Issue #11, Volume #1

He Was a Financial Genius… And a Gentleman

Three Things You Need To Know Now:

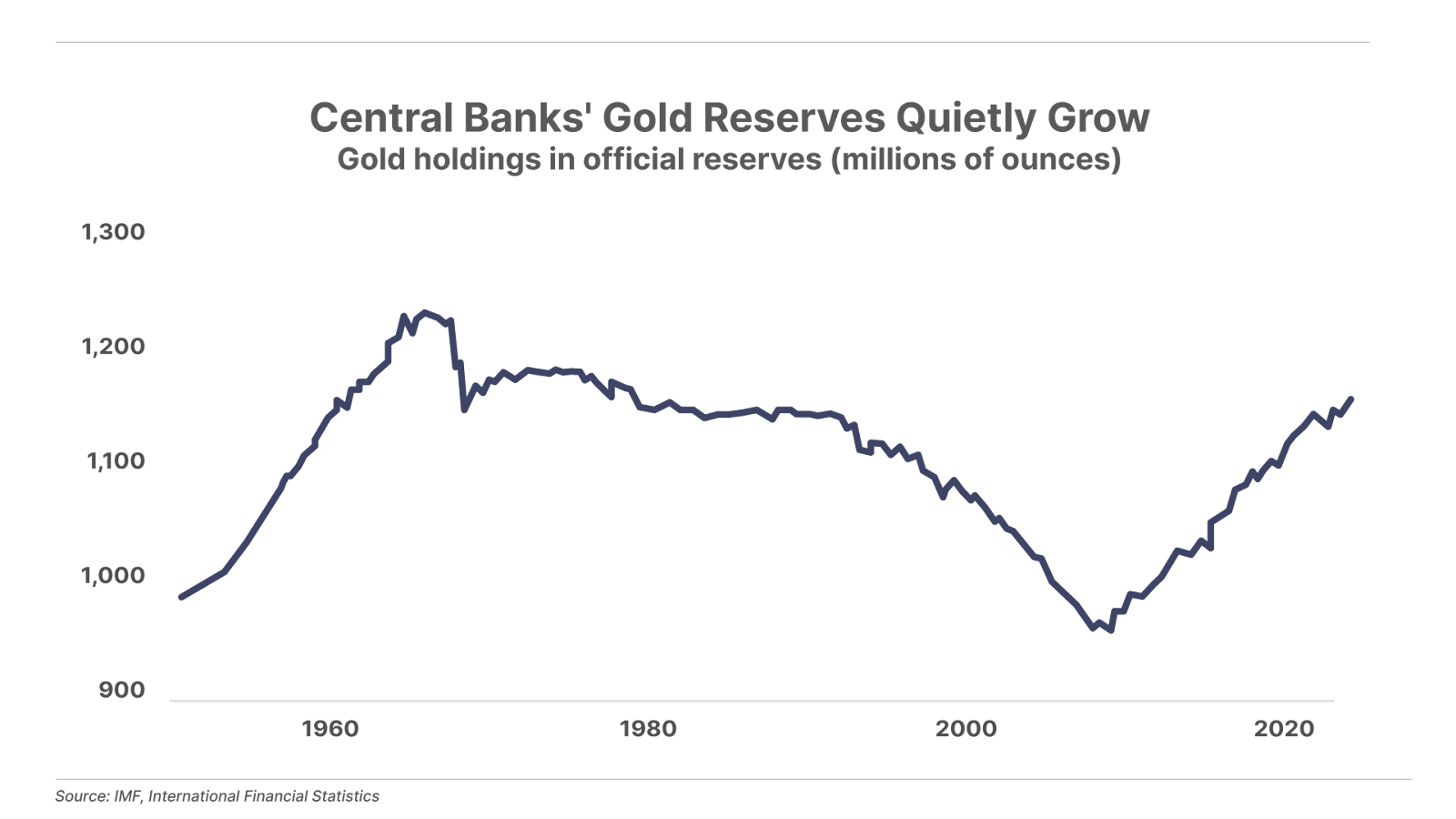

1. Markets are soaring because of a huge, new wave of liquidity. There were 21 interest rate cuts from central banks around the world in September, the most since April 2020 (in the midst of the COVID global shutdown). This surge in liquidity is similar in scale to the infusion that followed the 2008 Great Financial Crisis. Seems like the bankers might be overdoing it. I’d avoid any fixed income with a duration longer than two years. Stock markets continue to be strong. And it’s no surprise gold is having its best year in decades (see the “Chart of the Day,” below).

