Issue #32, Volume #1

If You Know How To Do This

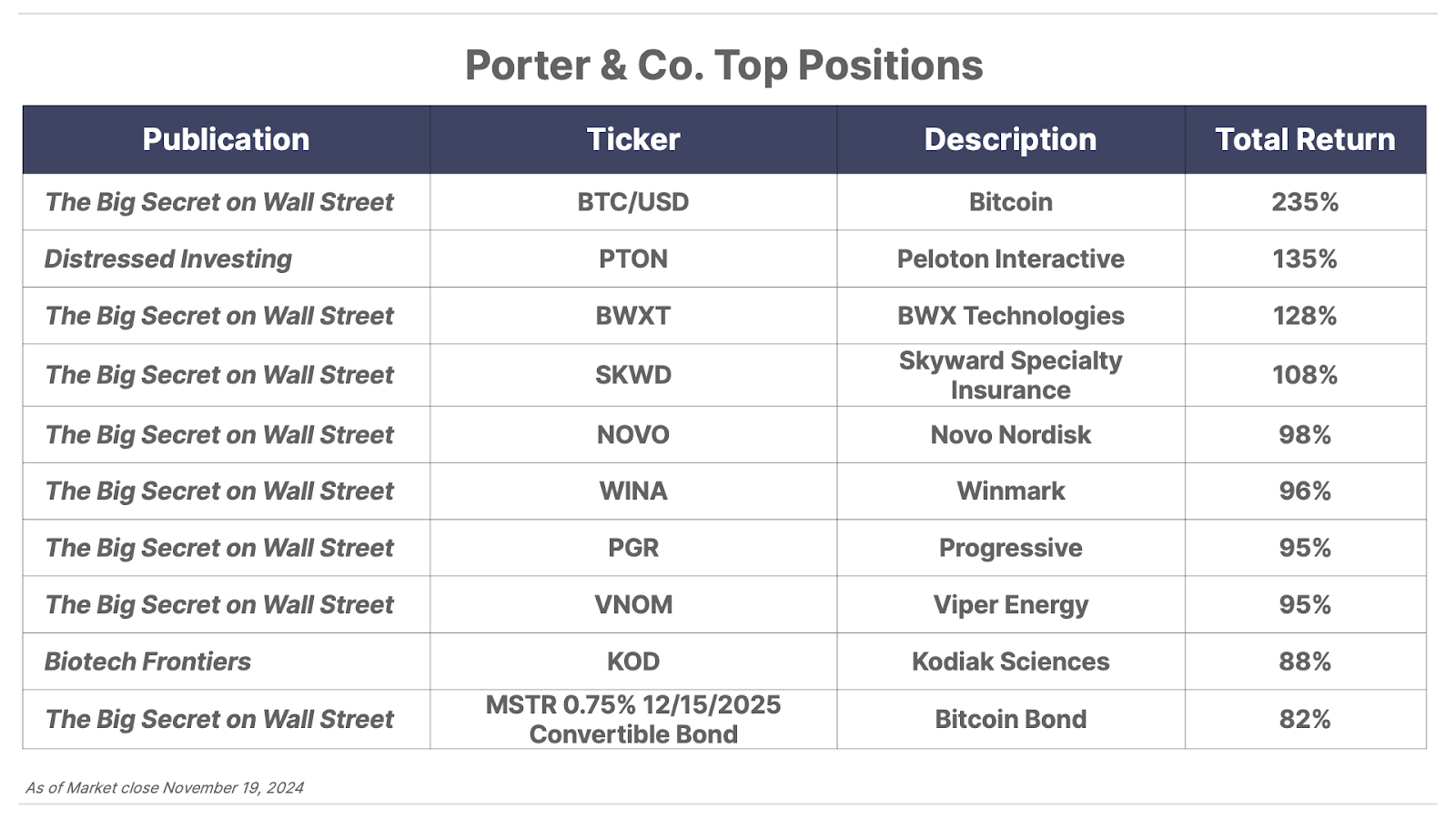

This is Porter & Co.’s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Three Things You Need To Know Now:

