10 Stocks That Are Likely to Soar

“When it’s raining gold, reach for a bucket…”

| Editor’s Note: We have an exciting announcement to make… We recently launched our latest Partners-only advisory, Biotech Frontiers, overseen by analyst Erez Kalir. In just over a month, Erez’s initial basket of 10 biotech stocks has already generated an average gain of over 15% for Partners… including 170% on one stock in a single day. In this week’s issue of The Big Secret on Wall Street, we introduce you to Erez and let him explain, in his own words, how to take advantage of what may prove to be the single best opportunity to buy biotech stocks we’ll see in our lifetimes… and he will discuss pricing anomalies so extreme that Erez himself has not observed them in any sector of the stock market in his own three decades as a professional investor. But first, let us tell you a story… and show you the kinds of gains Partners have been making in this underappreciated sector… |

Dwayne O. Andreas loved giving things away.

Sometimes, he was a little too generous.

After taking the reins at global agricultural giant Archer-Daniels-Midland in 1970, the short, bespectacled billionaire started tossing money down both sides of the political aisle… including a $25,000 check for the Richard Nixon presidential campaign that ended up funding the infamous 1972 Watergate scandal.

Andreas claimed he didn’t know what the money would be used for. Political donations, he said, were “just like tithing.” Since his devout Mennonite boyhood, he’d been raised to share liberally with others.

Perhaps that’s why he gave 17 million Americans fatty liver disease.

Like the Watergate slush fund, spreading the disease wasn’t intentional. Andreas just planned to get rid of a big pile of corn. In the mid-1970s, imprudent trade deals with Russia saddled America (and Andreas’ company, Archer-Daniels-Midland) with an overabundance of yellow kernels.

And when life gives you corn, you make high-fructose corn syrup (“HFCS”).

Andreas decided to manufacture the cavity-inducing liquid sweetener on a large scale, and sell it to the American public as a sugar substitute. So in 1982, he enlisted the help of his Presidential buddy Ronald Reagan – after greasing the wheels with some generous donations – and the Gipper obligingly placed a steep quota on sugar imports from overseas.

With less sugar sailing in, domestic sugar prices doubled – and in comparison, HFCS looked attractively cheap to many food manufacturers. Coke and Pepsi quickly switched to the liquid sweetener, followed by many other food and soft-drink brands. In 1977, Americans consumed around nine pounds of HFCS per person, per year. By 1999, they guzzled down over 63 pounds of the stuff per capita.

Archer-Daniels-Midland stock soared (around 450% between 1985 and 1995)… and Americans’ health suffered.

Today, the $5 billion HFCS industry is an American institution, with about 90% of its output used for the beverage industry: soda, juice, and so forth. The other 10% lurks in salad dressings, desserts, processed fruits, and, surprisingly, crackers. You really can’t get away from it. And neither can your liver.

As we now know, HFCS increases liver inflammation and stimulates this critical organ to make more fat. In America alone, about 17 million people currently suffer from fatty liver disease, also known as NASH (nonalcoholic steatohepatitis) – which can eventually lead to serious liver scarring and, possibly, liver cancer. Thanks, Dwayne O. Andreas.

Surprisingly, it’s taken until 2024 to find an effective cure for fatty liver disease (other than, of course, just never drinking soda).

The company that’s made the biggest strides toward a solution is a promising small biotech firm that targets NASH and other metabolic dysfunctions with a first-in-class oral, selective fatty-acid synthase inhibitor (“FASN”).

Early clinical data for the drug’s efficacy against NASH is compelling. According to Erez Kalir, our new biotech analyst here at Porter & Co, the company has multiple data, regulatory, and clinical-trial launch milestones to look forward to in 2024.

And it’s already passed the first of its tests with flying colors (and made Porter & Co. Partners a sizable chunk of change).

