Investors Suddenly Denied Access to Their Own Funds…

The day after Slava was sent to the funny farm, his wife marched into our skyscraper office in downtown Moscow – and pulled an Al Haig.

Al Haig was Secretary of State when U.S. President Ronald Reagan was felled by an assassin’s bullet on March 30, 1981. Haig – who apparently hadn’t received the memo about how it’s the vice president who takes over when the president is incapacitated – infamously declared on live television, “I am in control here,” thereby causing coronaries in scores of constitutional scholars across the country.

Slava was the guy who headed up the holding company of the $125 million hedge fund I (Kim Iskyan) was managing in Moscow, Russia in the autumn of 2008. While it was a terrible time to hold anything but cash everywhere, Russia – where the stock market fell 80% (the S&P 500 was down around 55%), and the economy contracted by 8% in 2009 compared with a 2.6% decline in the U.S. economy – was exotically toxic. And though my fund was outperforming the market by a wide margin, that’s meager consolation when you’ve lost more than $50 million of other people’s money.

During the commodities boom of the 2000s – of which Russia was a huge beneficiary – Slava had levered himself up to his eyeballs to buy Russian stocks and Moscow real estate. And as the cycle turned, by September 2008 his investment portfolio was decimated, and his hedge fund company was drowning, not waving. Unaccustomed to these kinds of setbacks, Slava was frozen in fear, couldn’t sleep, stopped eating, and had generally lost his marbles.

At least that’s what his wife – who I’d met just once before, at a company dinner – told us. After she’d had Slava admitted to a psychiatric hospital “for his own good,” she showed up in the middle of another down-big day, and informed our small team that she was the new sheriff in town.

The Gates Go Down

And the first thing she wanted to do was the hedge-fund equivalent of hara-kiri… self-immolation… jumping off the side of a building: Gate the fund.

That’s when a fund management company freezes investors’ money, and doesn’t allow them to redeem their shares… sometimes for a little while, and sometimes for years.. It’s intended to prevent a run on the fund, which would force the portfolio manager to liquidate the fund’s holdings – if that’s even an option – at fire-sale prices.

If one fund turns into the financial equivalent of a roach motel, it’s a problem. If it happens with a lot of funds, a case of the flu turns into an epidemic that signals something far worse is going on.

And that’s happening now.

The Secret Behind BREIT’s Outlandish Performance

The Blackstone Real Estate Investment Trust (BREIT) is a $69 billion private real estate investment trust (REIT). Launched in 2017, it was a magnet for institutional investors looking to earn a 4% yield – a king’s ransom in an era of 0% interest rates – while also allowing for capital appreciation from the 5,000 real estate properties held by the fund.

Most REITs are publicly traded and offer daily liquidity – which means that an investor can sell their shares, and receive cash in exchange immediately. As a private fund, redeeming shares in BREIT is more involved. Buried in fine print, the prospectus specifies that redemptions are capped at 2% of total assets per month, and 5% per quarter.

When prices are rising and the economy is booming and borrowing money is free, redemptions aren’t a problem… because no one wants to sell.

But as interest rates have been rising, that dynamic has been changing. And earlier this month, redemption requests hit the limit – and BREIT announced that it was gating the fund. Anyone who wanted their cash back would have to wait. Shares of Blackstone – a big asset manager with around $880 billion in assets under management – collapsed 9% after the announcement.