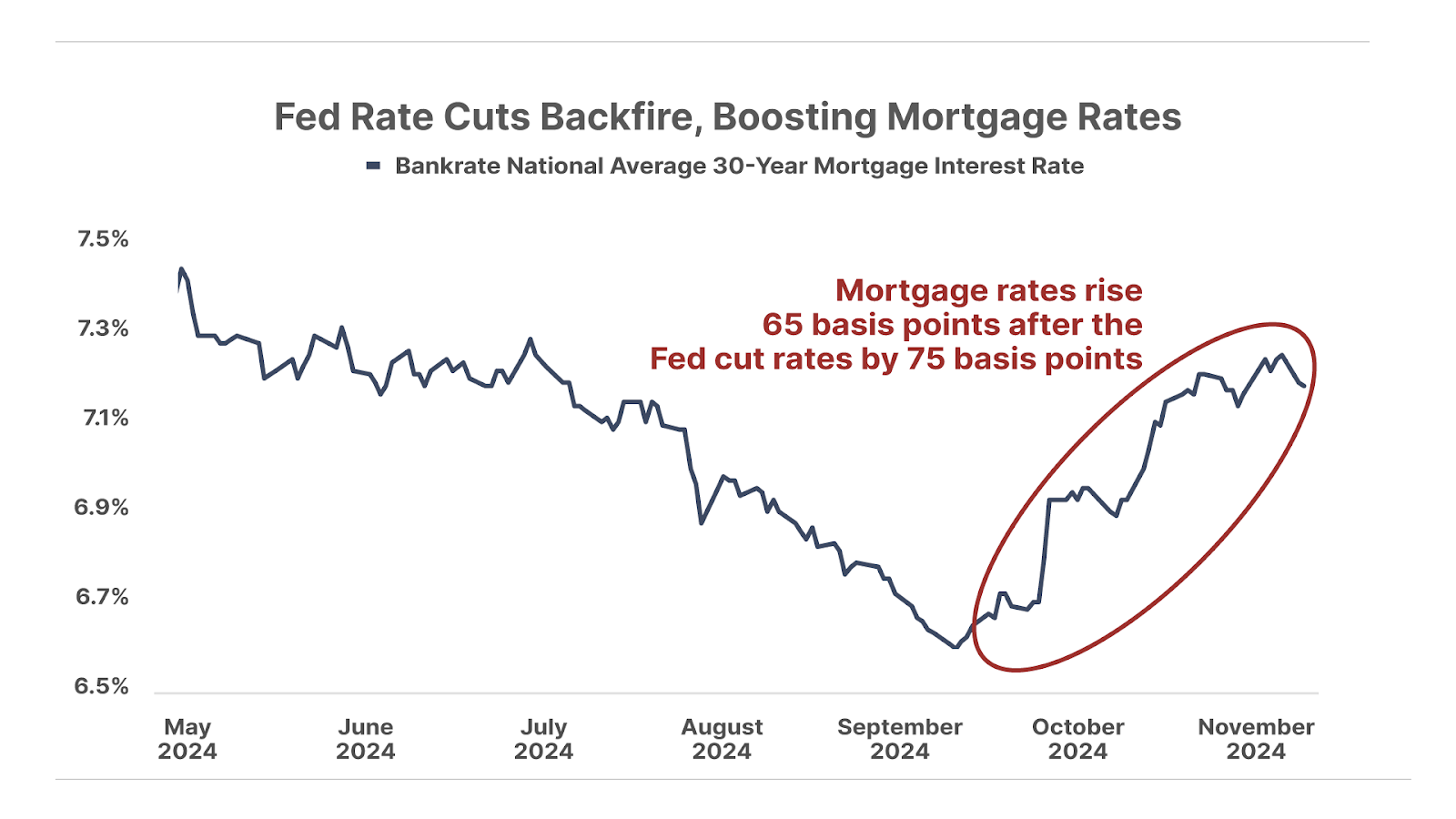

1. Fed rate cuts crush housing demand. Single-family housing starts dropped 6.9% in October, according to data released yesterday by the U.S. Census Bureau. One obvious reason why: 30-year mortgage rates have increased by 65 basis points since mid-September, to an average of just over 7%. That’s despite the Federal Reserve cutting overnight interest rates by 75 basis points since then. Usually, the bond market (and mortgage rates) follow the Fed’s bidding. That they’re not – that long-dated Treasuries, and mortgage rates, are moving in the opposite direction – is the bond market’s way of saying that inflation isn’t dead yet, and that the Fed started cutting rates too soon. So bond investors are demanding higher interest rates on long-term bonds. This is a big problem for the housing market – and for the rest of the real economy, where borrowing costs are determined by long-term interest rates. The bond market is speaking, Jay Powell… are you listening?