Here’s Where We Come In…

Not all biotech stocks tell the same story. Some startups follow a clear, smooth path to success. Others skyrocket, then quickly fall back to Earth. But, generally speaking, as a sector, biotech stocks perform differently than tech stocks, “forever stocks,” and certainly the blue chips…

Fortunately, we have Erez, a biotech veteran, to help guide us to the right stocks. Erez attended Stanford University, where he double majored in biology and English… then earned a Master’s in cell biology and genetics at Oxford University and a JD from Yale Law School. Following his studies, he managed a hedge fund backed by the legendary Julian H. Robertson at Tiger Management. We’re delighted to have Erez leading our newest research advisory, Biotech Frontiers.

And it’s off to a good start. On January 9, we opened up Erez’s Biotech Frontiers to Partner Pass members only.

Erez… In His Own Words

We are now on the cusp of another: the unfolding revolution in life sciences and biotech. It will be at least as important, far reaching, and profound as these other two. It’s my great privilege to get to explore this with you in Biotech Frontiers.

The thing about these tsunamis is… if you are relatively early to them, understand what they’re about, and are able to identify the right financial instruments to ride them, you can earn generational wealth. For example, investing $1 million into a basket of Amazon, Google, Microsoft, and Apple in 2003 would have generated $50 million today.

Another thing about these tsunamis is that they’re not only about generating wealth, but also about understanding the world we live in as it changes. There aren’t many sectors of the stock market where novel developments are going to reshape how humans live. This isn’t true, for example, about property-and-casualty (P&C) insurance or financial services.

But it’s true about life sciences, and it’s true about biotech. What’s coming down the pike in life sciences holds out the potential to eradicate or dramatically shrink the leading disease-driven causes of death… and to change our sense of what it means to be human (for instance, by giving us the tools to pre-select many traits of our offspring before they’re born).