2. Today’s OPEC meeting saw the Saudis warning of $50 oil. The Wall Street Journal is quoting Saudi oil minister Prince Abdulaziz bin Salman as saying “Some better shut up and respect their commitments to OPEC+,” in reference to Iraq, which has been violating production limits by 400,000 barrels per day (about 10% over their limit). There’s hardly a group of people anywhere that I’ll enjoy watching suffer more than OPEC members. Those folks have been manipulating the world’s oil market for decades. But guess what? Their share of the world market has now fallen below 50%. And thanks to huge new discoveries in Guyana and Brazil and increasing production in the U.S.’s Permian Basin, OPEC’s control of the market isn’t likely to return for decades, if ever. The last time the Saudis launched a full-blown price war to force compliance among OPEC members was 1986. Oil fell to $10 per barrel. Today it sits around $70 per barrel. Here’s hoping they do it again!

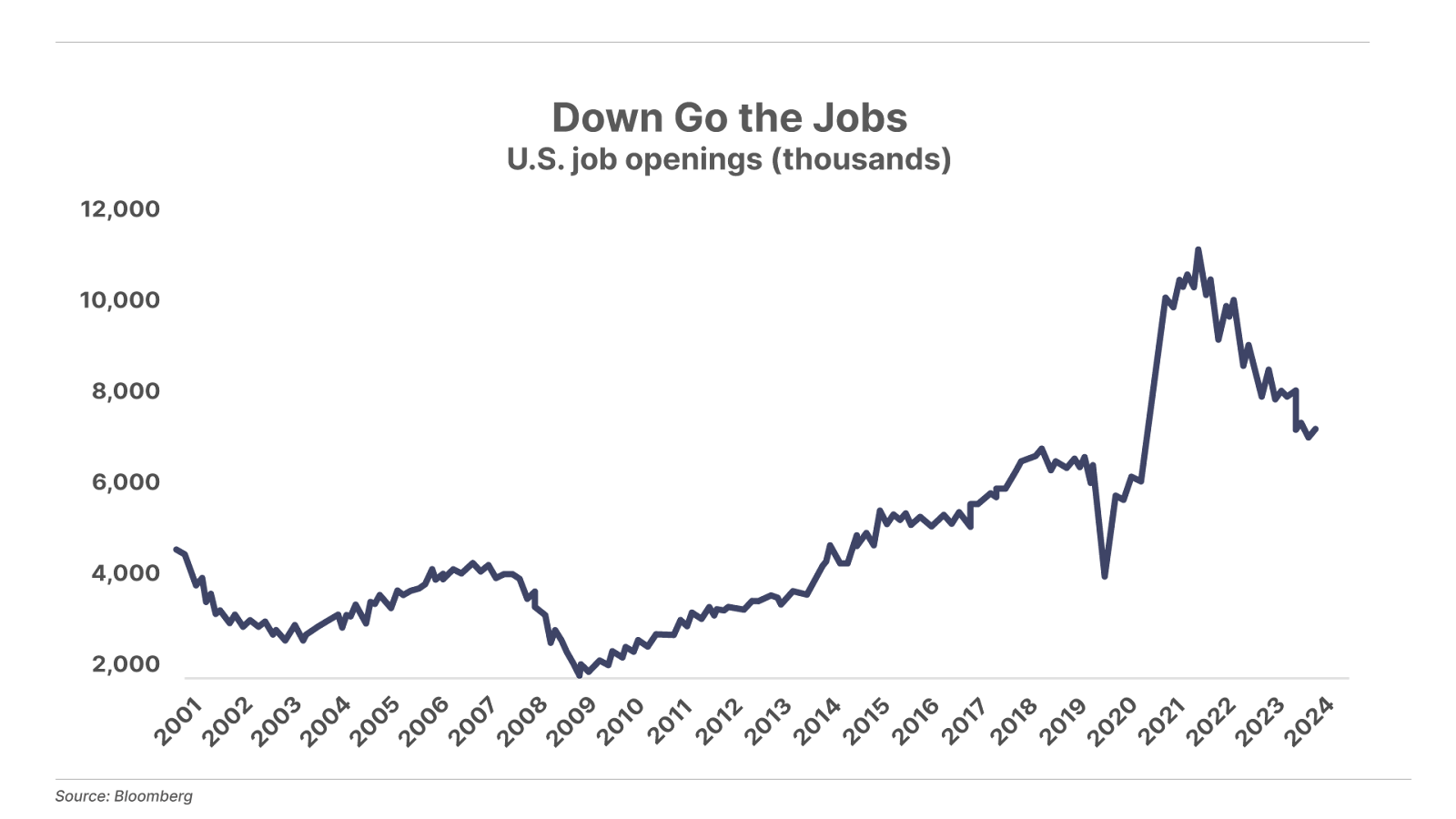

3. More signs of economic weakness. The JOLTS (Job Openings and Labor Turnover Survey, produced by the Bureau of Labor Statistics) job openings data for August that was released today bounced slightly, but not enough to change the downward trend that’s been in place since mid-2022. Meanwhile, all of the other economic data released today was weak: Manufacturing ISM was flat (but contracting) at 47.2% in September. Prices declined sharply to 48.3% (from 54.0% in August). Construction spending declined 0.1% and Manufacturing Employment declined sharply to 43.9% from 46.0%.