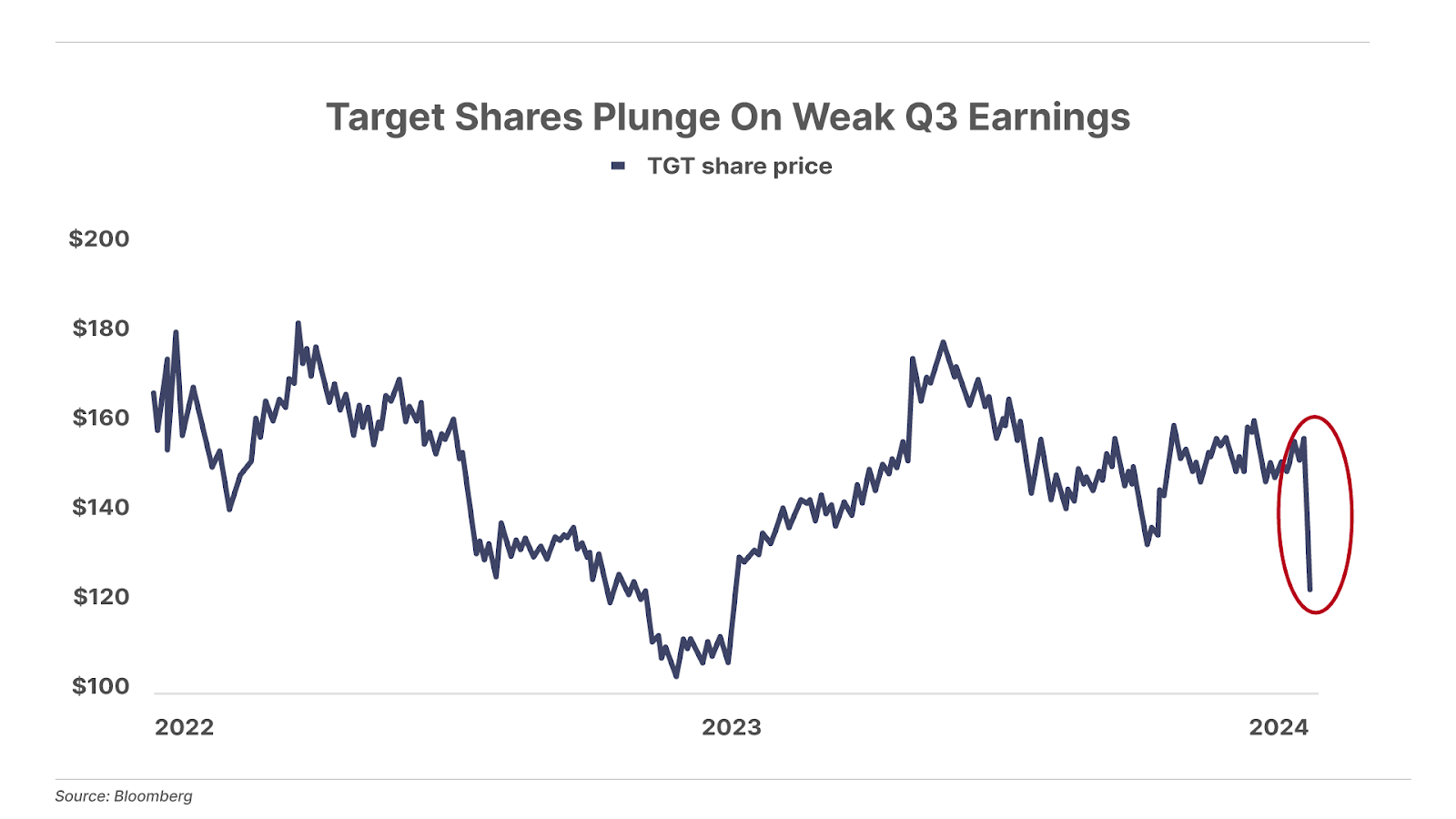

2. Target misses… Walmart hits… hello, recession. Shares of retailer Target (TGT) fell more than 20% today after it released disappointing third-quarter earnings, and cut its full-year profit outlook. Due in part to lingering inflation and concerns about what’s next for the U.S. economy, consumers are spending less on nice-but-not-necessary items at inexpensive-but-not-cheap stores like Target. They’re instead shopping for value, at… Walmart (WMT), which on Tuesday reported strong earnings, and raised its sales and profit targets for the year, as the shares hit an all-time high. When the American consumer – consumption accounts for 62% of U.S. economic output – leaves Target in favor of Walmart, you know things are looking bad… for retailers looking at the holiday shopping season, and for the economy overall. (See below for more on this.)