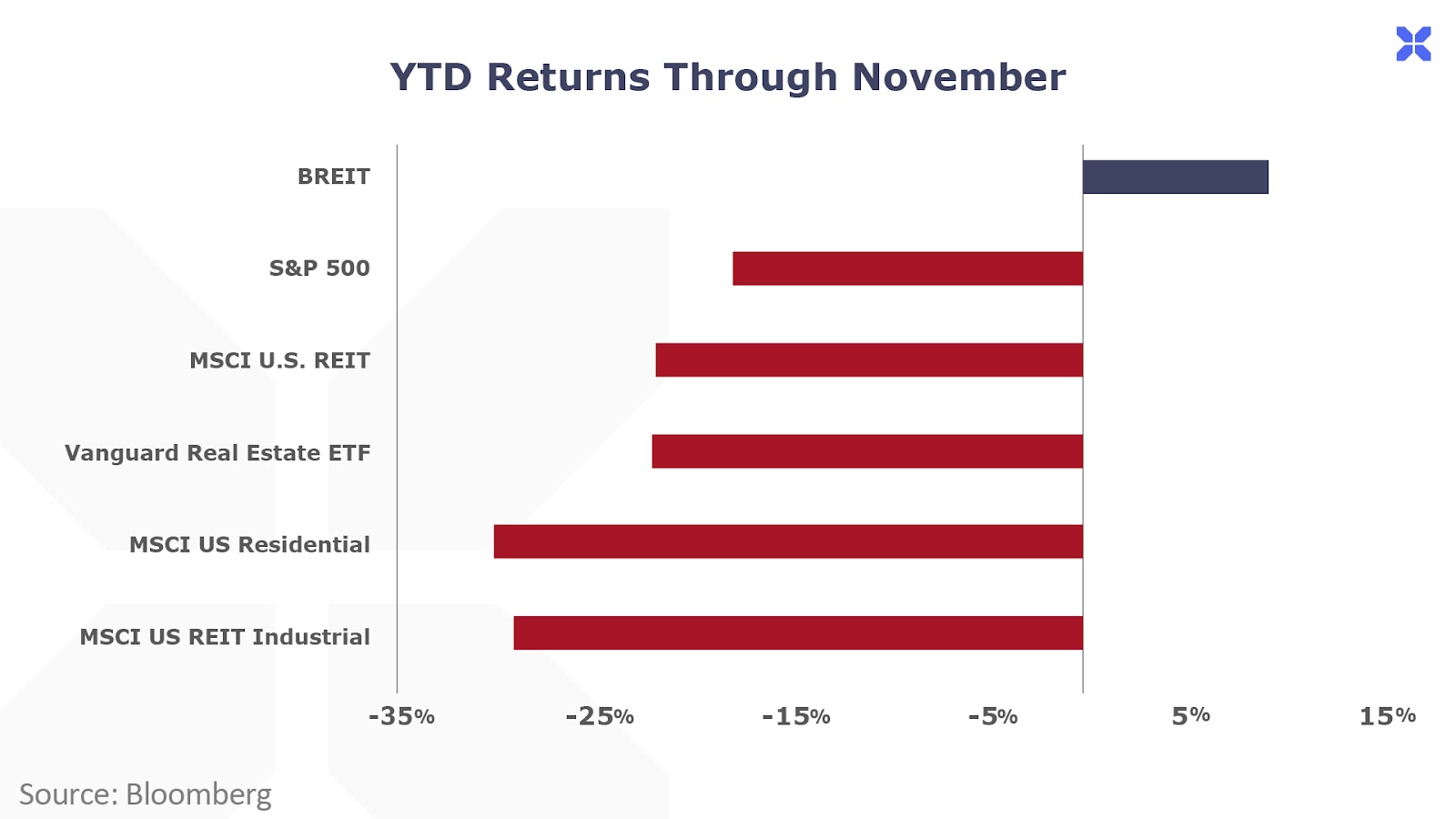

One possible – seemingly counterintuitive – reason that investors turned wary of BREIT: Its extraordinary returns. Despite drawing in more than $25 billion in the twelve months ended September 30 – an impossible sum of cash to put to work effectively by buying real estate, one of the more cumbersome assets to buy and sell – BREIT was up 7.8% in 2022 as of end-November. That compares to a 26.9% decline in the MSCI US REIT index, and a 27.1% drop in the Vanguard Real Estate ETF. (The S&P 500 fell 18.7% over the period.)

How did BREIT generate such incredible returns? Simple: Leverage of around 50%… and derivatives. As the Wall Street Journal explained…

“Over the past year, [BREIT] bought interest-rate hedges with a notional value of $30.9 billion. That was an astute and timely bet that rates would rise, producing an unrealized gain of $5.1 billion. That means roughly 8 percentage points of the fund’s 9.3% return this year—more than 80% of its total performance—has come from its derivatives trading rather than its property portfolio.”

In other words… BREIT is a hedge fund disguised as a real estate investment vehicle. And last month, some investors got spooked. Or, they figured that it was time to take profits when their real estate fund outperformed the index by an absurd 3,500 basis points over an 11-month period.

But now, they’re stuck until BREIT re-opens… and it won’t be pretty when it does. Investors in BREIT are likely lining up to get their money back, and the fund will struggle to figure out how to handle selling thousands of properties (likely at lower valuations than most recently recorded) to give investors back their cash.

