Issue #24, Volume #1

Financial Repression, Inflation, Malinvestment, And War

Three Things You Need To Know Now:

1. Look out below! After the close of trading on October 30, Microsoft shares fell 6%, marking the sharpest one-day decline in two years. Meta shares dropped 4% as the company’s Q4 revenue guidance came in below expectations. Apple is now down almost 5% in five days which disappointed investors banking on an “upgrade supercycle” from the company’s new artificial-intelligence (“AI”)-enabled iPhone 16 model. Apple guided for a low-to-mid single-digit increase in revenue. Record high valuations + higher inflation + weaker results = very poor equity returns going forward. If this trend of future earnings downgrades continues, investors paying a near-record 26x earnings for the S&P 500 (see below) are going to be saying “look out below” for the next several quarters.

2. Higher inflation with a weak economy? Welcome to the 1970s. October’s Job Openings and Labor Turnover Survey showed that 12,000 new jobs were created during the month, compared to 223,000 in September. Market expectations were for about 100,000 new jobs. Monthly job creation peaked at 900,000 in February 2022, and has fallen fairly steadily since then. If you want to understand more about what’s coming for the economy, please watch this conversation I had with economist Peter St Onge. In the presentation I reveal the #1 stock to insulate yourself from what’s coming next, regardless of who wins the election.

3. Boeing goes bust. A resounding 88% of participating readers agree with our call that a government bailout is in the plane maker’s future. And there’s more bad news: On Monday, the 33,000 Boeing factory workers currently on strike will hold a key vote on whether they will accept the company’s latest employment contract offer. Boeing has sweetened the deal with the promise of a 38% pay raise over four years (up from its original offer of 25%), plus a $12,000 one-time bonus for union members (up from an original $7,000 offer). Currently Boeing is losing $100 million each day because of this strike.

And there’s this…

A massive sign of a top in the equity markets. As I pointed out on X (Twitter), the S&P 500 is trading at the highest valuations any of us have ever seen in our lifetimes – higher even than the 2000-era bubble. I know it’s hard to remember, but you want to buy low and sell high. For some reason, most investors always do the opposite. Don’t be one of them.

Not a good sign for future returns. https://t.co/bmNEaozKhc

— Porter Stansberry (@porterstansb) October 30, 2024

Beware The Four Horsemen of America’s Coming Financial Apocalypse

- Financial Repression

- Inflation

- Malinvestment

- War

America faces its gravest financial situation, of all time.

Not that you’d know it by looking at the markets. Stocks are at all-time highs. Gold is soaring. Employment remains strong. And, even though inflation remains above 3%, the Federal Reserve is cutting interest rates…

Wait, what? Why is the Fed cutting rates when inflation is high and the market is soaring?

Welcome to financial repression.

Let me show you what they don’t want you to know.

The last time the U.S. government was in this much debt was just after World War II. Rather than cutting spending and paying down the debt, between 1950 and 1980, it launched the largest peacetime military buildup in history, spending almost 20% of GDP amassing huge supplies of nuclear weapons and starting proxy wars all over the world.

You’ll recall this was because of the “domino theory,” the idea that once communism spread far enough, it would overwhelm America. Nobody bothered to ask how many aircraft carriers the Soviets had (none). Or how many of their tanks actually worked (not many). Or whether it could even feed its own army (it couldn’t). But, never let the facts stand in the way of government spending!