And one more thing…

In the past I’ve been critical of Joby Aviation (Nasdaq: JOBY), the “flying car” start-up. But the firm announced today that Toyota Motor (TM) will invest another $500 million in the business. This will bring Toyota’s investment in Joby to almost $1 billion. Joby has been burning through about $400 million a year to develop its flying cars. Toyota, you might recall, helped launch Tesla (TSLA) by investing $50 million into the business back in 2010, for a 3.2% share of the equity. But then the Japanese automaker sold its stake in 2016.

Chart of the Day:

Maybe the Swiss Shouldn’t Have Sold Gold Below $300

Since the early 1970s, U.S. government policy (and the activities of our secret agencies) has persuaded, threatened, and bullied our trading partners (most notably the Saudis) to accept the U.S. dollar (and thus our Treasury bonds) in lieu of gold.

Our military might and the access to our huge economy persuaded the world to go along with the “dollar exchange standard.”

And from the 1970s through the Great Financial Crisis, central banks around the world sold their gold reserves. By the late 1990s, confidence in the U.S. dollar was so strong, even the Swiss were dumping gold, selling more than half of their legendary hoard and driving the price below $300 per ounce.

But, even though nobody seemed to notice, ever since the Great Financial Crisis (and since I wrote The End of America) central banks around the world have been buying gold – more and more every year. In fact, official gold reserves at central banks have completely rebounded and are now at levels last seen in the 1970s.

Think about this: the last time central banks around the world owned this much gold, interest rates in the U.S. were well over 10%. We think gold will go higher.

Richard Russell’s Wisdom: The Four Laws of Investing

Richard Russell’s Dow Theory Letters was the first investment newsletter I ever read.

Russell was a legend. He started out writing for Barron’s. Then, beginning in 1958 and continuing until his death in 2015, he wrote his Dow Theory Letter every month.

Russell’s investment theory was based on Dow’s Theory. Charles Dow, who in 1889 began publishing The Wall Street Journal, created the very first stock index, the Dow Jones Industrial Average. There were only 12 stocks in the original index (today, there are 30). Dow also created a “rails” index, which now is called the Dow Jones Transportation Average.

Dow believed that, using both indexes, you could predict when bull markets or bear markets were imminent. It’s a trend-following strategy. When both the Dow Jones Industrial Average and the Dow Jones Transportation Average are trending higher, then a bull market is confirmed. When both indexes “break down” – that is, when both indexes make a new “lower low” or violate a 90-day moving average – then a bear market is confirmed.

Russell followed this strategy for decades and then, in the late 1980s, as the markets changed – with technology and services becoming more economically important in the U.S. than manufacturing – he developed his own proprietary index he called the Primary Trend Index.

Many investors relied on Russell’s market prognostications, but I think the most insightful things he wrote were the surprisingly simple and timeless principles of successful investment. He distilled all of these ideas into a single essay, called “Rich Man, Poor Man.”

(You can read the whole thing, here.)

Rich Man, Poor Man – The Four Laws

The first law: Time matters most of all.

“Compounding is the royal road to riches,” Russell explained. “To compound successfully you need the following: perseverance in order to keep you firmly on the savings path. You need intelligence in order to understand what you are doing and why. And you need a knowledge of the mathematics tables in order to comprehend the amazing rewards that will come to you if you faithfully follow the compounding road. And, of course, you need time, time to allow the power of compounding to work for you. Remember, compounding only works through time.”

And the second? Don’t lose money.

Virtually everyone ends up losing money because most people do not understand how to mitigate risk and they cannot resist their own greed. If you doubt me, just ask any well-known local accountant. They see how much money most people lose on their “investments.” As Russell wrote: “I can tell you that most people definitely do lose money, lose big time – in the stock market, in options and futures, in real estate, in bad loans, in mindless gambling, and in their own business.”

The third law isn’t a simple rule, but it’s a concept that’s critically important.

