Dismal Quarterly Results Highlight Deeper Problems

Activist Investors Might Be Seeing an Opportunity

No matter how hard Tom the cat tries – with axes, poison, bazookas, or pianos dropped from above – he just can’t catch (or kill) clever Jerry, the mouse.

The warring animated duo, who starred in 166 violently slapstick cartoon shorts since the Hanna-Barbera studio launched the Tom & Jerry franchise in 1940, are mostly wordless, punctuated by occasional yelps of “Help!” “NOOO!” or “Something’s burning!” (Often, Tom’s fur or whiskers.)

Now, though, thanks to the Chinese coffee-shop chain Luckin, the cat-and-mouse pair has a new catchphrase: “Who took my mascarpone latte?”

Luckin, which is back from a near-death experience of fraud charges and a delisting from the New York Stock Exchange in 2020, serves intriguing treats like “velvet lattes” and liquor-infused chocolate milk – and, most recently, a Tom-and-Jerry-themed mascarpone cheese latte, paired with special Tom and Jerry stickers. (One reviewer claims the latte’s flavor is “reminiscent of cheesecake.”)

Besides attention-grabbing flavors, Luckin’s genius lies in its deep understanding of its demographic of penny-conscious Chinese students. The high-tech coffee shop brews specialty drinks for roughly half the price of a Starbucks latte, and its app-only purchase system dispenses with cash register lines altogether.

And thereby hangs a “tail…”

Tom and Jerry are a curiously appropriate pair of mascots for the scrappy coffee chain, which keeps trouncing its main rival in China, Starbucks, by almost every metric.

Despite Starbucks’ long-standing presence in the country (they brewed their first Americano in Beijing in 1999), home-grown Chinese coffee chains like Luckin, Cotti, and Manner are now edging out the green mermaid. The number of coffee shops in the tea drinkers’ paradise skyrocketed 53% in 2023 alone – with Luckin at the head of the line, opening more than a quarter of the 18,241 new establishments. (Starbucks only opened 785 new stores during the same time period.)

Luckin isn’t the biggest coffee shop in the world, but it’s now officially the biggest one in China. The upstart chain posted $995 million in revenue in the fourth quarter of last year, compared to Starbucks’ $735 million for the same period. Luckin now runs 13,000 shops in China, compared to fewer than 7,000 for Starbucks.

Starbucks’ stumble in China isn’t a one-off. The coffee giant’s woes extend across the globe.

Over the past several years, the corporation has found itself dealing with politically-motivated boycotts, union spats, supply-chain malfunctions, and a clueless new CEO who’s spent six months cosplaying as a barista – resulting in one of the company’s worst quarters on record, in Q1 2024.

In this week’s issue, we’ll discuss the future of this once capital efficient powerhouse… and whether investors should perhaps send their drink back up to the counter and ask for a new one…

Starbucks’ First Revenue Decline in Over a Decade

Over the past several decades, Starbucks (Nasdaq: SBUX) has grown from a tiny, regional coffee chain to one of the world’s most popular and recognizable brands. And its simple business model is one we’ve admired for years. As Porter explained when he first recommended the stock to subscribers a little over 16 years ago…

… it’s a truly fantastic business…

If you know anyone who drinks Starbucks coffee, you understand my point. These folks aren’t addicted to coffee; they’re addicted to Starbucks. These addicts have powered the rise of the most dominant new American brand of the last 20 years. It’s hard to believe, but Starbucks only began operations in 1985. That’s the power of an incredibly strong stimulant packaged in a premium brand…

Starbucks is not a complicated business. It sells premium coffee, at a premium price, at premium locations to highly addicted customers willing to pay $4.50 for a cup of coffee.

Despite significant ups and downs in the economy – including the 2008-2009 Great Financial Crisis and the 2020 COVID-19 lockdowns – SBUX shares have delivered a total return of 1,090% since that first recommendation (16.7% annualized). That’s more than triple the return of the S&P 500 (350%) over that time.