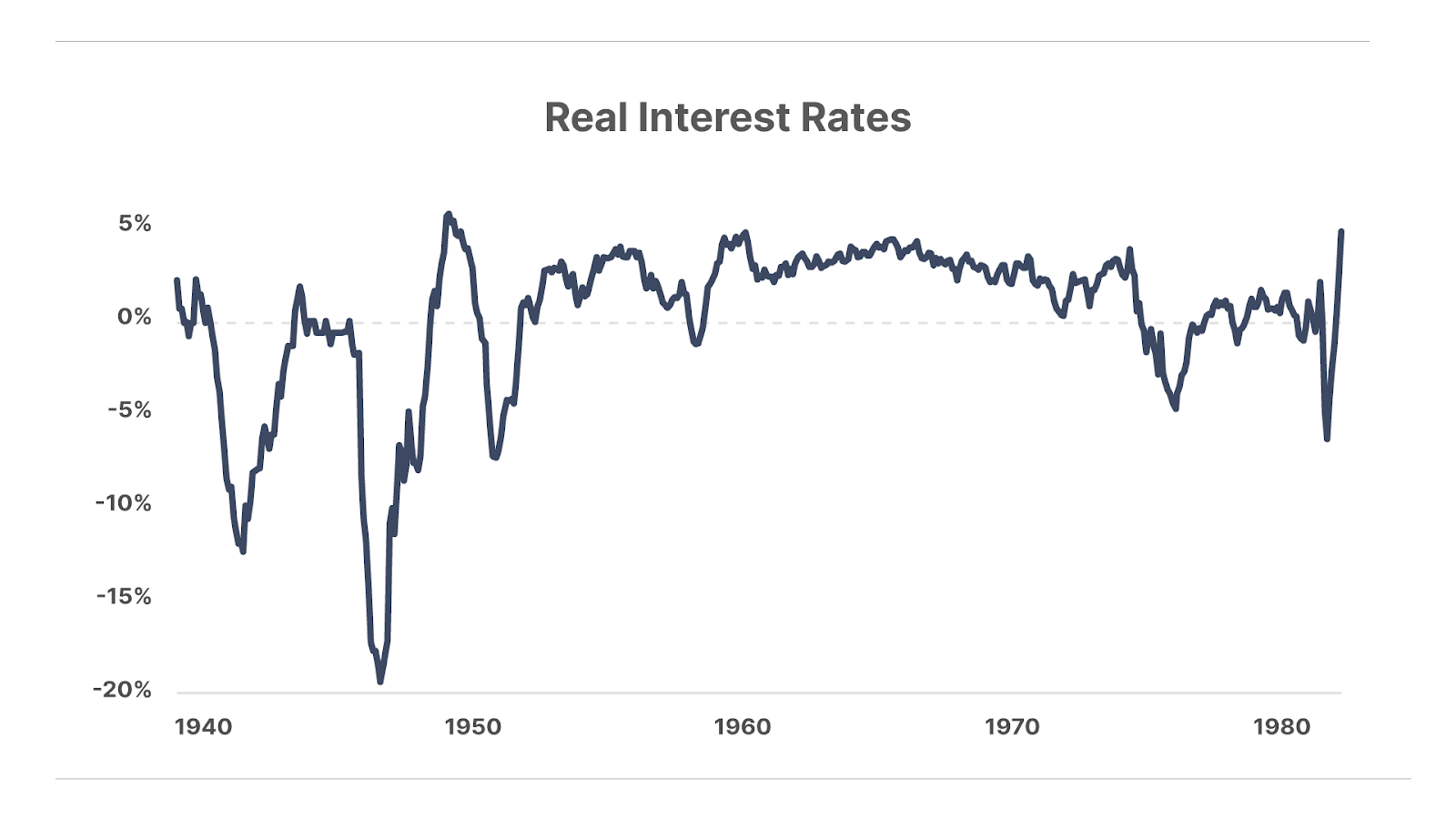

By the 1970s, the only way to sustain the spending was by having the Federal Reserve cut interest rates to well below the inflation rate, leading to a massive decline in purchasing power.

