By Special Arrangement: A Look Inside A Market Classic

Editor’s Note:

We hope you’re having a wonderful holiday with your family and friends, with thoughts about interest rates, debt and inflation fading into the night like the peals of Santa’s bells and the smoke of New Year’s fireworks. While we’re also getting into the eggnog, we’re sharing with you a special treat in this week’s “Something You Don’t Know.”

By special arrangement with the publisher, we’re happy to share an excerpt of trader, statistician, and risk analyst Nassim Taleb’s 2007 classic, The Black Swan: The Impact of the Highly Improbable. “Black swans” are rare outlier events with outsize impact (usually negative, for those who were caught flat-footed). This book is the seminal work on understanding – and preparing for, as much as we can – the unexpected in markets, and in life.

One insight from Taleb’s book is that black swan events aren’t unexpected for everyone. As you’ll read in our excerpt below, the turkey is surprised… but the butcher isn’t.

Our goal here at Porter & Co. is to avoid “being the turkey” – particularly relevant as we reflect on Christmas dinner just days ago – as we continue to navigate historically challenging markets… and – coming soon – what will likely be a historic bursting of the debt bubble, creating enormous opportunities in the distressed debt asset class.

The full book is available here on Amazon.

Barring any black swans, we’ll be back in the New Year.

Now on to The Black Swan…

How To Learn From The Turkey

How can we logically go from specific instances to reach general conclusions? How do we know what we know? How do we know that what we have observed from given objects and events suffices to enable us to figure out their other properties? There are traps built into any kind of knowledge gained from observation.

Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.

The rest of this chapter will outline the Black Swan problem in its original form: How can we know the future, given knowledge of the past; or, more generally, how can we figure out properties of the (infinite) unknown based on the (finite) known? Think of the feeding again: What can a turkey learn about what is in store for it tomorrow from the events of yesterday? A lot, perhaps, but certainly a little less than it thinks, and it is just that “little less” that may make all the difference.

The turkey problem can be generalized to any situation where the same hand that feeds you can be the one that wrings your neck. Consider the case of the increasingly integrated German Jews in the 1930s—or how the population of Lebanon got lulled into a false sense of security by the appearance of mutual friendliness and tolerance.

Let us go one step further and consider induction’s most worrisome aspect: learning backward. Consider that the turkey’s experience may have, rather than no value, a negative value. It learned from observation, as we are all advised to do (hey, after all, this is what is believed to be the scientific method). Its confidence increased as the number of friendly feedings grew, and it felt increasingly safe even though the slaughter was more and more imminent. Consider that the feeling of safety reached its maximum when the risk was at the highest!

But the problem is even more general than that; it strikes at the nature of empirical knowledge itself. Something has worked in the past, until—well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst viciously misleading.

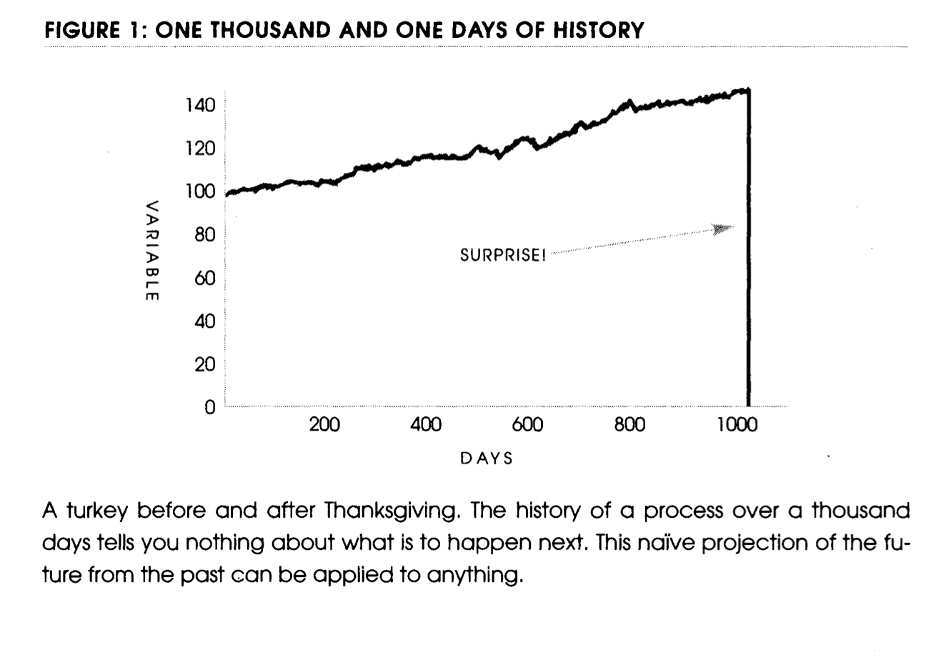

Figure 1 provides the prototypical case of the problem of induction as encountered in real life. You observe a hypothetical variable for one thousand days. It could be anything (with a few mild transformations): book sales, blood pressure, crimes, your personal income, a given stock, the interest on a loan, or Sunday attendance at a specific Greek Orthodox church. You subsequently derive solely from past data a few conclusions concerning the properties of the pattern with projections for the next thousand, even five thousand, days. On the one thousand and first day—boom! A big change takes place that is completely unprepared for by the past.