However, despite that strong performance, the stock is trading well below its 2021 high – and last month dropped 16% after reporting one of the company’s worst quarters ever.

During Q1, sales fell for the first time in over a decade (except during the COVID lockdowns). Total revenue declined 2% to $8.6 billion, North American revenue was flat at $6.38 billion, while international revenue fell 5% to $1.76 billion.

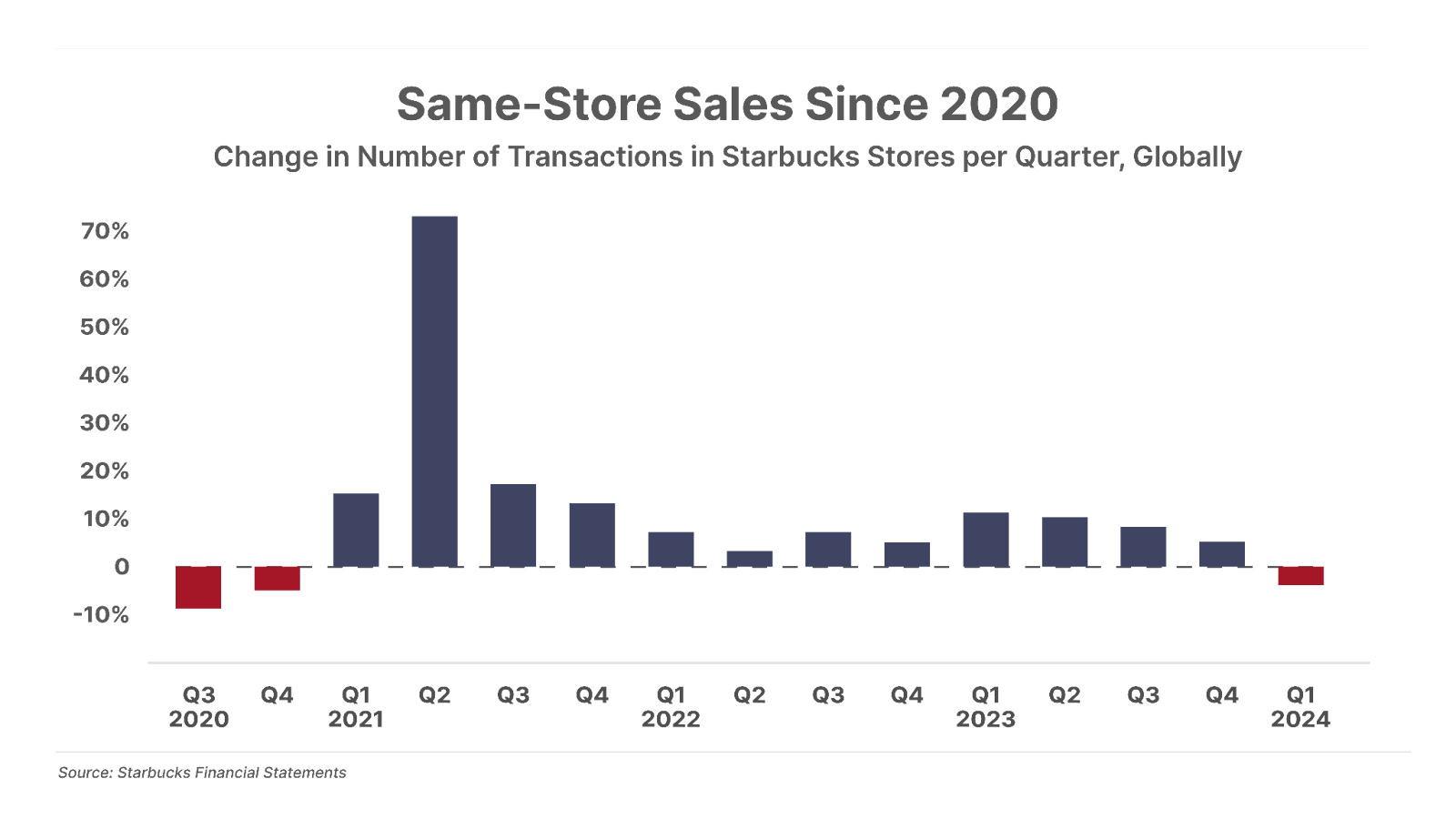

While non-U.S. performance was the real drag, results were particularly poor in China, where same-store sales – sales from existing stores, excluding the impact of new store openings – fell 11%. Total customer transactions across all stores declined 7%, with all geographic segments showing weakness. Earnings per share fell 14% year-over-year. Active U.S. Starbucks Rewards members – the company’s most-loyal customers – also declined (4%) for the first time in years. And in its earnings conference call, management cut its full-year growth forecast to low-single digits (from mid double-digits previously) and warned that full-year earnings may be flat.

The results were a “stunning across-the-board miss on all key metrics,” an analyst for investment bank William Blair told CNBC. The 16% plunge following the report was the worst drop in the stock price since the COVID crash – and shares are now trading at $75, more than 40% below their July 2021 peak.

Given our longtime fondness for the company, this recent sudden weakness got our attention. We’re always on the lookout for world-class businesses facing temporary problems that cause their shares to trade at discounted prices.

However, this does not appear to be the case for Starbucks. The company’s CEO, Laxman Narasimhan – who became the company’s head in April 2023 – blamed its poor performance on cold weather and “conflict in the Middle East.” But in fact, the company is facing a fistful of significant structural problems with no easy solutions.

Consumers Are (Finally) Pulling Back

The first big challenge isn’t isolated to Starbucks alone. A number of other consumer-facing companies – from McDonald’s (MCD) to Nike (NKE) to PepsiCo (PEP) – have recently warned about slowing consumer spending.

In short, after years of robust buying, it is becoming increasingly clear that U.S. consumers are running out of cash.

This shouldn’t be a surprise. Inflation has been running well above the Federal Reserve’s 2% target for three years. According to official measures, consumer prices have risen by an average of 20% since 2020 after the government unleashed massive fiscal and monetary stimulus following the pandemic.