I explain it this way: the market doesn’t owe you anything, and you can’t make the market give you anything. The reason why wealthy investors are so much more likely to succeed is that they can afford to wait patiently for exactly the right opportunity. Russell wrote “The advantage that the wealthy investor enjoys is that he doesn’t need the markets. I can’t begin to tell you what a difference that makes, both in one’s mental attitude and in the way one actually handles one’s money.”

I’ve been working with investors for almost 30 years, and if there’s absolutely one thing that sets apart the winners from the losers it’s that wealthy investors know what they’re doing (they do not invest in things where they might lose money) – and they’re patient.

It takes a long time to build a good business. Or to build a great brand. Or to pioneer a new technology. Good investors understand that progress isn’t always measured in this month’s cash flow. How many times have I heard, “But Porter, that stock you recommended two years ago hasn’t even moved yet…”?

If you understood the business and if you knew it was making great progress, that wouldn’t bother you in the least.

I remember when I first began recommending distressed debt to my subscribers in the aftermath of the Great Financial Crisis. One deal that Steve Sjuggerud and I found was a PIMCO closed-end prime mortgage fund that was trading at about half of net asset value, and was yielding 29%. Steve mortgaged his house to buy it – and other, similar opportunities. We went on to average 37% annualized returns on those distressed bonds over the next two years, and many of these bonds paid out high yields for the next four or five years. But still, subscribers complained: Porter, those opportunities only come around about once every decade…

That’s right. The market doesn’t often hand out free money. But it does happen often enough if you’re rich and if you’re patient. Funny how those two things – rich and patient – seem to go together. Maybe they’re linked.

Russell’s fourth commandment is probably the hardest for average investors: You must become a fanatic for understanding an asset’s intrinsic value and you must understand all the factors that create (or destroy) that value.

There are different factors that matter for different kinds of assets. Take an oil well, for example. There are a dozen different factors, all of which can make an oil well either extremely valuable – or actually a liability. The kind of rock is critical. The size of the reservoir. The amount of water in the well. The amount of gas in the well. The distance to a pipeline or railhead. The type of crude oil. The type of gas.

If all you know is the price of a stock or the yield of a bond, you don’t know anything about the value of what you’re buying. And you’re almost guaranteed to lose money as a result. But if you can become an expert in three or four different kinds of assets, then you can become a great investor if you’ll simply allocate to value.

As Russell says:

The wealthy investor tends to be an expert on values. When bonds are cheap and bond yields are irresistibly high, he buys bonds. When stocks are on the bargain table and stock yields are attractive, he buys stocks. When real estate is a great value, he buys real estate. When great art or fine jewelry or gold is on the ‘give away’ table, he buys art or diamonds or gold. In other words, the wealthy investor puts his money where the great values are.

One final note about Richard Russell.

When I was fired from my first job in financial research in January 1999 (my boss said I was the least entrepreneurial person he’d ever met – lol), I wrote to Russell asking if he’d consider taking me on as a research assistant for his newsletter. I wrote similarly to half a dozen other investment writers at the time. But Richard was the only person who ever wrote me back.

He sent a handwritten note to me, not an email. He complimented my work (he’d been following me at The Fleet Street Letter). He told me I would become a big success in this business and he encouraged me to strike out on my own. Later that month, I wrote my first subscription pitch, The New Railroad, and launched my own newsletter.

Richard Russell was a genius. And a gentleman.

Good investing,

Porter Stansberry

Stevenson, MD

P.S. Speaking of compounding… and the kind of wealth it can create… let me tell you about Pieter Slegers.

I caused a ruckus just before last week’s Porter & Co. annual conference last week over this young Belgian man – whose views on investing are almost eerily similar to mine (and I think Richard Russell would approve too).

After I read Pieter’s Compounding Quality, I suggested – well, insisted – that the conference team find a way to get him to speak to our Partner Pass members.

And Pieter didn’t disappoint. My “investing brother from another mother” wowed the audience with his focus on exceptionally high-caliber companies that have big moats and trade at a reasonable price.

I only recently discovered Pieter and Compounding Quality. And I don’t think I’ve ever seen someone whose work I’m willing to so wholeheartedly endorse so quickly.

The fact is: Pieter is one of a kind. While he’s still a young man, he’s got the insight (and performance) of an investor with decades of experience, and I believe that following his ideas could make you a lot of money.To find out more about Compounding Quality, and get the full portfolio and all of Pieter’s ongoing analysis and recommendations, check out the special offer Pieter has put together exclusively for Porter & Co. It’s a fantastic deal: You’ll receive the Founding Partner package for the price of an annual membership (on the web page link, just select the “Annual” choice, and Pieter will manually upgrade you.)