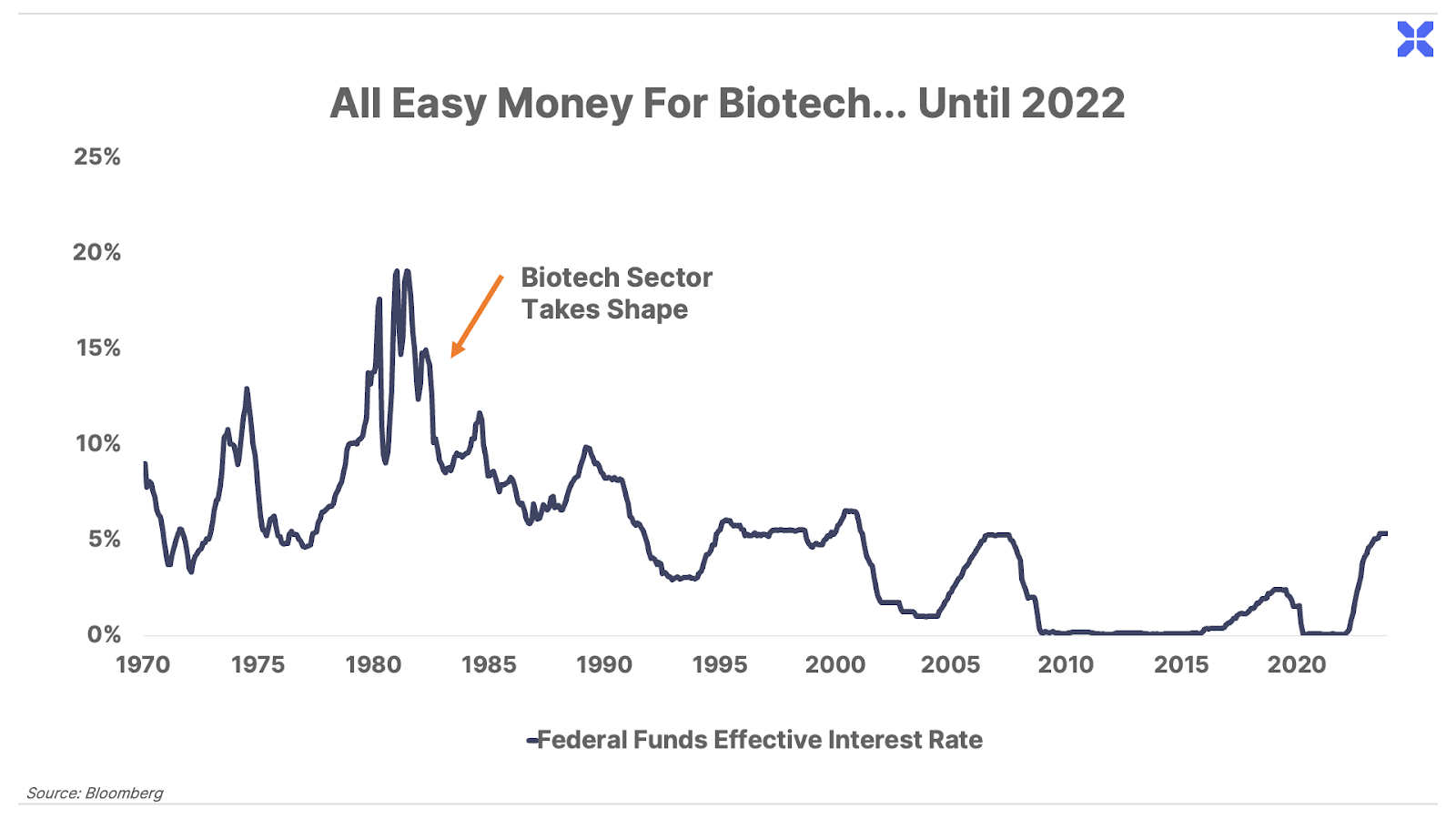

The companies behind these miraculous advances hold the potential to make great financial gains as their research progresses toward FDA approval, clinical availability, and commercialization. But over the last 18 to 24 months, this sector has endured the most brutal bear market in its history… for one main reason.