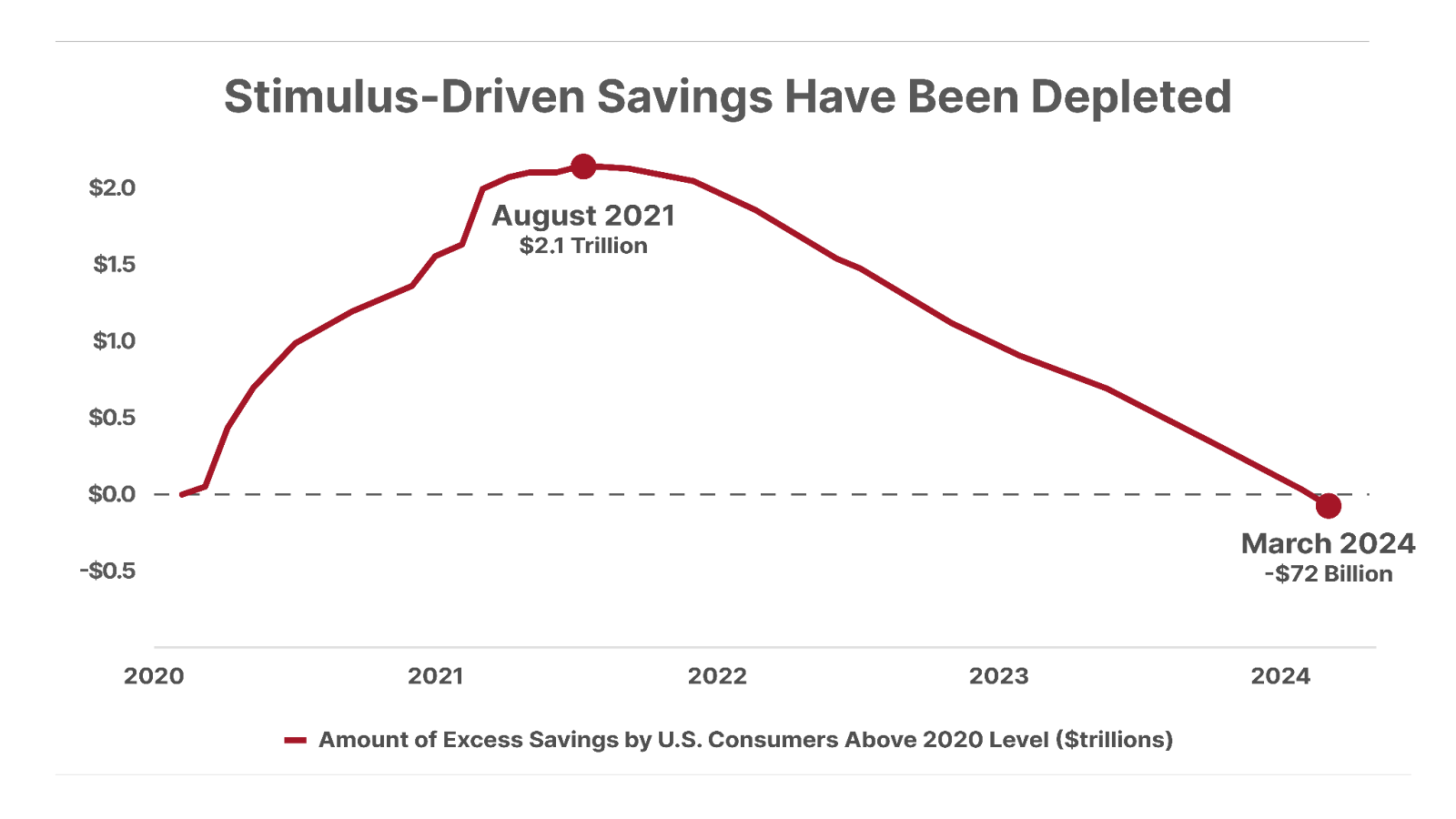

Meanwhile, data show consumers’ stimulus-fueled savings have officially run out.

The chart below shows the “excess savings” for U.S. households – which are savings above and beyond the level before major government stimulus ramped up in 2020. After reaching a peak of $2.1 trillion in August 2021, excess savings by U.S. households has now evaporated and dipped into negative territory – meaning Americans now have less savings than before the COVID stimulus began:

Recent surveys suggest more than 60% of Americans are now living paycheck to paycheck.

Given this bleak combination, it’s only natural that consumers would cut some unnecessary expenses. For many folks watching their monthly supply of funds dwindle, an $8 coffee is an obvious target – which could remain the case for the foreseeable future.

The “Secret” to Starbucks’ Success Is No Longer Being Applied

Customers with less cash isn’t the only problem Starbucks is facing today. The company’s management has also lost focus on what made the company so successful to begin with.

As we mentioned earlier, the “secret” to Starbucks’ success was simple: It sold premium coffee, at a premium price, at premium locations.

Longtime CEO Howard Schultz deserves much credit for the company’s decades-long success – leading the coffee maker over two stints between 1986 to 2017. Schultz’s original idea was to create a U.S. version of the classic Italian coffee house, with Starbucks locations serving as a “third place” – a comfortable space for people to gather and socialize outside of their homes and offices, akin to their neighborhood pub.

In other words, Schultz turned Starbucks into a beloved brand by offering customers a premium experience, not just a premium product.

However, management appears to have lost sight of this fact. To be fair, this trend began even before Schultz stepped down (for the third time) last year, but it has accelerated under the new CEO Narasimhan.

Surveys show Starbucks employees (or partners, as the company calls them) were once routinely among the most satisfied retail workers, thanks in large part to the company’s relatively generous compensation and benefits packages, and positive work culture.

