Issue #40, Volume #1

Saylor Is Flying Too Close to the Sun

This is Porter & Co.’s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” from across our different portfolios, by going here.

Three Things You Need To Know Now:

1. Whitney Tilson is running for mayor of New York City. As many of my long-time readers know, I’ve been friends with Whitney Tilson for 20 years. We first met because we were on different sides of a stock trade – Interoil Exploration. We were long. Tilson was short. He was a gentleman and open to honest debate. He also respected the work we did and, when the SEC targeted me with lawfare because of my reporting on USEC, Tilson was the only mainstream hedge fund manager who publicly supported me. He is a good man. And a good friend. He’s also a non-woke Democrat who wants to return NYC to a law-and-order town. As a part-time resident, I can’t vote in the election (and as a libertarian, I can’t vote in the Democratic primary that will most likely determine the next mayor), but I’m supporting Tilson financially. I’ll be organizing a dinner for his campaign in New York in the New Year. Let me know if you’d like to attend ([email protected].) Right now, though, what Tilson needs most is to prove that he can raise the funds required to launch a successful campaign. It is especially important for NYC residents to help and contribute up to $250 as soon as possible, since the city matches this amount eight to one, so $250 gives Whitney’s campaign $2,250. I hope you can help and support Whitney in whatever manner fits your means and ability to help. Here is the donation link.