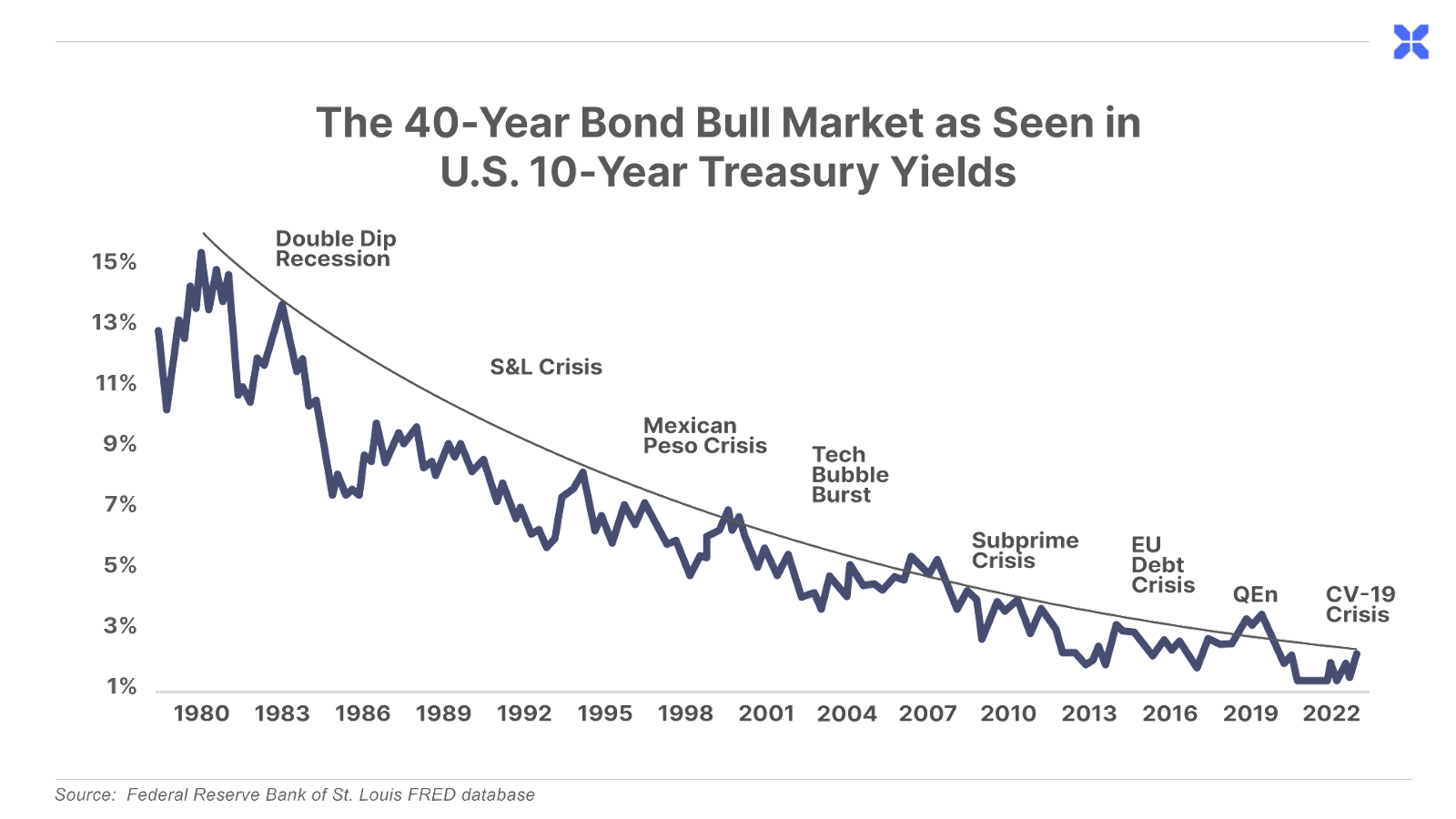

Biotech stocks have been crushed by record-high interest rates. The Federal Reserve may have forestalled runaway inflation with its serial rate hikes, but these same rate hikes have thrown the biotech sector for a loop.

For biotech stocks, interest rates are like financial gravity. When rates are low, stocks float upward. When rates are high and gravity is strong, valuation multiples collapse – and stocks fall back to Earth. And life-sciences stocks working to bring novel drugs and therapies to the world tend to be among the hardest hit.

To grasp why, it’s helpful to think of development-stage biotech stocks as long-duration equities… whose free cash flows (“FCF”) are far off in the future. In the near future, they have to spend a lot of money up front – performing research and development (R&D), running clinical trials, paying lawyers to help them obtain regulatory approvals, and eventually launching their new product.

All of this is money out the door – before any money comes in the door.

If they’re successful, biotech firms’ FCF tends to lie far out in the future. These FCFs can be astronomical for an effective new drug. But they have to be discounted back to the present. And as anyone who’s built a financial model knows, the more periods you have to discount your FCF back, the more sensitive the model is to changes in your discount rate – or in this case, to the U.S. interest rates that are the foundational benchmark for every discount rate in the world.

These conditions have helped to hammer biotech enterprise values (“EV”) across the board – including among compelling investment-grade companies. More than 70% of the global biotech sector now trades with an EV of $100 million or less.