Today, they increasingly report being overworked, underpaid, and micromanaged by managers more concerned with customer throughput than customer satisfaction. This, in turn, has led to longer wait times for customers and a loss of the friendly “third place” atmosphere that once drew them in.

The result is that Starbucks is increasingly becoming just another place to get coffee – like McDonald’s, Dunkin’ Donuts, and countless independent coffee shops – in the eyes of consumers. Yet, it’s still charging premium prices.

As Schultz himself noted in a public LinkedIn post in early May, that is a recipe for continued disappointment…

Over the past five days, I have been asked by people inside and outside the company for my thoughts on what should be done. I have emphasized that the company’s fix needs to begin at home: U.S. operations are the primary reason for the company’s fall from grace. The stores require a maniacal focus on the customer experience, through the eyes of a merchant. The answer does not lie in data, but in the stores.

Senior leaders – including board members – need to spend more time with those who wear the green apron. One of their first actions should be to reinvent the mobile ordering and payment platform – which Starbucks pioneered – to once again make it the uplifting experience it was designed to be. The go-to-market strategy needs to be overhauled and elevated with coffee-forward innovation that inspires partners, and creates differentiation in the marketplace, reinforcing the company’s premium position. Through it all, focus on being experiential, not transactional.

Strategic Missteps in China