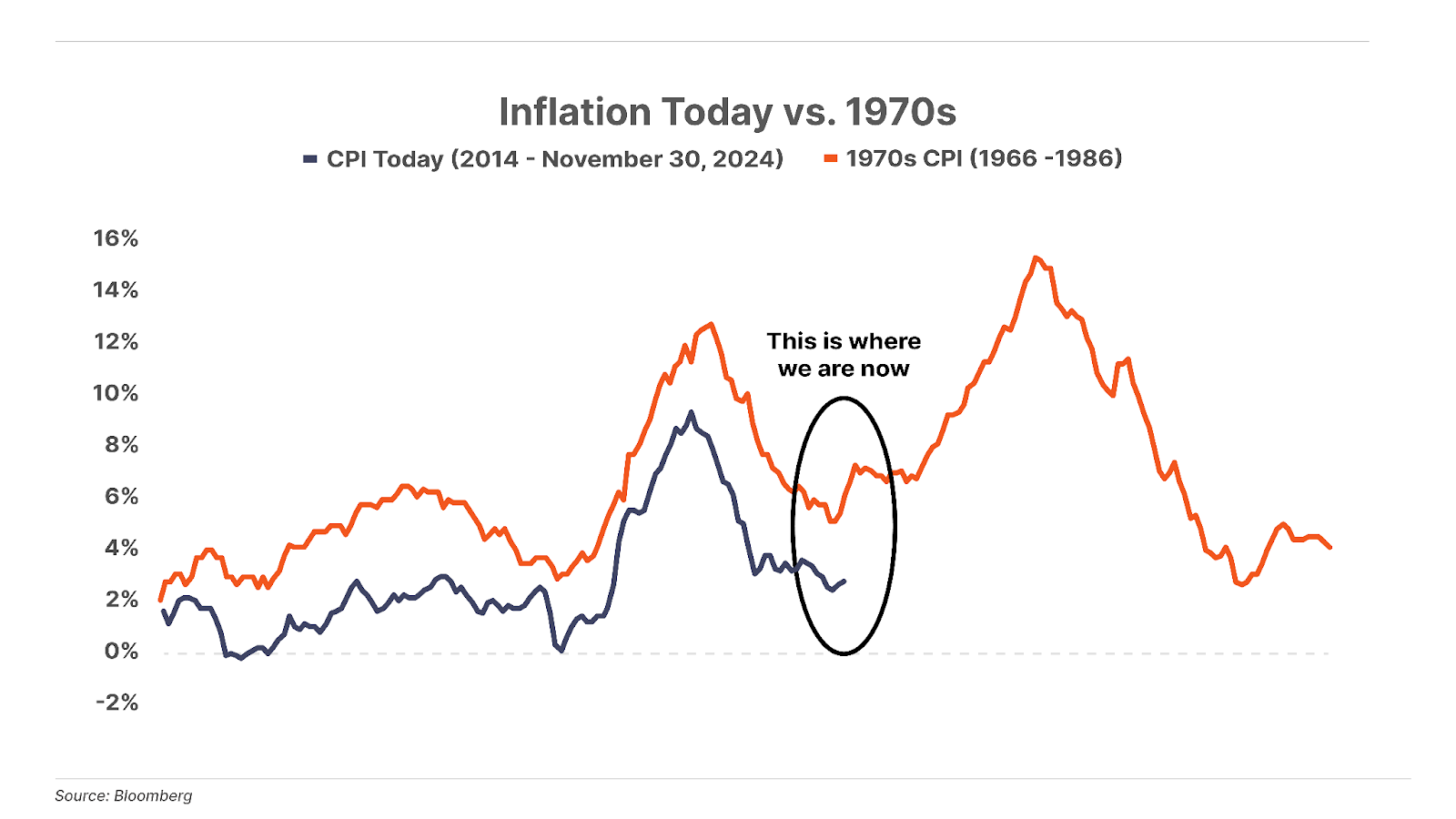

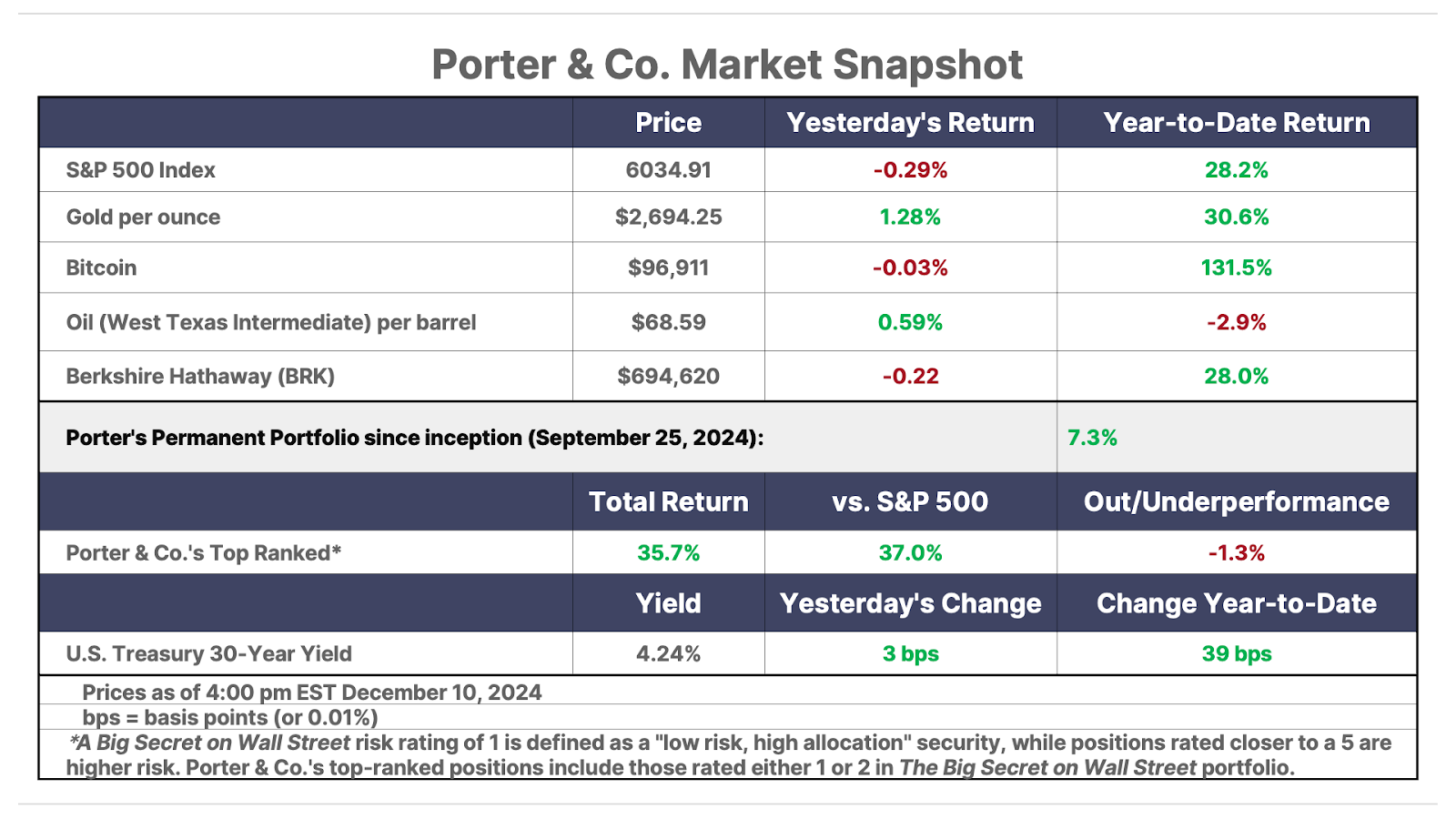

2. Inflation remains “sticky.” This morning, the Bureau of Labor Statistics reported consumer prices rose 2.7% year-over-year (0.3% month-over-month) in November, up from 2.6% (0.2%) in October. Core inflation – which excludes food and energy prices – remained at 3.3% year-over-year for the third consecutive month. However, while inflation remains well above the Federal Reserve’s official 2% target – and continues to look like a repeat of the “cut-too-soon” 1970s (see the graph below) – this month’s relatively modest increase is unlikely to dissuade the Fed from cutting rates by another 25 basis points when it meets next week.