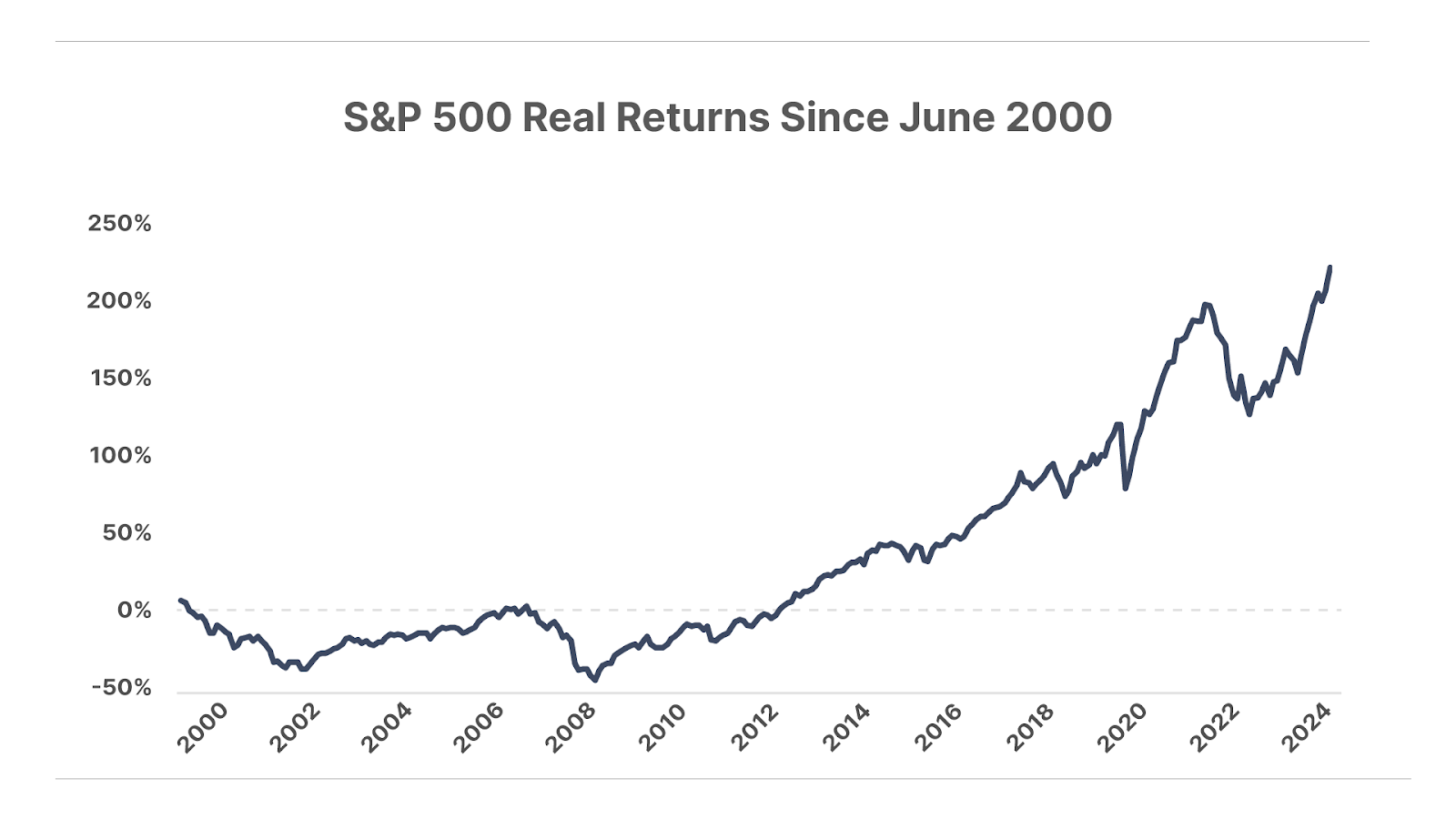

Here’s a fun fact: In real terms – that is, after factoring in the impact of inflation – the stock market produced zero return between 1966 and November 1982. That’s a 17-year period when buying and holding the S&P 500 didn’t make you any richer. (In fairness, it did protect you from total inflation of nearly 200% over that period.)

You might say… “Oh well, Porter, that won’t happen anymore – I mean, the 1970s were a real aberration.”

Nope. In fact, if you bought stocks in June 2000, you wouldn’t have earned a real return until April 2013.

And the same thing is about to happen again.

A combination of very expensive stocks and high inflation is about the worst mix for investors that exists. And, right now, our government has never been spending more and has never been more in debt. Government in the U.S. is completely out of control, spending almost 40% of GDP, with more than 75% of that going directly to transfer payments. America isn’t at risk of being a communist nation. We’ve already become one.

And, like all collectivist systems, ours is failing too. There is no way we can afford to spend $1 trillion a year in interest to finance our deficits, which are growing faster than GDP. And so, no matter how high inflation goes, the Fed will not increase interest rates. There is no way the government can afford to pay a real rate of interest on its debt.

Just do the math. By the end of 2025, no matter who is elected, we will owe $40 trillion. With inflation at 4%, that means we’d have to offer something like 5%, at a minimum, on these debts to finance them legitimately. That’s $2 trillion a year in interest.

Keep in mind, the total amount of income tax collected every year is $2.3 trillion.

Our government is bankrupt. And the only way they can keep the lights on is by printing trillions and trillions more. Which is what they are going to do.

That’s why this week even though the big tech stocks delivered great earnings (though less than enthusiastic outlooks), their share prices all got hit.

The reality is, financial repression is well under way. Gold is up 33% this year. The S&P 500 is up 19%.

So, even if you think you’re getting rich in stocks, you’re not: you’re not even keeping pace with inflation.

Here’s another sign of the apocalypse: malinvestment. These are huge distortions in our economy where massive amounts of otherwise-productive capital get sidelined or wasted to simply avoid taxes or inflation. These factors make the economy massively less productive, a primary reason collectivist economies don’t work.

The best-performing investment in the world over the last four years is MicroStrategy (MSTR), up 1,217%, beating out even Nvidia (NVDA), which is up 814%.

MicroStrategy’s Michael Saylor’s entire business strategy is simply shorting the dollar (borrowing dollars at fixed interest rates) and buying Bitcoin.

Simple question: How well is the economy functioning when the very highest rewards are accruing to the entrepreneur who is best at shorting the world’s reserve currency?