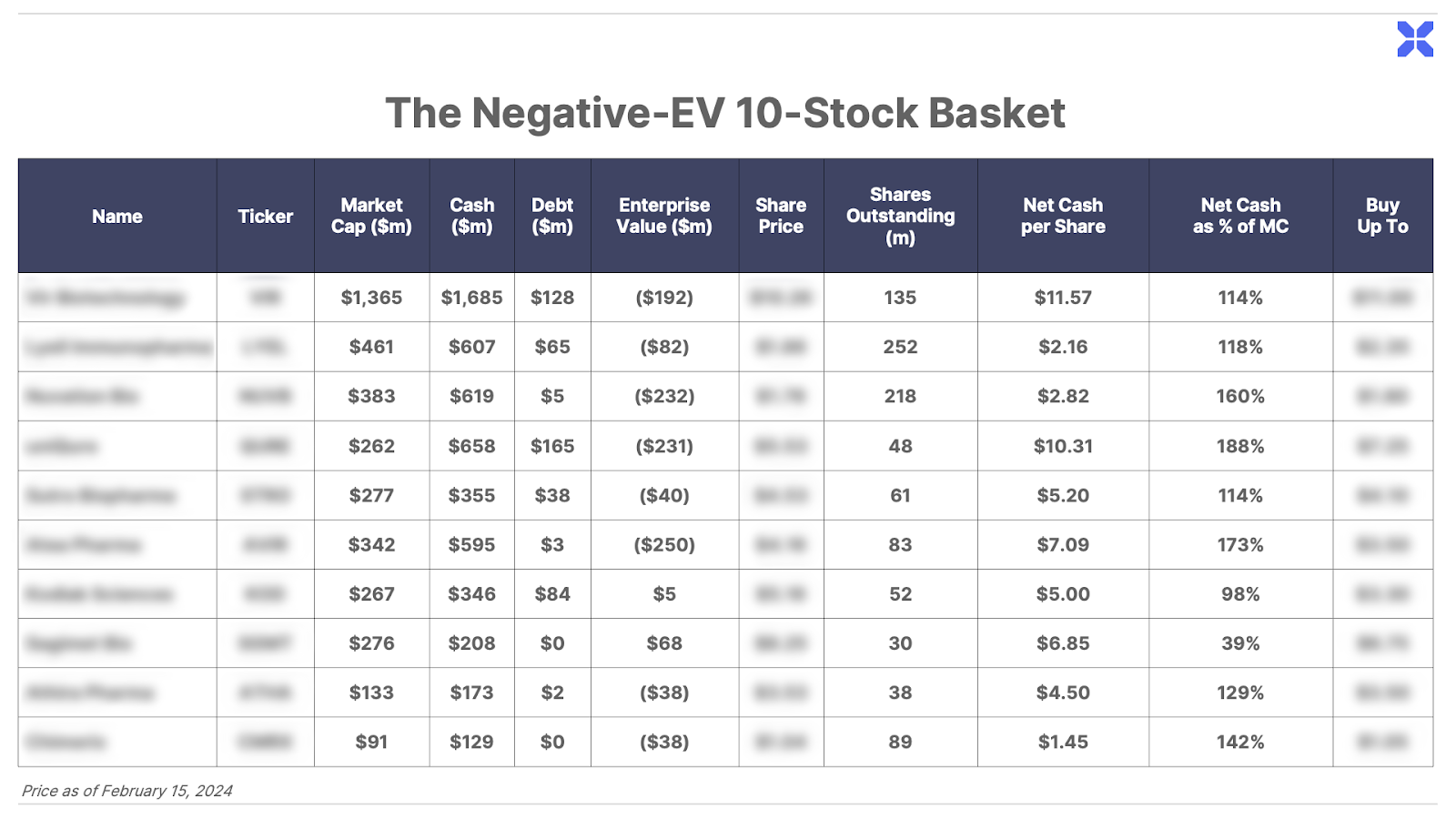

But the most startling statistic may be this: At the end of 2023, of 790 biotech companies that trade on the Nasdaq or NYSE, roughly 25% (or over 180 companies) traded with a negative EV.

A company’s EV is defined as its market capitalization less net cash. So a negative EV means there’s more net cash on the company’s balance sheet than the entire market capitalization of the company.

Over my two decades in investing, it’s been exceptionally rare to come across any meaningful swath of public companies trading with negative EVs. Why? Because a negative EV implies that if you could buy the whole company at once, you could shut it down, take the cash on its balance sheet, and come out ahead – i.e., you could get paid that net cash for shutting the company down.

And when conditions for these negative-EV companies shift for the better, the potential for outsized returns takes shape.

The Historical Record on Negative-EV Stocks

The CFA Institute is one of the most prestigious organizations for finance professionals in the world, famed for its rigorous approach to security analysis. In 2013 the CFA institute sponsored a study that examined every negative-EV stock that traded in the U.S. between 1972 and 2012, a 40-year span. The conclusion?