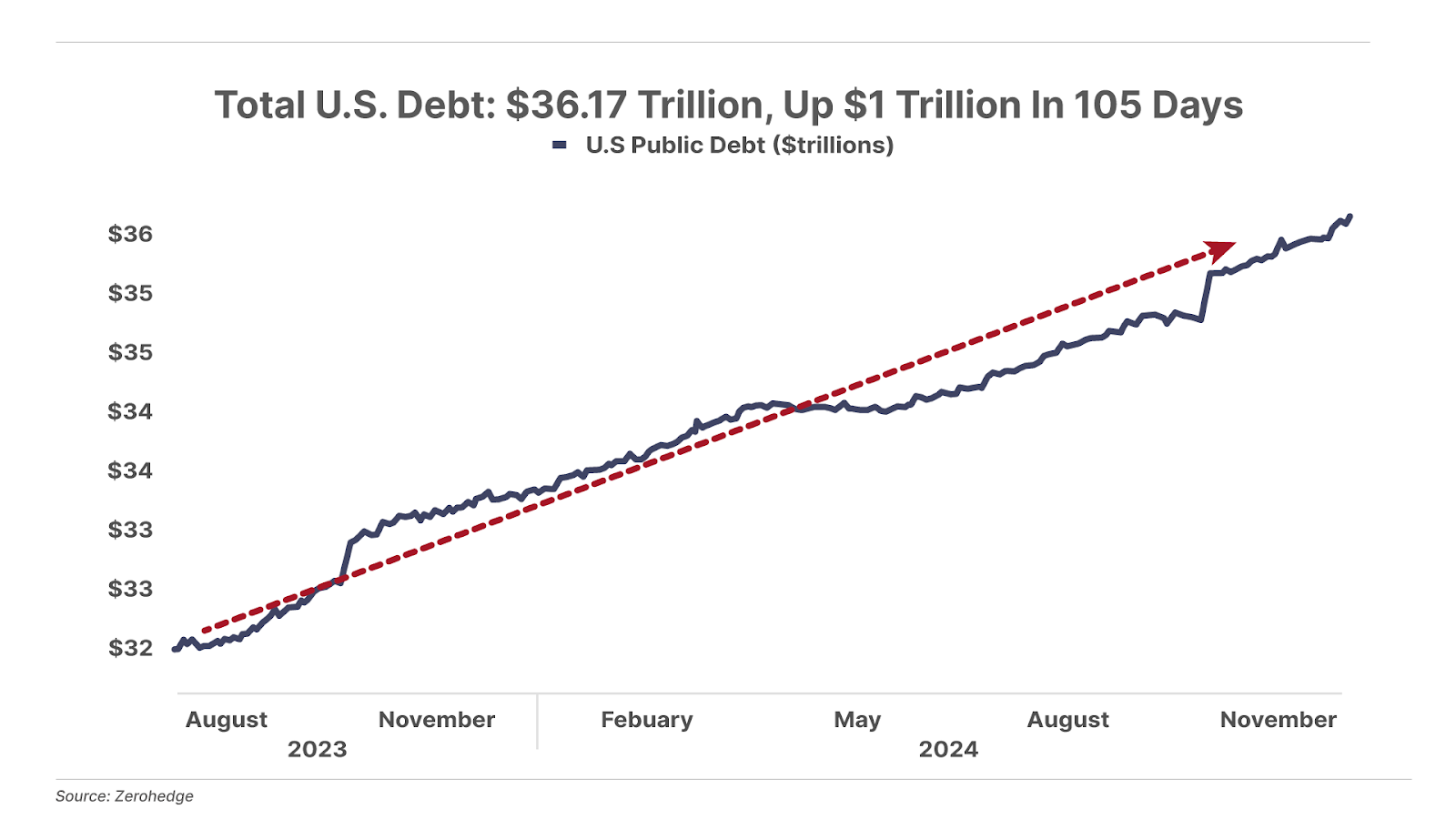

3. The U.S. is in a spiraling debt crisis. Total U.S. public debt has hit $36.17 trillion – up $1 trillion in only 105 days, and $13 trillion since 2020. At this pace, U.S. debt is on track to reach $40 trillion by February 2026. And it’s only growing worse, with total debt to GDP at record levels – 121% – up from roughly 60% in 2008. An incredible 28% of the government’s $5 trillion in annual revenue goes toward paying interest on this debt. We’ve said it before and we’ll say it again: this isn’t sustainable.