This is a fucking disaster. And every American should be out in the streets demanding the heads of our entire political class.

That will happen. And much sooner than you think too. The problem is, the media is sure to find a way to point people’s anger at some scapegoat instead of at the people who are actually responsible. Hopefully that isn’t you.

To succeed over the next decade or longer in the financial markets, you must find a way to escape the ongoing financial repression, as our government will default on its debts by greatly increasing the rate of inflation.

The impact of this default will be horrific on the poor and the middle class.

When money is undermined, the social contract between people and institutions is broken. You will see, all over the major economies of the West, soaring amounts of political and cultural unrest. You’ll see more strikes. You’ll see more gambling. You’ll see more prostitution, and more “weirdness.” (All of these things, by the way, happened 100 years ago in Germany, in the inflationary period under the Weimar Republic.)

You’ll see incredible amounts of violence. There will be wars in places like Toronto, that have only known peace for centuries. And the war in Europe will grow. Another world war is inevitable. Let’s hope it doesn’t become nuclear.

Maybe someday people will finally learn that spending money on government can only lead to inflation and violence. But that day isn’t here yet.

And that tuition is about to be paid.

Poll: Monthly real interest rates (that is, taking into account inflation) have been negative for some part of 23 of the past 40 years… and for 26 of the 40 years between 1940 and 1980, as shown below.

Good investing,

Porter Stansberry

Stevenson, MD

P.S. A surefire way to make money: Invest in developing technology – in the right companies – early.

Say… Bitcoin in 2015, Nvidia in 2016, and AMD in 2017.

And that’s what my friend Jeff Brown did: He recommended each of these to his readers well before anyone was talking about them

Since 2015 – when Jeff recommended it – Bitcoin is up 26,613%.

Nvidia… recommended in 2016, up 10,422%.

And AMD is up 1,229% since 2017.

Jeff is one of the best stock pickers I’ve ever worked with. And he has an uncanny ability to tell the future about the direction that technology is moving in, and who will be the winners.

In Tuesday’s Porter & Co. Spotlight, Jeff shared his report on a company he says “could become the market’s next AI darling.”

As always for our Spotlights, this is research that’s typically only available to Jeff Brown’s paying subscribers, but is free for the Porter & Co. family… Check it out here.

And if you want to find out more about Jeff’s research (at a substantial discount to his normal prices) and get his future recommendations, go here now.

Mailbag

Let me know what you think, by emailing me at [email protected]. I’d love to hear from you!

Today’s letter comes from J.E.A., who writes:

Dear Mr. Stansbery [sic],

I’m writing to express my concerns about your recent information and offerings. While I understand the anxiety and uncertainty many people are feeling about the current economic climate, I’m struggling to reconcile the high cost of your services with the dire financial situation of many Americans.

I’ve been following your work for some time, and I appreciate your insights into potential economic challenges. However, the significant fee for accessing your premium content seems excessive, especially considering the widespread financial hardship. It’s difficult to justify such a cost, particularly when many people are struggling to make ends meet.

I’m hoping you can provide more clarity on the following:

– The justification for the high fee: What specific, unique value does your premium service offer that cannot be found through other, more affordable sources?

– Your commitment to helping those in need: Given the current economic crisis, how are you ensuring that your services are accessible to a broader range of people, especially those who may be struggling financially?

I believe that financial literacy and preparedness are crucial, but they should be accessible to everyone, not just those who can afford high-priced subscriptions. Perhaps you could consider offering more affordable options or providing more free, valuable content to help people navigate these challenging times.

Thank you for your time and consideration. I look forward to your response.

Porter’s comment: We’re in the business of making rich people richer. We acknowledge that that might, at first, sound crass. But we think it’s important that the rich have at least one talented group on their side. Look at what the giant mass of mediocrity gets: government benefits, like healthcare, unemployment, disability, etc. Free education. Free roads. Unlimited opportunities like scholarships, internships, well-paying jobs. And they are the overwhelming beneficiaries of the world’s most corrupt retirement scheme. Meanwhile, nobody ever says “thank you” to the people who provide all of the capital, who pay all of the ridiculously progressive taxes, and who have invented all of the modern world’s most valuable new technologies. Instead, every day, the media pushes more and more propaganda that the rich are to blame for society’s ills because they don’t pay enough (only 95% of all taxes), or they are the wrong color (anti-racist means anti-white), or the wrong sex (men earn more), or believe in the wrong values (merit). The one thing we’ve noticed though, is you don’t see anyone clamoring to live around poor people. Wherever you find rich people living, that’s where everyone wants to move. Curious, isn’t it?