A Recession-Proof Business Model Up 200%

After weeks of relentless selling, the market found its footing this week following news of a potential easing in trade tensions that lifted investor sentiment. Even with the recent gains in stock prices, there are still many bargains to be found in shares of high-quality businesses trading at a discount.

In today’s Saturday Stock Screen, we’re taking a look at the latest list of potential opportunities popping up on our radar.

Each week here at Porter & Co. we apply our brainpower to uncover the most compelling, highest-upside investment ideas. And with this complimentary issue of the Daily Journal, we draw the curtain back to show you how we do it.

An important tool in our analytical toolbox is our stock screens, in which apply a list of criteria – relating to different financial, accounting, and performance parameters – to sift through the 3,000+ publicly traded stocks on U.S. markets. That’s how we’re able to identify the tiny fraction of the universe of U.S.-listed stocks that offer the best opportunities for making money.

We often use the results from these screens as a starting point for more in-depth analysis for possible inclusion in The Big Secret On Wall Street portfolio or any of our other portfolios.

For Partner Pass members, we’ll sometimes highlight an opportunity from the screen, or elsewhere, that appears particularly compelling (see below) – not as an official recommendation, but as a stock that’s on our radar.

Questions about our Saturday Stock Screen?… drop us an email at [email protected].

This week’s screen is inspired by the late Charlie Munger, Warren Buffett’s partner, who once described a dead-simple strategy for beating the market:

If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time. The problem is, few human beings have that kind of discipline.”