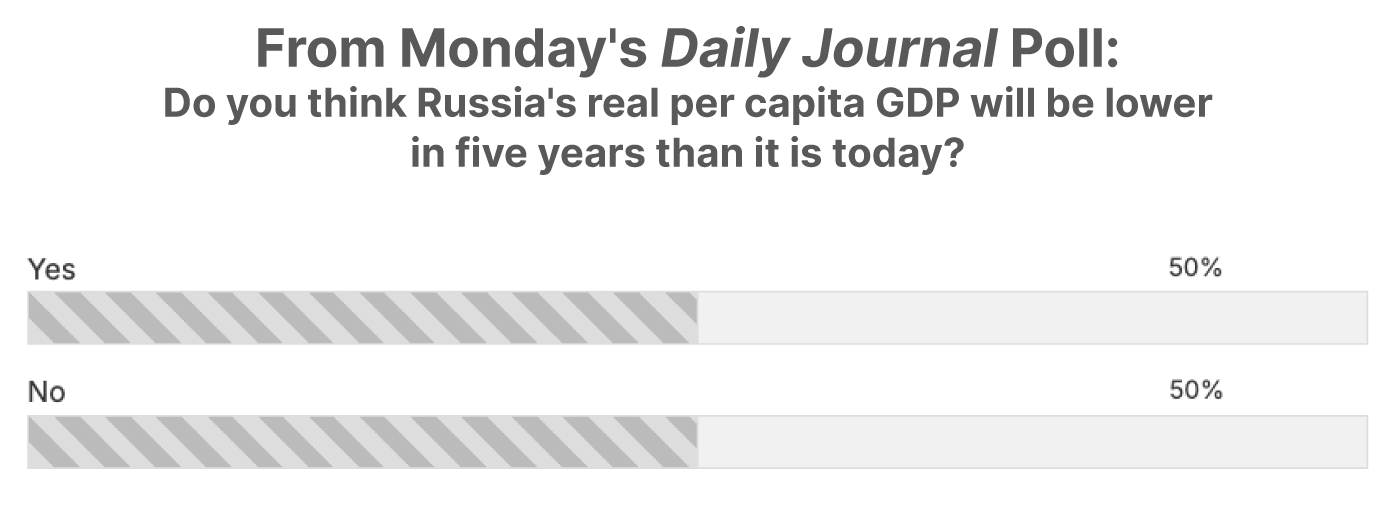

Poll Results

In the latest Black Label podcast, Porter sat down with polymath guest Jim Rickards to talk about the U.S. federal debt, the dangers of artificial intelligence, COVID… and much more… as well as the future of Russia. Porter and Jim disagreed about where Russia is going (as you’ll hear if you give the podcast a listen)… turns out that our Daily Journal readers do too: you’re split straight down the middle over whether Russia’s real per capita GDP is going up or down over the next five years.

