LNG producer and shipper in America.

We believe this stock is poised to appreciate by over 50-fold over the next decade, as its facilities come online. If you’re a fully paid-up subscriber, you can read the full details in this issue. And if you’re not yet a subscriber, you can go here to sign up.