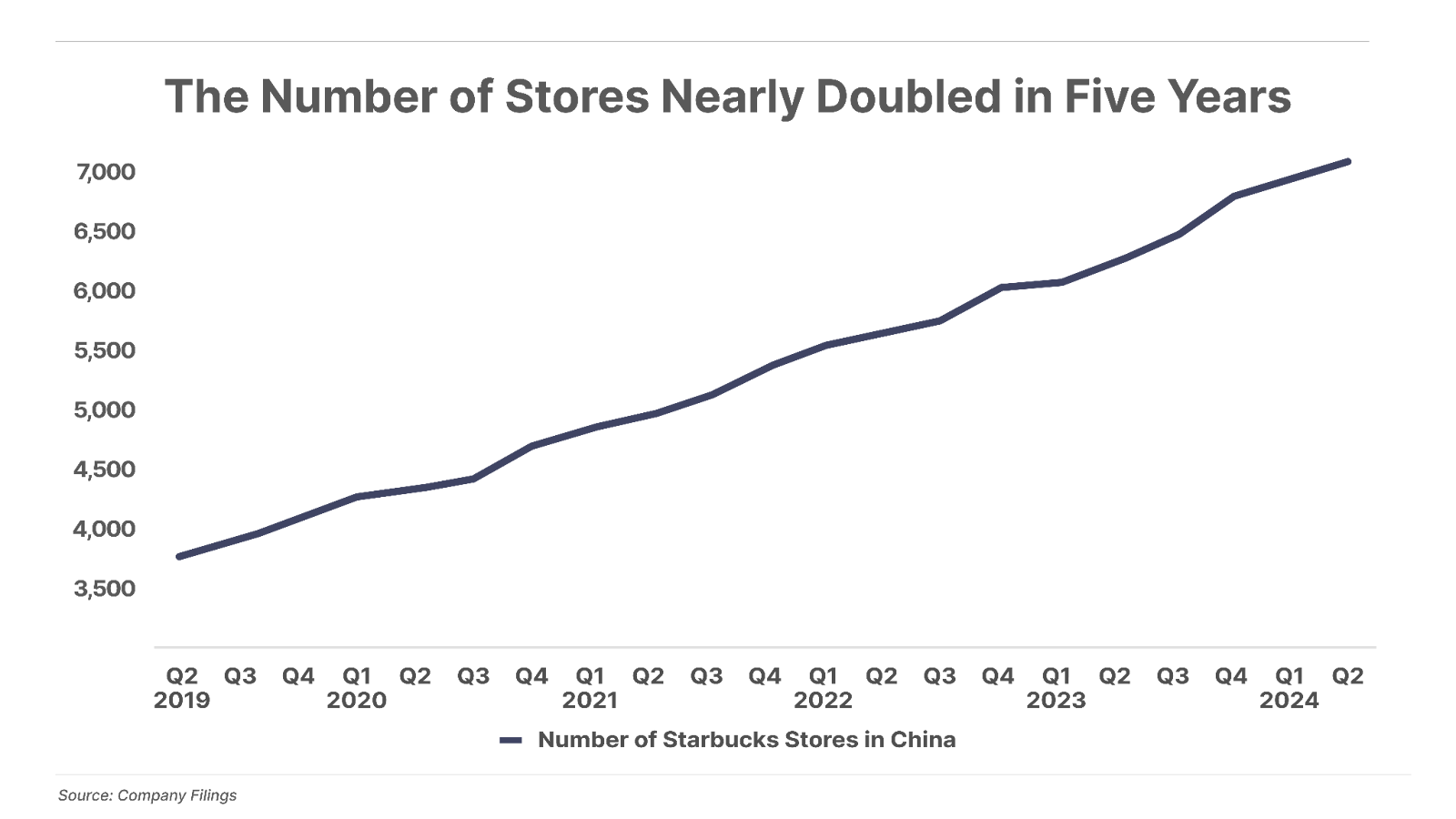

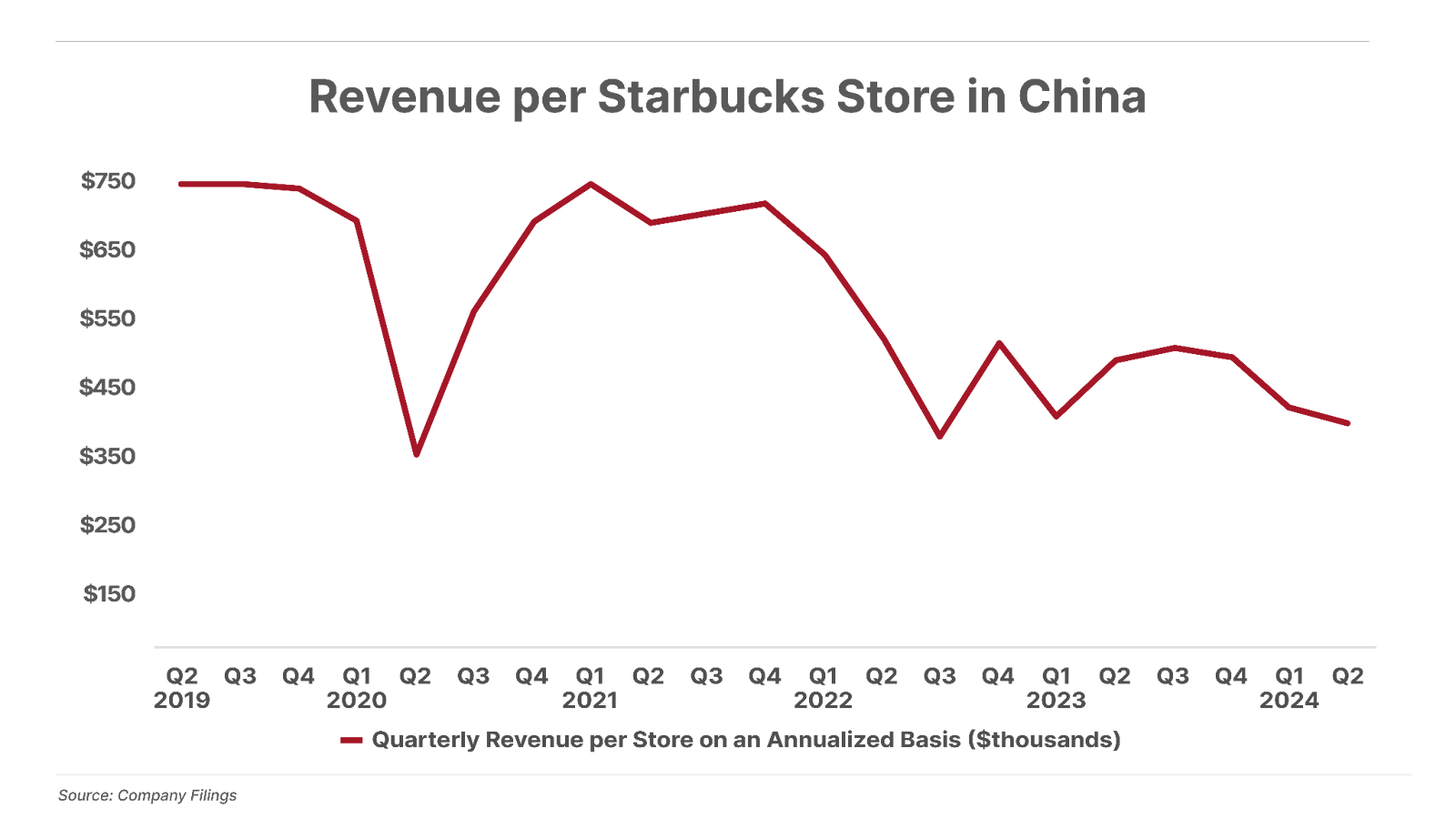

Finally, the third, and perhaps most significant, problem facing Starbucks today is its performance in China, which is the company’s second-largest market and primary source of growth over the past several years.

Much of the challenge in China is that while the company’s premium “third place” approach was instrumental in its previous success in the U.S., this strategy does not appear to be a great fit in China.

Starbucks has added more than 3,300 stores in China since 2019, an increase of nearly 90%.

However, the company’s total China sales were essentially flat over that period. That translates to a catastrophic 47% decline in revenue per store there over the past five years.

This slowdown has occurred despite a significant increase in Chinese coffee consumption over that time. Data from the International Coffee Organization shows consumption increased 15% last year alone.

As the rapid growth of up-and-coming rival Luckin Coffee – and its cheesecake flavored latte – mentioned earlier suggests, Chinese coffee consumers are different from their U.S. counterparts. They tend to be more concerned with convenience and value than experience. And by not sufficiently catering to this behavior, Starbucks is currently losing on both measures.

There are a couple important reasons for this.

First, Luckin has focused heavily on efficiency, with automated drink-making, cashless payments, and convenient grab-and-go store formats. Starbucks has largely stuck to its traditional, “third place,” barista-operated format that worked so well in the U.S.