And one more thing…

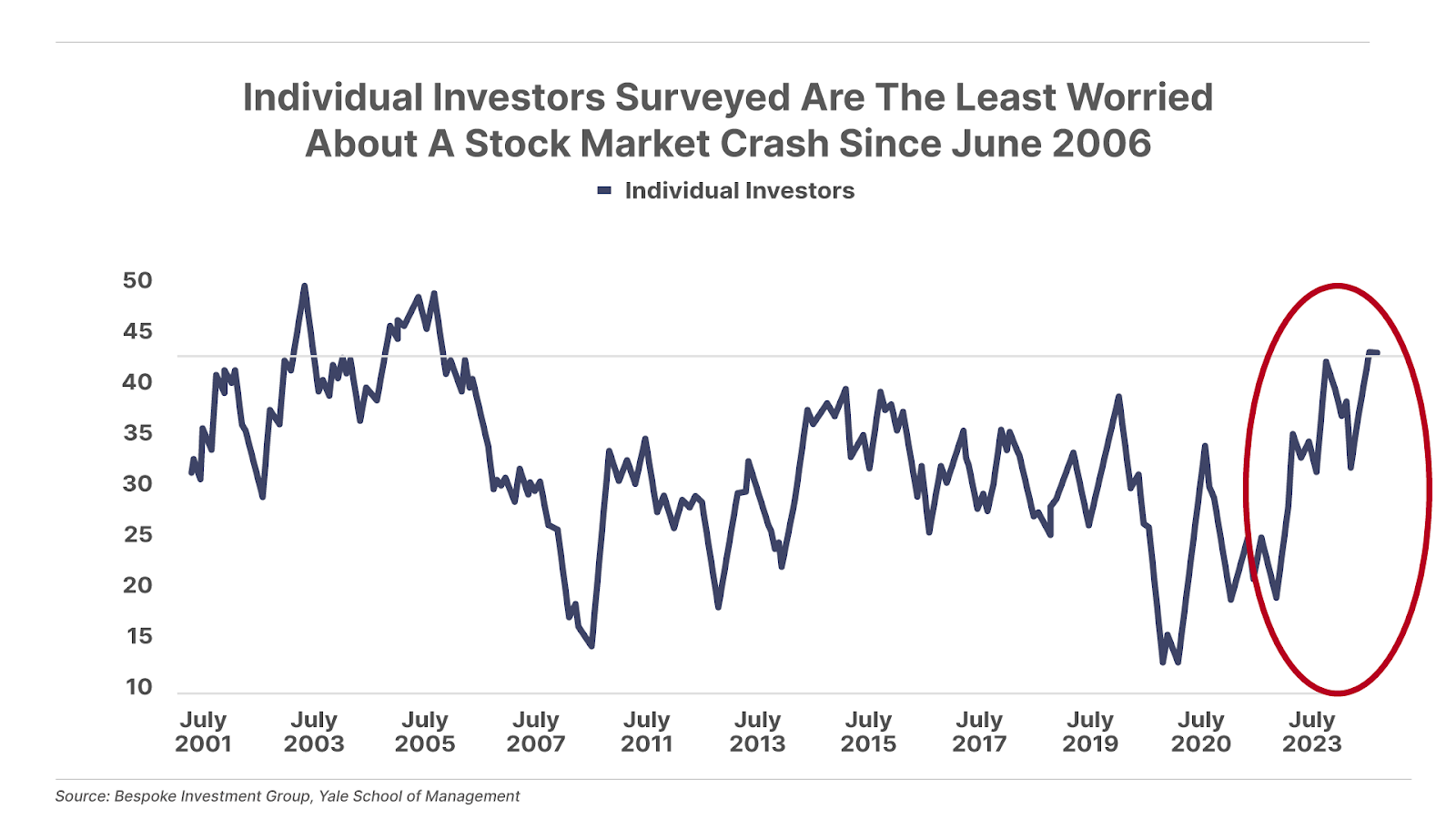

When no one is worried… be (very!) worried. 46% of mom-and-pop investors in the U.S. think there’s less than a 10% chance of a market crash over the next six months… the most optimistic outlook since June 2006. When way too many people agree on the same thing… you can be certain that they’re wrong, and that the exact opposite of what the sheeple think will happen. Don’t say we didn’t warn you…