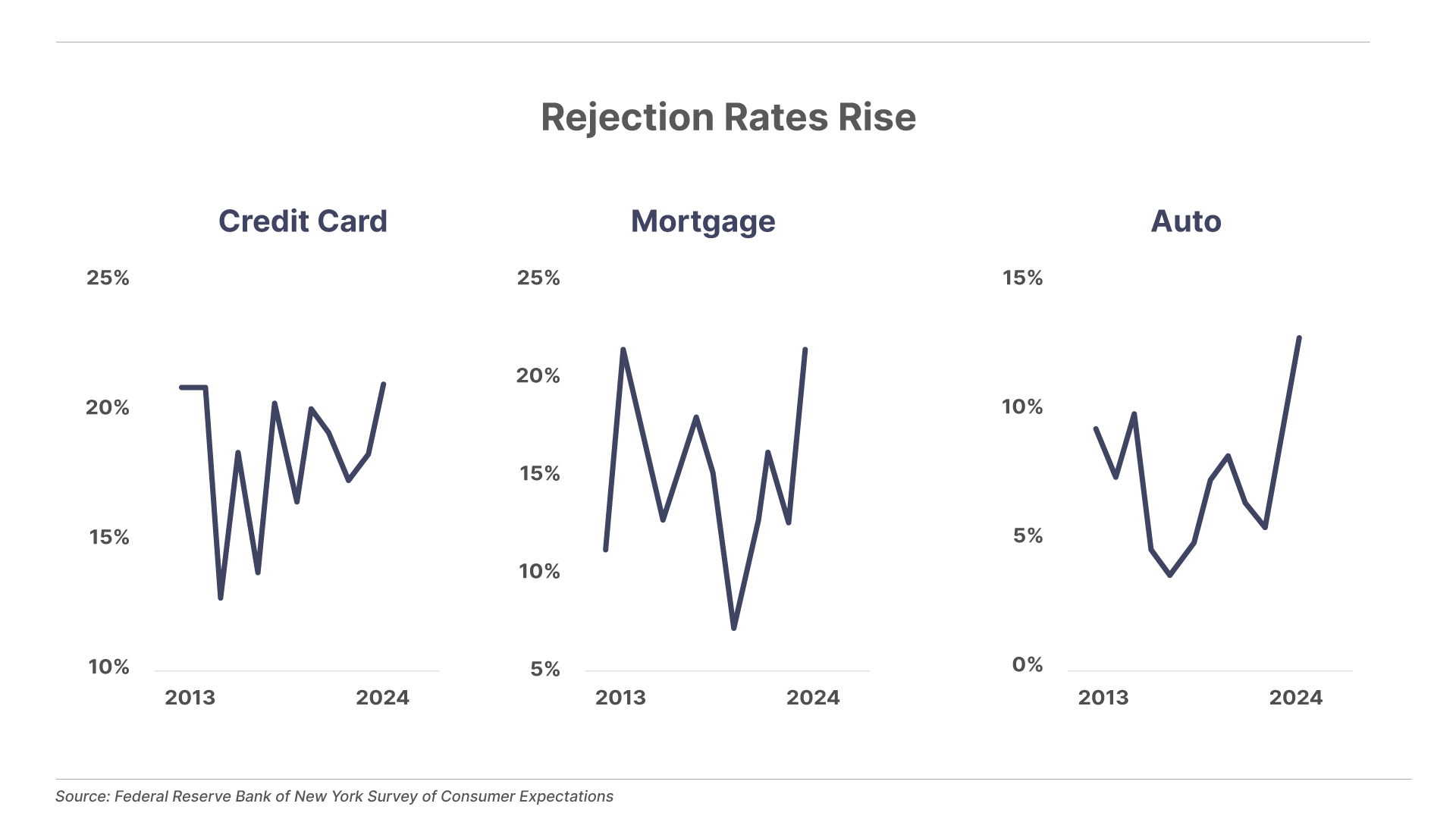

3. Early signs of trouble in consumer credit. A new survey from the Federal Reserve Bank of New York shows consumers are now having a difficult time accessing additional credit, with applications for credit cards, mortgages and auto loans, being turned down at the highest rates in over a decade. Recent data suggest Americans have increasingly been turning to credit to make ends meet. And if access to additional credit is now drying up, it’s just a matter of time before the “resilient consumer” finally taps out.

