In this issue, we introduce the ultimate recession-proof “forever” stock. Its dominant competitive position and world-class capital efficiency set the stage for 15% annual returns over the next decade.

AI Will Supercharge This Leading Makeup and Cosmetics Brand

A “Forever Company” That Could Deliver 15% Compounded Returns

Welcome to Porter & Co.! If you’re new here, thank you for joining us… and we look forward to getting to know you better. You can email your personal concierge, Lance, at this address, with any questions you might have about your subscription… The Big Secret on Wall Street… how to navigate our website… or anything else. You can also email our “Mailbag” address at any time: [email protected].

At the end of this issue, you’ll find our model portfolio, watchlist (which is also here), and Mailbag — as well as a “Best Buys” section, where we’ll briefly cover three portfolio names that we think you should consider buying first.

Again… we’re excited that you’re with us…and we’re looking forward to a long and fulfilling relationship.

If you’re not a member and would like to learn more, click here.

Four-year-old Kasia didn’t know it… but September 29, 1982 was the last time she would ever run an errand with her dad.

That morning, Kasia happily tagged along with her father, Adam Janus, as he stopped off at a Chicago-area Jewel-Osco drugstore to pick up a few items. One of those things was a red-and-white box containing a bottle of Extra-Strength Tylenol painkillers.

“I remember him picking up that box and putting it in the basket,” she told NBC years later. “That was my last time with him.”

Hours after the drugstore trip, 27-year-old Adam was dead. As police would later learn, he’d unknowingly swallowed a Tylenol capsule laced with cyanide.

Adam’s cause of death was released too late for Kasia’s 25-year-old uncle Stanley and his new wife Theresa. As family and friends gathered after Adam Janus’ death – initially assumed to be a heart attack – Stanley and Theresa complained of headaches and each popped a capsule from the same red-and-white bottle in the Januses’ kitchen.

Within two days, the newlyweds were also dead.

Over the next few weeks, investigators gradually pieced together a terrifying story: someone in the Chicago area had been entering drugstores (most frequently, the Jewel-Osco chain), opening random bottles of Tylenol, and dropping in poisoned capsules.

Seven people – including the three Janus family members, a young flight attendant, and a 12-year-old girl – died after swallowing one of the tainted pills. After the sixth and seventh victims were found, the Washington Post reported, “Investigators say it is possible that all the poisoned ‘Extra-Strength Tylenol’ bottles of capsules originated in shipments to the Jewel-Osco drugstore chain in the area.”

In the mass panic that followed the “Chicago Tylenol Murders,” Johnson & Johnson, Tylenol’s manufacturer, recalled 31 million bottles of the painkiller and implemented the first-ever “triple-seal tamper-resistant packaging,” which soon became industry standard. (Unfortunately, despite a $100,000 reward, the mysterious killer was never caught.)

And, in a roundabout way, the unsolved 1980s case launched one of the most successful “Forever Companies” of all time…

The Tylenol murders were the start of a long downward spiral for Jewel-Osco, a combined grocery and drug chain that sometimes appeared as a standalone Osco drugstore but more frequently with a companion Jewel grocery. Three years after the 1982 tragedy, the company was in the news again – this time, for supplying salmonella-contaminated milk to 20,000 unlucky customers, and eventually forking over $40 million in damages.

Along with the bad press, Jewel-Osco endured a rocky 1984 management shakeup and a hostile takeover by a larger company, American Stores – and then turned out to be a bad bargain for the aggressive buyer.

In particular, the Osco Drug side of the business was a disappointment. Eighteen months after the acquisition, Osco’s operating results were consistently below expectations – ultimately spurring American Stores to sell 125 Oscos and Jewel-Oscos in 1991.

By 1989 – after almost a decade of bad headlines, operational challenges, and underperformance – Osco president Dick George had had enough. He decided to resign from the troubled company and strike out on his own.

And he’d cash in on the one part of the Osco business that did seem to work: cosmetics.

A Huge New Market That No One Else Noticed

During his time running the company, Dick George had paid special attention to the sales of Osco’s highest-margin items: cosmetics, perfumes, and other beauty products. After studying this segment over time, he identified a critical shortcoming among the retailers serving this lucrative market.