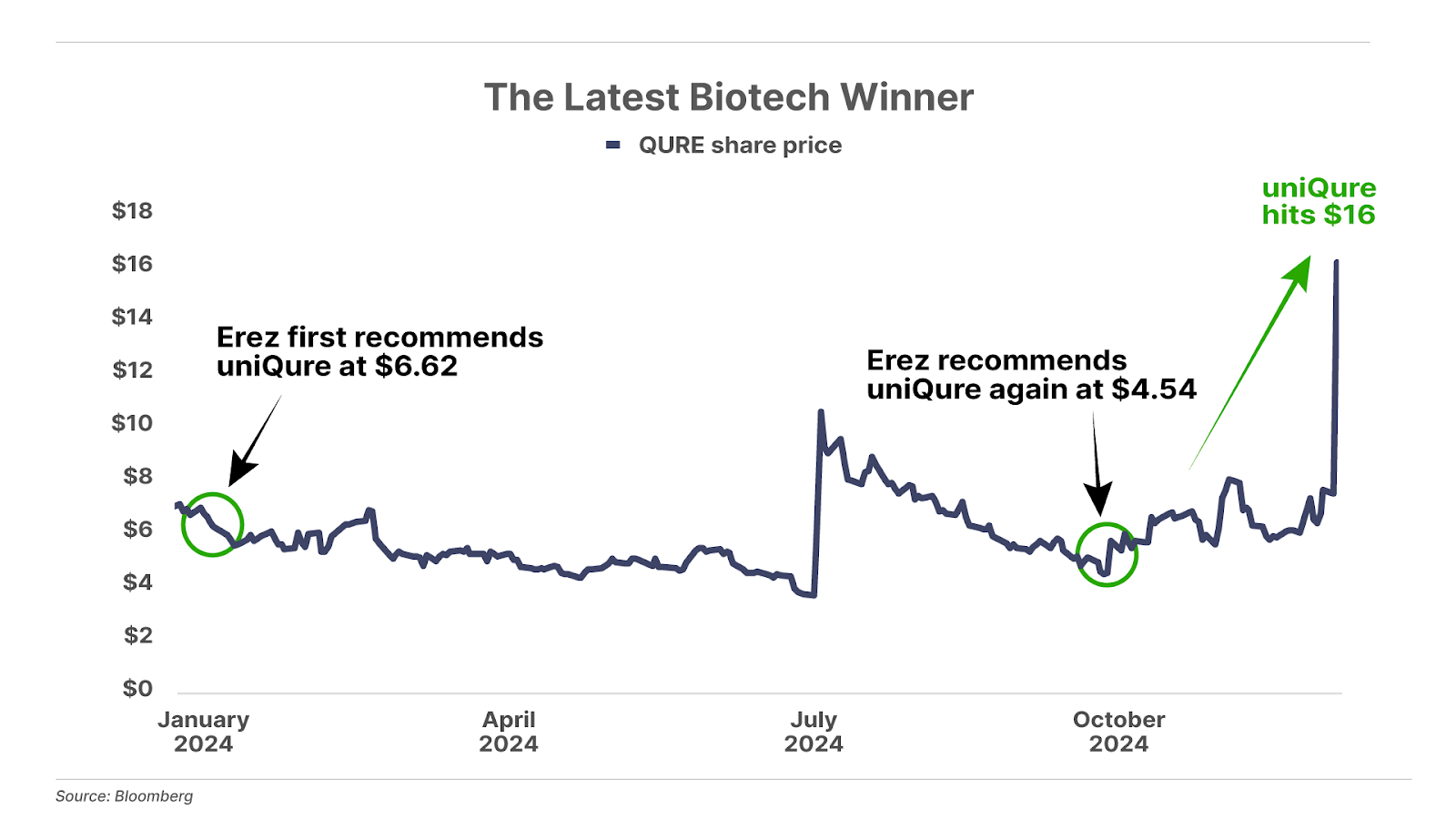

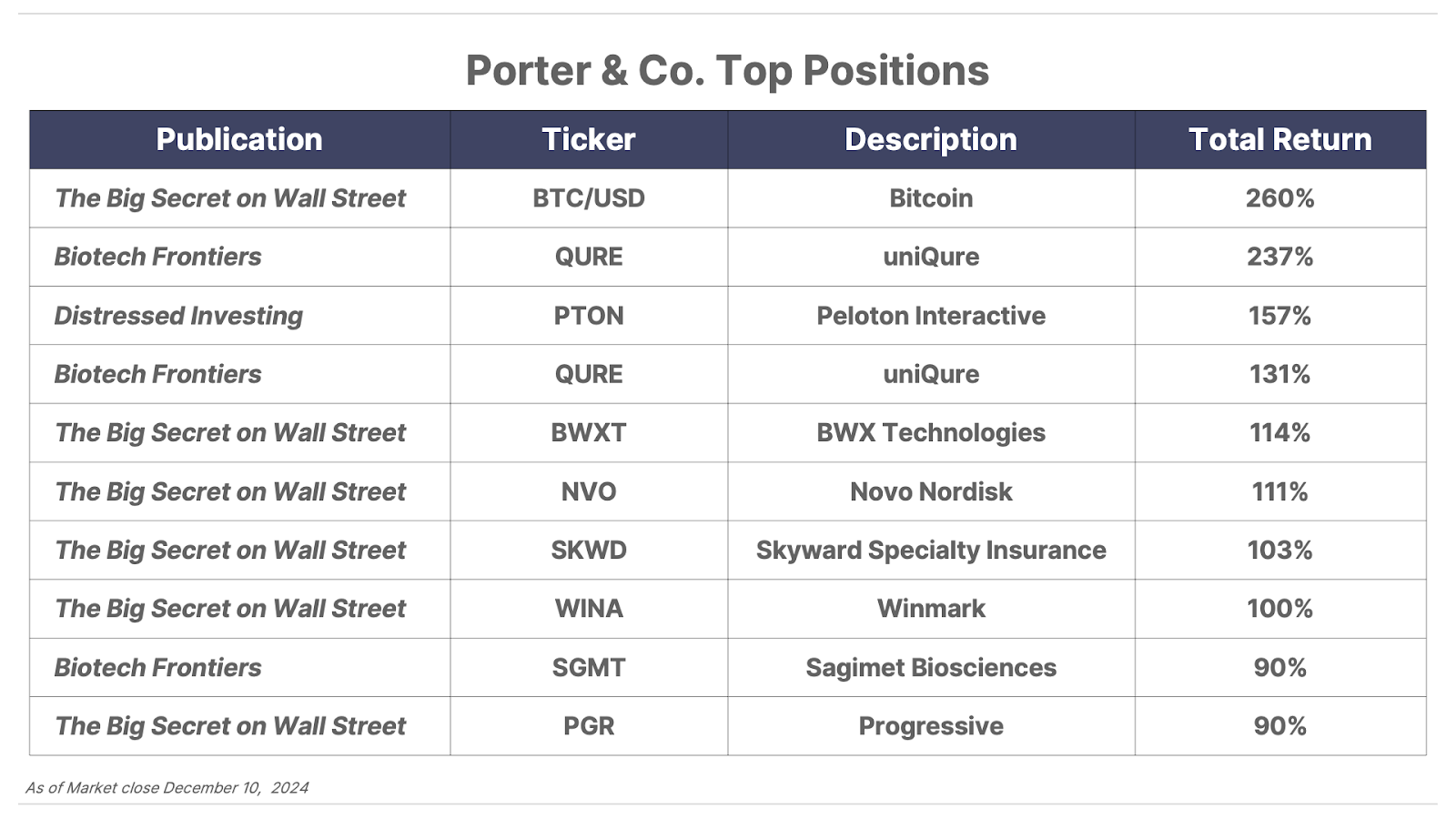

And also… A 250%+ biotech winner.

Biotech Frontiers stock uniQure (Nasdaq: QURE), which Erez Kalir recommended in October at $4.54 per share, bounced to $16 yesterday after announcing that the FDA had issued accelerated approval for uniQure’s breakthrough gene therapy for Huntington’s disease – a 250% gain in two months.

Erez has been on an extraordinary run since we launched Biotech Frontiers in January… Out of 20 recommendations for 2024, 18 are up, for a 90% win rate… two are up 100% or more, and overall the portfolio is up 42.5%. If you’ve benefitted from Erez’s research over the last year, let me know at [email protected].

And if you’d like to learn more about getting access to Biotech Frontiers… please call Lance James, our Director of Customer Care, at 888-610-8895, or +1 443-815-4447 internationally.

When The Highflyers Start Going To Jail, The Party Is Over;

Saylor Is Flying Too Close to the Sun

The FBI arrested my friend Oren Alexander this morning.

I met Oren about four years ago. He lived a few houses down from me on Flamingo Drive in Miami Beach.

We met through mutual friends in the spearfishing community. Not surprisingly, there are not a lot of people who enjoy holding their breath, swimming 50 to 80 feet underwater in shark-infested waters, and spearing big groupers that are hiding deep in caves. Why did I want to do this at 50 years old? Well, I was retired. And I needed something to do that was like buying tech stocks at the top of a bull market: there are also lots of ways to die when you’re spearfishing.

(Complete aside: here’s a video of me shooting a big grouper 70 feet underwater, in a small cave. On the next dive, to retrieve that fish, I was attacked by a 12-foot tiger shark and I would have certainly died that day, without the incredibly brave actions of my dive partner, Morgan Williams, who dove down to drive the shark away from me. Here’s a photo of us with our catch. Morgan is on my right. Porter & Co. conference attendees will recognize my long time assistant, Alicia Hsieh (pronounced: shay), on my left. Yep, Alicia free dives too.)