And one more thing…

Signs of a top

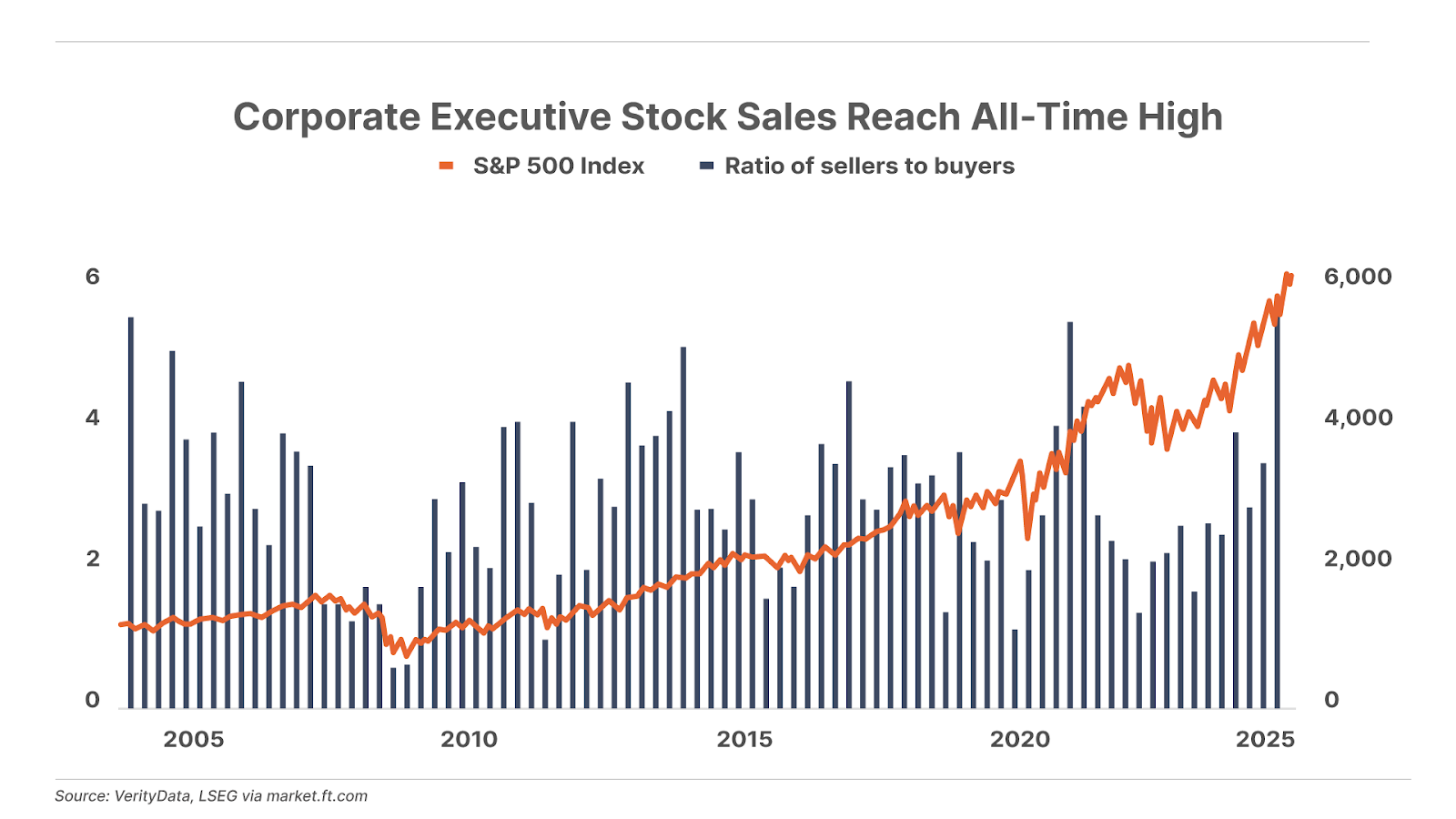

Insiders are selling… a lot. Corporate insiders – senior executives who hold shares of their publicly traded companies – know more than anyone else about the condition of their employers. Right now, U.S. corporate insiders are selling shares at a record pace, relative to the number of shares that they’re buying. Some of that is profit taking, particularly after a strong post-election run in markets. Regardless, it doesn’t signal confidence in share prices by the people who should know best. Notably, insiders sold heavily late in the dot-com bubble – in 2006-2007 before the Global Financial Crisis… and in late 2020 through 2021 before the 2022 market selloff.

Poll: President-elect Donald Trump has made cutting government a centerpiece of his evolving Cabinet, assigning Tesla head Elon Musk and biotech entrepreneur (and former Republican presidential candidate) Vivek Ramaswamy the task of eliminating government waste.

However… as we explained, Trump’s plans – including tariffs, increased border security, military expansion, and tax cuts – would cost an additional $7.5 trillion over the next four years. And that’s not including ongoing growth in legally mandated spending on entitlement programs like Social Security and Medicare – spending that is on track to grow by more than $20 trillion over the next decade. All told, this suggests that the government will rack up at least another $30 trillion in new debt – adding to the current level of $36 trillion – over the next decade.

In that context… Do you think that the federal debt will be higher, or lower, at the end of Trump’s term in office?