Traditional beauty retailers were split into two camps. Grocery stores and drugstores sold discount brands. Meanwhile, mall department stores and specialty retailers exclusively sold higher-end, luxury brands. But George realized that most women bought beauty products across the value spectrum. The same consumer might buy value makeup or perfumes for day-to-day wear, and then switch to premium brands for weekend outings and special occasions.

Since retailers only catered to only one end of the market, shoppers had to visit multiple stores to buy their beauty products.

From this simple insight, a new retail concept was born. In 1989, George resigned from Osco and devised a business plan. He wanted to create the first cosmetics store that offered products across the value spectrum – from mass market to premium brands.

George introduced the concept to fellow Osco executive Terry Hanson. Hanson had just replaced George at Osco. But he didn’t hesitate in relinquishing his lucrative presidential perch. As Hanson explained in a 2017 interview, he immediately joined the start-up because he “just believed in it so strongly.”

In addition to a mix of product offerings, Hanson drew upon his 20 years in retail to introduce other innovative store features designed to create a better shopping experience. For example, Hanson knew that women were more likely to shop at locations with parking lots closer to store fronts. This led to the idea of building free-standing locations in strip malls, in contrast with big-brand retailers buried deep within shopping malls.

This not only saved customers time, but it boosted the bottom line. Leasing standalone stores in strip malls cost less than premium-priced locations in shopping malls.

Hanson also did away with the aggressive sales tactics commonly used by large department stores. As he explained to the Chicago-area Daily Herald in 2017:

“Women didn’t want to be ‘attacked’ going into the store by clerks who would spray them with fragrances.”

Hanson and George trained employees as consultants who would offer expert help only when requested. They designed the stores to be open, inviting, and filled with displays that customers could peruse on their own. This was a critical distinction versus traditional department-store layouts, which kept merchandise behind glass enclosures. This forced customers to engage with commission-based salespeople, who pushed them to buy products that generated the highest commissions – not always the products that best met a customer’s needs.

George and Hanson devised a brilliant alternative sales strategy with a much lighter touch. They built full-service beauty salons into each store, with the idea that customers would naturally inquire about (and eventually purchase) the products being used. This would pull customers toward new products, instead of pushing them through aggressive sales tactics. It also offered customers additional convenience, by providing a one-stop shop for both beauty treatments and products.

Each of these ideas were small, but powerful tweaks to the existing beauty retail concept. Combined, they offered a revolutionary change to the customer buying experience. Other industry experts recognized the brilliance of their approach. George and Hanson attracted another 11 former Osco executives to join the start-up. And within only four months of drafting the business plan, they raised $11.5 million in venture financing.

The first store opened in the northwest Chicago suburbs in 1990. It was an instant hit, leading to four successful store openings the following year. George and Hanson continued refining the model with new stores, and growth accelerated throughout the 1990s and 2000s.