Oren wasn’t to everyone’s taste. He’s been accused to raping multiple women, over many years, dating back all the way to high school in Miami. But, of course, when I met him, I didn’t know anything about that.

What I did know was: I’d never before seen anyone spend so much money in my life. Only in his early 30s, Oren lived in a $50 million waterfront mansion. In Miami Beach, it’s not uncommon for people to have their own planes and a nice boat. But in addition to a jet and several yachts, Oren had a sea plane. He’d go out spearfishing, have his seaplane come pick him up in the Bahamas, and then have his chef make sushi with his catch for his friends that same night.

I once had dinner at his house when he served a dozen bottles of Château Margaux, all from great vintages dating back to 1982. And a representative from the estate was there to pour the wines. I’d never seen anything like that kind of incredible extravagance.

Oren, as you might imagine, thought highly of himself. But he’d become a force in the high-end real estate brokerage world, selling condos and mansions in Miami, New York, Aspen. and L.A. for tens or even hundreds of millions. He once sold hedge-fund head Ken Griffin (of Citadel) a $238 million condo on Miami Beach.

Knowing Oren was like being friends with a modern-day Gatsby. Watching it all – like when he bought a lot across the street from his house just to build a pickleball court – was very entertaining. Going to the party when he married a Victoria’s Secret model was fun. And, of course, Oren was connected. Need floor seats to the Miami Heat basketball game for your son’s 11th birthday? No problem.

But you could also see, clearly, tragedy was looming. One way or another, I knew fate would take its course: reversion to the mean. Maybe the people he’d run over in the real estate world would find a way to bring him down. Or maybe it would just be his own hubris. It was going to happen, one way or another.

How did I know? Oren wasn’t a kind person. Once, while he was a guest on my yacht, he put his hands on our beautiful French stewardess, who was like family to us. One of our mates threatened to kill him if he ever did it again. And this guy wasn’t joking. He killed monsters for a living; he would have happily gutted him.