Recession Is Here And That’s Good News

If You Know How To Do This…

The last time Target missed earnings this badly (see point 2 above) was in the summer of 2022.

That began a very weak period for stocks. The stock market and the bond market fell sharply through October of that year. Big tech stocks, like Netflix (NFLX) and Meta (META), fell 50%. It was the worst period for bonds in more than 40 years. Even hedge funds designed to protect investors, like Bridgewater Associates’ All-Weather fund, saw huge declines, down more than 20%.

The previous notable big earnings miss for Target was in the first quarter of 2015.

And, while most investors have forgotten, that miss too marked the beginning of a weak period for stocks and corporate bonds.

Peak-to-trough from early 2015 through early 2016, stocks fell 19% – just missing the official decline for a bear market. Even more notably, in 2015 the corporate bond market declined.

For a brief period in late 2015, high-yield bonds offered almost a 10% premium in yields compared to U.S. Treasuries. It was a period of notable distress for investors in the oil and gas industry – and, thus, incredible opportunities.

Seeing this opportunity, I launched a distressed-credit advisory, Credit Opportunities. And we went “shopping” in the energy sector.

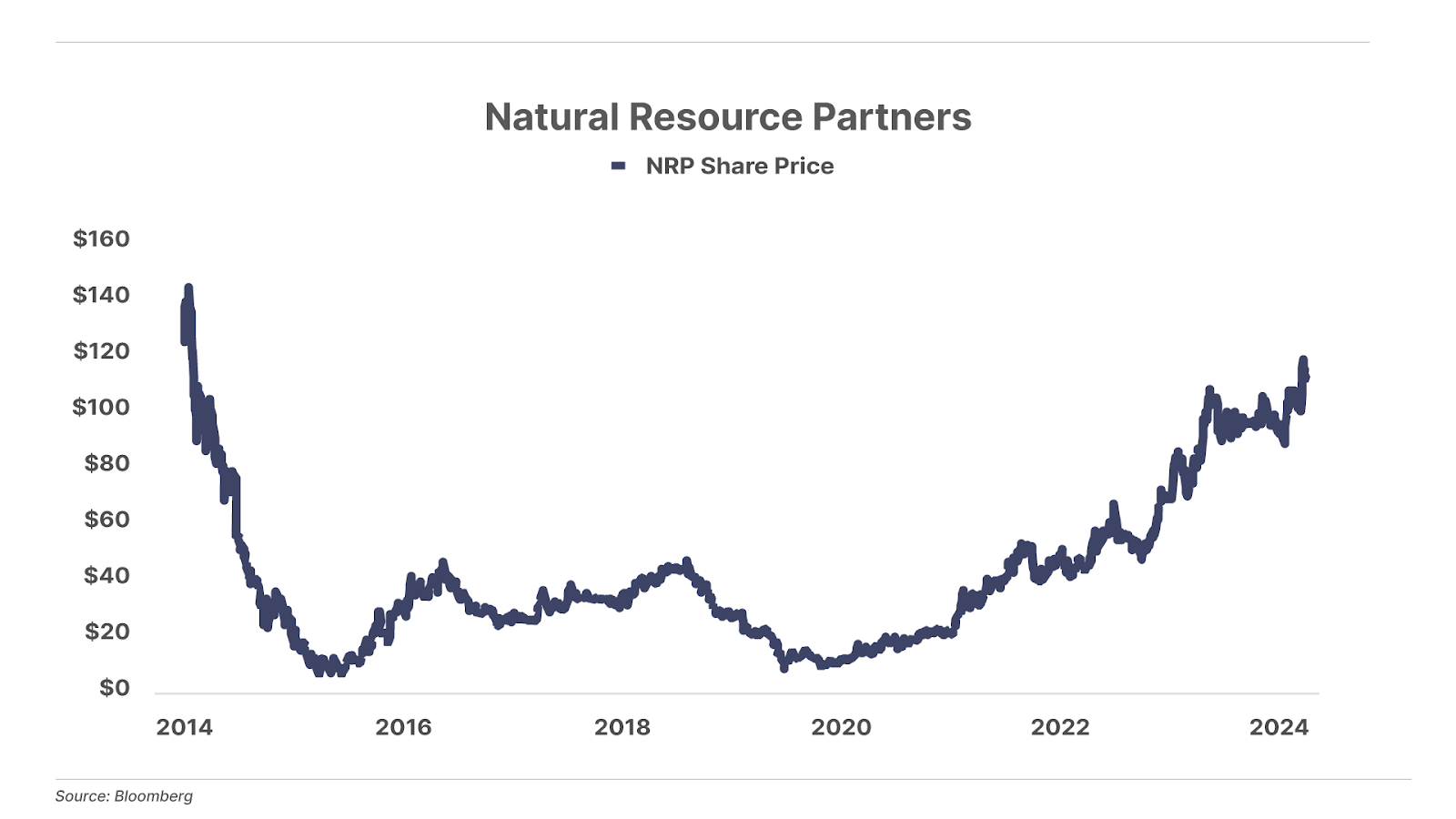

Our very first recommendation, in November 2015, was to buy both the shares and the bonds of Natural Resource Partners (NRP).