Consider the surprise of the Great War. After the Napoleonic conflicts, the world had experienced a period of peace that would lead any observer to believe in the disappearance of severely destructive conflicts. Yet, surprise! It turned out to be the deadliest conflict, up until then, in the history of mankind.

Note that after the event you start predicting the possibility of other outliers happening locally, that is, in the process you were just surprised by, but not elsewhere. After the stock market crash of 1987, half of America’s traders braced for another one every October—not taking into account that there was no antecedent for the first one. We worry too late—ex post. Mistaking a naive observation of the past as something definitive or representative of the future is the one and only cause of our inability to understand the Black Swan.

It would appear to a quoting dilettante—i.e., one of those writers and scholars who fill up their texts with phrases from some dead authority—that, as phrased by Hobbes, “from like antecedents flow like consequents.” Those who believe in the unconditional benefits of past experience should consider this pearl of wisdom allegedly voiced by a famous ship’s captain:

But in all my experience, I have never been in any accident. . . of any sort worth speaking about. I have seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in disaster of any sort.

– E. J. Smith, 1907, Captain, RMS Titanic

Captain Smith’s ship sank in 1912 in what became the most talked-about shipwreck in history.

Trained to be Dull

Similarly, think of a bank chairman whose institution makes steady profits over a long time, only to lose them in a single reversal of fortune. Traditionally, bankers of the lending variety have been pear-shaped, clean-shaven, and dress in possibly the most comforting and boring manner, in dark suits, white shirts, and red ties. Indeed, for their lending business, banks hire dull people and train them to be even more dull. But this is for show.

If they look conservative, it is because their loans only go bust on rare, very rare, occasions. There is no way to gauge the effectiveness of their lending activity by observing it over a day, a week, a month, or… even a century!

In the summer of 1982, large American banks lost close to all their past earnings (cumulatively), about everything they ever made in the history of American banking—everything. They had been lending to South and Central American countries that all defaulted at the same time— “an event of an exceptional nature.”

So it took just one summer to figure out that this was a sucker’s business and that all their earnings came from a very risky game. All that while the bankers led everyone, especially themselves, into believing that they were “conservative.” They are not conservative; just phenomenally skilled at self-deception by burying the possibility of a large, devastating loss under the rug.

In fact, the travesty repeated itself a decade later, with the “risk-conscious” large banks once again under financial strain, many of them near-bankrupt, after the real-estate collapse of the early 1990s in which the now-defunct savings and loan industry required a taxpayer-funded bailout of more than half a trillion dollars. The Federal Reserve bank protected them at our expense: when conservative bankers make profits, they get the benefits; when they are hurt, we pay the costs.

After graduating from Wharton, I initially went to work for Banker’s Trust (now defunct). There, the chairman’s office, rapidly forgetting about the story of 1982, broadcast the results of every quarter with an announcement explaining how smart, profitable, conservative (and good looking) they were. It was obvious that their profits were simply cash borrowed from destiny with some random payback time. I have no problem with risk taking, just please, please, do not call yourself conservative and act superior to other businesses who are not as vulnerable to Black Swans.

Another recent event is the almost-instant bankruptcy, in 1998, of a financial investment company (hedge fund) called Long-Term Capital Management (LTCM), which used the methods and risk expertise of two “Nobel economists,” who were called “geniuses” but were in fact using phony, bell curve-style mathematics while managing to convince themselves that it was great science and thus turning the entire financial establishment into suckers. One of the largest trading losses ever in history took place in almost the blink of an eye, with no warning signal.

A Black Swan Is Relative to Knowledge

From the standpoint of the turkey, the nonfeeding of the one thousand and first day is a Black Swan. For the butcher, it is not, since its occurrence is not unexpected. So, you can see here that the Black Swan is a sucker’s problem. In other words, it occurs relative to your expectation.

You realize that you can eliminate a Black Swan by science (if you’re able), or by keeping an open mind. Of course, like the LTCM people, you can create Black Swans with science, by giving people confidence that the Black Swan cannot happen—this is when science turns normal citizens into suckers.

Note that these events do not have to be instantaneous surprises. Some past historical fractures have lasted a few decades, like, say, the computer that brought consequential effects on society without its invasion of our lives being noticeable from day to day. Some Black Swans can come from the slow building up of incremental changes in the same direction, as with books that sell large amounts over years, never showing up on the bestseller lists, or from technologies that creep up on us slowly, but surely.

Likewise, the growth of Nasdaq stocks in the late 1990s took a few years—but the growth would seem sharper if you were to plot it on a long historical line. Matters should be seen on some relative, not absolute, timescale: earthquakes last minutes, 9/11 lasted hours, but historical changes and technological implementations are Black Swans that can take decades.

In general, positive Black Swans take time to show their effect while negative ones happen very quickly— it is much easier and much faster to destroy than to build. (During the Lebanese war, my parents’ house in Amioun and my grandfather’s house in a nearby village were destroyed in just a few hours, dynamited by my grandfather’s enemies who controlled the area. It took seven thousand times longer—two years—to rebuild them. This asymmetry in timescales explains the difficulty in reversing time.)

You can purchase the full book here on Amazon.

Porter & Co.

Stevenson, MD

Click play to stream the documentary for free.

P.S. If you’d like to learn more about the Porter & Co. team – all of whom are real humans, and many of whom have Twitter accounts – you can get acquainted with us here.