And so, I stopped fishing and socializing with Oren and so did my other friends. I wondered how long it would be before it all blew up. I always figured his demise would correspond to the next big financial crisis. And I still do…

Jason Goepfert, along with Ned Davis and my old partner Steve Sjuggerud, is one of the best technical market analysts in the world. These guys don’t draw lines on charts. They study the underlying fundamentals of the markets quantitatively. They use statistics and correlations to see into the overall health of the market.

Today Jason reported on X: “There have now been more declining than advancing stocks in the S&P 500 for 7 straight days. The index is less than 3% off its peak. That’s happened twice before in the last 25 years.”

This long decline in market breadth, and a top in securities prices, happened in early 2000, just before the massive tech collapse. And it happened again in early 2021, just before the massive COVID collapse.

Bull markets build market concentration. And sooner or later, the entire market is only being held up by a few stocks – usually trading on completely unrealistic expectations. When the selloff comes, it will come hard. And drive the S&P down 30% to 50% in a matter of weeks.

I believe that time is here. I believe so, not only because of the market breadth issue that Jason so wisely notes, but because there’s a chorus of other signs. Oren’s demise chief among them in my mind. Oren was created by the great inflation of the last decade. He’s going to jail – probably for a long, long time. Reality is striking back.

Who else is begging for mean reversion? Michael Saylor.

After Microsoft’s (MSFT) shareholders voted against holding Bitcoin in Microsoft’s treasury, Saylor said it was only a matter of time before MicroStrategy (MSTR) surpassed Microsoft’s market capitalization.

What? Microsoft is the world’s leading software company. It sells $250 billion or more of software every year and is, by far, the dominant provider of business software. Saylor’s MicroStrategy, on the other hand, is borrowing money and selling shares to buy Bitcoin.

I believe Bitcoin is a wonderful innovation. I believe it works better than gold, in many ways, as a store of value. But borrowing money to buy a speculative asset that’s completely unproductive can easily be fatal. Just ask the Hunt brothers, who tried to corner silver in 1980 at $50 per ounce. Or Warren Buffett, who made a similar mistake in 1997 – only to watch silver crash in 2000.

I suspect that Saylor’s prediction about Microsoft was the top in Bitcoin for this cycle.

What should you do with all of this information? Just remember to follow the trailing stops we recommended on our tech-stock portfolio. Raise at least 25% of your portfolio in cash. And, if any of these “tea leaves” ends up being right, be prepared to buy high-quality businesses (see our subscribers-only recommended list) when stocks fall below our buy-up to prices.

Good investing,

Porter Stansberry

Stevenson, MD

Mailbag

Let me know what you think, by emailing me at [email protected]. I’d love to hear from you!

Today’s letter comes from S.F., who writes:

On page 5 of your Permanent Portfolio report, you write:

“The Permanent Portfolio mutual fund (PRPFX), based on Browne’s concept, has compounded at around 7% a year since 1987, with extremely low volatility. Its largest peak-to-trough decline since 1989 is only 12.5% from July 2012 to September 2014.”

I am curious about how you define peak-to-trough decline. When I look at the chart in Bloomberg, that July 2012-September 2014 period falls within a much longer and deeper drawdown: one that started on 8/31/11 and bottomed on 1/29/16, during which time it fell 30.94%.

There were also three other drawdowns of more than 14% the way I see it.

Porter responds:

Here’s the weird thing – since 2006, a European research firm, Curvio, has performed back-tests on such a strategy using those four ETFs… SPY (SPDR S&P 500 ETF), TLT (20-Year Treasury ETF), GLD (SPDR Gold ETF), and SHY (iShares 1-3 Year Treasury Bond ETF).

The results show a compound annual growth rate of 7.2% and a maximum drawdown of only 12.5%, between July 2012 and September 2014. This approach’s extremely low volatility (standard deviation of 8.4%) creates a 0.74 Sharpe Ratio (which is a measure of return per unit of volatility.)

But I digress… after running the numbers on Bloomberg, the Permanent Portfolio (PRPFX) had a maximum drawdown of 27.2% (132 days) in 2008. We’ll be updating the data referenced in the Permanent Portfolio report.

P.S. Marc Chaikin – along with Erez – is also looking at biotech…

In yesterday’s Porter & Co. Spotlight – in which each week we highlight an analyst who Porter believes in and follows – we published a recommendation (which is normally available only to paying subscribers) about a biotech that the Power Gauge says is going up.

The Power Gauge is Marc’s proprietary way of looking at stocks (which we discussed here)… he looks at a vast array of factors to analyze the financial, earnings, technicals, and expert views of a stock.

Marc developed his first stock analysis tool over a three-decade career on Wall Street… and retired in 1999. But then he came back to put together the Power Gauge – to place into the hands of everyday investors the kind of analytical power that’s generally only available to Wall Street hedge funds and other big institutional investors.

Marc explains how it works here… and what it could mean for your portfolio.