The Ultimate Recession-Proof Business

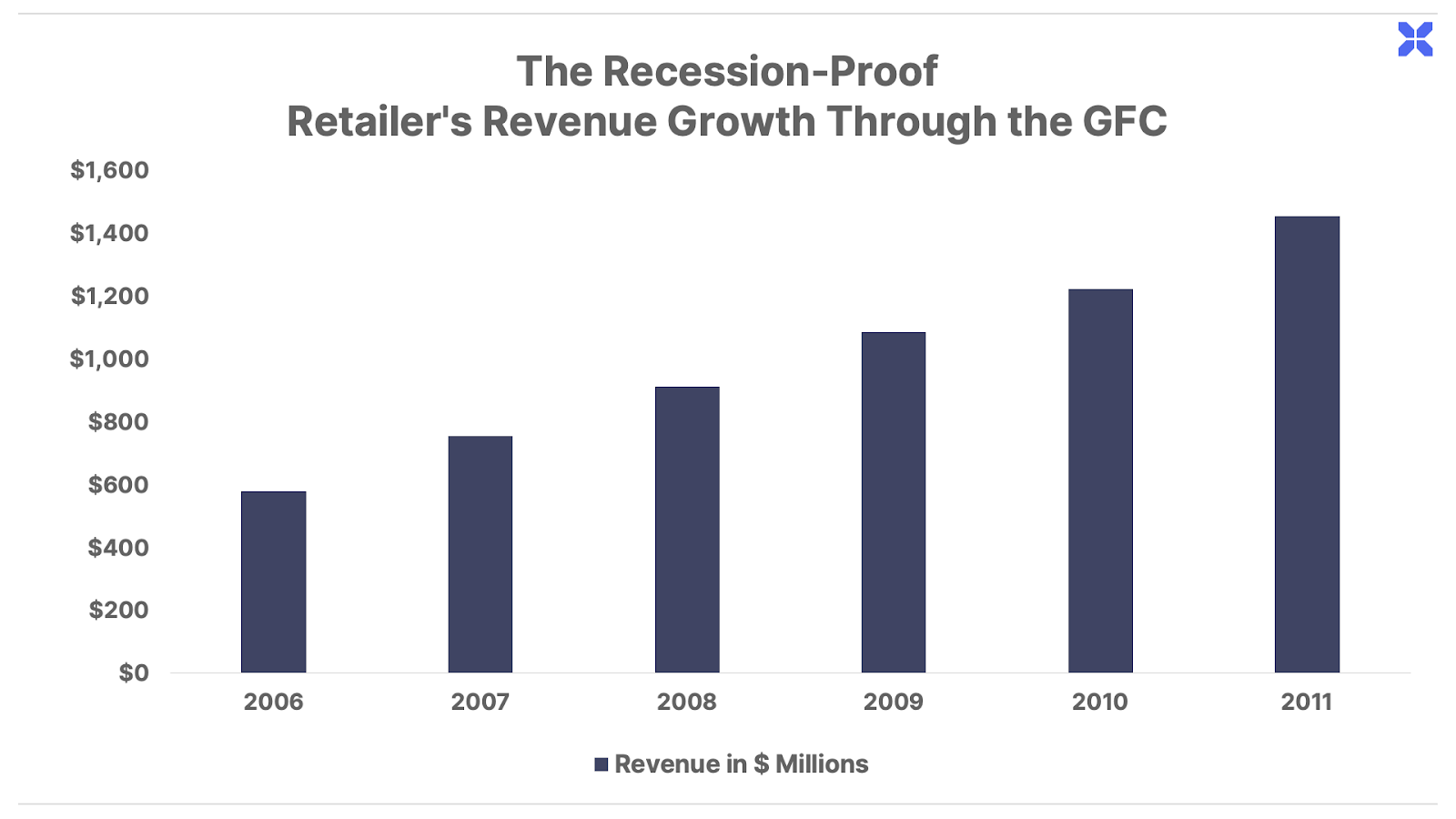

In October 2007, the company filed for an initial public offering (“IPO”). Unlike most retailers that suffered a collapse in demand during the Great Financial Crisis (“GFC”), the business grew sales consistently throughout the recession:

The company benefits from the “lipstick effect” – when consumers continue spending on makeup and other beauty products regardless of the economic climate. Looking your best never goes out of style, even in the worst economic crisis of a generation.

The business not only escaped the GFC unfazed, but it also shrugged off the rise of e-commerce that disrupted other businesses. Most brick-and-mortar retailers have suffered declining sales and shrinking profit margins because of Amazon and other online shopping alternatives. But this company has consistently taken market share from its traditional retail peers, while expanding its profit margins over the last decade.

That’s how it became one of the best performing stocks in the market, delivering a 22-fold return since its 2007 IPO. That compares with a three-fold gain in the S&P 500 Index over the same period.

As we’ll show in this issue, this share-price performance reflects the company’s entrenched competitive advantages built into its clever business model. These advantages have grown stronger over time with the company’s increasingly dominant size as America’s number-one beauty retailer. It has also boosted its profitability and capital efficiency, putting the company’s financial returns on par with today’s leading technology companies.

Looking ahead, the company is poised to expand its competitive position through the development of cutting-edge artificial intelligence (AI) and augmented reality (AR) technologies. These offer the potential to supercharge sales and further elevate the company’s already best-in-class profit margins and capital efficiency.

This content is only available for paid members.

If you are interested in joining Porter & Co. either click the button below now or call our Customer Care team at 888-610-8895.