The average 12-month return for stocks in this group was 50.4%. That’s not a typo. Had you been able to find and invest in every one of these stocks over that time frame and held each for one year, your portfolio would have returned over 50%… beating the market average return by over 5x.

Let’s pause to appreciate what unfolded in the world over the 40 years covered by the CFA study: the oil crisis of the 1970s… the high inflation of the 1970s and early ’80s… the 1987 stock market crash… the early 1990s recession… the Russian sovereign default… the Asian financial crisis… and even the Global Financial Crisis of 2008-09. Finding a magic formula that consistently returned 50% a year through these cataclysmic events is almost unbelievable. Yet that’s what buying a basket of negative-EV stocks would have done.

More recently, Broken Leg Investing – a blog for deep-value investors – updated the CFA Institute study. It looked at every U.S. negative-EV stock from 1999 to 2016. Their findings? These stocks returned 27.4% annualized, trouncing the Nasdaq’s 5.1% annual return over the same period by a similar 5x. Notably, this more recent study encompassed both the 2001 dot-com bust and the 2008-09 Global Financial Crisis… so it, too, covered a period of economic rough sledding.

Back to Biotech and Our Current Opportunity

So if buying negative-EV stocks is a “magic formula” that crushes the market averages, why isn’t it widely talked about and why don’t more people do it? The answer is – because negative-EV stocks are generally extremely rare. Most of the time, fewer than 1% of publicly listed stocks trade with a negative EV.

In fact, finding these companies is ordinarily a sleuthing exercise done by the world’s deep-value investors… the successors to Warren Buffett’s mentor Benjamin Graham, who called his search for negative-EV stocks “cigar butt investing.” As Graham colorfully put it, “A cigar butt found on the street that has only one puff left may not offer much of a smoke, but the bargain purchase will make that puff all profit.”

A Master Class From My Mentor

Friends have sometimes asked me what it was like to work with Julian Robertson – the investing version of playing football with Joe Montana. Julian was remarkable in many ways. But the single quality that stood out to me was his exceptional ability to know what mattered in a specific situation and to focus on that one thing, zeroing out the rest.

Let me explain…

Julian was fluent in every aspect of finance. He could parse the most complex details of a cash flow statement… spot with X-ray vision how a company was manipulating an earnings report… imagine with prophetic clarity how the competitive landscape in an entire industry would evolve… or talk inside baseball on arcane currency pairs with a full-time FX trader, who would leave the conversation wondering why Julian knew more about currencies than he did…

Do you remember the Victorinox “SwissChamp” Swiss Army knife, the big one that had all the tools? That was Julian.

But Julian’s most special gift of all was knowing precisely which tool to apply in any given situation. This talent made him a fortune during the Global Financial Crisis, when I worked with him. In addition to managing $1 billion of his own money, Julian had also invested $4 billion of his fortune with about 30 different money managers, a famous ecosystem known as the “Tiger Cubs.” Most of these money managers had reputations as stock pickers. And, in 2008, as the markets sold off, most of these money managers were running around pitching Julian on the great bargain opportunity they saw in their favorite XYZ stock.

Adapting Our Seven-Piece Framework

- The science

- The size of the market opportunity

- The cap table

- The catalysts

- The balance sheet

- The big-picture backdrop

- The risk/reward and expected value

Guided by company balance sheets, I screened the entire U.S. biotech universe to create a list of stocks trading at negative EVs. That results in about 250 stocks out of roughly 1,000 biotechs. I then combed through that list name by name, applying several of our other factors as secondary filters. Specifically, I asked:

- Which of these companies are engaged in promising science?

- Which of these stocks have potential catalysts over the next 12 to 18 months?

- Which of these negative-EV stocks are owned by the smart money – elite biotech hedge funds and venture capitalists, large institutional capital, or Big Pharma strategic partners?

Introducing Our Negative-EV Biotech Basket