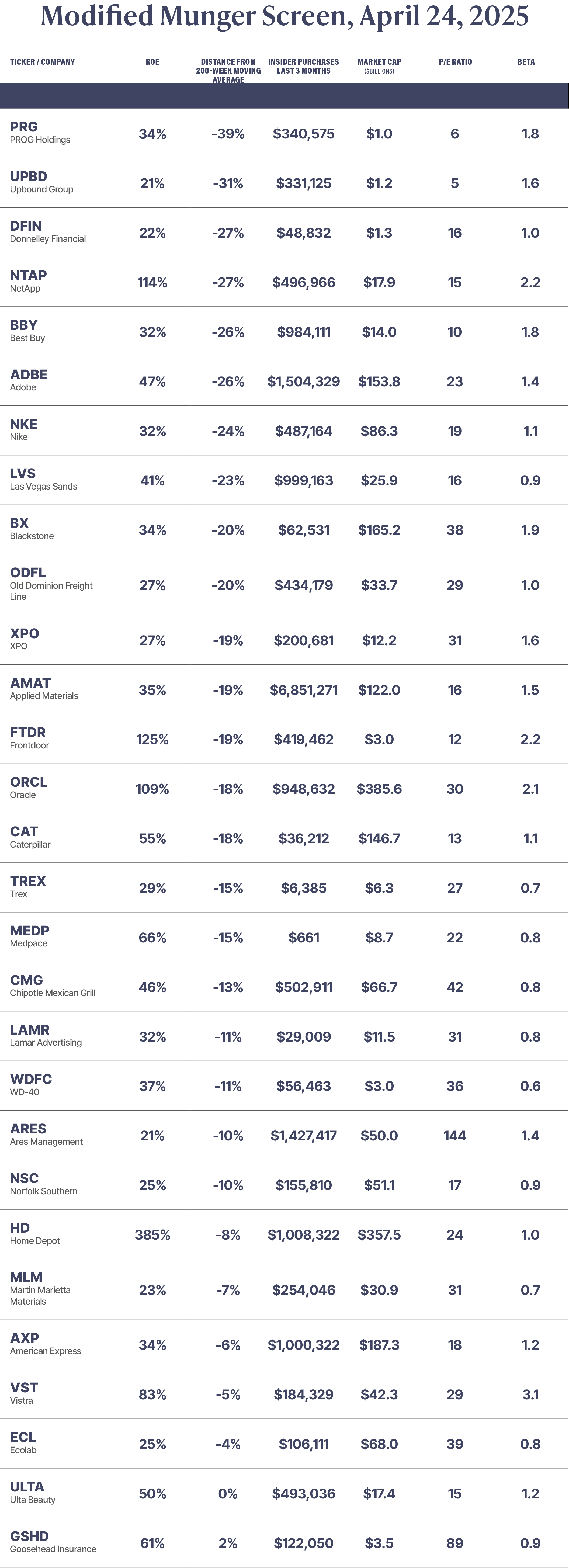

Our Modified Munger screen applies the following criteria, based on this original idea:

- Return on equity (“ROE”) exceeding 20% as a filter for high-quality businesses

- Insider purchases within the last three months, to screen for businesses where insiders see enough value in their own shares to make an open-market purchase

- Market capitalization over $1 billion to exclude micro-cap, low-liquidity stocks

- Stocks trading below the 200-week moving average, as well as those trading up to 5% above the 200-week moving average (this extra 5% lets us capture an additional set of stocks that are within 5% of trading below their 200-week moving average – a trend line that shows that average price of a stock over the last 200 weeks)

We also display each stock’s price-to-earnings (P/E) ratio, as well as its beta (a measure of volatility versus the overall market). These are not used in the screening criteria, but rather to provide a reference point for noting the valuation and volatility of the stocks on the list.

As of Thursday’s close, this screen produced the following 29 stocks:

Highs And Lows

Each week, we also monitor any stocks in the market making new 52-week highs. We do this because any stock on its way to generating 2x, 3x, or 10x returns will spend a lot of time making new 52-week highs along the way. Thus the new 52-week-high list provides an opportunity to flag these potential high performers before they really break out, with a particular emphasis on lower-profile, less widely-followed stocks that might have otherwise gone unnoticed.

Notable stocks making new 52-week highs last week:

- Agnico Eagle Mines (AEM)

- British American Tobacco (BTI)

- Coca-Cola (KO)

- Eldorado Gold (EGO)

- Franco-Nevada (FNV)

- Grindr (GRND)

- Philip Morris International (PM)

- Kinross Gold (KGC)

- Kroger (KR)

- Sandstorm Gold (SAND)

- Sprott (SII)

- Stride (LRN)

- ThredUp (TDUP)

- Triple Flag Precious Metals (TFPM)

- Weis Markets (WMK)

- Wheaton Precious Metals (WPM)

We also monitor stocks on the new 52-week-low list. In many cases, the names on this list are there for good reason – the market is often correctly pricing in their weak fundamentals. However, once in a while, a great business with excellent long-term prospects finds itself on this list due to a temporary setback. This can create the rare opportunity to buy top-shelf merchandise at bargain-basement prices.

Notable stocks making new 52-week lows last week:

- CarMax (KMX)

- Global Payments (GPN)

- Installed Building Products (IBP)

- Korn Ferry (KFY)

- Novo Nordisk (NVO)

- Robert Half (RHI)

- Spectrum Brands (SPB)

- Sphere Entertainment (SPHR)

- Sweetgreen (SG)

- UnitedHealth (UNH)

- Virtus Investment Partners (VRTS)

- Yelp (YELP)

FOR PARTNERS ONLY

An Under-The-Radar Retail Winner

For Parter Pass members, below we’re taking a closer look at one of the companies that has routinely shown up on the 52-week high list this year. This online retail marketplace has all the hallmarks of the ultimate crisis-proof business model, and the market seems to agree. The shares have shrugged off the market turbulence and concerns about a global trade war, gaining nearly 200% year to date. But given its small market capitalization of just under $500 million, this business has largely flown under Wall Street’s radar.

(To become a Partner Pass member, contact Lance James, our Director of Customer Care, at 888-610-8895, internationally at +1 443-815-4447, or via email at [email protected].)

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care team at 888-610-8895.