Days after BREIT gated, the second-largest private real estate investment trust, $14 billion Starwood Real Estate Income Trust (SREIT), announced it would similarly limit redemptions after – as happened with BREIT – investor withdrawals exceeded monthly limits.

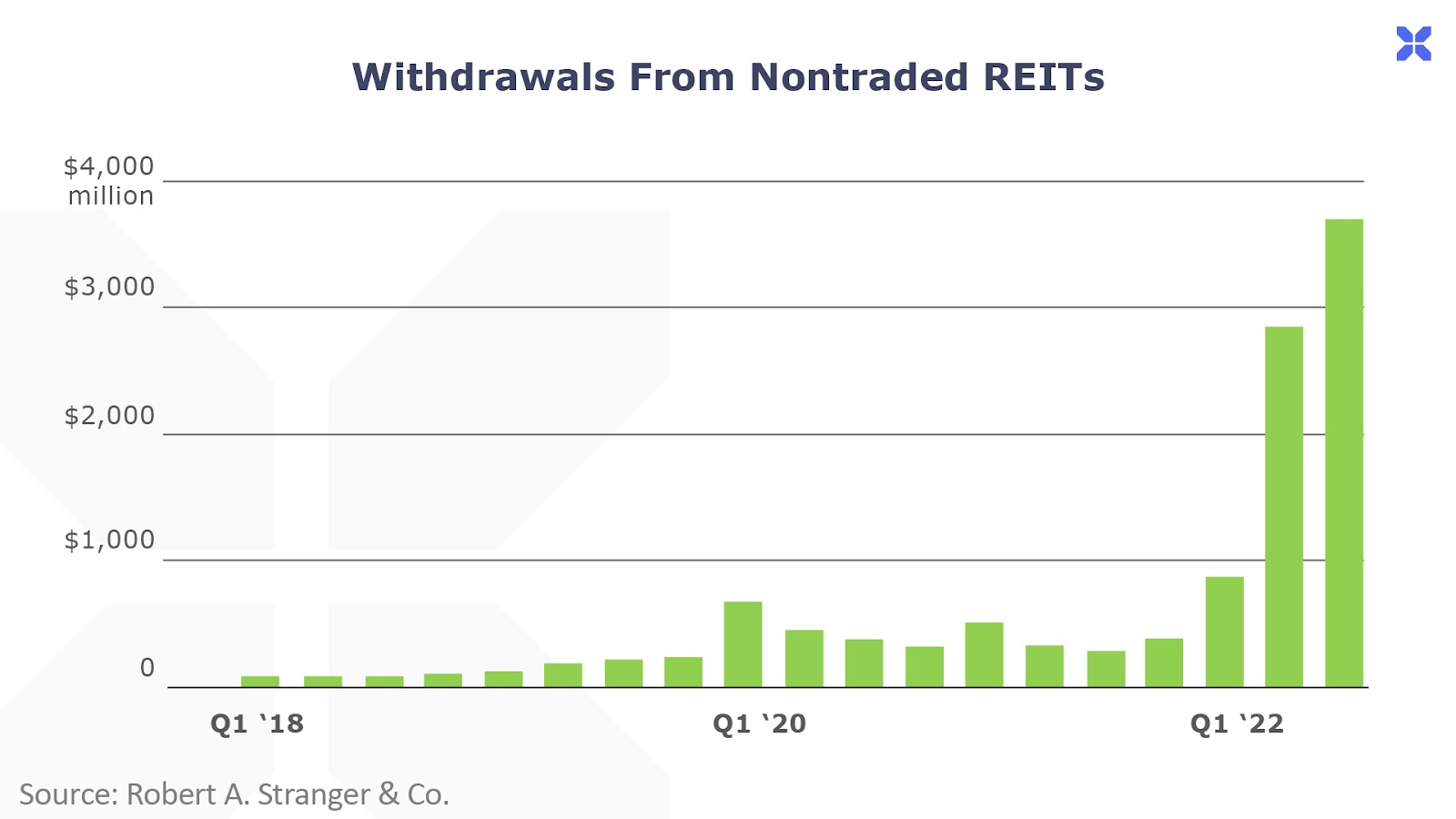

Overall, private REITs like BREIT and SREIT saw $3.7 billion in redemptions in the third quarter, a 12x increase over the past year.

More alarmingly, what’s happening isn’t limited to real estate. On November 15, Bloomberg reported that billionaire investor Steven Cohen was considering capping redemptions on his $26 billion dollar hedge fund, Point 72. Several other high-profile funds recently instituted longer lock-ups on investor capital, including Citadel and Millennium Management, which each manage more than $50 billion in assets. Investors now must wait five years to pull cash from Millennium and four years to redeem from Citadel.