This company owns an enormous portfolio of royalties on coal mines.

Where other investors saw an industry in permanent decline and a company in financial distress, we saw an inevitable recovery because of the critical role coal plays in both electricity and steel.

We also knew that the company’s bonds were “money good” because it owned more than enough assets to repay us in full, even in the event of a bankruptcy.

Thus, from our perspective, there was zero risk in buying these bonds. And the stock, while volatile, was trading at such a low price that if the market for coal didn’t disappear permanently, we stood to earn outrageous returns. To hedge the extreme volatility of the shares, we recommended buying a blended position: 75% in the bonds and 25% in the stock.

The bonds were trading at more than a 30% discount to their face value – $675.80 for each $1,000 bond. And stock was around $15 a share (since adjusted by a 1-for-10 reverse split).

We were a little early. Three months later, in early 2016, the stock bottomed at $5 per share. On paper, the stock was down 75%. Was this a disaster in the making? Not at all. The bonds didn’t budge. And we knew it was only a matter of time until the market saw what we saw: a very capital efficient business with an incredibly resilient product.

About a year later, the picture looked very different.

In February 2017, we were able to sell the bonds at a premium to face value ($1,005), booking 62% total return in about 15 months. There is something unbelievably satisfying about earning better than equity-like returns on risk-free bonds. But, that wasn’t the best part. The best part was we’d been smart enough to buy the stock too. Shares of NRP have gone up more 1,000% since then, for annualized returns of 32%.

This is exactly why we look at recessions and corporate distress as good news.

To be able to acquire these kinds of distressed assets, you have to understand that there’s a corporate credit cycle. You have to know where you are in that cycle. And you have to be wise enough to have cash when these opportunities emerge.

I strongly recommend taking steps now to hedge your portfolio and to raise cash.

What stocks should you sell? My recommendation is to look at your portfolio and identify which companies haven’t been performing well over the last five years. Simple test: how much has revenue grown over the last five years? We’ve experienced a huge inflationary boom. Did the company participate?

Here are several companies that haven’t performed well and their average revenue growth over the last five years:

- Hasbro (HAS, -4%)

- 3M (MMM, -4.6%)

- Intel (INTC, -7%)

- AT&T (T, -7.5%)

- Principal Financial (PFG, -7.5%)

- Aflac (AFL, -12%)

- AIG (AIG, -12%)

After identifying companies that haven’t performed by an objective measure, the next step is to see if there’s an obvious reason why they haven’t.