Second, Luckin has adopted a franchising model, while Starbucks owns or licenses all of its stores (in China and elsewhere). This model – along with Luckin’s smaller, bare-bones stores – generate significantly lower operating costs. As a result, Luckin is able to sell its drinks for about half the cost of those at Chinese Starbucks stores.

Unless Starbucks makes similar strategic shifts – and management has shown no indication it intends to do so – it’s difficult to see how the company can regain its footing in this once-promising market.

Without the Chinese market to fuel continued expansion, the company’s future growth is likely to be dramatically slower than projected. And this in turn means the stock’s current multiple of roughly 20 times earnings is likely still far too high.

Ultimately, unless Schultz decides to return a fourth time to right the ship once more, Starbucks could become the target of an activist campaign. This is precisely the type of situation that activist investing firms like Elliott Management and Starboard Value love: a once-dominant company with a fantastic business model suffering from a crisis of leadership.

Following these investors can be incredibly lucrative – activist investing can produce fantastic, low-risk returns in virtually any market environment. That’s why we launched a service dedicated entirely to this strategy last fall: Porter & Co. Activist Investor. Early subscribers have already had the chance to lock in gains of more than 30% while taking very little risk.

You can learn more about Activist Investor by calling customer-care concierge Lance James and his team at (888) 610-8895.

Porter & Co.

Stevenson, MD