When funds are gated, it usually means bad things ahead…

“When you see prominent institutions telling people they can’t take their money out, that’s never a happy thing” – Former U.S. Treasury Secretary Larry Summers on Blackstone’s $69 billion real estate fund limiting redemptions

— Porter & Company (@Porter_and_Co) December 15, 2022

In 2008-2009, many funds – like the one I was managing in Moscow – were gated… in December 2008, a record $100 billion in redemption requests hit the hedge fund industry.

While redemptions haven’t reached that level of panic yet… the trend has started. In October, investors pulled $14 billion from hedge funds – the highest level since 2016, and the fifth consecutive month of outflows.

Why? Two words: cheap money.

Easy Money Out… Distress In

After the 2008-2009 global economic crisis, in an effort to prevent a replay, lawmakers beefed up banking regulations and cracked down on the irresponsible lending standards that inflated the housing bubble.

But trying to regulate away the next crisis is like playing Whac-A-Mole: The next crisis is going to pop up in a brand-new hole. The leverage that built up in the banking sector during the housing bubble found an alternative home in private investment vehicles, like BREIT. And now we’re seeing the consequence of that, with the evolving disaster of BREIT and SREIT and – as we’ve written before – other dire challenges facing the global economy now.

The underlying issue – the cause of myriad financial disasters ever since the people of Mesopotamia created the shekel, the first known form of currency – isn’t bad regulation… or greed… or mortgage brokers looking to make a quick buck. It’s debt.

In the wake of the global economic crisis, the Federal Reserve created nearly $8 trillion in new credit, while keeping interest rates pinned at zero. That allowed for the likes of BREIT to borrow like there was no tomorrow. And it inspired investors searching for yield to pour money into the likes of BREIT like there was no tomorrow.

But now, spiking interest rates are creating deep distress for an economy built upon the fragile foundation of cheap money.