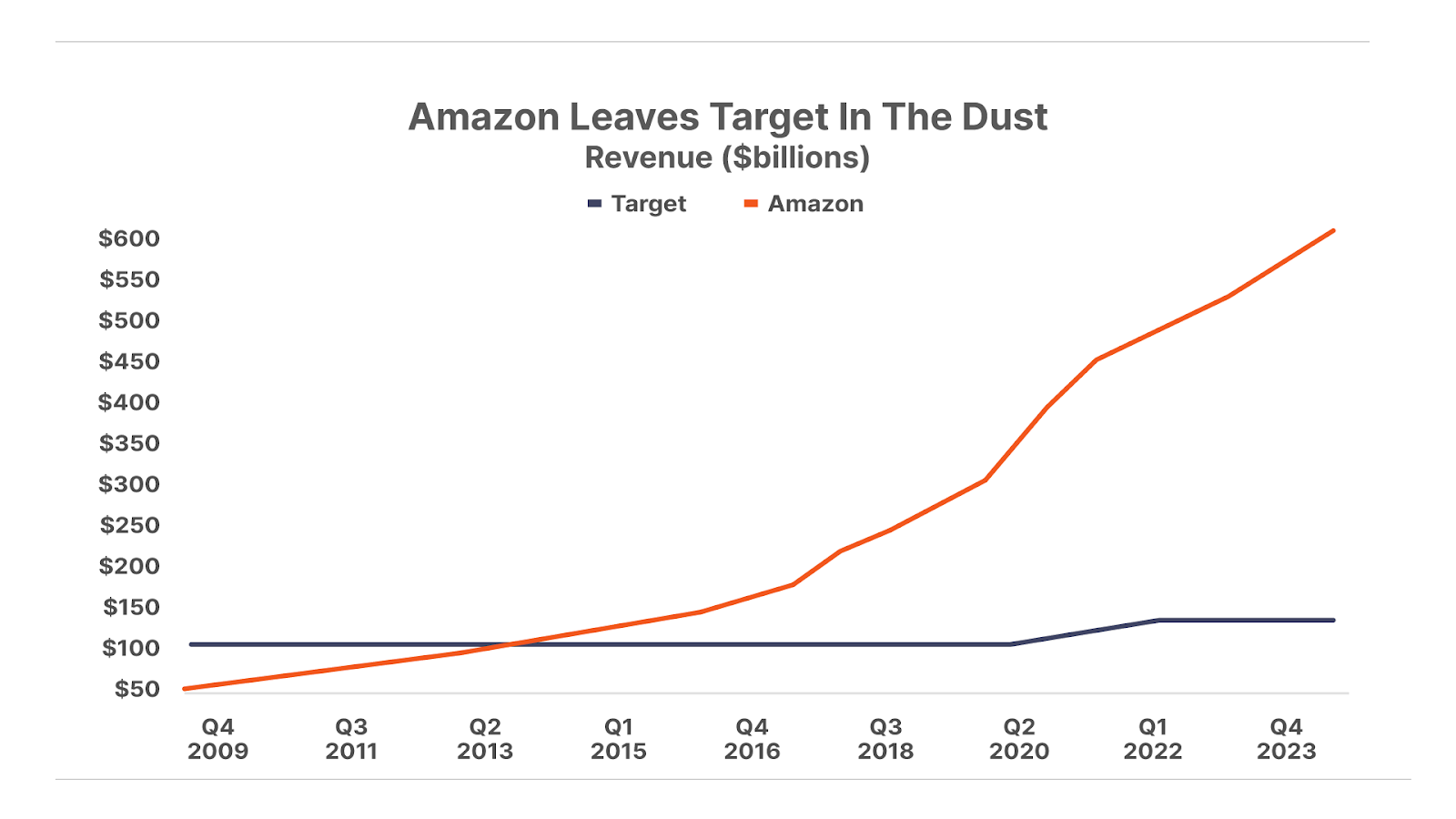

In Target’s case, that’s easy. There’s an Amazon-sized elephant in the room. The chart below shows how Amazon’s (AMZN) revenue overtook Target’s revenue in 2014 – a decade ago. On a relative basis Target has lost ground to Amazon every year for more than 20 years.

Don’t own stocks like these.

As this recession develops, we’ll continue to recommend shorting weak businesses in The Big Secret on Wall Street. We’re making our second such recommendation tomorrow. These positions will help to hedge against the temporary drawdowns in our other, high-quality investments.

The other thing we’ll do, of course, is look for outstanding distressed opportunities in great companies, like we did with Natural Resource Partners in 2015. And today we have a huge advantage: our distressed-debt analyst Martin Fridson, who runs our Distressed Investing advisory. Marty is the most acclaimed research analyst in the history of the high-yield market. There’s no one better to help us find these amazing “money good” opportunities.

So, I hope you’ll stay tuned. And, if you aren’t yet, please consider joining with us at Porter & Co. as a Partner Pass Member. Yes, it’s an investment in us. But it will pay great dividends for you across your investing lifetime.

If you are not yet a Partner Pass Member, contact Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.

Regards,

Porter Stansberry

Stevenson, MD

As always share your thoughts on this topic with me directly: [email protected]

P.S. One of the many things that I admire about my friend and former colleague Jeff Brown…

… in addition to his extraordinary stock-picking talent, and his uncanning ability to see into the future of technology, to discern tomorrow’s winners…

… is that he doesn’t shy away from slaughtering sacred cows.

In the past, I’ve been raked over the coals for forecasting the bankruptcy of General Motors (GM)… that the shares of Fannie Mae (FNMA) and Freddie Mac (FMCC) would go to zero… and, more recently, that Boeing (BA) will go bust.

Today… Jeff is forecasting an unprecedented crash in what’s been one of the market’s hottest sectors, artificial intelligence (“AI”). He thinks that many in-the-headlines AI stocks will drop by 50% or more in coming weeks… including one that he calls “AI’s Most Toxic Ticker” that, if it’s in your portfolio, you should sell at once.

That ticker is part of a special presentation Jeff has put together that I’m excited to announce we’re giving Porter & Co. subscribers a special sneak preview. Note: this hasn’t been released anywhere else yet, and it won’t be until tonight. (Included is a Porter & Co. subscriber discount… watch to find out more.)