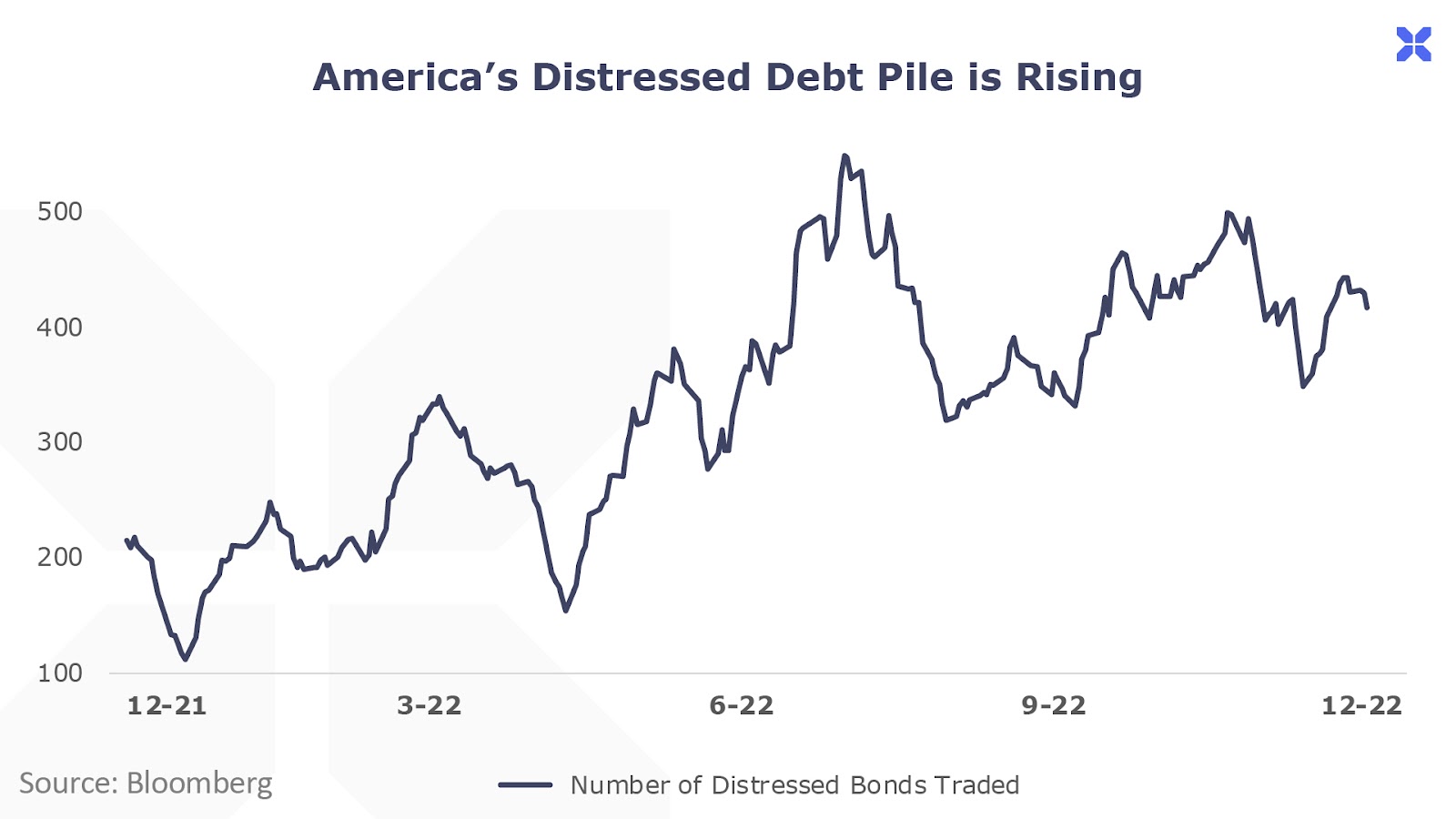

Another sign: The number of corporate bonds that are characterized as distressed in U.S. markets has exploded nearly four-fold since the end of last year… from 112 in late 2021, to 417 today.

Also a reason for concern: vehicles that provide loans to midsize companies and for leveraged buyouts. On December 6, Blackstone’s $50 billion private credit fund – created just two years ago – capped redemptions… in other words, that fund is now also gated, after investors pulled out 5% of assets in the three months ended November 30.

Private credit is a shadowy but enormous asset class that’s grown from just $41 billion in 2000, to an extraordinary $1.22 trillion as of the end of 2021.

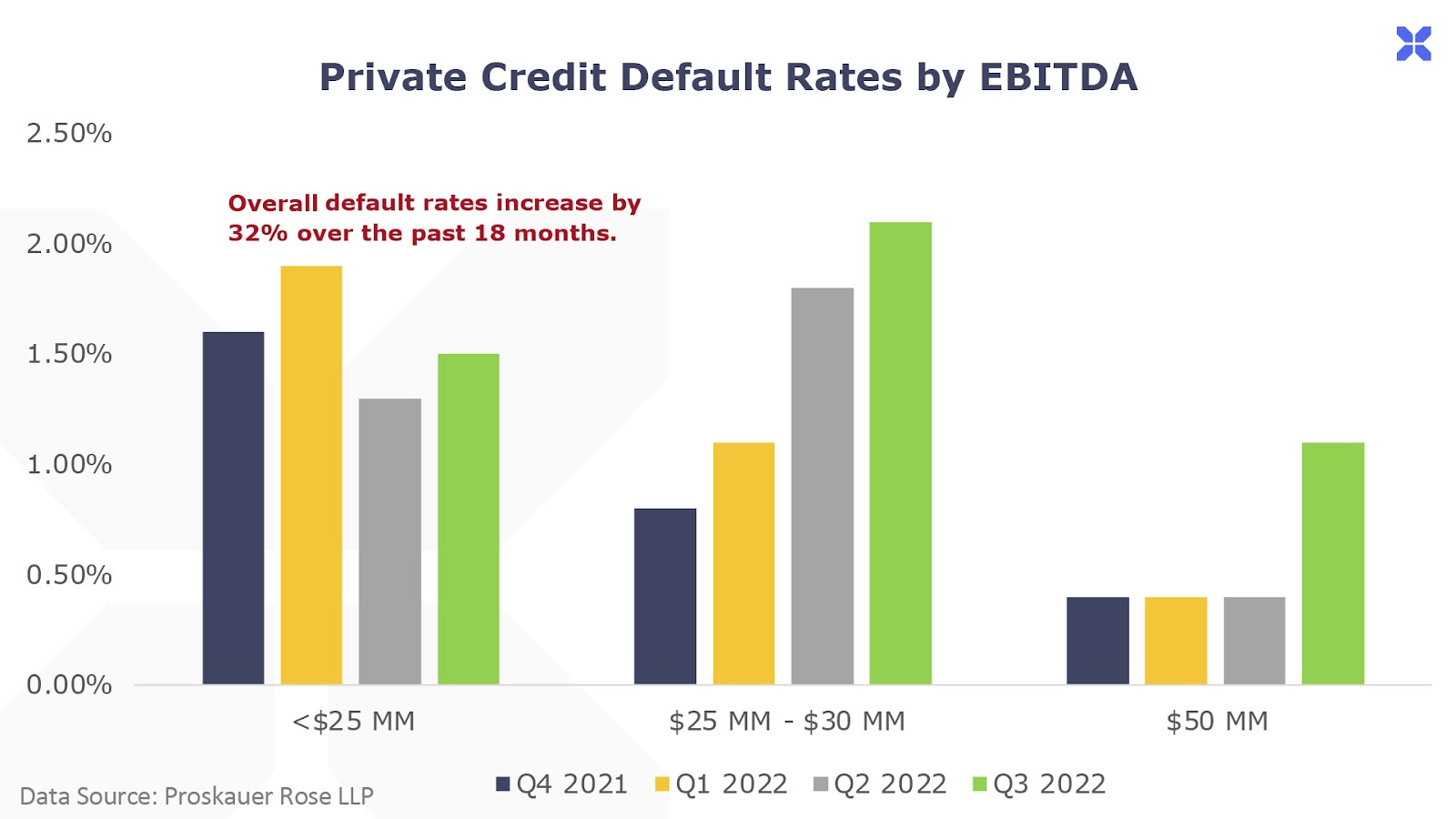

And now, default rates in the private credit market are rising… for example, default rates for companies with less than $50 million in EBITDA increased to 1.1% in the third quarter, compared to 0.4% in the prior quarter.

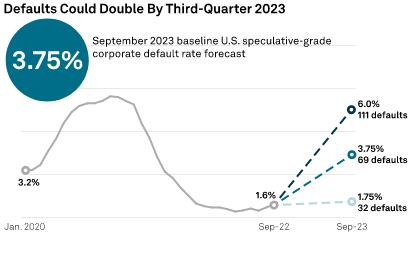

Meanwhile, despite low corporate default rates today, analysts at ratings agency S&P Global project a doubling in the default rate by the third quarter of next year:

Slava’s Wife, and What’s Next

One of the difficulties of protecting your assets from the impending debt implosion is that leverage lurks everywhere. How many investors in BREIT recognized – or bothered to learn – that real estate was a sideshow in what’s in effect a derivative-happy hedge fund in disguise?

Credit cycles are long-term affairs. On the way up, as interest rates fall, the excesses gradually accumulate. Eventually, these excesses culminate into a full-fledged mania. That’s what we saw with the record boom across stock, crypto and real estate prices in 2020-2021.

The process works similarly on the way down. When the cheap money goes away, which started with the Fed’s rate-hiking campaign in early 2022, the implosion doesn’t happen overnight. The first casualties occur in the most speculative asset classes, as we’ve seen with countless high-flying stocks and cryptocurrency implosions, with many down 80% or more.

Eventually, the weakness on the fringes of the market finds its way into real estate markets… private credit markets… and anywhere else that debt has found a home. Which is everywhere.

Distressed Debt Solution Under Construction…

One solution: Invest in companies that are impervious to the vagaries of the credit cycle… like the capital-efficient companies that form a part of Porter & Co.’s The Big Story on Wall Street (This Week) portfolio.

Another way: Beat the debt demons at their own game. In a credit crash, investors sell everything … both good companies (those that have ample cash flow to support their debt) and bad (those that don’t) credits are sold off indiscriminately. That creates an enormous opportunity for nimble investors who can uncover fundamentally strong credits that were unjustifiably sold off.

That’s going to be the focus of Porter & Co.’s distressed debt advisory, coming next year… stay tuned.

P.S. Slava’s wife’s Al Haig moment (like Al Haig’s Al Haig moment) didn’t last long. Two days later – before her gating directive, issued under dubious authority, could be implemented – Slava returned from the facility… not exactly tanned, ready and rested (it was wintertime in Moscow after all), but looking surprisingly good for a guy who had lost his money, his fund and his marbles (and likely soon, his wife).

And the first thing he did: Gate the fund. And that was that for my hedge fund career.

Porter & Co.

Stevenson, MD